The Macro Concerns In 3 Charts

To be sure, two big events will likely capture investors' attention in the short-run: Apple's (NASDAQ: AAPL) earnings and today's Fed Meeting, which concludes this afternoon at 2:00pm eastern. However, from an intermediate-term perspective, it appears that the macro picture still holds the key.

The good news from the shorter-term view is (a) Apple's earnings exceeded expectations, (b) the company upped its dividend by 16%, and (c) Tim Cook announced his company would be buying back a cool $100 billion in stock. The bad news is that iPhone sales missed the mark. The stock initially moved higher on the report, but it is important to remember that positive earnings reports have not been rewarded during the current reporting season.

The reason cited for the less-than enthusiastic response to earnings beats this quarter is the idea of "peak earnings." We have Caterpillar (NYSE: CAT) to thank for this theme as CAT's management said that the current results would likely be the "high water mark" for the year.

So, despite the fact that earnings results are at their best levels in years (JP Morgan reports that the blended earnings rate is on track for 23.2% growth for the quarter), market indices have responded with a yawn. Again, the key here appears to be concerns about the outlook going forward. Remember, stock prices discount what is expected to happen in the future and not what is happening at the present time.

As far as the Fed is concerned, the concern is two-fold. First, there is the worry that Jay Powell's gang is going to have to get more aggressive now that inflation looks to be perking up. The second is the fear of a "policy mistake." The most popular scenario here is the idea that the Fed may want to tighten more aggressively - just as the economy starts to slow.

Which brings us to the intermediate-term macro view. At issue here is the concern that the economy's performance is currently as good as it's going to get. Or put in market vernacular, we could be seeing "peak economic growth."

This particular theme started in Europe but is now spreading to the U.S. Anyone paying attention to the data knows that the economic numbers from across the pond have been punk lately. And while the common theme here at home is that the economy is accelerating, some of the most recent data have suggested otherwise.

Exhibit A here would be yesterday's ISM report. From my seat, the following three charts sum up the macro "concerns" very nicely.

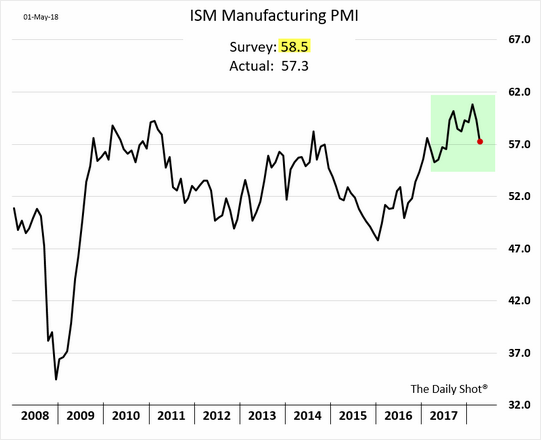

First there is the headline Manufacturing PMI (Purchasing Managers Index).

As the shaded area of the graph illustrates, the index, which is designed to indicate the state of the manufacturing sector, has pulled back of late. Oh, and the index reading came in at 57.3 versus the consensus estimate of 58.5. And this is called a "miss."

While it is true that a reading of 57.3 continues to suggest healthy, no, make that strong manufacturing activity, the point is the trend is not heading in the right direction. Hence the worries about "peak growth."

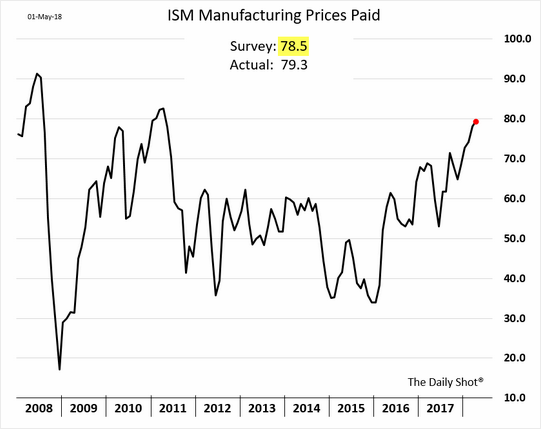

Next up is the issue of inflation. Although the Fed focuses on Core PCE readings, which are just now beginning to approach the stated target of 2%, there are other measures of inflationary pressures that are worth noting.

For example, the Prices Paid component of yesterday's ISM report came in above expectations (79.3 vs. 78.5) and has clearly been rising since the beginning of 2016.

Before you start sending "yea, but" emails, yes, I will admit that price inputs to the manufacturing sector are not as impactful to inflation as wages. However, there is no denying that costs to manufacturers are on the rise. And if history has taught us anything, it is that manufacturers tend to pass on increased costs to the consumer. And with wages also rising modestly, the argument that inflationary pressures are building is a fairly easy one to make.

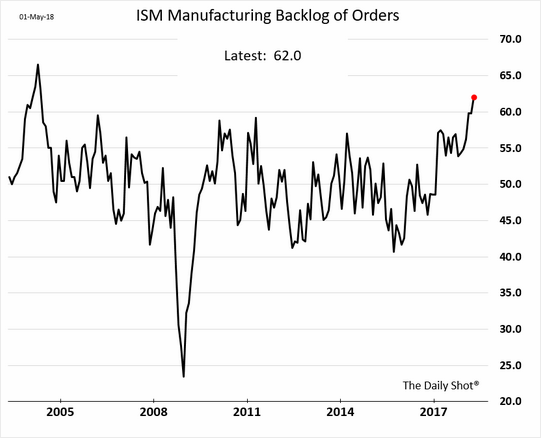

Speaking of the labor force, there has been a great deal of discussion about the "tightness" of the labor market. The bottom line is we're told that it is becoming difficult to find enough skilled workers to meet demand. The next chart shows this concept in action as the "backlog of orders" is also rising - and at the highest level seen since 2004.

In short, some manufacturers are running into difficulty filling orders. And it isn't much of a stretch to conclude that this is due to the tightness labor market.

So, thinking back to your Econ 101 class, what happens when demand exceeds supply? Oh, that's right; prices increase. And in this case, the idea is that wages are likely to rise due to short supply of workers.

To be clear, I am NOT suggesting that we have a 1970's-style inflation problem on our hands. However, I am thinking that with inflationary pressures starting to heat up, the Fed "may" need to do more, which, in turn, means higher interest rates. And while rates remain low by historical standards, they may begin to take a bite out of stock market demand at some point.

Bottom Line: It is this macro-level thinking that looks to be behind the current trend of traders selling into any/all rallies. And while I have no idea how long the current sloppy action will last, it is important to recognize why traders are doing what they are doing.

Thought For The Day:

We tend to judge others by their behavior, and ourselves by our intentions. -Stephen M.R. Covey

Wishing you green screens and all the best for a great day,

David D. Moenning

Founder, Chief Investment Officer

Heritage Capital Research

HCR Focuses on a Risk-Managed Approach to Investing

Must Read: What Risk Management Can and Cannot Do

HCR's Financial Advisor Services

HCR's Individual Investor Services

Questions, comments, or ideas? Contact Us

At the time of publication, Mr. Moenning held long positions in the following securities mentioned: none - Note that positions may change at any time.

Disclosures

The opinions and forecasts expressed herein are those of Mr. David Moenning and may not actually come to pass. Mr. Moenning's opinions and viewpoints regarding the future of the markets should not be construed as recommendations. The analysis and information in this report is for informational purposes only. No part of the material presented in this report is intended as an investment recommendation or investment advice. Neither the information nor any opinion expressed constitutes a solicitation to purchase or sell securities or any investment program.

Any investment decisions must in all cases be made by the reader or by his or her investment adviser. Do NOT ever purchase any security without doing sufficient research. There is no guarantee that the investment objectives outlined will actually come to pass. All opinions expressed herein are subject to change without notice. Neither the editor, employees, nor any of their affiliates shall have any liability for any loss sustained by anyone who has relied on the information provided.

Mr. Moenning may at times have positions in the securities referred to and may make purchases or sales of these securities while publications are in circulation. Positions may change at any time.

The analysis provided is based on both technical and fundamental research and is provided "as is" without warranty of any kind, either expressed or implied. Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

Investments in equities carry an inherent element of risk including the potential for significant loss of principal. Past performance is not an indication of future results.