Current Market Concerns: The Good, The Bad...

In speaking with folks about the state of the stock market over the past week, it occurred to me that people's views vary widely and seem to fall into one of three categories: the good, the bad, and the just plain ugly.

Those seeing the glass as at least half empty are baffled by the recent rebound in stock prices and the fact that the S&P 500 opens today's trade just 1% (1.007% to be exact) from an all-time high. And yet, our friends in the bull camp are frustrated that prices aren't even higher as they see nothing but blue skies ahead.

So, I thought it might be a good idea to take a moment this morning to sift through the various inputs to the current market action and see if we can't come to some sort of a conclusion about what may lie ahead.

The Good Stuff

By my count, there are five major inputs that I can place in the "good" category.

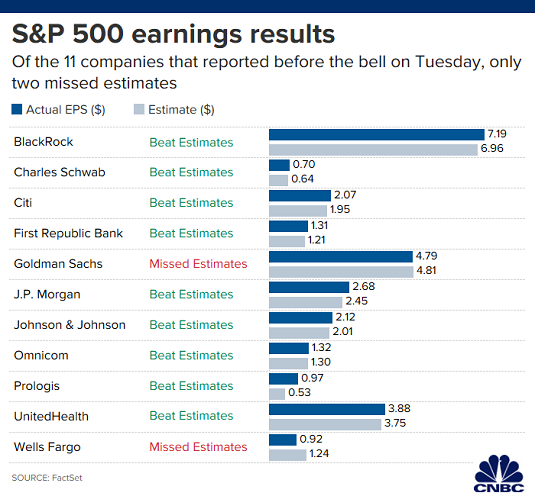

First up is the early results from this quarter's earnings parade. For example, according to CNBC and FactSet, of the 11 companies that reported before the bell yesterday, 9 beat estimates and 2 missed. And for anyone keeping score at home, this is a "beat rate" that is better than average.

View Chart Online

Image Source: CNBC.com

We all know the way this game is played. Analysts spend the three months leading up to quarterly reports beating down estimates to a level that becomes relatively easy to hurdle over. This has been going on since the beginning of time on Wall Street.

However, the bottom line is that the earnings season is not only NOT the abject disaster our furry friends in the bear camp had been predicting, but is actually looking pretty good so far.

Next up is the U.S. consumer. The key here appears to be the idea that John and Jane Q. Public don't seem to be phased by the global slowdown, the trade war, BREXIT, or the drama in D.C. Nope, the U.S. consumer just keeps on keepin' on. As in spending, that it is. You know, the stuff that accounts for 70% of the GDP in this country.

So, as long as mom and pop aren't worried about any of the bad stuff out there, the bulls can continue to thumb their noses at the notion that when the world sneezes, the U.S. will catch cold. So far at least, it just isn't happening. And as long as consumers continue to spend, the U.S. economy will continue to grow, and in turn, so too will corporate profits, which, of course, means stock prices also have room to grow.

Then there is the status of the trade war. As I've been saying for some time now, Wall Street doesn't necessarily need a deal to get done, it merely needs an indication that a deal will get done at some point - and soon enough to not further damage economic growth. In other words, investors simply need to be assured that the trade war won't be prolonged indefinitely and wind up creating a global recession in the process. So, at this stage of the game, progress - as in any progress - is a good thing. And this is what Friday's rally was about.

Next is the parade of central bankers hoping to keep the world out of a deflationary spiral by offering up all kinds of ongoing monetary stimulus. Sure, you can argue that Jay Powell was slow to embrace the global slowdown and his stubborn stance contributed to the market meltdown last December. But since his abrupt U-turn, the Fed has taken a friendly stance. And as the saying goes, "Don't fight the Fed."

And finally, there is the hope that a "hard BREXIT" (where the UK leaves the EU without any trade deals in place) can be avoided. This was the word yesterday. And while this story will undoubtedly change a time or two before the end of the month, the thinking is that if a "hard BREXIT" can be avoided, a recession may also be avoided.

The Bad Stuff

While I hate to be accused of talking out of both sides of my mouth, unfortunately, last week's much ballyhooed "Phase One" trade deal has to be put in the "bad stuff" category.

Yes, the de-escalation of the now almost 2-year old trade war is welcome. And the fact that additional tariffs won't go into effect this month is good.

But... We must first recognize that the so-called "Phase One deal" isn't even done yet. And second, if one digs into the data, they will find good news is actually hard to come by.

According to Greg Daco of Oxford Economics (as reported in WSJ Daily Shot on 10/14/19) the current deal would contribute +0.1% to annual GDP growth. The problem is that Daco estimates the trade war is currently costing GDP about -0.6%. As such, this mini deal doesn't really make the economic outlook rosier, simply less bad.

Next up is the subject of the global slowdown. The hope is that the pace of the slowdown is beginning to ebb, or perhaps might even be turning. However, this morning the IMF once again reduced their estimates for global growth due to their view that international trade is grinding to a halt. The data point worth noting here is the IMF projects world trade volumes to rise a smidge over 1% in 2019, which is down from the 5.5% rise seen in 2017.

The IMF says this sharp slowdown can be attributed to "rising trade barriers that have stunted manufacturing and investment around the world." As a result, the IMF's growth forecast for the U.S. were cut by 0.2% to 2.4% for 2019. Across the pond, the euro-area forecasts were cut 0.1% to 1.2% and China's forecast was lowered 0.1% to 6.1%.

While the bears would likely add a few more issues to the "bad" category, I'll end with this morning's report on Retail Sales, which declined for the first time in 7 months. While sales are up a healthy 4.1% over the last year, the September number "missed" as estimates had been for a gain of 0.3%.

Although one report does not a trend make, analysts are ultra-sensitive these days to anything suggesting that the slowdown in manufacturing is spilling over into the consumer.

And The Just Plain Ugly...

Although I am a card-carrying member of the-glass-is-half-full club when looking at the prospects for the stock market, there can be little argument that there is indeed some ugliness out there.

For starters, I'll point to the ISM data. While the ISM Non-Manufacturing index remains in expansion territory, the Manufacturing index has been in the contraction zone for some time and now the ISM Composite also finds itself below the expansion line.

Yes, it is true that manufacturing only accounts for something like 12% of U.S. GDP. But the fear is that the "manufacturing recession" will have an impact on both corporate and consumer sentiment. And if CEO's stop expanding and/or hiring, and if the consumers pull in the reins, well, bad things could happen.

Finally, there is the oil patch. Lest we forget, it was the collapse of oil prices that led to the 2015-16 earnings recession and a mini bear market in stocks. Well, don't look now fans, but the E&P and Oil Services stocks have been getting crushed lately.

Here's how the WSJ described the situation. "Horrific. Terrible. Abysmal. The worst. Those are terms equity analysts are using to describe investors' attitude toward energy stocks...While U.S. oil prices have lost about 26% over the past year, the SPDR S&P Oil & Gas Exploration & Production exchange-traded fund, a widely cited barometer, has lost nearly half of its value, accounting for dividends. Meanwhile, the PHLX Oil Service Index, a basket of 15 companies that help oil producers unearth oil and gas, is down 54%." Ugly indeed.

The Takeaway

So, where does all of the above leave us? In short, stuck in a trading range.

The problem here is that while stocks do tend to look ahead and discount future expectations, there are simply too many uncertainties for traders to embrace an all-clear attitude. Then on the negative side, with the global central bankers all mounting their white horses, it is hard to see a hugely negative outcome.

Thus, the end result would appear to be a stalemate with a modestly positive bias.

Thought For The Day:

Life is a great big canvas, and you should throw all the paint on it you can. -Danny Kaye

Wishing you green screens and all the best for a great day,

David D. Moenning

Founder, Chief Investment Officer

Heritage Capital Research

HCR Focuses on a Risk-Managed Approach to Investing

What Risk Management Can and Cannot Do

Disclosures

At the time of publication, Mr. Moenning held long positions in the following securities mentioned: JPM, JNJ - Note that positions may change at any time.

NOT INVESTMENT ADVICE. The opinions and forecasts expressed herein are those of Mr. David Moenning and Heritage Capital Research and may not actually come to pass. The opinions and viewpoints regarding the future of the markets should not be construed as recommendations. The analysis and information in this report is for informational purposes only. No part of the material presented in this report is intended as an investment recommendation or investment advice. Neither the information nor any opinion expressed constitutes a solicitation to purchase or sell securities or any investment program.

Any investment decisions must in all cases be made by the reader or by his or her investment adviser. Do NOT ever purchase any security without doing sufficient research. There is no guarantee that the investment objectives outlined will actually come to pass. All opinions expressed herein are subject to change without notice. Neither the editor, employees, nor any of their affiliates shall have any liability for any loss sustained by anyone who has relied on the information provided.

Mr. Moenning of Heritage Capital Research is an investment adviser representative of Eastsound Capital Advisors, LLC, a registered investment advisor. The adviser may not transact business in states where it is not appropriately registered, excluded or exempted from registration. Individualized responses to persons that involve either the effecting of transaction in securities, or the rendering of personalized investment advice for compensation, will not be made without registration or exemption.

Mr. Moenning and Heritage Capital Research may at times have positions in the securities referred to and may make purchases or sales of these securities while publications are in circulation. Positions may change at any time.

The analysis provided is based on both technical and fundamental research and is provided "as is" without warranty of any kind, either expressed or implied. Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

The author neither endorses nor warrants the content of this site, any embedded advertisement, or any linked resource. The author or his managed funds may hold either long or short positions in the referenced securities. Republication rights must be expressly granted by author in writing.

Investments in equities carry an inherent element of risk including the potential for significant loss of principal. Past performance is not an indication of future results.