Maybe He Will. Maybe He Won't. And That's The Point.

Maybe he will, maybe he won't. Impose those nasty tariffs on steel and aluminum, that is. And that's the point as the stock market appears to be figuring out that with this President, a deal isn't a deal until the deal is actually done.

That's right. Just about the time traders were starting to calculate who the global winners and losers would be with the President's wildly unpopular stance on trade, we learn that, hey, he was only negotiating. Such is life with this administration.

On Friday, stocks rallied as it started to become clear that NOBODY liked the Trump Tariffs. As such, the thinking went, maybe the President was merely sending up a trial balloon and would relent before the actual tariffs were put in place. One could hope, right?

Then on Monday, a similar theme played out. Stocks opened lower on fears of what a trade war with not only China, but also the EU, Canada and Mexico might look like. Before you could blink, the Dow was down 150 points and it looked like the bears had found a new raison d'etre.

However, then the tweets began to surface Monday Morning...

We have large trade deficits with Mexico and Canada. NAFTA, which is under renegotiation right now, has been a bad deal for U.S.A. Massive relocation of companies & jobs. Tariffs on Steel and Aluminum will only come off if new & fair NAFTA agreement is signed. Also, Canada must..

— Donald J. Trump (@realDonaldTrump) March 5, 2018

...treat our farmers much better. Highly restrictive. Mexico must do much more on stopping drugs from pouring into the U.S. They have not done what needs to be done. Millions of people addicted and dying.

— Donald J. Trump (@realDonaldTrump) March 5, 2018

While the President has remained steadfast in his stance to impose tariffs and/or fight trade wars because "they are easy to win," these tweets as well as other commentary/reports suggested that Trump may simply be negotiating here.

Another way to put it is the President may be showing signs of "flexibility" on the issue. But in any event, the mood started to shift on Wall Street around mid-morning Monday.

House Speaker Paul Ryan also weighed in. Ryan said he was "extremely worried" about Trump's trade plan and suggested that Congressional leaders may not rule out potential action if Trump decides to move forward with his plans to impose tariffs.

So, with traders doing a double-take on the probability of these tariffs actually being implemented, stocks rallied again on Monday. And just like that, the S&P 500 has recovered more than half of the dive seen from Tuesday through Thursday.

The bottom line is that after a serious bout of volatility, this market appears to be trying to find its footing. And to be sure, if the President does decide to defy just about everybody on the planet and impose tariffs on steel and aluminum, the bears will become emboldened again.

However, as long as it appears that negotiations are ongoing and that there is a chance a trade war doesn't happen, then investors may continue to buy the dips.

Looking At The Charts

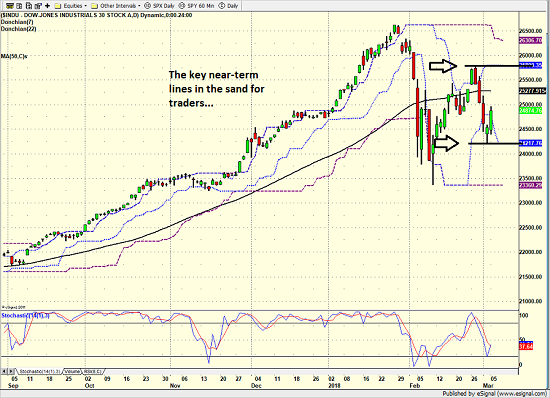

From a technical perspective, the near-term lines in the sand are now clear and the game is fairly obvious...

S&P 500- Daily

View Larger Image Online

In short, a break of either line would likely lead to a retest of the highs/lows, depending on which line is violated, of course. If the lower line, which represents Friday's low is violated, you can rest assured that a retest of the panic low seen on Friday, Feb 9 would come into play. And a break above the Feb 27 high would likely usher in a retest of the highs.

Game on...

Thought For The Day:

He is nearest to God who needs the fewest things. -Socrates

Wishing you green screens and all the best for a great day,

David D. Moenning

Founder, Chief Investment Officer

Heritage Capital Research

HCR Focuses on a Risk-Managed Approach to Investing

Must Read: What Risk Management Can and Cannot Do

HCR's Financial Advisor Services

HCR's Individual Investor Services

Questions, comments, or ideas? Contact Us

At the time of publication, Mr. Moenning held long positions in the following securities mentioned: None - Note that positions may change at any time.

Disclosures

The opinions and forecasts expressed herein are those of Mr. David Moenning and may not actually come to pass. Mr. Moenning's opinions and viewpoints regarding the future of the markets should not be construed as recommendations. The analysis and information in this report is for informational purposes only. No part of the material presented in this report is intended as an investment recommendation or investment advice. Neither the information nor any opinion expressed constitutes a solicitation to purchase or sell securities or any investment program.

Any investment decisions must in all cases be made by the reader or by his or her investment adviser. Do NOT ever purchase any security without doing sufficient research. There is no guarantee that the investment objectives outlined will actually come to pass. All opinions expressed herein are subject to change without notice. Neither the editor, employees, nor any of their affiliates shall have any liability for any loss sustained by anyone who has relied on the information provided.

Mr. Moenning may at times have positions in the securities referred to and may make purchases or sales of these securities while publications are in circulation. Positions may change at any time.

The analysis provided is based on both technical and fundamental research and is provided "as is" without warranty of any kind, either expressed or implied. Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

Investments in equities carry an inherent element of risk including the potential for significant loss of principal. Past performance is not an indication of future results.