The Straws Breaking The Market's Back

Monday was another volatile day on Wall Street as the Dow Jones Industrial Average plunged 602 points. Granted, problems at Apple (AAPL) and Goldman Sachs (GS) accounted for 170 of those points. And yes, the machines were clearly at work again yesterday - especially in the afternoon where programs produced four distinct waves of selling between 2:30 pm eastern and the time the closing bell rang. However, it appears that oil and the U.S. dollar are the straws that may be breaking the market's back here.

The De-FAANG-ing Continues

Apple was a focal point early in the game as Lumentum (LITE), the company that produces the laser technology that powers the iPhone's facial recognition feature announced that "a large customer had cut orders." Traders assumed the customer in question was Apple and in the time it takes to turn on your iPhone X, the worries about the health of the world's biggest company was on. AAPL wound up falling a quick $10 (or 5.03%) and Lumentum dropped 33%. Ouch.

This, of course, led traders to continue to de-FAANG their portfolios, reduce their exposure to one of the biggest trades ever, and reconsider valuations in general. As you might suspect, the former tech darlings as well as many high-beta issues took it on the chin again.

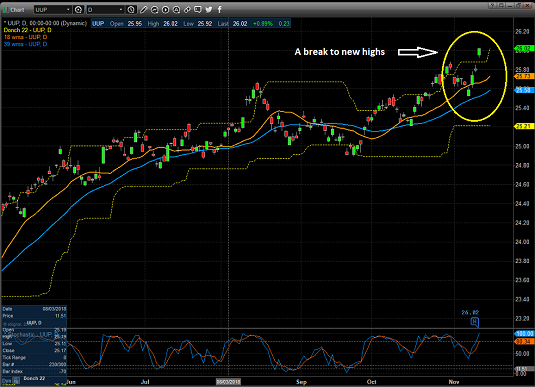

The Real Story Was the Dollar

But in the early going, the real story of the day was the greenback. In case you weren't paying attention, the U.S. Dollar broke out to a new 17-month high early in the session, spooking traders in the process.

Invesco DB US Dollar Fund (UUP) - Daily

View Larger Chart

Why should you care about the state of the dollar, you ask? One word. Earnings.

Don't forget that approximately 40% of S&P 500 company earnings are generated outside of the good 'ol USofA. The bottom line is that a rising dollar puts pressure on profits. And with lots of folks already concerned that Q3 earnings represent the "as good as it gets" high-water mark for this cycle, the stronger dollar simply causes more worry about future EPS growth.

It is also important to remember that a rising dollar poses problems for many foreign countries. The thinking is a stronger dollar perpetuates a slowdown of the global economy. And the last thing stock market bulls need right now is more talk of slowing growth.

And Then Oil...

Then there is the oil story. Over the last 28 trading sessions, the price of oil has nosedived in an eye-popping fashion. See below.

United States Oil Fund (USO) - Daily

View Larger Chart

One of the keys to yesterday's action is that oil appeared to be bouncing higher early in the session on the back of word that the Saudis were talking about cutting production. However, the good mood didn't last long, and the session turned ugly for oil as "Texas Tea" closed at a fresh new low.

To be sure, there are supply issues at play here. Yet at the same time, given the corresponding drop in commodity indices, it is hard not to think that there might be a message about global growth mixed into the price of oil here.

So... With the ongoing battle over BREXIT as well as issues including rising rates, Italy, the new political games in D.C., and the trade war, the addition of the dollar's rise and another dive in oil proved to be the straw that broke the camel's back. In short, there were simply too many negative inputs for the bulls to overcome on Monday.

Now mix in the overbought condition of the market, the expectation that the major indices will likely "retest" the recent lows, and key technical levels snapping like toothpicks. As a result, what you get is another WHOOSH to downside as buyers simply stand aside and let the sell algos do their thing.

But today is another day and upbeat earnings from retailers are giving the bulls a little lift in the early going. However, given the bearish action we are seeing here, I think we should buckle up and brace for an extended period of testing before Santa arrives.

Thought For The Day:

The true measure of a person is how they treat someone who can do him absolutely no good. - Samuel Johnson

Wishing you green screens and all the best for a great day,

David D. Moenning

Founder, Chief Investment Officer

Heritage Capital Research

HCR Focuses on a Risk-Managed Approach to Investing

What Risk Management Can and Cannot Do

ANNOUNCEMENT:

HCR Awarded Top Honors in 2018 NAAIM Shark Tank Portfolio Strategy Competition

Each year, NAAIM (National Association of Active Investment Managers) hosts a competition to identify the best actively managed investment strategies. In April, HCR's Dave Moenning took home first place for his flagship risk management strategy.

Disclosures

At the time of publication, Mr. Moenning held long positions in the following securities mentioned: AAPL - Note that positions may change at any time.

The opinions and forecasts expressed herein are those of Mr. David Moenning and may not actually come to pass. Mr. Moenning's opinions and viewpoints regarding the future of the markets should not be construed as recommendations. The analysis and information in this report is for informational purposes only. No part of the material presented in this report is intended as an investment recommendation or investment advice. Neither the information nor any opinion expressed constitutes a solicitation to purchase or sell securities or any investment program.

Any investment decisions must in all cases be made by the reader or by his or her investment adviser. Do NOT ever purchase any security without doing sufficient research. There is no guarantee that the investment objectives outlined will actually come to pass. All opinions expressed herein are subject to change without notice. Neither the editor, employees, nor any of their affiliates shall have any liability for any loss sustained by anyone who has relied on the information provided.

Mr. Moenning may at times have positions in the securities referred to and may make purchases or sales of these securities while publications are in circulation. Positions may change at any time.

The analysis provided is based on both technical and fundamental research and is provided "as is" without warranty of any kind, either expressed or implied. Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

Investments in equities carry an inherent element of risk including the potential for significant loss of principal. Past performance is not an indication of future results.