While We Are Waiting, Let's Check On The Cycles

To be sure, the current stock market is focused on a couple key things. While this can clearly be placed in the Captain Obvious category, first there is the trade war. From a near-term perspective it's this week's trade negotiations. And second, there is the upcoming Fed meeting. Yes, yes, the economic data has had some impact of late as well, usually when the numbers represent a big surprise (such as last week's ISM reports). But the bottom line is traders continue to be uber sensitive to the first two issues - as in 1% moves within a minute sensitive!

In case you've been living in a cave without a nearby cell tower (aren't the new neighborhood cell poles awesome!), stocks have clearly been driven to and fro on each and every update of these topics for many moons now. And unless/until something changes on either the trade or Fed fronts, we can likely expect the intraday volatility to stick around.

While We Wait...

So, while we wait for the next headline or tweet storm, I thought this might be a good time to check in on how the market is faring relative to the projection made by Ned Davis Research's "Cycle Composite."

Longtime readers are likely familiar with my love affair with the cycle composite projection and how the composite is constructed. As such, feel free to skip the next paragraph.

However, if you are new to my sometimes meandering market missives, you should know that NDR's Cycle composite is a combination of the 1-year seasonal cycle, the 4-year Presidential cycle, and the 10-year decennial cycle. NDR throws all the data back to 1900 into the computers and creates a "mashup" of the historical cycles - aka the Cycle Composite.

I've been following the various cycle projections for years. For me it is fascinating how the market will, more times than not, follow the general theme of the cycle projection. While it is true that there are times when the market simply ignores the historical cycles and goes on its merry way, I can also say that when the market is "in sync" with the cycle projection, the composite's projection can be good - as in scary good. I guess the key here is to recognize that, as the saying goes, while history rarely repeats itself exactly, it does oftentimes rhyme.

What Do The Cycles Say?

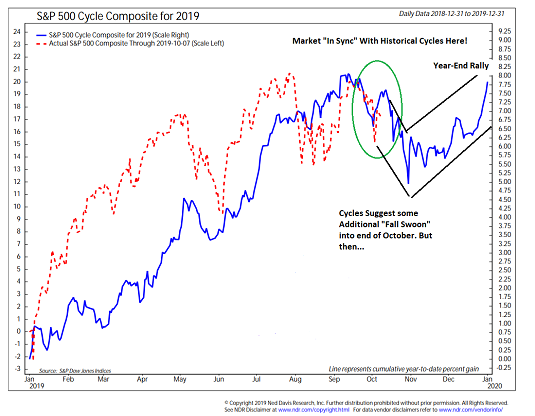

Without further ado, below is a chart of the S&P 500 (red dashed line) overlaid on the cycle composite's projection (blue line) for the year. From my seat, there are several takeaways here...

First, as the chart clearly shows, stocks went nuts early in the year as stocks reacted to the Fed's complete flip-flop and pretty much ignored any cyclical downturns until May. As such, we can conclude that the market was somewhat "out of sync" with the cycle composite (in a good way) from early January through the end of April.

Next, the traditional "Sell in May" move began right on schedule this year. And while the move in the market was much more severe than the cycles had called for, the end result was that by the beginning of June, the market was back in line with where the projection said it would be.

Then with hopes for a positive resolution of the trade war improving, the S& once again sprinted away from the cycle projection into the end of July with the S&P scoring new all-time highs. But I will argue that the move was still largely in line with what the cycle composite had projected.

Next came the "sloppy period" from July through August. And once again, the S&P stuck to the script.

And since the beginning of September, the market has continued to follow the lead of the cycle composite's projection. So much so that as of Monday's close, the S&P 500 closed almost EXACTLY where the cycle said it would (the green circle on the chart). Eerie, right!

What's Next?

Naturally, the next thing to do here is to look at what is projected for the remainder of the year. The bad news for the bulls is the cycle composite suggests that the traditional "fall swoon" is likely to continue through the end of the month.

The good news is that from there, after a brief period of backing and filling, the typical year-end rally is projected to commence. And although the trend of the cycle composite is more important than the level, the projection is for the S&P to finish near the highs of the year. Insert "Thumbs Up" emoji here.

While the market will likely continue to be driven by the news, my view on how the two big issues play out into the end of the year (i.e. global central bankers continuing to ease and stocks continuing to discount the idea that the Administration will try to get some sort of trade deal done before the election season heats up) suggests that the market may continue to stick to the script for the final 3 months of 2019. Fingers crossed!

Thought For The Day:

Let's make lying bad again! - Bumper sticker first seen September 2019

Wishing you green screens and all the best for a great day,

David D. Moenning

Founder, Chief Investment Officer

Heritage Capital Research

HCR Focuses on a Risk-Managed Approach to Investing

What Risk Management Can and Cannot Do

Disclosures

At the time of publication, Mr. Moenning held long positions in the following securities mentioned: none - Note that positions may change at any time.

NOT INVESTMENT ADVICE. The opinions and forecasts expressed herein are those of Mr. David Moenning and Heritage Capital Research and may not actually come to pass. The opinions and viewpoints regarding the future of the markets should not be construed as recommendations. The analysis and information in this report is for informational purposes only. No part of the material presented in this report is intended as an investment recommendation or investment advice. Neither the information nor any opinion expressed constitutes a solicitation to purchase or sell securities or any investment program.

Any investment decisions must in all cases be made by the reader or by his or her investment adviser. Do NOT ever purchase any security without doing sufficient research. There is no guarantee that the investment objectives outlined will actually come to pass. All opinions expressed herein are subject to change without notice. Neither the editor, employees, nor any of their affiliates shall have any liability for any loss sustained by anyone who has relied on the information provided.

Mr. Moenning of Heritage Capital Research is an investment adviser representative of Eastsound Capital Advisors, LLC, a registered investment advisor. The adviser may not transact business in states where it is not appropriately registered, excluded or exempted from registration. Individualized responses to persons that involve either the effecting of transaction in securities, or the rendering of personalized investment advice for compensation, will not be made without registration or exemption.

Mr. Moenning and Heritage Capital Research may at times have positions in the securities referred to and may make purchases or sales of these securities while publications are in circulation. Positions may change at any time.

The analysis provided is based on both technical and fundamental research and is provided "as is" without warranty of any kind, either expressed or implied. Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

The author neither endorses nor warrants the content of this site, any embedded advertisement, or any linked resource. The author or his managed funds may hold either long or short positions in the referenced securities. Republication rights must be expressly granted by author in writing.

Investments in equities carry an inherent element of risk including the potential for significant loss of principal. Past performance is not an indication of future results.