Lots of Inputs But Only One Real Focal Point

So many inputs, so little time for a Monday morning market missive. For example, there is a new record for the S&P 500. A new record for the amount of global debt sporting negative yields (now $13 trillion according to Barron's). A new approach for many of the world's central bankers. A new reason to buy gold. A new crypto currency play from our friends at Facebook (FB). A not-so new geopolitical skirmish that is clearly heating up. New expectations for the trade war with China. And of course, a host of new economic data to consider.

The news flow is enough to drive global macro analysts crazy. Again, so many inputs, so many permutations to consider. And so many different ways to play.

However, from my seat, the bottom line here is pretty straightforward. If traders have learned anything over the last decade, it is that when the world's central bankers are all singing the same dovish song, the refrain for market participants becomes, "Happy days are here again." I.E. Risk assets tend to rise and bond yields tend to fall as stocks discount better days ahead and bond traders fall all over themselves to buy bonds.

Rarely has the message from central bankers been so clear, or so universal. Which, of course, makes the appropriate trading decisions a bit simpler.

Super Mario's Last Hurrah

Mario Draghi kicked things off last week by reinvigorating his now famous "whatever it takes" message from a few years back. More specifically, the ECB President said, "We have our mandate... We are ready to use all instruments that are necessary to fulfill the mandate."

In case your Fed-speak is a little rusty, Mr. Draghi basically said Tuesday that the ECB would be looking at taking action "commensurate to the severity of the risk" to the economic outlook. The ECB's "tools" being considered here include (a) extending the time frame before the next interest-rate increase, (b) a cut to the already negative policy rates, or (c) initiating another round of bond buying (QE).

In response, global bond yields continued their dive. This time though, the move might be more about getting into bonds before the next round of QE buying starts. Something former PIMCO "Bond King" Bill Gross referred to as "shaking hands with the government" (I.E. buying what the government is buying, before the government starts buying).

CNBC's Kelly Evans had an interesting take/rant on the subject as she wrote Wednesday, "Yields on global sovereign debt are now so low they barely qualify as "yields" anymore. Both France and Portugal saw their ten-year bond yields immediately fall to zero. Zero!!! For Portugal!!! Remember the PIIGS?! (Portugal's 10-year yielded 16.5% seven years ago.) Germany saw its 10-year yield plunge to -0.3%, a fresh low. Stunning.

The Fed's 180

Here at home, Jerome Powell followed suit Wednesday by providing a message to the markets that was as dovish as could be without actually cutting rates (a move that virtually nobody expected to happen).

The WSJ's Greg Ip summed it up nicely by writing, "Chairman Jerome Powell said the Fed was prepared to react aggressively to any weakness, drawing from research that says when rates are historically low, officials should move faster and sooner because they have less room to cut."

It's that last part that is important. You see, the Fed has historically been slow to act and has often been accused of being behind the curve. This is what a "data dependent" approach tends to produce, as much of the data is rear-view mirror stuff. And in my opinion, this is at least part of the reason for the stock market freak-out we saw last December.

So, in an effort to make things clear (perhaps as in "crystal clear") Powell said, "An ounce of prevention is worth a pound of cure."

In essence, Powell appears to have laid the groundwork for an "insurance cut," which would allow the FOMC to get the fed funds rate in line with market rates. To review, the Government's two-year note, which is viewed as being the most sensitive to Fed expectations, closed Thursday at 1.73%, which is the lowest level seen since late 2017, and more than 50 basis points below the current fed funds range of 2.25% to 2.50%. As such, the fed funds rate is currently out of line with the market.

The big takeaway here is that the Fed has continued to pivot away from its hawkish stance of seven months ago. First, Powell &P Company decided to become "patient," implying they wouldn't raise rates until/unless the data warranted. And now, they've done a complete 180 by suggesting that a rate cut is on tap as soon as next month.

What About China?

What about the trade deal, you ask? Isn't a truce in the trade war supposed to make everything all better again? My take is that if a deal with China doesn't happen, the "insurance cut" becomes a certainty and may be even bigger than expected. For example, the Fed could buy by 50 basis points in July -or- cut by 25 and end the "runoff" program early. We'll see.

The Takeaway

To be sure, the debates over the trade deal and Fed moves will rage on in the coming week. But for me, the key is that traders of all shapes and sizes know what to do when the global central bankers cut rates. Buy 'em!

So, for now at least, my take is that the stock market once again has a central banker tailwind blowing at its back. This usually means that the path of least resistance is higher and that the dips should be bought.

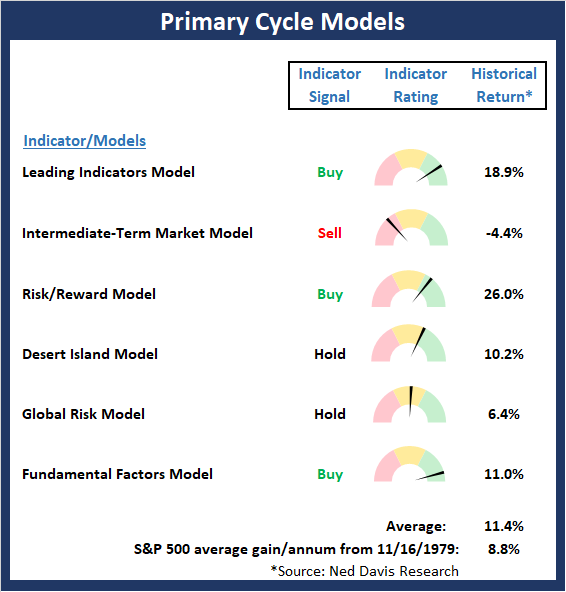

The State of My Favorite Big-Picture Market Models

Make no mistake about it; this remains a news-driven environment. As such, it is important to recognize that there is no way to effectively "model" the environment. The good news is with the Fed's 180-degree pivot now nearly complete, market participants are looking beyond the uncertainties and to the improving conditions that lower rates have historically meant to the market.

This week's mean percentage score of my 6 favorite models pulled back to 62.9% from 65.4% last week (Prior readings: 62.9%, 60%, 60%, 72.5%, 81.1%, 83.9%) while the median also slipped to 66.3% versus 71.3% last week (Prior readings: 68.8%, 62.5%, 62.5%, 80.0% 82.5%, 86.7%, 86.7%).

View My Favorite Market Models Online

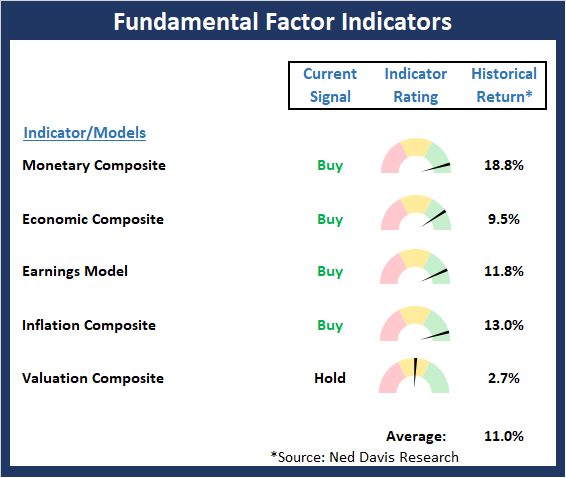

The State of the Fundamental Backdrop

Once again, there were no changes to the Fundamental Factors board this week. As I've been saying for some time now, I continue to believe the Fundamental backdrop remains constructive and favors the bulls.

View Fundamental Indicator Board Online

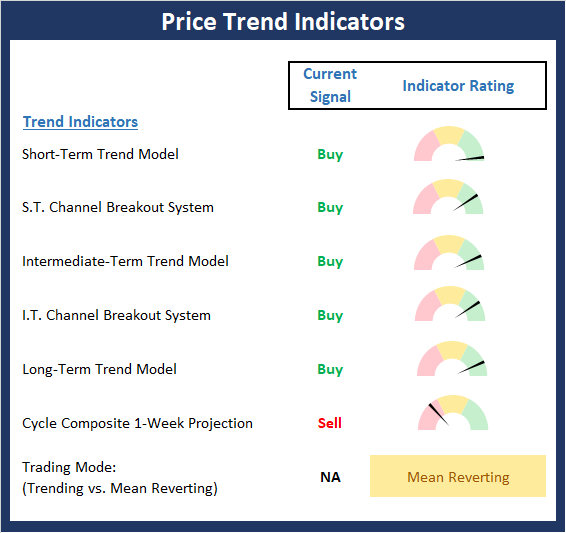

The State of the Trend

After consolidating the week prior, the Dow and S&P 500 stepped lively to new all-time highs on the back of the Fed suggesting, in a manner only central bankers can, that a rate cut is likely on the way. As expected, the move in the major blue-chip indices pushed the majority of the indicators on the trend board into the green. The only nagging red is the cycle composite reading, which is negative for next week, but then returns to positive for much of the next month.

View Trend Indicator Board Online

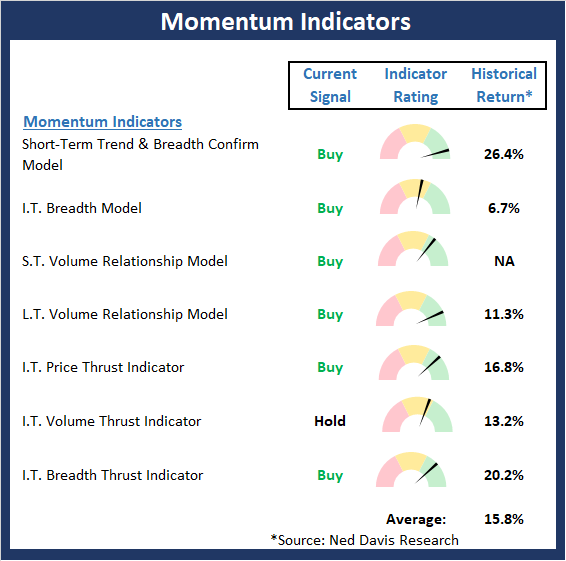

The State of Internal Momentum

What a difference a week can make in the indicator world. Last week, I opined that the Momentum Board looked a little sloppy. However, this week, there is an abundance of green and not a single sell-signal. And with the historical return average well above the mean, the odds favor the bulls and the dips should be bought.

View Momentum Indicator Board Online

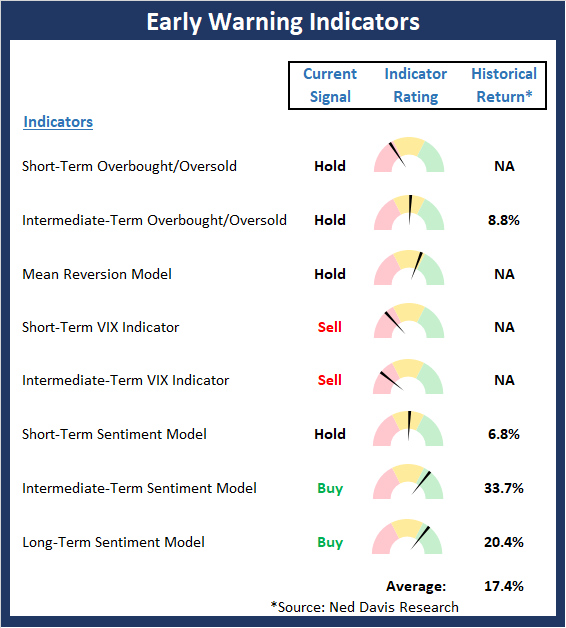

The State of the "Trade"

The Early Warning board appears to be in a state of transition. Whereas the board did a nice job of signalling that the table had been set for the bulls a few weeks back, it now appears to be moving in the opposite direction. Although the board is largely neutral at this time, the oscillators are swinging toward a decent bearish "set-up" at this time.

View Early Warning Indicator Board Online

Thought For The Day:

The difference between genius and stupidity is that genius has its limits. -Albert Einstein

Wishing you green screens and all the best for a great day,

David D. Moenning

Founder, Chief Investment Officer

Heritage Capital Research

HCR Focuses on a Risk-Managed Approach to Investing

What Risk Management Can and Cannot Do

Disclosures

At the time of publication, Mr. Moenning held long positions in the following securities mentioned: None - Note that positions may change at any time.

Leading Indicators Model: A group of indicators that have historically shown tendencies to lead the market at major turning points.

Intermediate-Term Market Model: A composite model (model of models) focused on trend and momentum indicators which has been designed to provide identify intermediate-term trading opportunities.

Risk/Reward Model: A model-of-models intended to provide an overall view of the state of the risk/reward environment. The model includes tape, monetary, and sentiment indicators as well as 7 big-picture market model readings.

Desert Island Model: If I was stranded on a desert island with access to only one market model to manage money with, this would be the model. The model is a comprehensive model-of-models comprised of trend, momentum, mean reversion, economic, monetary, sentiment, and factor-based indicators/models.

External Factors Model: A model-of-models designed to provide a reading on the "macro state" of the market environment. The model is comprised of indicators/models in the areas of various index yields, industrial production, investors sentiment, and historic volatility.

Short-Term Trend-and-Breadth Signal Explained: History shows the most reliable market moves tend to occur when the breadth indices are in gear with the major market averages. When the breadth measures diverge, investors should take note that a trend reversal may be at hand. This indicator incorporates NDR's All-Cap Dollar Weighted Equity Series and A/D Line. From 1998, when the A/D line is above its 5-day smoothing and the All-Cap Equal Weighted Equity Series is above its 25-day smoothing, the equity index has gained at a rate of +32.5% per year. When one of the indicators is above its smoothing, the equity index has gained at a rate of +13.3% per year. And when both are below, the equity index has lost +23.6% per year.

Channel Breakout System Explained: The short-term and intermediate-term Channel Breakout Systems are modified versions of the Donchian Channel indicator. According to Wikipedia, "The Donchian channel is an indicator used in market trading developed by Richard Donchian. It is formed by taking the highest high and the lowest low of the last n periods. The area between the high and the low is the channel for the period chosen."

Intermediate-Term Trend-and-Breadth Signal Explained: This indicator incorporates NDR's All-Cap Dollar Weighted Equity Series and A/D Line. From 1998, when the A/D line is above its 45-day smoothing and the All-Cap Equal Weighted Equity Series is above its 45-day smoothing, the equity index has gained at a rate of +17.6% per year. When one of the indicators is above its smoothing, the equity index has gained at a rate of +6.5% per year. And when both are below, the equity index has lost -1.3% per year.

Cycle Composite Projections: The cycle composite combines the 1-year Seasonal, 4-year Presidential, and 10-year Decennial cycles. The indicator reading shown uses the cycle projection for the upcoming week.

Trading Mode Indicator: This indicator attempts to identify whether the current trading environment is "trending" or "mean reverting." The indicator takes the composite reading of the Efficiency Ratio, the Average Correlation Coefficient, and Trend Strength models.

Volume Relationship Models: These models review the relationship between "supply" and "demand" volume over the short- and intermediate-term time frames.

Price Thrust Model Explained: This indicator measures the 3-day rate of change of the Value Line Composite relative to the standard deviation of the 30-day average. When the Value Line's 3-day rate of change have moved above 0.5 standard deviation of the 30-day average ROC, a "thrust" occurs and since 2000, the Value Line Composite has gained ground at a rate of +20.6% per year. When the indicator is below 0.5 standard deviation of the 30-day, the Value Line has lost ground at a rate of -10.0% per year. And when neutral, the Value Line has gained at a rate of +5.9% per year.

Volume Thrust Model Explained: This indicator uses NASDAQ volume data to indicate bullish and bearish conditions for the NASDAQ Composite Index. The indicator plots the ratio of the 10-day total of NASDAQ daily advancing volume (i.e., the total volume traded in stocks which rose in price each day) to the 10-day total of daily declining volume (volume traded in stocks which fell each day). This ratio indicates when advancing stocks are attracting the majority of the volume (readings above 1.0) and when declining stocks are seeing the heaviest trading (readings below 1.0). This indicator thus supports the case that a rising market supported by heavier volume in the advancing issues tends to be the most bullish condition, while a declining market with downside volume dominating confirms bearish conditions. When in a positive mode, the NASDAQ Composite has gained at a rate of +38.3% per year, When neutral, the NASDAQ has gained at a rate of +13.3% per year. And when negative, the NASDAQ has lost at a rate of -14.279% per year.

Breadth Thrust Model Explained: This indicator uses the number of NASDAQ-listed stocks advancing and declining to indicate bullish or bearish breadth conditions for the NASDAQ Composite. The indicator plots the ratio of the 10-day total of the number of stocks rising on the NASDAQ each day to the 10-day total of the number of stocks declining each day. Using 10-day totals smooths the random daily fluctuations and gives indications on an intermediate-term basis. As expected, the NASDAQ Composite performs much better when the 10-day A/D ratio is high (strong breadth) and worse when the indicator is in its lower mode (weak breadth). The most bullish conditions for the NASDAQ when the 10-day A/D indicator is not only high, but has recently posted an extreme high reading and thus indicated a thrust of upside momentum. Bearish conditions are confirmed when the indicator is low and has recently signaled a downside breadth thrust. In positive mode, the NASDAQ has gained at a rate of +22.1% per year since 1981. In a neutral mode, the NASDAQ has gained at a rate of +14.5% per year. And when in a negative mode, the NASDAQ has lost at a rate of -6.4% per year.

Short-Term Overbought/sold Indicator: This indicator is the current reading of the 14,1,3 stochastic oscillator. When the oscillator is above 80 and the %K is above the %D, the indicator gives an overbought reading. Conversely, when the oscillator is below 20 and %K is below its %D, the indicator is oversold.

Intermediate-Term Overbought/sold Indicator: This indicator is a 40-day RSI reading. When above 57.5, the indicator is considered overbought and wnen below 45 it is oversold.

Mean Reversion Model: This is a diffusion model consisting of five indicators that can produce buy and sell signals based on overbought/sold conditions.

VIX Indicator: This indicators looks at the current reading of the VIX relative to standard deviation bands. When the indicator reaches an extreme reading in either direction, it is an indication that a market trend could reverse in the near-term.

Short-Term Sentiment Indicator: This is a model-of-models composed of 18 independent sentiment indicators designed to indicate when market sentiment has reached an extreme from a short-term perspective. Historical analysis indicates that the stock market's best gains come after an environment has become extremely negative from a sentiment standpoint. Conversely, when sentiment becomes extremely positive, market returns have been subpar.

Intermediate-Term Sentiment Indicator: This is a model-of-models composed of 7 independent sentiment indicators designed to indicate when market sentiment has reached an extreme from a intermediate-term perspective. Historical analysis indicates that the stock market's best gains come after an environment has become extremely negative from a sentiment standpoint. Conversely, when sentiment becomes extremely positive, market returns have been subpar.

Long-Term Sentiment Indicator: This is a model-of-models composed of 6 independent sentiment indicators designed to indicate when market sentiment has reached an extreme from a long-term perspective. Historical analysis indicates that the stock market's best gains come after an environment has become extremely negative from a sentiment standpoint. Conversely, when sentiment becomes extremely positive, market returns have been subpar.

Absolute Monetary Model Explained: The popular cliche, "Don't fight the Fed" is really a testament to the profound impact that interest rates and Fed policy have on the market. It is a proven fact that monetary conditions are one of the most powerful influences on the direction of stock prices. The Absolute Monetary Model looks at the current level of interest rates relative to historical levels and Fed policy.

Relative Monetary Model Explained: The "relative" monetary model looks at monetary indicators relative to recent levels as well as rates of change and Fed Policy.

Economic Model Explained: During the middle of bull and bear markets, understanding the overall health of the economy and how it impacts the stock market is one of the few truly logical aspects of the stock market. When our Economic model sports a "positive" reading, history (beginning in 1965) shows that stocks enjoy returns in excess of 21% per year. Yet, when the model's reading falls into the "negative" zone, the S&P has lost nearly -25% per year. However, it is vital to understand that there are times when good economic news is actually bad for stocks and vice versa. Thus, the Economic model can help investors stay in tune with where we are in the overall economic cycle.

Inflation Model Explained: They say that "the tape tells all." However, one of the best "big picture" indicators of what the market is expected to do next is inflation. Simply put, since 1962, when the model indicates that inflationary pressures are strong, stocks have lost ground. Yet, when inflationary pressures are low, the S&P 500 has gained ground at a rate in excess of 13%. The bottom line is inflation is one of the primary drivers of stock market returns.

Valuation Model Explained: If you want to get analysts really riled up, you need only to begin a discussion of market valuation. While the question of whether stocks are overvalued or undervalued appears to be a simple one, the subject is actually extremely complex. To simplify the subject dramatically, investors must first determine if they should focus on relative valuation (which include the current level of interest rates) or absolute valuation measures (the more traditional readings of Price/Earnings, Price/Dividend, and Price/Book Value). We believe that it is important to recognize that environments change. And as such, the market's focus and corresponding view of valuations are likely to change as well. Thus, we depend on our Valuation Models to help us keep our eye on the ball.

Disclosures

NOT INVESTMENT ADVICE. The opinions and forecasts expressed herein are those of Mr. David Moenning and Heritage Capital Research and may not actually come to pass. The opinions and viewpoints regarding the future of the markets should not be construed as recommendations. The analysis and information in this report is for informational purposes only. No part of the material presented in this report is intended as an investment recommendation or investment advice. Neither the information nor any opinion expressed constitutes a solicitation to purchase or sell securities or any investment program.

Any investment decisions must in all cases be made by the reader or by his or her investment adviser. Do NOT ever purchase any security without doing sufficient research. There is no guarantee that the investment objectives outlined will actually come to pass. All opinions expressed herein are subject to change without notice. Neither the editor, employees, nor any of their affiliates shall have any liability for any loss sustained by anyone who has relied on the information provided.

Mr. Moenning of Heritage Capital Research is an investment adviser representative of Eastsound Capital Advisors, LLC, a registered investment advisor. The adviser may not transact business in states where it is not appropriately registered, excluded or exempted from registration. Individualized responses to persons that involve either the effecting of transaction in securities, or the rendering of personalized investment advice for compensation, will not be made without registration or exemption.

Mr. Moenning and Heritage Capital Research may at times have positions in the securities referred to and may make purchases or sales of these securities while publications are in circulation. Positions may change at any time.

The analysis provided is based on both technical and fundamental research and is provided "as is" without warranty of any kind, either expressed or implied. Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

The author neither endorses nor warrants the content of this site, any embedded advertisement, or any linked resource. The author or his managed funds may hold either long or short positions in the referenced securities. Republication rights must be expressly granted by author in writing.

Investments in equities carry an inherent element of risk including the potential for significant loss of principal. Past performance is not an indication of future results.