The Lines In The Sand Are Clear

On Monday morning, I opined that the so-called "tariff tantrum" (I.E. last week's 3.5-day, 5% decline in response to the threat of tariffs on steel and aluminum) had ushered in the third chapter in the "crash playbook" - aka the "retest phase."

Unlike the first two phases - the "emotional decline" and the "dead cat bounce" - the "retest" doesn't always play out the same way. Sometimes the retest is short and shallow. Other times it is deeper and more meaningful. And then there are even times when the indices "take out" the old lows, scaring the bajeebers out of everyone involved in the process.

However, the concept of the move is usually the same. After a spirited dive and some sort of "sigh of relief" rebound, something usually comes to the surface to remind traders of why the decline started in the first place.

In this case, Chairman Powell's testimony on Capitol Hill triggered fears of a fourth rate hike this year and got traders leaning on the sell button again. And then it was the President's almost off-the-cuff announcement of tariffs that really got the ball rolling for our furry friends in the bear camp.

Just like that, the warm and fuzzy feeling that had accompanied the 7.7% rebound from the February 8 low was gone and worries about the outlook for rates and the economy took center stage. Bam, the S&P gave up 5%.

But after three straight red closes and another impressive Friday reversal, some are arguing that the "retest" is now over.

I see their point here. Stocks reached extreme oversold levels during the dive and sentiment readings reversed hard. In addition, there were some positive technical divergences during the Feb 9 washout and reversal. And now that the S&P has retraced half of the "retest" decline, those favoring the bull camp can certainly argue that a check mark can be made on the "retest."

But, I decided a long time ago to not make "bets" on whether a bottom "should" be in or not. No, I find it much safer to simply let Ms. Market tell me when the corrective phase has ended. And this is where a little chart analysis/voodoo comes in.

A Very Interesting Chart Setup

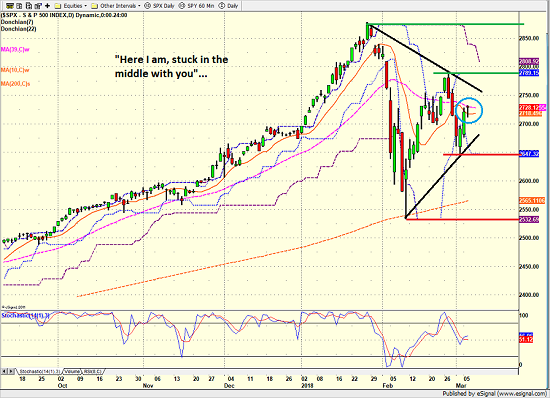

The chart below is one of the most interesting I've seen in a very long time. And I think the action in the coming days will act as an "announcement" regarding what will come next.

S&P 500- Daily

View Larger Image Online

First, note the downtrend and uptrend lines drawn in black from the recent highs and lows. In technical terms, this is called a "wedge." And since the S&P currently resides in the center of the wedge, my technician friends tell me that the line the indices break first will determine the direction of the next trend.

However, one thing I've learned about technical analysis in the high-speed trading era is that nothing is simple anymore and trendlines breaking aren't the neat and tidy signals they once were.

So, I've drawn in a few more lines here. While a trendline break in either direction would definitely be worth noting, I'll argue that the near-term support and resistance would actually carry more weight. Thus, a break above the green line at 2789 would likely trigger a test of the top green line (the old high) and a break below the first red line at 2645(ish) would create a move toward the next red line (the old low).

Rarely do we see such a wonderfully symmetrical set up. And with the market sitting almost exactly in the center of the entire formation, I have to believe that a break of either team's line in the sand is going to be very important.

This Just In...

Just when I thought "normal" market forces (and yes, I use that term tongue in cheek) would produce a technical outcome on the charts, the news of Gary Cohn's resignation hits the wires. Traders are voting with their feet and the algos are running wild once again as the thinking is that Cohn's resignation lends credence to the idea that the tariffs may actually be put into effect.

As such, it looks like the "C" leg of the retest phase (where leg "A" is down, leg "b" is up, and leg "c" is down) is about to begin. So stay tuned and be sure to watch those lines in the sand.

Thought For The Day:

The only way to do great work is to love what you do. -Steve Jobs

Wishing you green screens and all the best for a great day,

David D. Moenning

Founder, Chief Investment Officer

Heritage Capital Research

HCR Focuses on a Risk-Managed Approach to Investing

Must Read: What Risk Management Can and Cannot Do

HCR's Financial Advisor Services

HCR's Individual Investor Services

Questions, comments, or ideas? Contact Us

At the time of publication, Mr. Moenning held long positions in the following securities mentioned: None - Note that positions may change at any time.

Disclosures

The opinions and forecasts expressed herein are those of Mr. David Moenning and may not actually come to pass. Mr. Moenning's opinions and viewpoints regarding the future of the markets should not be construed as recommendations. The analysis and information in this report is for informational purposes only. No part of the material presented in this report is intended as an investment recommendation or investment advice. Neither the information nor any opinion expressed constitutes a solicitation to purchase or sell securities or any investment program.

Any investment decisions must in all cases be made by the reader or by his or her investment adviser. Do NOT ever purchase any security without doing sufficient research. There is no guarantee that the investment objectives outlined will actually come to pass. All opinions expressed herein are subject to change without notice. Neither the editor, employees, nor any of their affiliates shall have any liability for any loss sustained by anyone who has relied on the information provided.

Mr. Moenning may at times have positions in the securities referred to and may make purchases or sales of these securities while publications are in circulation. Positions may change at any time.

The analysis provided is based on both technical and fundamental research and is provided "as is" without warranty of any kind, either expressed or implied. Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

Investments in equities carry an inherent element of risk including the potential for significant loss of principal. Past performance is not an indication of future results.