A Worry Worth Considering

To be sure, there will be a lot of keystrokes used to talk about Apple (NASDAQ: AAPL) today. Frankly, it is very interesting to hear all the analysts talk about Apple's upside potential given the growth in services segment, the hardware deliveries, the higher than expected average selling price, and then make the argument for AAPL getting a higher multiple. And my guess is that many readers would like nothing more than 1,000 words about Apple's bright future.

But this morning, I thought I'd step away from all the company-specific issues that have driven so much of the action of late, and instead, focus on the bigger picture.

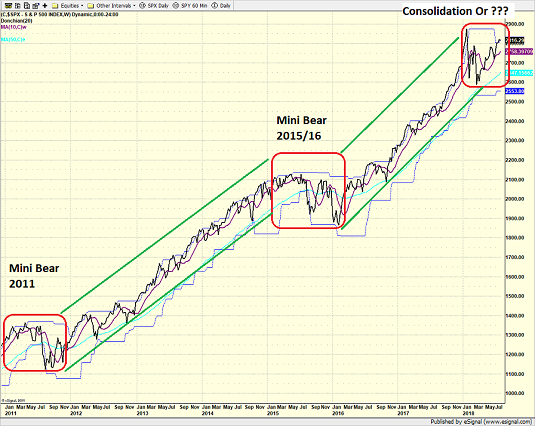

As you are likely aware, I've been of the mind that the stock market has spent the last six months digesting or consolidating the big gains the S&P 500 enjoyed (57.1% to be exact) since the last "mini bear" market ended in February 2016.

Most folks define a bear market as a decline of 20% or more in their index of choice. However, I think shallower declines that last a protracted length of time can also be considered as least some sort of bear. So, given that (a) there has been some pretty brutal action in a fair number of high profile stocks lately, (b) most corrective phases don't last more than a few months, and (c) valuations remain historically high, I think it is worth entertaining the possibility that the bears could be lurking.

Below is a graphic depiction of what I'm thinking. And since markets do tend to travel in cycles, I want to make room in my brain for the idea that the next big move could be down.

S&P 500 - Daily

View Larger Image Online

The question, of course, is what would cause investors to change their currently upbeat view of the world? What would cause folks to start selling stocks or demanding more of the companies they own?

#SlowingGrowth

Cutting to the chase, the answer is a slowdown in the rate growth for either the economies of the world or corporate earnings. To be clear, I don't think we would need to see a recession per se in order for this market to continue moving sideways or even down for a while. With valuations where they are, a growth slowdown might be enough to cause buyers to stand aside for awhile and/or sellers to get active.

The recent action in Facebook (NYSE: FB) is a good example of what I'm talking about. In the blink of an eye, the value of FB was reduced by 20%. Why? Because the company's earnings report and conference call suggested that the firm's growth rate is going to fall. Bam. Just like that, traders "corrected" their expectations by moving the price down.

So, let's take this concept and apply it to the broad market. If economic growth was the cause for prices being bid up in 2017, then the argument can certainly be made that a slowdown in the rate of expected growth could create the opposite effect.

The key point on this fine Wednesday morning is that we may be starting to see this in places like Europe, China, and even to a certain extent in the good 'ol USofA.

Is China Slowing?

According to the latest data, the Chinese economy may be slowing. For example, the recent PMI (Purchasing Managers' Index) data, business activity definitely faltered in July. The manufacturing PMI fell to a five-month low, while the import subindex of slipped to a 23-month low.

What's the reason for the slowdown, you ask? The WSJ opines that the PMI is the "first official data reflecting the impact of U.S. tariffs." And suggests that "trade tensions have started to pinch China's economic growth."

Is Europe Slowing?

The answer is yes. According to this month's GDP report, the eurozone's economy slowed again in the second quarter. The European Union's statistics agency reported that GDP for the 19 Eurozone countries came in at an annualized rate of just 1.4% in Q2.

Now toss in tariffs and trade talks with the Brits and the U.S., and well, it is easy to become less than optimistic about the outlook in the coming quarters.

Is the U.S. Economy Slowing?

In a word, no. However, the rate of growth appears to be. In fact, many analysts believe that Q2's growth rate may be the peak for this cycle. Especially given the trade war, inflation, etc.

One piece of evidence here is the model I follow on U.S. Industrial Production just issued a sell signal. The signal was triggered by, yep, you guessed it; a slowdown in the rate of growth. And since the stock market is a discounting mechanism of future expectations, well, you probably don't need me to even finish this thought.

To be fair, there are lots of other data points suggesting the U.S. economy is doing just fine, thank you - such as this morning's ADP Private Payrolls report, which came in above expectations. But the key is that there are some signs of a slowdown in the rate of growth - if you want to look for them.

Trade Talks Revived?

The good news is that the U.S. and China are at least talking about talking about trade. Bloomberg reported Tuesday that Representatives of U.S. Treasury Secretary Steven Mnuchin and Chinese Vice Premier Liu He are having private conversations as they "look for ways to reengage in negotiations."

As you will recall, negotiations to resolve the trade dispute with China have been stalled for weeks, with both sides refusing to budge from what appear to be hardened positions. However, apparently there are some high-level talks (talks about talking, that is) occurring behind the scenes.

There is little doubt that word of a possible resolution to the trade war would be music to the market's ears in the short run. And yes, this alone might be enough to turn the tide on the #SlowingGrowth theme.

But if you are looking for a reason to either take or maintain a modestly cautious stance, the idea that growth may be slowing is something to consider.

Publishing Note: My next report will be published Monday morning.

ANNOUNCEMENT:

HCR Awarded Top Honors in 2018 NAAIM Shark Tank Portfolio Strategy Competition

Each year, NAAIM (National Association of Active Investment Managers) hosts a competition to identify the best actively managed investment strategies. In April, HCR's Dave Moenning took home first place for his flagship risk management strategy.

Want to Learn More? Contact Dave

A Word About Managing Risk in the Stock Market

Thought For The Day:

A lie can travel halfway around the world while the truth is putting on its shoes. - Mark Twain

Wishing you green screens and all the best for a great day,

David D. Moenning

Founder, Chief Investment Officer

Heritage Capital Research

HCR Focuses on a Risk-Managed Approach to Investing

Must Read: What Risk Management Can and Cannot Do

HCR's Financial Advisor Services

Questions, comments, or ideas? Contact Us

At the time of publication, Mr. Moenning held long positions in the following securities mentioned: AAPL, FB - Note that positions may change at any time.

Disclosures

The opinions and forecasts expressed herein are those of Mr. David Moenning and may not actually come to pass. Mr. Moenning's opinions and viewpoints regarding the future of the markets should not be construed as recommendations. The analysis and information in this report is for informational purposes only. No part of the material presented in this report is intended as an investment recommendation or investment advice. Neither the information nor any opinion expressed constitutes a solicitation to purchase or sell securities or any investment program.

Any investment decisions must in all cases be made by the reader or by his or her investment adviser. Do NOT ever purchase any security without doing sufficient research. There is no guarantee that the investment objectives outlined will actually come to pass. All opinions expressed herein are subject to change without notice. Neither the editor, employees, nor any of their affiliates shall have any liability for any loss sustained by anyone who has relied on the information provided.

Mr. Moenning may at times have positions in the securities referred to and may make purchases or sales of these securities while publications are in circulation. Positions may change at any time.

The analysis provided is based on both technical and fundamental research and is provided "as is" without warranty of any kind, either expressed or implied. Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

Investments in equities carry an inherent element of risk including the potential for significant loss of principal. Past performance is not an indication of future results.