Are The Economic Surprise Indices Trying To Tell Us Something?

As the saying goes, "There are three kinds of lies. Lies. Damned lies. And statistics."

Experience has taught me that this is especially true in the investing game as I have seen countless analysts, columnists, and pundits over the years use whatever data they can dig up to prove their point. As for the truth, well, that's often another story altogether. And it is for this reason that I counsel young financial advisors to be VERY careful about what they read and who they listen to when it comes to the markets.

For example, there has been a lot of bruhaha lately about the divergence between the so-called hard and the soft data as well as the "economic surprise" indices. By now, you are likely aware that the hard economic data such as the country's GDP growth rate has not confirmed the softer, gentler sentiment surveys, which have been suggesting that the economy is about to roar for most of the year.

Many believe that the hard data will "catch up" to the soft data and the economy will perk up in the second half of the year. We're told that this is the way situations like this have played out in the past. As such, it's okay to bid up stock prices because the economy is about to surge.

Then there are the economic surprise indices. Based on the name, one would expect these indices to illustrate surprises in the economic data. And given that the most recent trend on these indices is down, well, the bears suggest that the good times in the stock market are about to come to a screeching halt.

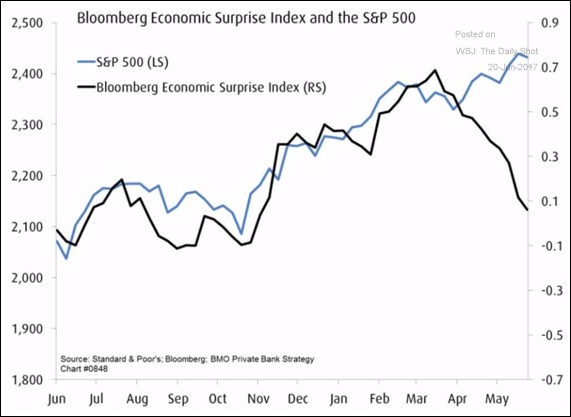

Take a gander at the chart below and see if you don't also come away with a negative vibe about what is happening in the economy and the stock market.

What folks seem to be concerned about here is the divergence between the direction of the Economic Surprise index and the stock market. In the chart above, the Citi Surprise Index has tanked while stocks have continued to rise. In fact, the WSJ tells us that on Monday, the S&P 500 at its 24th record high of the year, which was just one session after the Citigroup U.S. Economic Surprise Index fell to its lowest reading since August 2011. And that can't be good, right?

Below is another version of this data series - this one is from Bloomberg - over the past year. As you can plainly see, the S&P 500 has diverged from the surprise index recently.

The fact that the surprise index has been moving lower has become a source of consternation for those in the bear camp. This left the WSJ asking readers yesterday, "Is the market predicting improvements in the economy or are the surprise indices signaling a correction in stocks?"

Before you start entering orders to buy those leveraged, inverse stock market ETFs, it is important to remember that the devil is always in the details. In this case, it is the assumption of what the name of this chart implies.

If you do some digging, you will find that these economic surprise indicators measure how the economic data fares relative to economists' expectations. It's that last part that is important here. You see, when this index moves down, it doesn't indicate that there was a big negative surprise in the economic data, rather that there was a big difference between the data and what economists had expected.

While the bears use this type of statistical analysis to try and sound the alarms, I am more concerned about what the stock market has done in the past when such a condition has existed.

So, here's what I found. According to Jonathan Krinsky, a technician at MKM Partners, history shows that bad economic surprise readings make poor stock-market signals. Krinsky says that since 2004, the surprise index diverged negatively when the stock market was at or near 52-week highs on nine separate occasions. I was interested to learn that the big dives in the surprise index signaled a lower stock market three months later only twice, in 2007 and 2011. And if memory serves, both occasions had some pretty big stuff going on.

So... maybe the bears will be right this time around. However, from my seat, the divergence between the stock market and the surprise indices doesn't seem to be a reason to run and hide.

Thought For The Day:

Why not do something nice for someone today for no reason at all...

Current Market Drivers

We strive to identify the driving forces behind the market action on a daily basis. The thinking is that if we can both identify and understand why stocks are doing what they are doing on a short-term basis; we are not likely to be surprised/blind-sided by a big move. Listed below are what we believe to be the driving forces of the current market (Listed in order of importance).

1. The State of the U.S. Economy

2. The State of Earning Growth

3. The State of Trump Administration Policies

Wishing you green screens and all the best for a great day,

David D. Moenning

Chief Investment Officer

Sowell Management Services

Disclosure: At the time of publication, Mr. Moenning and/or Sowell Management Services held long positions in the following securities mentioned: none. Note that positions may change at any time.

Looking for a "Modern" approach to Asset Allocation and Portfolio Design?

Looking for More on the State of the Markets?

Disclosures

The opinions and forecasts expressed herein are those of Mr. David Moenning and may not actually come to pass. Mr. Moenning's opinions and viewpoints regarding the future of the markets should not be construed as recommendations. The analysis and information in this report is for informational purposes only. No part of the material presented in this report is intended as an investment recommendation or investment advice. Neither the information nor any opinion expressed constitutes a solicitation to purchase or sell securities or any investment program.

Any investment decisions must in all cases be made by the reader or by his or her investment adviser. Do NOT ever purchase any security without doing sufficient research. There is no guarantee that the investment objectives outlined will actually come to pass. All opinions expressed herein are subject to change without notice. Neither the editor, employees, nor any of their affiliates shall have any liability for any loss sustained by anyone who has relied on the information provided.

The analysis provided is based on both technical and fundamental research and is provided "as is" without warranty of any kind, either expressed or implied. Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

David D. Moenning is an investment adviser representative of Sowell Management Services, a registered investment advisor. For a complete description of investment risks, fees and services, review the firm brochure (ADV Part 2) which is available by contacting Sowell. Sowell is not registered as a broker-dealer.

Employees and affiliates of Sowell may at times have positions in the securities referred to and may make purchases or sales of these securities while publications are in circulation. Positions may change at any time.

Investments in equities carry an inherent element of risk including the potential for significant loss of principal. Past performance is not an indication of future results.

Advisory services are offered through Sowell Management Services.