Are Bonds Crossing The Line In The Sand?

When stocks enter what I like to call "melt up" mode, everything is right with the world. The economic data is strong. Earnings are fantastic. Inflation is low. Consumers are happy and shopping. Employers are hiring. In short, things look good as far as the eye can see.

Having been in this business since 1980, I am happy to report that I've seen this movie before. What I've learned about this type of environment is it has a funny way of driving folks absolutely crazy - especially if they find themselves sitting on the sidelines, or worse yet, on the wrong side of the trend. And as I've mentioned a time or two lately, these joyrides to the upside tend to last longer than almost anyone can imagine.

However, once all the players are darn sure they've got the game nailed (meaning that everyone is fully invested) something crawls out of the woodwork to change the game. Something to put some fear back into the mix. Something to cause investors large and small to question their no-brainer thesis. Something that makes the "weak holders" decide that it's time to exit stage left.

While I don't want to be accused of being a "Debbie Downer" on this fine Wednesday morning, somebody's got to say it; the point is that this too shall pass at some point.

In my experience, the key is to be ready for that "something." To be ready for the game to suddenly change. Instead of waking up surprised to find the stock market in a downtrend and uttering the words, "Wait, what?" when looking at your portfolio, the trick is to make like a boy scout and be prepared.

For me, this means being on the lookout for that "something" to come crawling out of the woodwork. And while one day does not a trend make, I've got my eye on the state of the bond market here.

You see, the yield on the U.S. Government 10-Year made a break for the border yesterday. And while, the move may not wind up being a complete game-changer. It is definitely something to pay attention to.

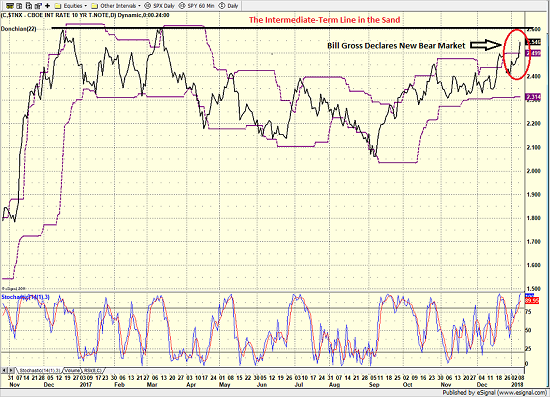

As you can see from the chart below, the 10-year put in a breakout of sorts yesterday.

U.S. 10-Year Treasury Yield - Daily

View Larger Image Online

There are two issues at work here. First is the concern that the Bank of Japan is about to reverse course on monetary policy. And to hear the bears tell it, if the BOJ starts down this road, the ECB will likely follow close behind. And with the U.S. Federal Reserve already in tightening mode, this would mark the beginning of the end for the QE era.

Oh, and then just to keep things interesting, former Bond King, Bill Gross, declared that bonds entered a bear market yesterday as the yield on the 10-year went through his 2.5% line in the sand.

On that score, I will have to humbly disagree with Mr. Gross. While 2.5% may be the key for him, to me, 2.6% appears to be a more important level on both the short- and long-term charts. And from a secular basis, I'm going to say that 3.0% is the more important line in the sand.

U.S. 10-Year Treasury Yield - Weekly

View Larger Image Online

However, as I fire up my machine this morning, I see that the 10-year is pushing higher and is currently trading at 2.59%. According to Bloomberg, officials in Beijing are planning to either slow or halt purchases of U.S. Treasuries going forward.

Some argue that China's comments represent political posturing in response to increasing trade tensions with the U.S.

The bottom line is that if bond yields continue to rise in a swift manner, they will begin to bite and stocks will suffer. And while this may not be the "something" that puts the brakes on the equity "melt up," I believe this remains "something" to watch here.

Thought For The Day:

Let a fool hold his tongue and he will pass for a sage. -Publilius Syrus

Current Market Drivers

We strive to identify the driving forces behind the market action on a daily basis. The thinking is that if we can understand why stocks are doing what they are doing on a short-term basis; we are not likely to be surprised/blind-sided by a big move. Listed below are what we believe to be the driving forces of the current market (Listed in order of importance).

1. The State of the Economy

2. The State of Interest Rates

3. The State of Earnings Growth

4. The State of Fed Policy

Wishing you green screens and all the best for a great day,

David D. Moenning

Disclosure: At the time of publication, Mr. Moenning held long positions in the following securities mentioned: none.

Note that positions may change at any time.

Disclosures

The opinions and forecasts expressed herein are those of Mr. David Moenning and may not actually come to pass. Mr. Moenning's opinions and viewpoints regarding the future of the markets should not be construed as recommendations. The analysis and information in this report is for informational purposes only. No part of the material presented in this report is intended as an investment recommendation or investment advice. Neither the information nor any opinion expressed constitutes a solicitation to purchase or sell securities or any investment program.

Any investment decisions must in all cases be made by the reader or by his or her investment adviser. Do NOT ever purchase any security without doing sufficient research. There is no guarantee that the investment objectives outlined will actually come to pass. All opinions expressed herein are subject to change without notice. Neither the editor, employees, nor any of their affiliates shall have any liability for any loss sustained by anyone who has relied on the information provided.

Mr. Moenning may at times have positions in the securities referred to and may make purchases or sales of these securities while publications are in circulation. Positions may change at any time.

The analysis provided is based on both technical and fundamental research and is provided "as is" without warranty of any kind, either expressed or implied. Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

Investments in equities carry an inherent element of risk including the potential for significant loss of principal. Past performance is not an indication of future results.