Is It Over? And What To Expect Next

I ended last week's pre-holiday missive with the following: "It is easy to say the bulls are due. Really due." And as if right on cue, stocks proceeded to bounce hard the following session with the Dow Jones Industrial Average enjoying its biggest one-day point gain in history: 1,086.25. Nice.

To be sure, the bounce was to be expected. The market was oversold - as in VERY oversold - on just about every metric. Sentiment was reaching "give up" levels. Technical support zones had been obliterated. Trend measures pointed straight down. Market models flashed sell signals across the board. Everybody was now a bear. And the VIX had finally exceeded the magical 30-mark. As such, once the White House assured everyone that Jay Powell's job was "safe," (and for the record, the Fed Chair can only be fired for "cause" - aka malfeasance) an explosive, sigh-of-relief / short-covering / it's-time-to-go-the-other-way rally began. It will suffice to say that Wednesday was a good day.

But then came the reversal early Thursday morning. In keeping with the current trend, traders wasted little time in returning to the sell button. If you will recall, prior to the big bounce, the game had been to sell into EVERY advance the indices offered - no matter how short or small. So, with the market sinking again, the goodness of Wednesday's algo-induced blast appeared to be at risk.

Well, until 2:30 pm eastern time, that is. At that point, the boys trained their computer toys on the buy side. Word was that some $60 billion in pension money needed to be invested. So, in the ensuing 90 minutes, the Dow surged 860 points. Yowza! Talk about a perfect example of computers chasing their tails.

It was at this point that the, "Is it over?" calls began. Two straight up days. A key reversal. Losses quickly being erased. Suddenly everybody was feeling better about the market. Suddenly it was time to "take advantage" and to "buy the dip," right? Or so I was asked.

My response to the inquiry of whether or not this was time to abandon our risk-managed positions and reinvest the cash on the sidelines was simple, "Not so fast!"

The Crash Playbook Back In Play

I explained that the current decline represents a classic "waterfall decline" or something William O'Neil termed a "bad news panic." I opined that since the environment was now identifiable, every trader on the planet was about to implement what I call the "Crash Playbook."

I have reviewed the playbook many times over the years and my guess is that most readers have their own versions by now. So, let's turn to chapter 3, "The Dead Cat Bounce."

The playbook reminds us that after an initial painful decline and the emotional low, a bounce of the dead cat variety begins. The surge higher is usually short, sharp, and takes your breath away. I think we can make a check mark here.

The only question at this stage of the game is how high will the bounce go? The level getting the most attention on the topic is around 2600 on the S&P 500 and 24,400 on the DJIA. And should the S&P manage to get through the 2627 level and hold on, technicians can argue that the low of this bear phase had been seen.

What Comes Next?

Let's return to the playbook. History teaches us that after some exciting upside action during these short/sharp bounces, the reason the decline began in the first place tends to resurface. The indices bump into resistance as the initial dip-buyers are back to even, fear returns, and all the traders and their machines go the other way. Thus, the "retest" phase begins.

After all the V-Bottoms that have occurred over the past seven years or so, the question I was asked late last week was, "Dave, should we really expect stocks to go back down? Do we really need a retest?" The answer, in a word is, yes.

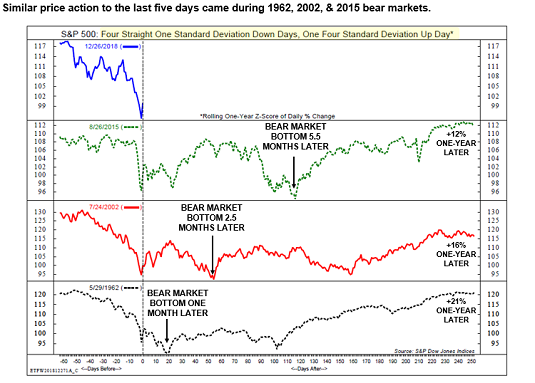

Exhibit A in my argument comes from the good folks at Ned Davis Research. NDR looked back at history and suggests that the markets that most closely resemble the current action were the bears of 1962, 2002, and 2015.

These markets were chosen for many reasons. One of the important criteria was the violent price action into and then out of a bottom. Mathematically speaking, NDR looked for markets where there were four straight one-standard deviation down days followed by a four-standard deviation up day. In other words, they were looking for what we have seen recently - a prolonged flush to the downside followed by an explosion to the upside.

Below is a chart comparing the current market with the bears of 2015, 2002, and 1962.

Historical Review: Expect A Retest

View Larger Chart Online

Source: Ned Davis Research

The key takeaway is that the first bottom, which was followed by a big bounce (a four standard deviation upside event), wasn't the ultimate bottom in these cases. No, in 2015, the ultimate bottom occurred 5.5 months later. In 2002, the low was 2.5 months after the initial bottom. And in 1962, the final bottom was put in 1 month after the first bounce began.

Next, many analysts have noted that there were several 5% up days that didn't lead to the final low in 2008 - and in the 1930's. Ugh.

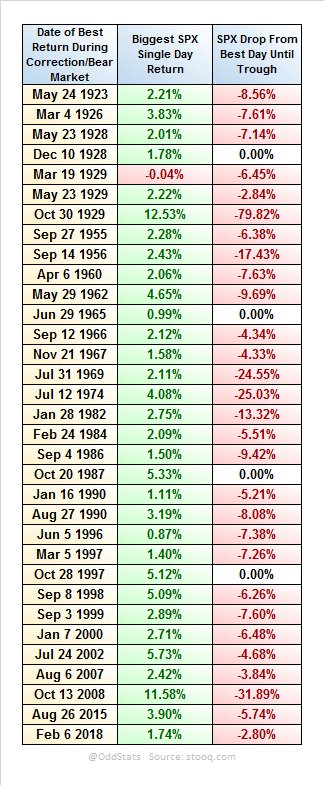

For the statistically inclined, I present Exhibit B. The following chart shows what has transpired after the biggest "bounces" occurring during corrections and bear markets going back into the 1920's. The first two columns show the date and gain of the best rally day during the corrections/bears. The third column contains the drop from the top of the best rally until the ultimate correction/bear low.

Historical Review: Decline From Initial Bounces

View Larger Chart Online

As you can see, the market usually declines a fair amount after a strong bear market bounce. In fact, the average pullback after the strongest rally of each bear market since 1923 on the S&P has been -10.22%. And if one removes the -79.8% decline seen in 1929 and the -31.9% drop in 2008, the average falls to -7.3%.

In English, this means that after the biggest rallies seen in bear markets, the indices experience a pullback the vast majority of the time. So, if one applies the average historical decline of -7.3% to Thursday's high, you get 2308, which would represent a new low level for the current bear. And yes, it is easy to argue that the current bounce isn't over. But keep that average -7.3% pullback in mind the next time this market starts to look toppy.

But, to be fair, this is not to say that a 5% up day hasn't marked the ultimate bottom during bear markets. According to Sentimentrader.com, a 5% up day did mark the lows in 1970, 1987, 1998, and 2009. So, there's that.

Are We Sure This Is A Bear?

Another good question at this stage of the game is whether or not we've actually got a bear market on our hands. For me, this is simple. If it looks like a bear (check the weekly charts), walks like a bear (review the declines of the major indices), and acts like a bear (look at the number of stocks down 20% or more and the global markets), it's probably a bear.

So, just because the S&P's decline on a closing basis has not yet breached the -20% mark does not mean that we don't have a bear market on our hands.

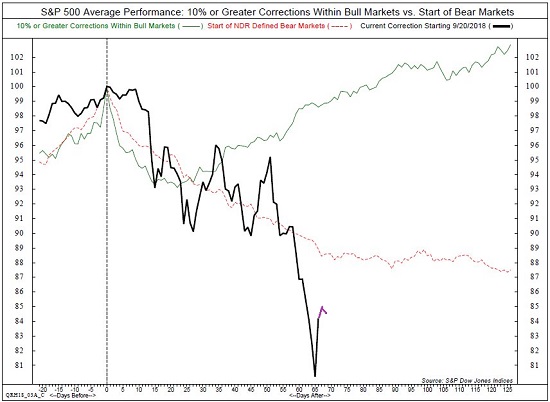

Next, I'll offer an updated version of NDR's chart comparing the historical action of corrections versus bears and let you decide for yourself.

Historical Review: Bear Versus Correction

View Larger Chart Online

Source: Ned Davis Research

The bottom line here (for me, anyway) is if the bulls can't make a higher high and then start trending higher right here, right now, the answer is pretty obvious.

The Good News

The good news here is we need to remember that the best returns in the market occur AFTER bear market declines. If memory serves, I believe one-third of bull market gains occur in the first one-half of the bull's run.

The point is that once a bear market finally does bottom and that bottom is successfully tested, the gains tend to be pretty good.

From a shorter-term perspective, it is important to recognize that once extreme oversold and sentiment conditions are achieved, rallies tend to follow. Again, once the retest is out of the way, of course.

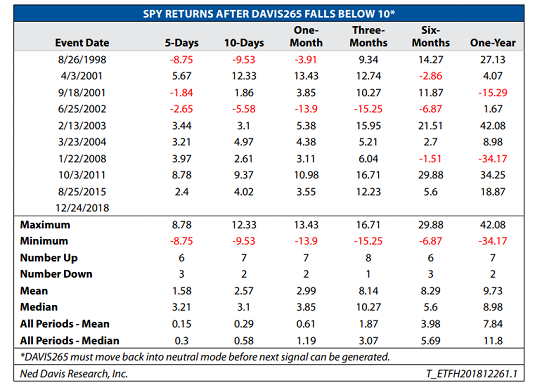

For example, below is a chart showing the returns of the SPY after extreme negative readings are achieved on Ned Davis Research's Short-Term Sentiment model.

Historical Review: Returns After Negative Sentiment Extremes

View Larger Chart Online

Source: Ned Davis Research

As the chart indicates, two weeks after the extreme sentiment reading was reached, the average return for the SPY has been 2.57%, which is nearly nine times the average return for all two-week periods. And since the SPY has been higher two weeks later 7 out of the 9 occurrences, the odds of a gain over the next two weeks would appear to be roughly 78%.

Three months after an extreme negative sentiment reading, the SPY was higher 8 out of 9 times, sporting an average gain of 8.14%, which is four times the norm for all three-month periods.

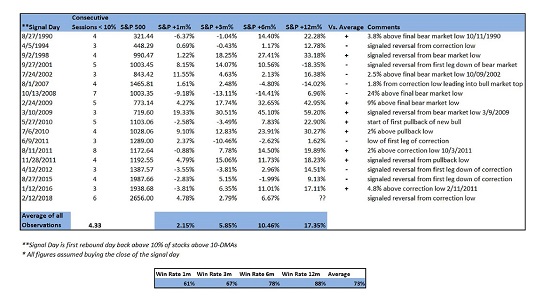

Next, we have research for Lowry's reviewing the S&P 500 performance after the extreme oversold conditions.

Lowry's looks at the percentage of stocks above their 10-day moving averages as a way to measure overbought/oversold conditions. The table below illustrates the results of the S&P when the percentage of stocks above their 10-day MA's was less than 10% for a minimum of three consecutive trading days.

Historical Review: Returns After Extreme Oversold Conditions From 1990

View Larger Chart Online

Source: Lowry's Research

What Lowry's found is that after such an extreme oversold signal was given, the average return for the next 12 months was +17.35%. This far exceeds the average return for all 12-month periods of +7.1%. Oh, and since the S&P was higher a year later 15 out of the 17 times, the odds of a gain over the next year are 88.2%. Not bad.

One caveat here is that, according to Lowry's, the best returns from this signal occurred after meaningful corrections or bear market lows while the weaker returns tended to occur when the market was in the early stages of a protracted bear market. Examples here would include 2001, 2007, and 2008, as well s the initial leg down during the "mini bear" of 2011.

So, the key here would appear to be that if we are closer to the end than the beginning of the current bear move, the odds suggest that investors can expect strong gains in 2019. But, if we are merely in the early stages of this bear, the current oversold condition isn't likely to be the last.

The Takeaway: Caution Near-Term, Optimism Longer-Term

To sum up, my take on the current situation is as follows. First, forgive me for donning my Captain Obvious hat here, but I believe stocks are in the midst of a cyclical bear market. Given that the secular bull which began on March 9, 2009 is likely to remain intact and we do not expect a recession to accompany this move, we will be looking for a more modest bear attack and NOT something akin to 2000-02 or 2007-09. No, we're expecting something more in the -20% to -25% range.

Since several indices and many stocks have already breached this level, we can now begin to look for a bottom. The argument can be made that Wednesday's 1,086-point blast on the DJIA marked the bottom of the decline. History shows that some bear markets have indeed ended with such a move.

From a near-term perspective, stocks have experienced a classic waterfall/panic decline, are very oversold, and sentiment has reached extreme readings. Such conditions tend to create strong countertrend moves, which can present trading opportunities for the nimble.

Yet, history also shows that after a "dead cat bounce," fear returns more often than not and a retest of the lows (or a series of retests) occur. It is during the retest phase that Ms. Market tends to tip her hand and we can attempt to determine whether or not the ultimate low has been put in. The key here isn't necessarily the price level itself (so don't put all your eggs on those magical price levels bandied about on TV), but rather the momentum and "oomph" behind the retest phase.

In short, the bulls would like to see the retest(s) occur on lighter volume, lower VIX readings, and divergent model/breadth behavior. All would suggest that the lows are in. But if the growling grows louder on the decline, it pays to curb your enthusiasm for a while.

It is also important to recognize that the bottoming/basing process, from which new bull markets are ultimately born, takes time to complete as a news-driven market may require several tests of the bottom and for the news flow to improve.

On that front, given the current 90-day trade negotiation window currently in play with China, I presume it will take time to resolve this issue - or - for Ms. Market to become comfortable with the likely outcome. However, the good news is the "Fed Issue" (i.e. the idea that the sale of $50 billion per month is on autopilot) could easily be solved in the near-term simply by Powell stating that the current QT will be part of the Fed's overall monetary policy going forward.

From a longer-term view, in order to signal that the bear has run its course (remember, the average bear that occurs within the context of a secular bull lasts 283 calendar days or about 9 months - Source: Ned Davis Research) the bulls will want to see a series of breadth thrusts where prices surge, advancing issues swamp decliners, and up volume overwhelms down volume on a cumulative 10-day basis.

History shows that such "thrust" events act as an "all clear" signal where stock market returns tend to be much stronger than normal for the next year. And yes, you can count on us to let you know when any of these signals are flashed.

Summary: For now, longer-term investors should stay patient, remain cautious and await the "all clear" signals while shorter-term traders may attempt to "ride the range" during the bounce/retest phase.

Finally, I will be taking a break from the keyboard this week in order to recharge the batteries and prepare for what could be a very busy start to the new year.

Here's wishing everyone a Happy, Healthy, Safe, and Prosperous 2019!

Now let's turn to the weekly review of my favorite indicators and market models...

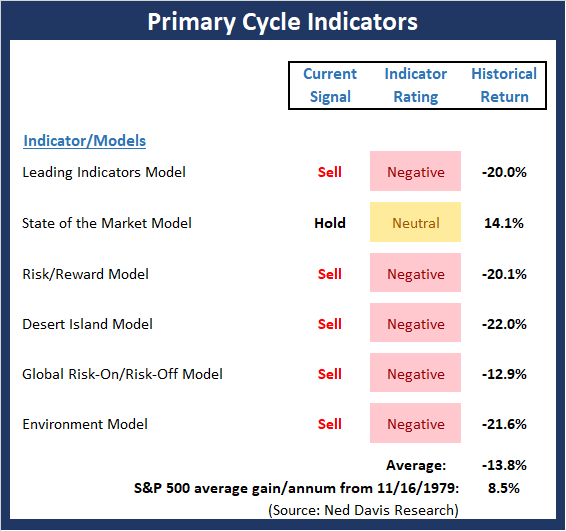

The State of the Big-Picture Market Models

I like to start each week with a review of the state of my favorite big-picture market models, which are designed to help me determine which team is in control of the primary trend.

View My Favorite Market Models Online

The Bottom Line:

- There was another important change to the Primary Cycle board this week as my "Desert Island" Model (if was stranded on a desert island, was forced to manage money, and could only use one indicator) fell into negative territory. I will also note the average of the historical returns for the models stands at -13.8% annualized.

To be sure, December's "waterfall decline" has pushed stocks into extreme oversold territory, which means a bounce of the "dead cat" variety was due. But, with only one of the primary cycle models not negative, the message from this board is that we've got a bear market on our hands that is likely to stick around for several months.

This week's mean percentage score of my 6 favorite models declined to 36.5 (from 41.9, 2 weeks ago: 47.8%, 3 weeks ago: 53.6%, 4 weeks ago: 57.9%) while the median fell to 440% (from 44.2%, 2 weeks ago: 45%, 3 weeks ago: 55%, 4 weeks ago: 52.5%).

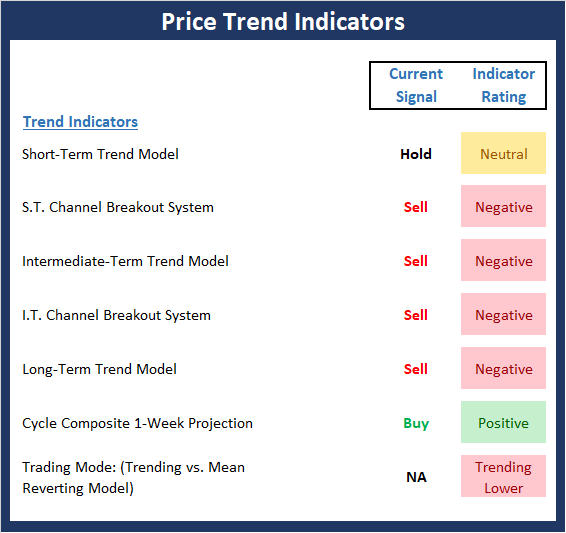

The State of the Trend

Once I've reviewed the big picture, I then turn to the "state of the trend." These indicators are designed to give us a feel for the overall health of the current short- and intermediate-term trend models.

View Trend Indicator Board Online

The Bottom Line:

- The recent bounce in stock prices was a welcome reprieve from the relentless selling that has taken place since December 3, which is a textbook example of a "waterfall decline" and/or "panic selling." The good news is the DJIA closed Friday 1350 points above the Christmas Eve low. The bad news is the bounce has, so far at least, not repaired any of the technical trend damage.

In order for the technical picture to improve, the major indices will need to (a) successfully test the 12/24 low and (b) create a series of higher highs and higher lows.

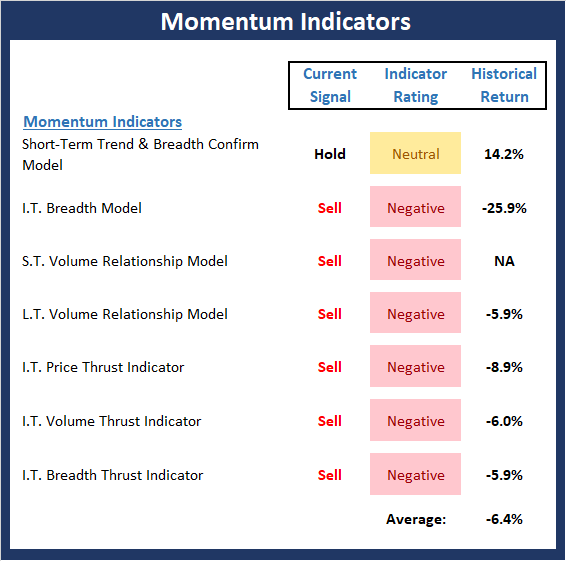

The State of Internal Momentum

Next up are the momentum indicators, which are designed to tell us whether there is any "oomph" behind the current trend.

View Momentum Indicator Board Online

The Bottom Line:

- As I wrote two weeks ago, the type of extremely negative condition seen on the Momentum board tends to lead to countertrend rallies. Thus, it was not surprising to see a near-term bounce take hold. However, thus far, there has been little in the way of improvement from a momentum perspective.

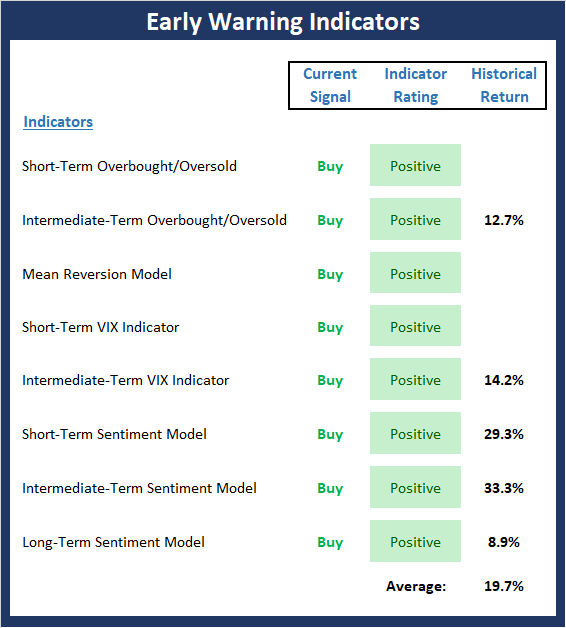

The State of the "Trade"

We also focus each week on the "early warning" board, which is designed to indicate when traders might start to "go the other way" -- for a trade.

View Early Warning Indicator Board Online

The Bottom Line:

- I wrote last week: "The table remains set for a strong countertrend rally." While the DJIA made headlines with the biggest 1-day point gain in history, the bounce so far has been a bit underwhelming. The good news is the "Early Warning Indicators" continue to sport a bright shade of green. However, traders need to be on the lookout for an "abrupt rally failure," which would likely usher in a retest and/or the beginning of the bottoming phase.

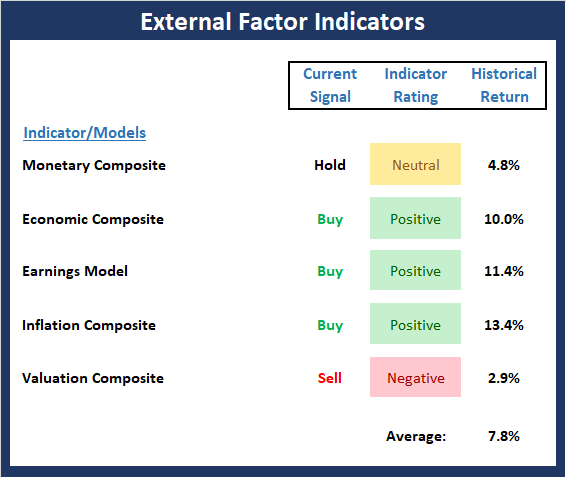

The State of the Macro Picture

Now let's move on to the market's "environmental factors" - the indicators designed to tell us the state of the big-picture market drivers including monetary conditions, the economy, inflation, and valuations.

View Environment Indicator Board Online

The Bottom Line:

- The External Factors board continued to improve last week, albeit at a very modest pace. The obvious change is the uptick in our Monetary Composite as rates have backed off their recent highs, have broken intermediate-term support, and are now trending lower. In addition, the Valuation Composite saw meaningful improvement in its component readings - just not enough to push the model into the neutral zone. The takeaway here is that while valuations are improving (earnings have moved higher while price has moved lower, thus improving the P/E ratio) the gains are not enough to push the overall valuation model rating higher. Finally, it is worth noting that EPS estimates continue to fall, which represents a significant risk moving into 2019.

Thought For The Day:

One chance is all you need. -Jesse Owens

Wishing you green screens and all the best for a great day,

David D. Moenning

Founder, Chief Investment Officer

Heritage Capital Research

HCR Focuses on a Risk-Managed Approach to Investing

What Risk Management Can and Cannot Do

HCR Awarded Top Honors in 2018 NAAIM Shark Tank Portfolio Strategy Competition

Each year, NAAIM (National Association of Active Investment Managers) hosts a competition to identify the best actively managed investment strategies. In April, HCR's Dave Moenning took home first place for his flagship risk management strategy.

Disclosures

At the time of publication, Mr. Moenning held long positions in the following securities mentioned: SPY - Note that positions may change at any time.

Indicators Explained

Short-Term Trend-and-Breadth Signal Explained: History shows the most reliable market moves tend to occur when the breadth indices are in gear with the major market averages. When the breadth measures diverge, investors should take note that a trend reversal may be at hand. This indicator incorporates NDR's All-Cap Dollar Weighted Equity Series and A/D Line. From 1998, when the A/D line is above its 5-day smoothing and the All-Cap Equal Weighted Equity Series is above its 25-day smoothing, the equity index has gained at a rate of +32.5% per year. When one of the indicators is above its smoothing, the equity index has gained at a rate of +13.3% per year. And when both are below, the equity index has lost +23.6% per year.

Channel Breakout System Explained: The short-term and intermediate-term Channel Breakout Systems are modified versions of the Donchian Channel indicator. According to Wikipedia, "The Donchian channel is an indicator used in market trading developed by Richard Donchian. It is formed by taking the highest high and the lowest low of the last n periods. The area between the high and the low is the channel for the period chosen."

Intermediate-Term Trend-and-Breadth Signal Explained: This indicator incorporates NDR's All-Cap Dollar Weighted Equity Series and A/D Line. From 1998, when the A/D line is above its 45-day smoothing and the All-Cap Equal Weighted Equity Series is above its 45-day smoothing, the equity index has gained at a rate of +17.6% per year. When one of the indicators is above its smoothing, the equity index has gained at a rate of +6.5% per year. And when both are below, the equity index has lost -1.3% per year.

Cycle Composite Projections: The cycle composite combines the 1-year Seasonal, 4-year Presidential, and 10-year Decennial cycles. The indicator reading shown uses the cycle projection for the upcoming week.

Trading Mode Indicator: This indicator attempts to identify whether the current trading environment is "trending" or "mean reverting." The indicator takes the composite reading of the Efficiency Ratio, the Average Correlation Coefficient, and Trend Strength models.

Volume Relationship Models: These models review the relationship between "supply" and "demand" volume over the short- and intermediate-term time frames.

Price Thrust Model Explained: This indicator measures the 3-day rate of change of the Value Line Composite relative to the standard deviation of the 30-day average. When the Value Line's 3-day rate of change have moved above 0.5 standard deviation of the 30-day average ROC, a "thrust" occurs and since 2000, the Value Line Composite has gained ground at a rate of +20.6% per year. When the indicator is below 0.5 standard deviation of the 30-day, the Value Line has lost ground at a rate of -10.0% per year. And when neutral, the Value Line has gained at a rate of +5.9% per year.

Volume Thrust Model Explained: This indicator uses NASDAQ volume data to indicate bullish and bearish conditions for the NASDAQ Composite Index. The indicator plots the ratio of the 10-day total of NASDAQ daily advancing volume (i.e., the total volume traded in stocks which rose in price each day) to the 10-day total of daily declining volume (volume traded in stocks which fell each day). This ratio indicates when advancing stocks are attracting the majority of the volume (readings above 1.0) and when declining stocks are seeing the heaviest trading (readings below 1.0). This indicator thus supports the case that a rising market supported by heavier volume in the advancing issues tends to be the most bullish condition, while a declining market with downside volume dominating confirms bearish conditions. When in a positive mode, the NASDAQ Composite has gained at a rate of +38.3% per year, When neutral, the NASDAQ has gained at a rate of +13.3% per year. And when negative, the NASDAQ has lost at a rate of -12.29% per year.

Breadth Thrust Model Explained: This indicator uses the number of NASDAQ-listed stocks advancing and declining to indicate bullish or bearish breadth conditions for the NASDAQ Composite. The indicator plots the ratio of the 10-day total of the number of stocks rising on the NASDAQ each day to the 10-day total of the number of stocks declining each day. Using 10-day totals smooths the random daily fluctuations and gives indications on an intermediate-term basis. As expected, the NASDAQ Composite performs much better when the 10-day A/D ratio is high (strong breadth) and worse when the indicator is in its lower mode (weak breadth). The most bullish conditions for the NASDAQ when the 10-day A/D indicator is not only high, but has recently posted an extreme high reading and thus indicated a thrust of upside momentum. Bearish conditions are confirmed when the indicator is low and has recently signaled a downside breadth thrust. In positive mode, the NASDAQ has gained at a rate of +22.1% per year since 1981. In a neutral mode, the NASDAQ has gained at a rate of +14.5% per year. And when in a negative mode, the NASDAQ has lost at a rate of -6.4% per year.

Short-Term Overbought/sold Indicator: This indicator is the current reading of the 14,1,3 stochastic oscillator. When the oscillator is above 80 and the %K is above the %D, the indicator gives an overbought reading. Conversely, when the oscillator is below 20 and %K is below its %D, the indicator is oversold.

Intermediate-Term Overbought/sold Indicator: This indicator is a 40-day RSI reading. When above 57.5, the indicator is considered overbought and when below 45 it is oversold.

Mean Reversion Model: This is a diffusion model consisting of five indicators that can produce buy and sell signals based on overbought/sold conditions.

VIX Indicator: This indicator looks at the current reading of the VIX relative to standard deviation bands. When the indicator reaches an extreme reading in either direction, it is an indication that a market trend could reverse in the near-term.

Short-Term Sentiment Indicator: This is a model-of-models composed of 18 independent sentiment indicators designed to indicate when market sentiment has reached an extreme from a short-term perspective. Historical analysis indicates that the stock market's best gains come after an environment has become extremely negative from a sentiment standpoint. Conversely, when sentiment becomes extremely positive, market returns have been subpar.

Intermediate-Term Sentiment Indicator: This is a model-of-models composed of 7 independent sentiment indicators designed to indicate when market sentiment has reached an extreme from an intermediate-term perspective. Historical analysis indicates that the stock market's best gains come after an environment has become extremely negative from a sentiment standpoint. Conversely, when sentiment becomes extremely positive, market returns have been subpar.

Long-Term Sentiment Indicator: This is a model-of-models composed of 6 independent sentiment indicators designed to indicate when market sentiment has reached an extreme from a long-term perspective. Historical analysis indicates that the stock market's best gains come after an environment has become extremely negative from a sentiment standpoint. Conversely, when sentiment becomes extremely positive, market returns have been subpar.

Absolute Monetary Model Explained: The popular cliché, "Don't fight the Fed" is really a testament to the profound impact that interest rates and Fed policy have on the market. It is a proven fact that monetary conditions are one of the most powerful influences on the direction of stock prices. The Absolute Monetary Model looks at the current level of interest rates relative to historical levels and Fed policy.

Relative Monetary Model Explained: The "relative" monetary model looks at monetary indicators relative to recent levels as well as rates of change and Fed Policy.

Economic Model Explained: During the middle of bull and bear markets, understanding the overall health of the economy and how it impacts the stock market is one of the few truly logical aspects of the stock market. When our Economic model sports a "positive" reading, history (beginning in 1965) shows that stocks enjoy returns in excess of 21% per year. Yet, when the model's reading falls into the "negative" zone, the S&P has lost nearly -25% per year. However, it is vital to understand that there are times when good economic news is actually bad for stocks and vice versa. Thus, the Economic model can help investors stay in tune with where we are in the overall economic cycle.

Inflation Model Explained: They say that "the tape tells all." However, one of the best "big picture" indicators of what the market is expected to do next is inflation. Simply put, since 1962, when the model indicates that inflationary pressures are strong, stocks have lost ground. Yet, when inflationary pressures are low, the S&P 500 has gained ground at a rate in excess of 13%. The bottom line is inflation is one of the primary drivers of stock market returns.

Valuation Model Explained: If you want to get analysts really riled up, you need only to begin a discussion of market valuation. While the question of whether stocks are overvalued or undervalued appears to be a simple one, the subject is extremely complex. To simplify the subject dramatically, investors must first determine if they should focus on relative valuation (which include the current level of interest rates) or absolute valuation measures (the more traditional readings of Price/Earnings, Price/Dividend, and Price/Book Value). We believe that it is important to recognize that environments change. And as such, the market's focus and corresponding view of valuations are likely to change as well. Thus, we depend on our Valuation Models to help us keep our eye on the ball.

Disclosures

The opinions and forecasts expressed herein are those of Mr. David Moenning and may not actually come to pass. Mr. Moenning's opinions and viewpoints regarding the future of the markets should not be construed as recommendations. The analysis and information in this report is for informational purposes only. No part of the material presented in this report is intended as an investment recommendation or investment advice. Neither the information nor any opinion expressed constitutes a solicitation to purchase or sell securities or any investment program.

Any investment decisions must in all cases be made by the reader or by his or her investment adviser. Do NOT ever purchase any security without doing sufficient research. There is no guarantee that the investment objectives outlined will actually come to pass. All opinions expressed herein are subject to change without notice. Neither the editor, employees, nor any of their affiliates shall have any liability for any loss sustained by anyone who has relied on the information provided.

Mr. Moenning may at times have positions in the securities referred to and may make purchases or sales of these securities while publications are in circulation. Positions may change at any time.

The analysis provided is based on both technical and fundamental research and is provided "as is" without warranty of any kind, either expressed or implied. Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

Investments in equities carry an inherent element of risk including the potential for significant loss of principal. Past performance is not an indication of future results.