Portfolios

The Portfolio Design "Toolbox"

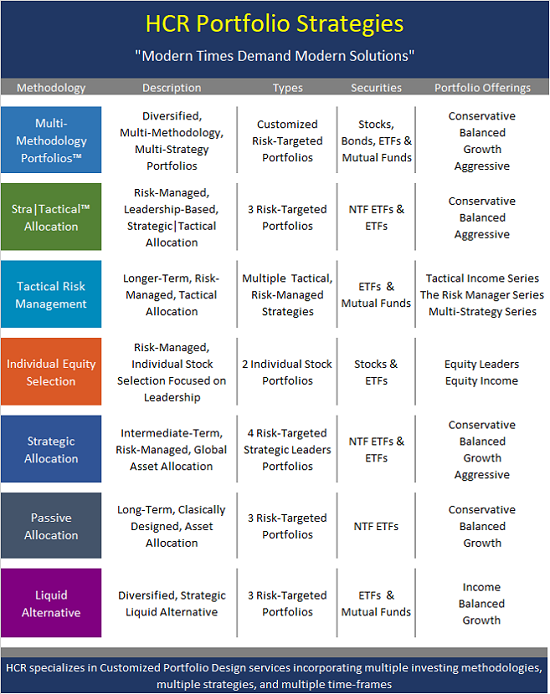

HCR offers an array of portfolio strategies across multiple investing methodologies. We think of these strategies as the tools in our toolbox used to build customized portfolios.

Below is a summary of the HCR offerings, sorted by what we call "Methodology Style Boxes" and a brief explanation of each portfolio series offered.

HCR Portfolio Offerings Summary

Multi-Methodology Investing™ Portfolios

Portfolios utilizing a modernized, multi-methodology/strategy/manager approach to diversification by employing multiple investing methodologies, multiple strategies, multiple managers, and multiple time-frames - all in a single portfolio. These portfolio are typically custom-designed for advisor partners. However, HCR also offers 5 pre-designed risk-targeted "modern" portfolio designs.

- Income

- Conservative

- Balanced

- Growth

- Aggressive

Stra|Tactical™ Allocation Portfolios

Risk-managed portfolios that straddle both the strategic and tactical methodology lines. These multi-strategy, multi-time-frame portfolios incorporate both longer-term "core" holdings as well as leadership-based strategies. HCR offers 4 risk-managed, Stra|Tactical™ portfolios.

- Conservative

- Balanced

- Aggressive

The Risk Manager Series - Winner of 2018 NAAIM Shark Tank Award

Longer-term, tactically risk-managed portfolios designed to stay in tune with the primary market cycle and to manage the risk of the overall market environment. The two primary goals are to (1) participate in stock market gains during positive "bull market" cycles, while (2) seeking to minimize the impact of severe "bear market" downturns. HCR offers multiple risk-managed, tactical allocation strategies.

- Tactical Income

- The Tactical Risk Manager Program- Winner 2018 NAAIM Shark Tank Award

- The Global Tactical Series

- The Multi-Strategy Series

- The Elevation Strategy

Dave Moenning, Founder and CIO of Heritage Capital Research, Captures Top Honors in the 2018 NAAIM Shark Tank Competition

The Elevation Strategy - A Tax-Efficient, Risk-Managed Portfolio

Developed as a customized solution for an independent TAMP provider, the Elevation Strategy is an active tactical tax-efficient strategy designed for investors seeking a risk-managed, tax-sensitive portfolio approach. The two primary goals are to (1) participate in stock market gains during positive cycles that would qualify as long-term for tax purposes, while (2) seeking to minimize the impact of severe market downturns such as those that occurred in 2000-2002 and 2007-2008. Learn More or feel free to Contact Heritage for information.

Equity Selection Portfolios

HCR offers a risk-managed, multi-strategy, multi-manager, equity portfolio. The portfolio focuses on the top rated stocks in each S&P sector as well as industry leadership, and incorporates a hedging strategy during severely negative markets.

- Equity Leaders Portfolio

- Equity Income Portfolio

Strategic Allocation Portfolios (The Strategic Leaders Series)

Intermediate-term, global asset allocation programs utilizing a strategic, risk managed approach to allocation in terms of class under- and over-weighting. HCR offers 4 risk-targted, stragetic portfolios.

- Strategic Leaders Conservative

- Strategic Leaders Balanced

- Strategic Leaders Growth

- Strategic Leaders Aggressive

Passive Allocation Portfolios

Longer-term "core" asset allocation portfolios utilizing a capital market assumption approach. HCR offers 3 risk-targted portfolios that employ low-cost, tax-efficient NTF ETFs.

- Conservative

- Balanced

- Growth

Liquid Alternative Portfolios

Longer-term, strategic alternative class offerings. HCR offers 3 risk-targeted portfolios focused on the liquid alternatives space.

- Alternative Income

- Alternative Balanced

- Alternative Growth

Have Questions? Want more Info? Contact Heritage or give us a call at (303) 670-9761