The Good, The Bad, And The Ugly

My quote system confirms that stocks finished higher on the week and that the S&P 500 gained ground all five days last week. And with the venerable index closing Friday at the second highest level ever on a daily basis (and the highest ever on a weekly basis), one can't be blamed for being enthused about the action.

However, I am struggling to get overly excited here and I wouldn't call the recent rally robust, as the intraday action seems to be driven more by the hopes that the trade war with China will come to an end soon than a rush to buy stocks. For example, take a look at a chart of the small caps last week - can you say sideways? And then there is the chart of the banks - ugh.

Yes, there is some good stuff happening in the market. But I guess my primary point on this fine Monday morning is that there is also some bad stuff to be found, as well as some downright ugly stuff. So, in an attempt to remain objective, I'm going to take a quick run through the good, the bad, and the ugly here.

The Good

The Economy/Earnings: Unless you've been sleeping in a cave, you can probably spit out the bull case pretty quickly. First and foremost, as the saying goes, "it's the economy..." Then there is the fact that earnings are at record highs - and expected to continue to grow.

In reality, these two issues alone are probably enough for the bulls to maintain possession of the ball and likely the reason that the major indices are within spitting distance of all-time highs - despite all the worries out there.

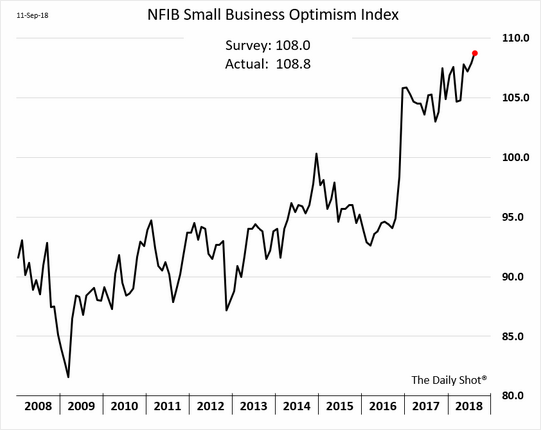

When one digs into the economic data, it is frankly difficult not to be upbeat. And this is definitely the case with small business owners. As Exhibit A, take a look at the chart of the NFIB's Small Business Optimism Index below.

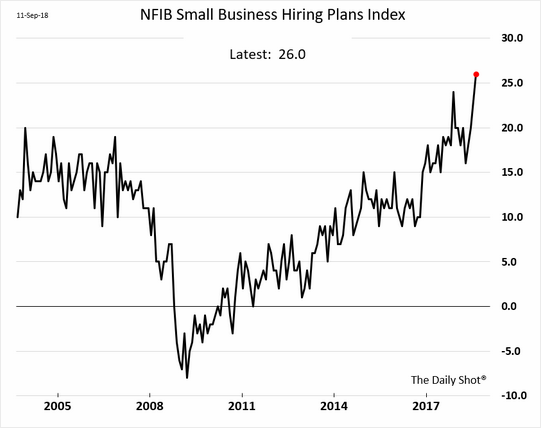

Jobs: While economics can be more art than science, the idea is that when business owners feel good about what is happening, they think about growth, and expanding, and, of course, hiring. On that note, check out the NFIB's Hiring Plans Index below.

Consumers are Happy Campers: Now mix in the recent reports on the state of the consumer. For example, we learned last week that Retail Sales have improved by 6.5% over the latest 12-month period, which represents the strongest level since December 2011. Digging deeper, we find that Discretionary Retail Sales advanced 5.5%, which was the best in three and a half years and the "core" reading was the best in seven years.

In addition, the Reuters/University of Michigan Consumer Sentiment Index rebounded 4.6 points in last week's September survey to a reading of 100.8, which was the second highest reading since January 2004.

All in, these stats suggest underlying consumer strength, which, is a positive for the economic outlook because, of course, the consumer accounts for more than two-thirds of GDP.

Inflation: Another positive can be found on the inflation front. First, let's remember that the Fed has been working hard to get inflation UP to their purported target of 2%. So, as the charts of both CPI and Core CPI illustrate, it appears that this mission has been accomplished. Check.

However, it is also positive that the trend of CPI appears to be turning down. This would seem to suggest that we don't need to worry about inflation overheating - at least for now.

No Recession in Sight: And finally, I follow several "Odds of Recession" models on a weekly basis. The bottom line here is that while the odds of a recession in the U.S. are rising (a wee bit), the models suggest that the actual chances of a recession in the near-term remain quite small. And since the worst bear markets in stocks tend to coincide with recessions, this too is a positive.

The Bad

Since I wrote a "Negative Nancy" piece entitled, What If Something Bad Actually Happens last week, I don't think I need to do a deep dive reviewing the bear case here.

The Trade War: Yet it is important to remember that there is what can be construed as a wall of worry out there. First, we've got the trade war, which continues to provide headlines for the algos to react to. Frankly, I remain amazed that Trump's profession to favor more tariffs continues to be news. How many times can the S&P drop 10 points in a couple minutes on the same headline?

About Those Happy Campers: Unfortunately, there is a "bad" associated with the good consumer confidence. Data from Ned Davis Research shows that good news on the consumer confidence front has actually been bad news for the stock market. Since 1967, the DJIA has gained ground at an average annualized rate of just 2.5% when the reading of the Conference Board's Consumer Confidence index has been above 110. The current reading is over 130, which is the highest level seen since the end of 2000.

De-FANGed: Next up, it looks like the so-called "FANGs" need an "AA" meeting as the charts of Facebook (FB), Netflix (NFLX), and Google's parent, Alphabet (GOOG) could cause one to drink heavily (however, a couple "A's" - as in Amazon (AMZN) and Apple (AAPL) continue to work well). The key concern here is that when "crowded" trades end, the rotation can be disruptive.

QT: Another concern that I didn't spend time on last week is a little something called "QT" (quantitative tightening). Yes, the Fed needs to return monetary policy back to "normal." This means that yes, this time it is indeed different in terms of the monetary models waving red flags.

However, if the Fed either misplays or overplays their hand, the worry is the result could be economic weakness.

Peak GrowthThen there is the "peak" argument. As in "peak earnings" and/or "peak economic growth."

Remember, the stock market is a discounting mechanism for future expectations. So, the simplest explanation for the "peak" worries is that if the rate of growth in the economy and/or earnings slows too much, so too will the multiple investors are willing to pay for stocks.

Late Innings: Finally, the words "late innings" - as in, "the current bull run is in the late innings" - were used a fair amount last week. First, there was hedge fund manager extraordinaire, David Tepper, saying that it was late in the game and he isn't very exposed to stocks right now. If you will recall, the once reclusive Tepper has been known to move markets, so it will be interesting to see if folks take his current caution about stocks to heart.

Then there are the folks at Ned Davis Research, who as you may know, tend to get the big-picture right the vast majority of the time. They too have been using the words "late innings" to describe the current "state of the market" recently.

The Ugly

Although stocks often climb a wall of worry, I'm going to suggest that the market doesn't ignore truly ugly conditions forever. And while the bulls are clearly still large and in charge here, I think it is important to remember that there are a few downright ugly issues to be aware of.

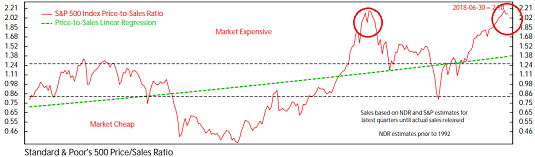

Valuations: First up is the valuations issue. I probably don't need to spend a lot of time here as most everybody knows that valuations are elevated by just about every traditional metric. However, the Price/Sales Ratio makes the point very clear. The chart below goes back to 1955.

The first peak in the P/S was in 2000. The second is now. 'Nuff said.

One of the valuation metrics that has been getting attention lately is the capitalization of the stock market as a percentage of GDP. The current reading for this ratio is 47.66 which is actually off the recent high of over 50. This reading was the highest since 2000 and the only other time the reading was at this level was in the 1930's.

History (and the computers at Ned Davis Research Group) shows that the stock market has not performed well after the percentage of stock market capitalization to GDP has been above 32.5. For example, one year later, the S&P 500 Total Return index sports an average gain of just 0.7%. Three years later, the market averaged a gain of only 1.23%. And five years later, the average gain has been 0.5%. Ugly indeed.

But then again, as the saying goes, "Valuations don't matter until they do. And then they matter a lot." So...

$1 Trillion Deficits Next up is the debt/deficit situation. We talked about debt last week. It will suffice to say, "Debt kills."

And in this category, we need to look at the budget deficit of the U.S. I'll let an excerpt from this week's Barron's article on the subject summarize the situation:

"There's no snooze button on the national debt clock, though you wouldn’t know it by the way public alarm has quieted as the situation grows worse.

October begins a new fiscal year for the U.S. government—and a faster ballooning of how much it owes. Barring a behavioral miracle in Congress, trillion dollar yearly budget shortfalls will return, perhaps as soon as the coming year. And unlike the ones brought by the financial crisis and Great Recession of 2007-09, these will start during a period of relative plenty, and won’t end.

Debt held by the public, a conservative tally of what America owes, will swell from $15.7 trillion at the end of September, or 78% of gross domestic product, to $28.7 trillion in a decade, or 96% of GDP."

According to Barron's, the only other time that debt-to-GDP approached this level was during World War II. Oh, and in 2003, this ratio was around 30%.

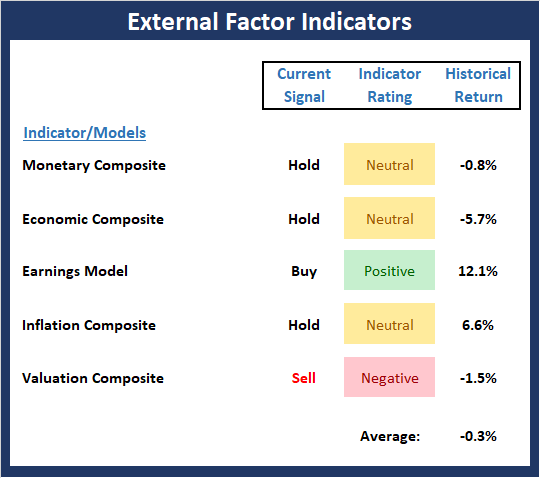

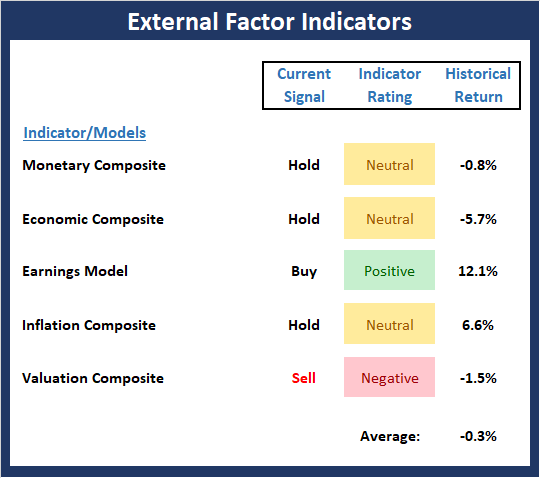

The External Factors Board Finally, let me draw your attention to my External Factors Indicator Board, which is published each week. But I've copied it below to make the point easier to see.

View External Factors Indicator Board Online

This week, I described the "state" of this board as "just plain ugly" given the current state of the market indices. As such, I thought it was appropriate to call you attention to it. The key here is that of the five models I use to highlight the market's "external" factors, only one is on a buy signal - this at a time when stocks are near all-time highs. Can you say, divergence?

The Takeaway

My takeaway from this week's macro review is this. First, the bulls have possession of the ball. Second, the trend is up, and investors need to remember that the trend is their friend. Third, there are "issues" to be aware of because when the tide does turn, and the bears find a "reason to be," those negatives WILL matter.

So, as a risk manager, I believe it is appropriate to stay seated on the bull train here. However, you should know where the exits are and have a plan to manage risk when/if the bears take control of the game.

Have a great week!

Moving On... Now let's turn to the weekly review of my favorite indicators and market models... "But first a word from our sponsor ;-)"...

INTRODUCING: THE ELEVATION STRATEGY

A Tax-Efficient Risk Management Strategy for the U.S. Stock Market

Believed to be unique in the industry, the Elevation strategy is a long-term, risk-managed portfolio solution designed for growth-oriented investors seeking a tax-efficient, risk-managed approach to the stock market. Our tests show that 75% of the Strategy's profitable trades since 3/31/1999 would have qualified as long-term for tax purposes.

The State of the Big-Picture Market Models

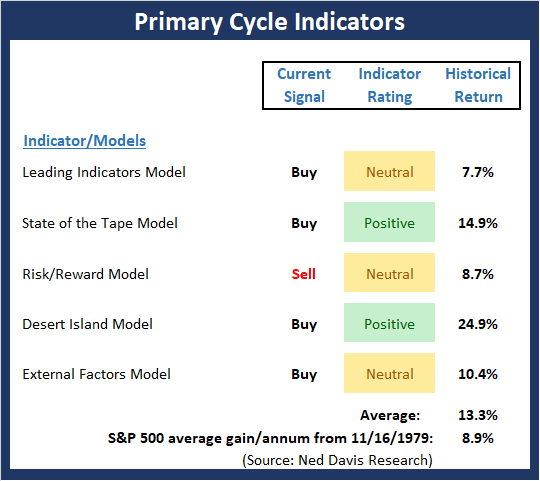

I like to start each week with a review of the state of my favorite big-picture market models, which are designed to help me determine which team is in control of the primary cycle.

View My Favorite Market Models Online

The Bottom Line:

- There are no changes to the Primary Cycle board this week. In order to guage the overall "tone" of the board, we decided to take the mean reading of the models This week's mean percentage score of my 5 favorite models is 60%. We will expand on this analysis in the coming weeks.

The State of the Trend

Once I've reviewed the big picture, I then turn to the "state of the trend." These indicators are designed to give us a feel for the overall health of the current short- and intermediate-term trend models.

View Trend Indicator Board Online

The Bottom Line:

- The Trend Board continues to be in pretty decent shape. And while I would like to apply some "yea, but's" to all the green on the board, the bottom line here is: "It is what it is." So, with price above its rising moving averages on both the daily and weekly charts, there isn't much to really complain about from a trend standpoint.

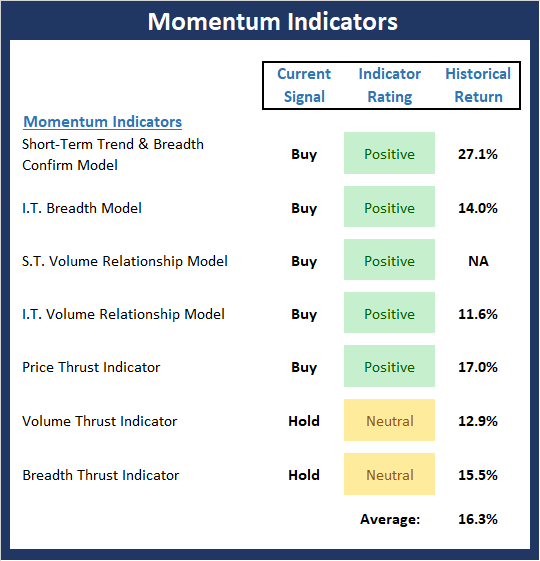

The State of Internal Momentum

Next up are the momentum indicators, which are designed to tell us whether there is any "oomph" behind the current trend.

View Momentum Indicator Board Online

The Bottom Line:

- The Momentum board sports a decent amount of green this week. And overall, the board is still in good shape. So, since the historical return of the market when the momentum indicators are in their current state is well above the mean, it appears the bulls should be given the benefit of the doubt.

The State of the "Trade"

We also focus each week on the "early warning" board, which is designed to indicate when traders might start to "go the other way" -- for a trade.

View Early Warning Indicator Board Online

The Bottom Line:

- The abundance of neutral readings on the "Early Warning" board suggests that neither team has an edge from a mean-reversion standpoint. However, it is worth noting that even a slight increase in the VIX would trigger a short-term sell signal. It is also worth noting that the S&P is close to becoming overbought on both a short, and intermediate-term basis.

The State of the Macro Picture

Now let's move on to the market's "external factors" - the indicators designed to tell us the state of the big-picture market drivers including monetary conditions, the economy, inflation, and valuations.

View External Factors Indicator Board Online

The Bottom Line:

- The External Factors board continues to be just plain ugly. Monetary is heading in the wrong direction. The economic model isn't happy. And valuations are extreme. I guess the good news is the inflation model is moving the right direction (but still in the neutral zone). All in, this board continues to give me pause from a big-picture perspective.

Thought For The Day:

Consider raising your expectations. As Michelangelo said, the danger is not that your hopes are too high, but rather...

Wishing you green screens and all the best for a great day,

David D. Moenning

Founder, Chief Investment Officer

Heritage Capital Research

HCR Focuses on a Risk-Managed Approach to Investing

What Risk Management Can and Cannot Do

ANNOUNCEMENT:

HCR Awarded Top Honors in 2018 NAAIM Shark Tank Portfolio Strategy Competition

Each year, NAAIM (National Association of Active Investment Managers) hosts a competition to identify the best actively managed investment strategies. In April, HCR's Dave Moenning took home first place for his flagship risk management strategy.

Disclosures

At the time of publication, Mr. Moenning held long positions in the following securities mentioned: AMZN, AAPL - Note that positions may change at any time.

Indicators Explained

Short-Term Trend-and-Breadth Signal Explained: History shows the most reliable market moves tend to occur when the breadth indices are in gear with the major market averages. When the breadth measures diverge, investors should take note that a trend reversal may be at hand. This indicator incorporates NDR's All-Cap Dollar Weighted Equity Series and A/D Line. From 1998, when the A/D line is above its 5-day smoothing and the All-Cap Equal Weighted Equity Series is above its 25-day smoothing, the equity index has gained at a rate of +32.5% per year. When one of the indicators is above its smoothing, the equity index has gained at a rate of +13.3% per year. And when both are below, the equity index has lost +23.6% per year.

Channel Breakout System Explained: The short-term and intermediate-term Channel Breakout Systems are modified versions of the Donchian Channel indicator. According to Wikipedia, "The Donchian channel is an indicator used in market trading developed by Richard Donchian. It is formed by taking the highest high and the lowest low of the last n periods. The area between the high and the low is the channel for the period chosen."

Intermediate-Term Trend-and-Breadth Signal Explained: This indicator incorporates NDR's All-Cap Dollar Weighted Equity Series and A/D Line. From 1998, when the A/D line is above its 45-day smoothing and the All-Cap Equal Weighted Equity Series is above its 45-day smoothing, the equity index has gained at a rate of +17.6% per year. When one of the indicators is above its smoothing, the equity index has gained at a rate of +6.5% per year. And when both are below, the equity index has lost -1.3% per year.

Cycle Composite Projections: The cycle composite combines the 1-year Seasonal, 4-year Presidential, and 10-year Decennial cycles. The indicator reading shown uses the cycle projection for the upcoming week.

Trading Mode Indicator: This indicator attempts to identify whether the current trading environment is "trending" or "mean reverting." The indicator takes the composite reading of the Efficiency Ratio, the Average Correlation Coefficient, and Trend Strength models.

Volume Relationship Models: These models review the relationship between "supply" and "demand" volume over the short- and intermediate-term time frames.

Price Thrust Model Explained: This indicator measures the 3-day rate of change of the Value Line Composite relative to the standard deviation of the 30-day average. When the Value Line's 3-day rate of change have moved above 0.5 standard deviation of the 30-day average ROC, a "thrust" occurs and since 2000, the Value Line Composite has gained ground at a rate of +20.6% per year. When the indicator is below 0.5 standard deviation of the 30-day, the Value Line has lost ground at a rate of -10.0% per year. And when neutral, the Value Line has gained at a rate of +5.9% per year.

Volume Thrust Model Explained: This indicator uses NASDAQ volume data to indicate bullish and bearish conditions for the NASDAQ Composite Index. The indicator plots the ratio of the 10-day total of NASDAQ daily advancing volume (i.e., the total volume traded in stocks which rose in price each day) to the 10-day total of daily declining volume (volume traded in stocks which fell each day). This ratio indicates when advancing stocks are attracting the majority of the volume (readings above 1.0) and when declining stocks are seeing the heaviest trading (readings below 1.0). This indicator thus supports the case that a rising market supported by heavier volume in the advancing issues tends to be the most bullish condition, while a declining market with downside volume dominating confirms bearish conditions. When in a positive mode, the NASDAQ Composite has gained at a rate of +38.3% per year, When neutral, the NASDAQ has gained at a rate of +13.3% per year. And when negative, the NASDAQ has lost at a rate of -9.15% per year.

Breadth Thrust Model Explained: This indicator uses the number of NASDAQ-listed stocks advancing and declining to indicate bullish or bearish breadth conditions for the NASDAQ Composite. The indicator plots the ratio of the 10-day total of the number of stocks rising on the NASDAQ each day to the 10-day total of the number of stocks declining each day. Using 10-day totals smooths the random daily fluctuations and gives indications on an intermediate-term basis. As expected, the NASDAQ Composite performs much better when the 10-day A/D ratio is high (strong breadth) and worse when the indicator is in its lower mode (weak breadth). The most bullish conditions for the NASDAQ when the 10-day A/D indicator is not only high, but has recently posted an extreme high reading and thus indicated a thrust of upside momentum. Bearish conditions are confirmed when the indicator is low and has recently signaled a downside breadth thrust. In positive mode, the NASDAQ has gained at a rate of +22.1% per year since 1981. In a neutral mode, the NASDAQ has gained at a rate of +14.5% per year. And when in a negative mode, the NASDAQ has lost at a rate of -6.4% per year.

Short-Term Overbought/sold Indicator: This indicator is the current reading of the 14,1,3 stochastic oscillator. When the oscillator is above 80 and the %K is above the %D, the indicator gives an overbought reading. Conversely, when the oscillator is below 20 and %K is below its %D, the indicator is oversold.

Intermediate-Term Overbought/sold Indicator: This indicator is a 40-day RSI reading. When above 57.5, the indicator is considered overbought and when below 45 it is oversold.

Mean Reversion Model: This is a diffusion model consisting of five indicators that can produce buy and sell signals based on overbought/sold conditions.

VIX Indicator: This indicator looks at the current reading of the VIX relative to standard deviation bands. When the indicator reaches an extreme reading in either direction, it is an indication that a market trend could reverse in the near-term.

Short-Term Sentiment Indicator: This is a model-of-models composed of 18 independent sentiment indicators designed to indicate when market sentiment has reached an extreme from a short-term perspective. Historical analysis indicates that the stock market's best gains come after an environment has become extremely negative from a sentiment standpoint. Conversely, when sentiment becomes extremely positive, market returns have been subpar.

Intermediate-Term Sentiment Indicator: This is a model-of-models composed of 7 independent sentiment indicators designed to indicate when market sentiment has reached an extreme from an intermediate-term perspective. Historical analysis indicates that the stock market's best gains come after an environment has become extremely negative from a sentiment standpoint. Conversely, when sentiment becomes extremely positive, market returns have been subpar.

Long-Term Sentiment Indicator: This is a model-of-models composed of 6 independent sentiment indicators designed to indicate when market sentiment has reached an extreme from a long-term perspective. Historical analysis indicates that the stock market's best gains come after an environment has become extremely negative from a sentiment standpoint. Conversely, when sentiment becomes extremely positive, market returns have been subpar.

Absolute Monetary Model Explained: The popular cliché, "Don't fight the Fed" is really a testament to the profound impact that interest rates and Fed policy have on the market. It is a proven fact that monetary conditions are one of the most powerful influences on the direction of stock prices. The Absolute Monetary Model looks at the current level of interest rates relative to historical levels and Fed policy.

Relative Monetary Model Explained: The "relative" monetary model looks at monetary indicators relative to recent levels as well as rates of change and Fed Policy.

Economic Model Explained: During the middle of bull and bear markets, understanding the overall health of the economy and how it impacts the stock market is one of the few truly logical aspects of the stock market. When our Economic model sports a "positive" reading, history (beginning in 1965) shows that stocks enjoy returns in excess of 21% per year. Yet, when the model's reading falls into the "negative" zone, the S&P has lost nearly -25% per year. However, it is vital to understand that there are times when good economic news is actually bad for stocks and vice versa. Thus, the Economic model can help investors stay in tune with where we are in the overall economic cycle.

Inflation Model Explained: They say that "the tape tells all." However, one of the best "big picture" indicators of what the market is expected to do next is inflation. Simply put, since 1962, when the model indicates that inflationary pressures are strong, stocks have lost ground. Yet, when inflationary pressures are low, the S&P 500 has gained ground at a rate in excess of 13%. The bottom line is inflation is one of the primary drivers of stock market returns.

Valuation Model Explained: If you want to get analysts really riled up, you need only to begin a discussion of market valuation. While the question of whether stocks are overvalued or undervalued appears to be a simple one, the subject is extremely complex. To simplify the subject dramatically, investors must first determine if they should focus on relative valuation (which include the current level of interest rates) or absolute valuation measures (the more traditional readings of Price/Earnings, Price/Dividend, and Price/Book Value). We believe that it is important to recognize that environments change. And as such, the market's focus and corresponding view of valuations are likely to change as well. Thus, we depend on our Valuation Models to help us keep our eye on the ball.

Disclosures

The opinions and forecasts expressed herein are those of Mr. David Moenning and may not actually come to pass. Mr. Moenning's opinions and viewpoints regarding the future of the markets should not be construed as recommendations. The analysis and information in this report is for informational purposes only. No part of the material presented in this report is intended as an investment recommendation or investment advice. Neither the information nor any opinion expressed constitutes a solicitation to purchase or sell securities or any investment program.

Any investment decisions must in all cases be made by the reader or by his or her investment adviser. Do NOT ever purchase any security without doing sufficient research. There is no guarantee that the investment objectives outlined will actually come to pass. All opinions expressed herein are subject to change without notice. Neither the editor, employees, nor any of their affiliates shall have any liability for any loss sustained by anyone who has relied on the information provided.

Mr. Moenning may at times have positions in the securities referred to and may make purchases or sales of these securities while publications are in circulation. Positions may change at any time.

The analysis provided is based on both technical and fundamental research and is provided "as is" without warranty of any kind, either expressed or implied. Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

Investments in equities carry an inherent element of risk including the potential for significant loss of principal. Past performance is not an indication of future results.