Bulls May Need To Slow Their Roll

The "State of the Markets"

The bulls encountered a bit of a challenge early last week, but by Friday appeared to be none the worse for wear as the rip-snorting bull run of 2018 continued unabated.

However, at least on Tuesday and Wednesday, it appeared that our furry friends in the bear camp had finally found something to get excited about as bond yields began to spike through what some viewed as critical levels. For example, former bond king, Bill Gross declared that a new bear market for bonds was upon us as rates went through his key line in the sand at 2.5% on the U.S. 10-year.

Personally, I think the more important levels for the 10-year yields are at 2.6% from a near-term perspective and 3.0% on a longer-term, weekly chart. However, the key is that rates were spiking on a Bloomberg report that the Chinese were considering paring back, or even halting, their purchases of U.S. treasuries. And by Wednesday morning, the 10-year was trading at 2.595%, which was within a whisker of my personal line in the sand.

In all honesty, I was ready to move into "panic early" mode (as in, "panic early or not at all") on Wednesday morning and was considering some defensive moves in the bond market. But, the more I thought about the situation, the more odd the report became, at least in my mind. My thinking was as follows...

First, China really doesn't have many alternatives when it comes to placing all those U.S. dollars it takes in. A Deutsche Bank report summed up the situation nicely. "The simple fact remains that in the short run, the US fixed income market is the only market with sufficient size and depth to accommodate the bulk of the demand from China."

Next, U.S. bonds continue to provide significantly higher yields than the other big markets such as Germany, UK, and Japan. And that's before you factor in the conversion of dollars into other currencies.

Oh and why would China intentionally "talk down" the prices of its own holdings? Remember, China is the largest foreign holder of U.S. bonds. So making statements that cause your positions to tank makes little sense from an investment standpoint.

And finally, I knew that China had been talking about diversifying their currency holdings for eons.

So, I stepped back from the keyboard and decided to simply watch the action for a bit. And sure enough, the next report out of the world's second biggest economy was that the initial report had been fake news.

As far as the stock market was concerned, nobody seemed to care. The "dip" - if you can really call it that - was bought and investors large and small appeared to go on about their business of putting money to work in stocks.

It didn't hurt that the economic data showed no sign of inflation and that consumers were still on a shopping spree. Or that the earnings from JP Morgan (NYSE: JPM) - a stock I've owned for some time - were pretty darned good. The bottom line is that the bulls remained in stampede mode and the major indices all finished at all-time highs.

From a big-picture perspective (which is what the first report each week is supposed to be all about), the trend is clearly an investor's friend here. However, the move is definitely a bit too enthusiastic for my taste and I worry that if the current run continues much longer, it could end in an ugly fashion. So, while Ms. Market doesn't give a hoot about what I think, I'd prefer to see the bulls slow their roll a bit in the near term.

In summary, I've been saying for some time now that it remains appropriate to side with the bulls here and to enjoy the ride. However, I believe it is also important to recognize that risk is elevated at this time. And for me, this means that the portfolio turbochargers (margin, leverage, and the like) should be in the "off" position and that taking one's foot off the gas to coast for a while might wind up being prudent.

Thought For The Day:

You are what you do, not what you say you'll do. - Carl Jung

Wishing you green screens and all the best for a great day,

David D. Moenning

President, Heritage Capital Research

Serving Financial Advisors since 1989

Serving individual investors since 1980

Quesitons, comments, or ideas? Contact Us

Disclosure: At the time of publication, Mr. Moenning held long positions in the following securities mentioned: JPM. Note that positions may change at any time.

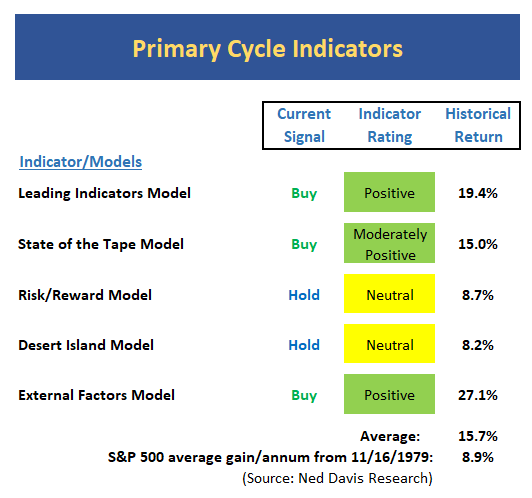

The State of the Big-Picture Market Models

It's a new week, so let's start things off with a review of the state of the market - I.E. a review my favorite big-picture market models, which are designed to tell us which team is in control of the prevailing major trend.

View My Favorite Market Models Online

Executive Summary:

- The Leading Indicators model, which was our best performing timing model during the last cycle, continues to hold steady with a reading of 80%. So, all good here.

- We have recently upgraded our "State of the tape" model to include an additional 5 indicator readings. The current reading of the new model has pulled back over thea past two weeks but remains in the positive zone. This is something to watch as this indicator now incorporates long-term overbought/sold readings.

- The Risk/Reward model continues to be struggle in this environment due to monetary and sentiment conditions. Thus, the model remains stuck in neutral.

- If I had to manage money from a desert island and could only use one model, I would use the aptly named model which is a combination of internal and external factors. Currently, the model remains on a long-term buy signal, however, the model reading remains in the neutral zone for a second consecutive week. To me this says, the trend is your friend but risk is elevated.

- The newly expanded External Factors model includes a total of 10 indicators ranging from earnings, yields, sentiment, monetary, economic, and volatility. The current model reading is positive - albeit only by a hair.

- In sum, the bulls remain large and in charge, but may need to slow their roll a bit if they expect the current trend to be sustainable.

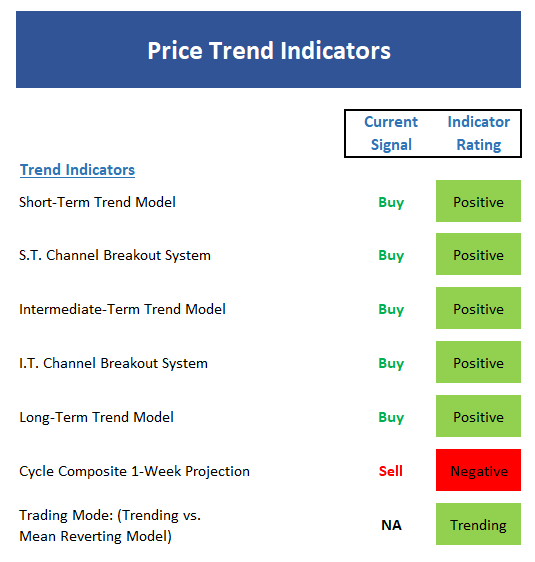

The State of the Trend

Digging into the details, I like to start my weekly review with a look at the "state of the trend." These indicators are designed to give us a feel for the overall health of the current short- and intermediate-term trend models.

View Trend Indicator Board Online

Executive Summary:

- The short-term trend of the stock market continues in melt-up mode. Where she stops, nobody knows.

- Both the short- and intermediate-term Channel Breakout Systems are positive to start the week. From a short-term perspective, a break below 2682 would turn the system negative, the trend stays positive above 2650 from an intermediate-term point of view.

- The intermediate-term Trend Model is positive. Although the weekly chart of the S&P 500 appears to now be in "parabolic mode"

- Ditto for the long-term Trend Model. The most bullish thing a market can do is make new highs.

- The Cycle Composite suggest a decline in the near-term.

- The Trading Mode models confirm that stocks are in a trending environment.

- In sum, same song, different week. There just isn't much to complain about here from an trend indicator standpoint.

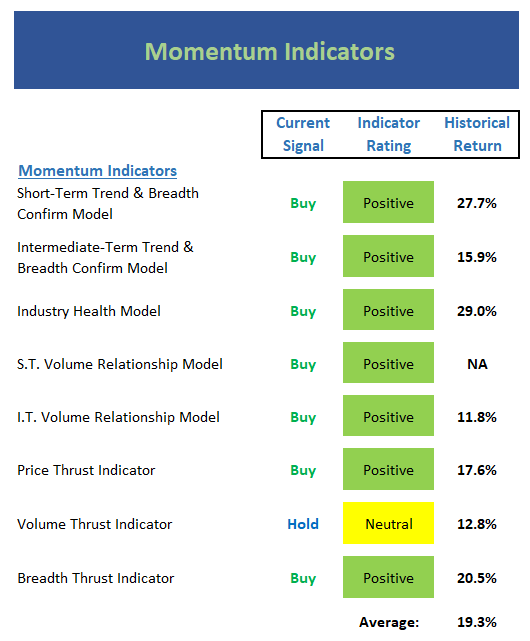

The State of Internal Momentum

Next up are the momentum indicators, which are designed to tell us whether there is any "oomph" behind the current trend.

View Momentum Indicator Board Online

Executive Summary:

- Both the short- and intermediate-term Trend and Breadth Confirm Models are positive

- It is worth noting that the advance/decline line for our multi-cap equity universe is at all-time highs. This represents a confirmation of the trend.

- The Industry Health Model has managed to inch into positive territory.

- The short-term Volume Relationship is positive and improving. However, I would prefer to see our measure of up volume making cycle highs. Currently it is not.

- Ditto for the intermediate-term Volume Relationship mode. The model itself is in good shape, but demand volume is below the 2016 high.

- Not surprisingly, the Price Thrust Indicator remains positive to start the week.

- However, the Volume Thrust Indicator is stuck in neutral here.

- The Breadth Thrust Indicator remains in the positive zone this week.

- The message from the momentum board is that we have a confirmed uptrend on our hands without any serious divergences.

The State of the "Trade"

We also focus each week on the "early warning" board, which is designed to indicate when traders might start to "go the other way" -- for a trade.

View Early Warning Indicator Board Online

Executive Summary:

- From a near-term perspective, stocks are overbought. However, as I've been saying, the intensity of the blast suggests the current condition is not a reason to sell.

- From an intermediate-term view, stocks are also overbought. But as I stated last week, I view this as a "good overbought" condition.

- The Mean Reversion Model continues to be out of whack and is currently neutral.

- The short-term VIX indicator has issued a sell signal but is currently dead neutral.

- The longer-term VIX Indicator remains on a buy signal.

- The sentiment models all currently reside in the "extreme optimism" zone - with one model reaching the highes reading seen in 15 years last week.

- While timing is always an issue, the early warning board suggests that stocks are overbought, sentiment is too optimistic, and the rally is due for a pause.

- From a pure momentum standpoint, it is important to recognize that when there is "oomph" behind a move, overbought conditions are a sign of strength and not a mean-reversion sell signal.

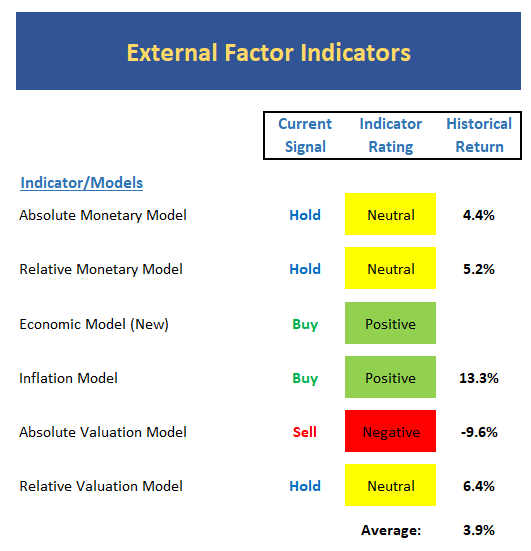

The State of the Macro Picture

Now let's move on to the market's "external factors" - the indicators designed to tell us the state of the big-picture market drivers including monetary conditions, the economy, inflation, and valuations.

View External Factors Indicator Board Online

Executive Summary:

- Absolute Monetary conditions haven't changed - the current model reading is dead neutral.

- The Relative Monetary Model also sports a dead neutral reading.

- Our Economic Model has been holding steady and continues to suggest a strong economic growth environment.

- The Inflation Model continues to suggest low inflationary pressures and sports the lowest reading since 2015.

- The Absolute Valuation Model is now giving back its recent modest gains as price is rising faster than earnings.

- Our Relative Valuation Model continues to move closer to a sell signal and is currently neutral by the slimmest of margins (0.3% to be exact)

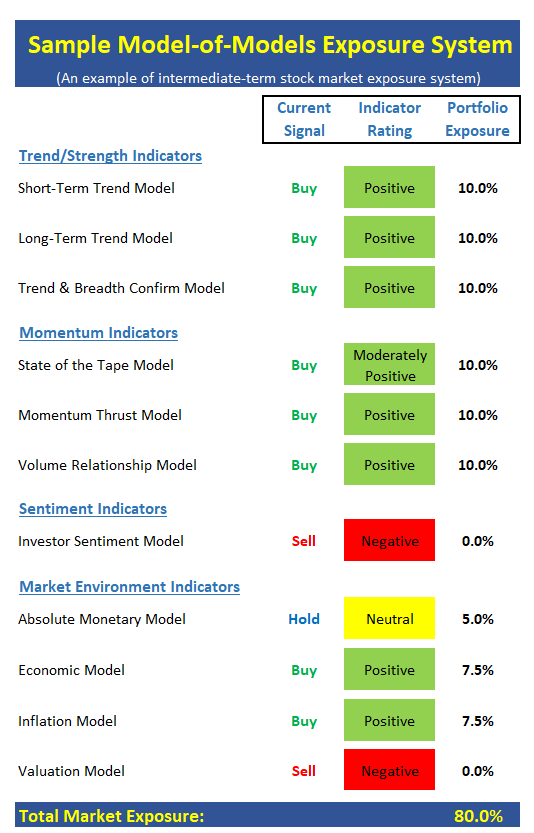

Sample Risk Exposure System

Below is an EXAMPLE of how some of above indicators might be used in order to determine exposure to market risk. The approach used here is a "Model of Models" comprised of 10 independent Models. Each model included gives separate buy and sell signals, which affects a percentage of the model's overall exposure to the market.

Trend models control a total 40% of our exposure. The 3 Momentum Models and 3 Environment Models each control 10% of the portfolio's exposure to market risk. The model's "Exposure to Market Risk" reading (at the bottom of the Model) acts as an EXAMPLE of a longer-term guide to exposure to market risk.

In looking at the "bottom line" of this model, my take is that readings over 75% are "positive," readings between 50% and 75% are "moderately positive," and readings below 50% should be viewed as a warning that all is not right with the indicator world.

View Sample Exposure Model Online

The model above is for illustrative and informational purposes only and does not in any way represent any investment recommendation. The model is merely a sample of how indicators can be grouped to create a guide to market exposure based on the inputs from multiple indicators/models.

Current Market Drivers

We strive to identify the driving forces behind the market action on a daily basis. The thinking is that if we can both identify and understand why stocks are doing what they are doing on a short-term basis; we are not likely to be surprised/blind-sided by a big move. Listed below are what we believe to be the driving forces of the current market (Listed in order of importance).

1. The State of the Economy

2. The State of Fed Policy

3. The State of Earnings Growth

Indicators Explained

Short-Term Trend-and-Breadth Signal Explained: History shows the most reliable market moves tend to occur when the breadth indices are in gear with the major market averages. When the breadth measures diverge, investors should take note that a trend reversal may be at hand. This indicator incorporates NDR's All-Cap Dollar Weighted Equity Series and A/D Line. From 1998, when the A/D line is above its 5-day smoothing and the All-Cap Equal Weighted Equity Series is above its 25-day smoothing, the equity index has gained at a rate of +32.5% per year. When one of the indicators is above its smoothing, the equity index has gained at a rate of +13.3% per year. And when both are below, the equity index has lost +23.6% per year.

Channel Breakout System Explained: The short-term and intermediate-term Channel Breakout Systems are modified versions of the Donchian Channel indicator. According to Wikipedia, "The Donchian channel is an indicator used in market trading developed by Richard Donchian. It is formed by taking the highest high and the lowest low of the last n periods. The area between the high and the low is the channel for the period chosen."

Intermediate-Term Trend-and-Breadth Signal Explained: This indicator incorporates NDR's All-Cap Dollar Weighted Equity Series and A/D Line. From 1998, when the A/D line is above its 45-day smoothing and the All-Cap Equal Weighted Equity Series is above its 45-day smoothing, the equity index has gained at a rate of +17.6% per year. When one of the indicators is above its smoothing, the equity index has gained at a rate of +6.5% per year. And when both are below, the equity index has lost -1.3% per year.

Industry Health Model Explained: Designed to provide a reading on the technical health of the overall market, Big Mo Tape takes the technical temperature of more than 100 industry sectors each week. Looking back to early 1980, when the model is rated as "positive," the S&P has averaged returns in excess of 23% per year. When the model carries a "neutral" reading, the S&P has returned over 11% per year. But when the model is rated "negative," stocks fall by more than -13% a year on average.

Cycle Composite Projections: The cycle composite combines the 1-year Seasonal, 4-year Presidential, and 10-year Decennial cycles. The indicator reading shown uses the cycle projection for the upcoming week.

Trading Mode Indicator: This indicator attempts to identify whether the current trading environment is "trending" or "mean reverting." The indicator takes the composite reading of the Efficiency Ratio, the Average Correlation Coefficient, and Trend Strength models.

Volume Relationship Models: These models review the relationship between "supply" and "demand" volume over the short- and intermediate-term time frames.

Price Thrust Model Explained: This indicator measures the 3-day rate of change of the Value Line Composite relative to the standard deviation of the 30-day average. When the Value Line's 3-day rate of change have moved above 0.5 standard deviation of the 30-day average ROC, a "thrust" occurs and since 2000, the Value Line Composite has gained ground at a rate of +20.6% per year. When the indicator is below 0.5 standard deviation of the 30-day, the Value Line has lost ground at a rate of -10.0% per year. And when neutral, the Value Line has gained at a rate of +5.9% per year.

Volume Thrust Model Explained: This indicator uses NASDAQ volume data to indicate bullish and bearish conditions for the NASDAQ Composite Index. The indicator plots the ratio of the 10-day total of NASDAQ daily advancing volume (i.e., the total volume traded in stocks which rose in price each day) to the 10-day total of daily declining volume (volume traded in stocks which fell each day). This ratio indicates when advancing stocks are attracting the majority of the volume (readings above 1.0) and when declining stocks are seeing the heaviest trading (readings below 1.0). This indicator thus supports the case that a rising market supported by heavier volume in the advancing issues tends to be the most bullish condition, while a declining market with downside volume dominating confirms bearish conditions. When in a positive mode, the NASDAQ Composite has gained at a rate of +38.3% per year, When neutral, the NASDAQ has gained at a rate of +13.3% per year. And when negative, the NASDAQ has lost at a rate of -8.5% per year.

Breadth Thrust Model Explained: This indicator uses the number of NASDAQ-listed stocks advancing and declining to indicate bullish or bearish breadth conditions for the NASDAQ Composite. The indicator plots the ratio of the 10-day total of the number of stocks rising on the NASDAQ each day to the 10-day total of the number of stocks declining each day. Using 10-day totals smooths the random daily fluctuations and gives indications on an intermediate-term basis. As expected, the NASDAQ Composite performs much better when the 10-day A/D ratio is high (strong breadth) and worse when the indicator is in its lower mode (weak breadth). The most bullish conditions for the NASDAQ when the 10-day A/D indicator is not only high, but has recently posted an extreme high reading and thus indicated a thrust of upside momentum. Bearish conditions are confirmed when the indicator is low and has recently signaled a downside breadth thrust. In positive mode, the NASDAQ has gained at a rate of +22.1% per year since 1981. In a neutral mode, the NASDAQ has gained at a rate of +14.5% per year. And when in a negative mode, the NASDAQ has lost at a rate of -6.4% per year.

Short-Term Overbought/sold Indicator: This indicator is the current reading of the 14,1,3 stochastic oscillator. When the oscillator is above 80 and the %K is above the %D, the indicator gives an overbought reading. Conversely, when the oscillator is below 20 and %K is below its %D, the indicator is oversold.

Intermediate-Term Overbought/sold Indicator: This indicator is a 40-day RSI reading. When above 57.5, the indicator is considered overbought and when below 45 it is oversold.

Mean Reversion Model: This is a diffusion model consisting of five indicators that can produce buy and sell signals based on overbought/sold conditions.

VIX Indicator: This indicator looks at the current reading of the VIX relative to standard deviation bands. When the indicator reaches an extreme reading in either direction, it is an indication that a market trend could reverse in the near-term.

Short-Term Sentiment Indicator: This is a model-of-models composed of 18 independent sentiment indicators designed to indicate when market sentiment has reached an extreme from a short-term perspective. Historical analysis indicates that the stock market's best gains come after an environment has become extremely negative from a sentiment standpoint. Conversely, when sentiment becomes extremely positive, market returns have been subpar.

Intermediate-Term Sentiment Indicator: This is a model-of-models composed of 7 independent sentiment indicators designed to indicate when market sentiment has reached an extreme from an intermediate-term perspective. Historical analysis indicates that the stock market's best gains come after an environment has become extremely negative from a sentiment standpoint. Conversely, when sentiment becomes extremely positive, market returns have been subpar.

Long-Term Sentiment Indicator: This is a model-of-models composed of 6 independent sentiment indicators designed to indicate when market sentiment has reached an extreme from a long-term perspective. Historical analysis indicates that the stock market's best gains come after an environment has become extremely negative from a sentiment standpoint. Conversely, when sentiment becomes extremely positive, market returns have been subpar.

Absolute Monetary Model Explained: The popular cliché, "Don't fight the Fed" is really a testament to the profound impact that interest rates and Fed policy have on the market. It is a proven fact that monetary conditions are one of the most powerful influences on the direction of stock prices. The Absolute Monetary Model looks at the current level of interest rates relative to historical levels and Fed policy.

Relative Monetary Model Explained: The "relative" monetary model looks at monetary indicators relative to recent levels as well as rates of change and Fed Policy.

Economic Model Explained: During the middle of bull and bear markets, understanding the overall health of the economy and how it impacts the stock market is one of the few truly logical aspects of the stock market. When our Economic model sports a "positive" reading, history (beginning in 1965) shows that stocks enjoy returns in excess of 21% per year. Yet, when the model's reading falls into the "negative" zone, the S&P has lost nearly -25% per year. However, it is vital to understand that there are times when good economic news is actually bad for stocks and vice versa. Thus, the Economic model can help investors stay in tune with where we are in the overall economic cycle.

Inflation Model Explained: They say that "the tape tells all." However, one of the best "big picture" indicators of what the market is expected to do next is inflation. Simply put, since 1962, when the model indicates that inflationary pressures are strong, stocks have lost ground. Yet, when inflationary pressures are low, the S&P 500 has gained ground at a rate in excess of 13%. The bottom line is inflation is one of the primary drivers of stock market returns.

Valuation Model Explained: If you want to get analysts really riled up, you need only to begin a discussion of market valuation. While the question of whether stocks are overvalued or undervalued appears to be a simple one, the subject is extremely complex. To simplify the subject dramatically, investors must first determine if they should focus on relative valuation (which include the current level of interest rates) or absolute valuation measures (the more traditional readings of Price/Earnings, Price/Dividend, and Price/Book Value). We believe that it is important to recognize that environments change. And as such, the market's focus and corresponding view of valuations are likely to change as well. Thus, we depend on our Valuation Models to help us keep our eye on the ball.

Disclosures

The opinions and forecasts expressed herein are those of Mr. David Moenning and may not actually come to pass. Mr. Moenning's opinions and viewpoints regarding the future of the markets should not be construed as recommendations. The analysis and information in this report is for informational purposes only. No part of the material presented in this report is intended as an investment recommendation or investment advice. Neither the information nor any opinion expressed constitutes a solicitation to purchase or sell securities or any investment program.

Any investment decisions must in all cases be made by the reader or by his or her investment adviser. Do NOT ever purchase any security without doing sufficient research. There is no guarantee that the investment objectives outlined will actually come to pass. All opinions expressed herein are subject to change without notice. Neither the editor, employees, nor any of their affiliates shall have any liability for any loss sustained by anyone who has relied on the information provided.

Mr. Moenning may at times have positions in the securities referred to and may make purchases or sales of these securities while publications are in circulation. Positions may change at any time.

The analysis provided is based on both technical and fundamental research and is provided "as is" without warranty of any kind, either expressed or implied. Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

Investments in equities carry an inherent element of risk including the potential for significant loss of principal. Past performance is not an indication of future results.