The Next Big Fear Is...

At the end of last week's missive, I concluded with the idea that the stock market continues to adjust/adapt to the new macro outlook, which includes higher rates, higher inflation, a stronger economy, and perhaps peak earnings growth.

This week, I believe it is important to add the idea that global growth may also be at or near a peak to the market's list of fears/worries. "Super Mario" (aka ECB President Mario Draghi) publicly alluded to such a concept during last week's speech at the IMF meeting in Washington, saying that "the growth cycle may have peaked" in the euro zone. And while some have argued that there was an issue with the exact translation, the bottom line is that "peak economic growth" may indeed be one of the primary narratives in the stock at this time.

Recall that "synchronized global growth" has been driving the action in the stock market for some time and was one of the main reasons investors could overlook elevated valuations and the prospect for higher rates. So, while the data continues to be good, many fear that the good news has already been priced into the market and that the road forward is going to get bumpy - as in very bumpy.

Then there is the reality that trees don't grow to the sky. At some point, the secular bull market that began on March 9, 2009 will end. And a great many analysts believe that like the last two cycles, this one will also end badly.

The problem, of course, is determining when the next market debacle is likely to occur. Remember, secular moves last many years (the last secular bull ran from the summer of 1982 through the spring of 2000). Frankly, I see such an effort as a fool's errand as the really big, really bad market declines tend to take place when no one is looking for them - not when just about everyone on the planet is prepping for such an event.

Personally, I don't have an opinion on whether or not we are seeing the peak in earnings, the economy, and/or the stock market from an intermediate-term perspective as I prefer to be "rules based" in my approach to portfolio management. Yet, it is vital to stay in tune with what market players believe is the prevailing theme.

So, my take is the corrective phase is likely to stick around a while and the "sloppy" action we've seen since the emotional, February low, is likely to continue. And yes, I will admit there is the possibility that the current correction morphs into a cyclical bear. But, at this stage of the game, my primary models are not suggesting that the fat lady is about to sing.

Thought For The Day:

There is no pillow so soft as a clear conscience. -French proverb

Wishing you green screens and all the best for a great day,

David D. Moenning

Founder, Chief Investment Officer

Heritage Capital Research

HCR Focuses on a Risk-Managed Approach to Investing

Must Read: What Risk Management Can and Cannot Do

HCR's Financial Advisor Services

HCR's Individual Investor Services

Questions, comments, or ideas? Contact Us

At the time of publication, Mr. Moenning held long positions in the following securities mentioned: None - Note that positions may change at any time.

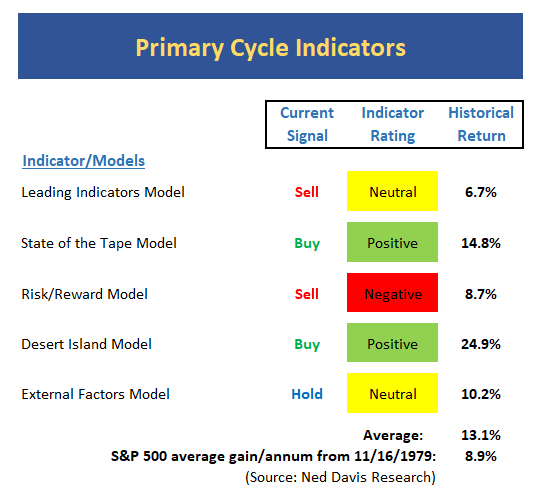

The State of the Big-Picture Market Models

It's a new week, so let's start things off with a review of the state of my favorite big-picture market models, which are designed to tell us which team is in control of the prevailing major trend.

View My Favorite Market Models Online

Executive Summary:

- The long-term Leading Indicators model remains on its recent sell signal, but the model reading itself is neutral.

- Our "State of the tape" model reading remains strong. While this may sound strange, the positive reading is largely a result of the intermediate-term mean-reversion components that are built into the model.

- The Risk/Reward model remains on sell signal and the model reading remains solidly negative.

- The reading of my "desert island" model is still in good shape overall. As I've been saying, this tells me to continue to give the bulls the benefit of any doubt

- The External Factors model remains in the neutral zone. But note that the historical return for stocks with the model in this zone is above average.

- My "bottom line" take is that while the market remains in a corrective/consolidation phase, the historical returns of the "primay cycles" models tell me to continue to side with the bulls.

The State of the Trend

Digging into the details, I like to start my weekly review with a look at the "state of the trend." These indicators are designed to give us a feel for the overall health of the current short- and intermediate-term trend models.

View Trend Indicator Board Online

Executive Summary:

- Another wild week left the trend of the S&P stuck in neutral.

- The short-term Channel Breakout System produced a buy signal last week. Keep in mind that with stocks in a mean-reverting environment, this system is much more active than traditional approaches to the method.

- The intermediate-term Trend Model remains stuck in the red zone - albeit only by a thin margin. A weekly close above 2675(ish) would cause the model to flip to positive.

- The intermediate-term Channel Breakout System remains on a sell signal and would require a move above 2717 to change to green.

- It is important to recognize that while the current corrective phase has been in place for three months now, the long-term Trend Model remains positive.

- The Cycle Composite points higher for the next week.

- From an intermediate-term perspective, the market remains in a mean-reverting mode.

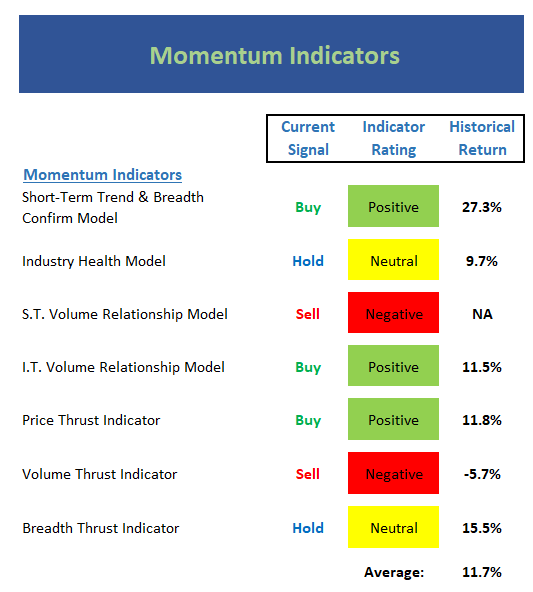

The State of Internal Momentum

Next up are the momentum indicators, which are designed to tell us whether there is any "oomph" behind the current trend.

View Momentum Indicator Board Online

Executive Summary:

- The short-term Trend and Breadth Confirm Model starts the week in the positive zone where historical returns have been quite strong.

- The Industry Health Model remains neutral. However, as I've mentioned, the fact that this model has stayed out of the negative zone is a modest plus for the bulls.

- The short-term Volume Relationship starts the week in negative territory, but only by a thin margin.

- Yet it is positive that the intermediate-term Volume Relationship Model remains in pretty good shape.

- The intermediate-term Price Thrust Indicator, which is an oscillator, starts the week positive - but by the slimmest of margins.

- The Volume Thrust Indicator slipped to negative last week - but as has been the theme this week, the indicator is only slightly negative.

- The Breadth Thrust Indicator also slipped back last week and is now neutral.

- Momentum remains an issue for this market and the bulls have a fair amount of work to do here if they expect to move forward to any meaningful degree.

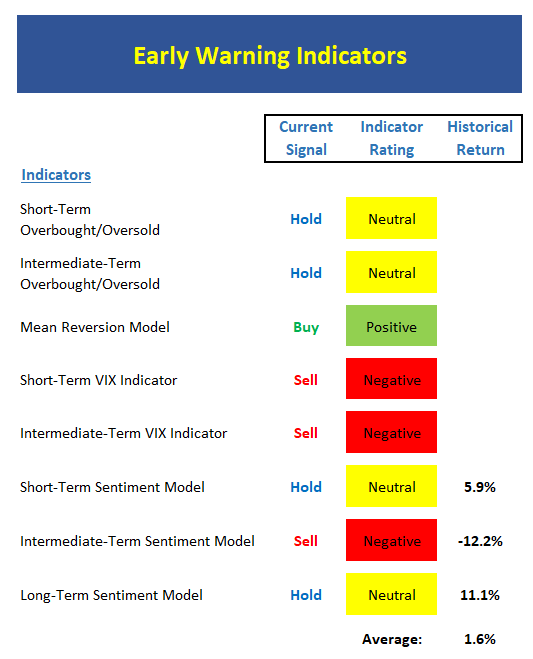

The State of the "Trade"

We also focus each week on the "early warning" board, which is designed to indicate when traders might start to "go the other way" -- for a trade.

View Early Warning Indicator Board Online

Executive Summary:

- From a near-term perspective, stocks are neither overbought nor oversold.

- From an intermediate-term view, stocks have worked off the recent oversold reading and remain neutral.

- The Mean Reversion Model remains on its 4/4 buy signal, which sports a modest gain at this stage.

- The short-term VIX signal remains on the recent sell signal.

- Our longer-term VIX Indicator is also on a sell signal.

- From a short-term perspective, market sentiment is currently neutral. This means neither team has an edge here.

- The intermediate-term Sentiment Model remains negative to start the week.

- The long-term Sentiment Model remains neutral this week. Note that the neutral reading is a dramatic improvement from the extreme negative readings seen since the beginning of the year.

- The early warning board doesn't provide much of a clue this week.

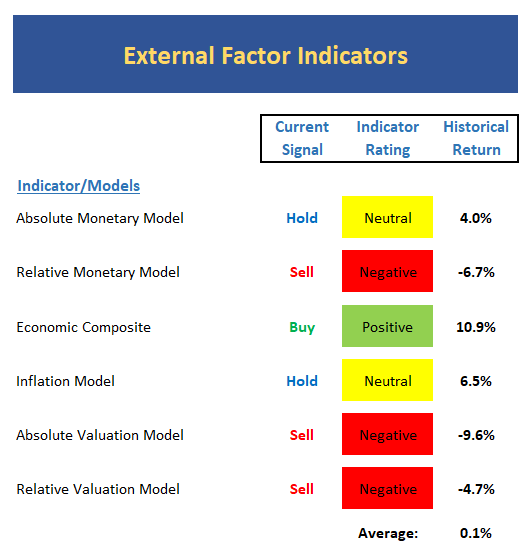

The State of the Macro Picture

Now let's move on to the market's "external factors" - the indicators designed to tell us the state of the big-picture market drivers including monetary conditions, the economy, inflation, and valuations.

View External Factors Indicator Board Online

Executive Summary:

- While my assessment of the Absolute Monetary model is beginning to sound like a broken record, the model remains at the low end of neutral and is on the verge of breaking down. But so far at least, the model remains neutral.

- The recent move up in rates has caused the Relative Monetary Model to fall into the red zone.

- The Economic Models remain in pretty good shape. This tells us that the economic backdrop continues to be constructive for stocks from an intermediate-term perspective.

- The inflation model remains neutral. My take here is that while there are inflationary pressures in the system, the model reading has yet to reach the "high inflation" zone.

- The Absolute Valuation model remains negative but continues to show some modest improvement due to the fact that "P" is going nowhere fast while "E" continues to improve.

- Our Relative Valuation Model remains negative as rates have now become a slight headwind for stocks.

- The bottom line is the External Factors board is no better than neutral at the present time.

Sample Tactical Allocation Model

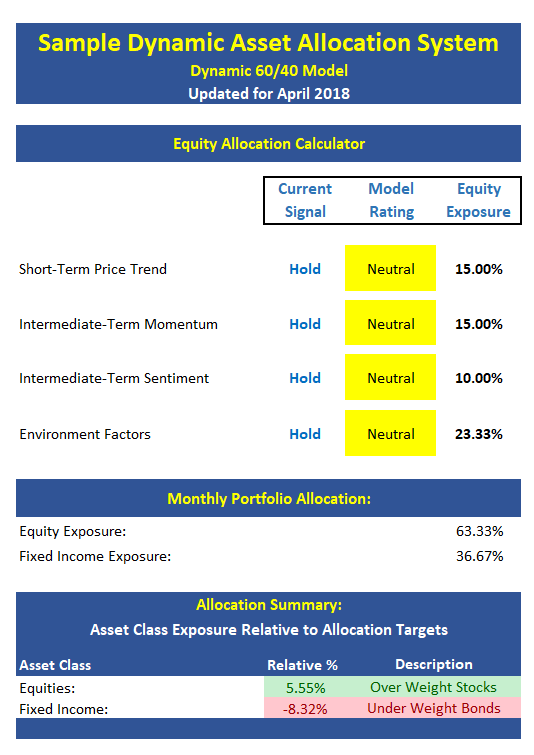

Below is an EXAMPLE (and ONLY an EXAMPLE) of how one might incorporate the indicator boards. The approach shown below is designed to provide the current equity allocation for a balanced tactical asset allocation model with a base target of 60/40 stocks/bonds.

The overall intent of the model is to keep equity exposure in line with current conditions. Since the model is updated monthly, we take a longer-term approach and allocate 40% of the exposure to Environmental factors, 40% to Trend and Momentum factors, and 20% to Sentiment.

The model above is for illustrative and informational purposes only and does not in any way represent any investment recommendation. The model is merely a sample of how indicators can be grouped to create a guide to market exposure based on the inputs from multiple indicators/models.

Beginning February 2018, the model will be updated monthly.

Indicators Explained

Short-Term Trend-and-Breadth Signal Explained: History shows the most reliable market moves tend to occur when the breadth indices are in gear with the major market averages. When the breadth measures diverge, investors should take note that a trend reversal may be at hand. This indicator incorporates NDR's All-Cap Dollar Weighted Equity Series and A/D Line. From 1998, when the A/D line is above its 5-day smoothing and the All-Cap Equal Weighted Equity Series is above its 25-day smoothing, the equity index has gained at a rate of +32.5% per year. When one of the indicators is above its smoothing, the equity index has gained at a rate of +13.3% per year. And when both are below, the equity index has lost +23.6% per year.

Channel Breakout System Explained: The short-term and intermediate-term Channel Breakout Systems are modified versions of the Donchian Channel indicator. According to Wikipedia, "The Donchian channel is an indicator used in market trading developed by Richard Donchian. It is formed by taking the highest high and the lowest low of the last n periods. The area between the high and the low is the channel for the period chosen."

Intermediate-Term Trend-and-Breadth Signal Explained: This indicator incorporates NDR's All-Cap Dollar Weighted Equity Series and A/D Line. From 1998, when the A/D line is above its 45-day smoothing and the All-Cap Equal Weighted Equity Series is above its 45-day smoothing, the equity index has gained at a rate of +17.6% per year. When one of the indicators is above its smoothing, the equity index has gained at a rate of +6.5% per year. And when both are below, the equity index has lost -1.3% per year.

Industry Health Model Explained: Designed to provide a reading on the technical health of the overall market, Big Mo Tape takes the technical temperature of more than 100 industry sectors each week. Looking back to early 1980, when the model is rated as "positive," the S&P has averaged returns in excess of 23% per year. When the model carries a "neutral" reading, the S&P has returned over 11% per year. But when the model is rated "negative," stocks fall by more than -13% a year on average.

Cycle Composite Projections: The cycle composite combines the 1-year Seasonal, 4-year Presidential, and 10-year Decennial cycles. The indicator reading shown uses the cycle projection for the upcoming week.

Trading Mode Indicator: This indicator attempts to identify whether the current trading environment is "trending" or "mean reverting." The indicator takes the composite reading of the Efficiency Ratio, the Average Correlation Coefficient, and Trend Strength models.

Volume Relationship Models: These models review the relationship between "supply" and "demand" volume over the short- and intermediate-term time frames.

Price Thrust Model Explained: This indicator measures the 3-day rate of change of the Value Line Composite relative to the standard deviation of the 30-day average. When the Value Line's 3-day rate of change have moved above 0.5 standard deviation of the 30-day average ROC, a "thrust" occurs and since 2000, the Value Line Composite has gained ground at a rate of +20.6% per year. When the indicator is below 0.5 standard deviation of the 30-day, the Value Line has lost ground at a rate of -10.0% per year. And when neutral, the Value Line has gained at a rate of +5.9% per year.

Volume Thrust Model Explained: This indicator uses NASDAQ volume data to indicate bullish and bearish conditions for the NASDAQ Composite Index. The indicator plots the ratio of the 10-day total of NASDAQ daily advancing volume (i.e., the total volume traded in stocks which rose in price each day) to the 10-day total of daily declining volume (volume traded in stocks which fell each day). This ratio indicates when advancing stocks are attracting the majority of the volume (readings above 1.0) and when declining stocks are seeing the heaviest trading (readings below 1.0). This indicator thus supports the case that a rising market supported by heavier volume in the advancing issues tends to be the most bullish condition, while a declining market with downside volume dominating confirms bearish conditions. When in a positive mode, the NASDAQ Composite has gained at a rate of +38.3% per year, When neutral, the NASDAQ has gained at a rate of +13.3% per year. And when negative, the NASDAQ has lost at a rate of -8.5% per year.

Breadth Thrust Model Explained: This indicator uses the number of NASDAQ-listed stocks advancing and declining to indicate bullish or bearish breadth conditions for the NASDAQ Composite. The indicator plots the ratio of the 10-day total of the number of stocks rising on the NASDAQ each day to the 10-day total of the number of stocks declining each day. Using 10-day totals smooths the random daily fluctuations and gives indications on an intermediate-term basis. As expected, the NASDAQ Composite performs much better when the 10-day A/D ratio is high (strong breadth) and worse when the indicator is in its lower mode (weak breadth). The most bullish conditions for the NASDAQ when the 10-day A/D indicator is not only high, but has recently posted an extreme high reading and thus indicated a thrust of upside momentum. Bearish conditions are confirmed when the indicator is low and has recently signaled a downside breadth thrust. In positive mode, the NASDAQ has gained at a rate of +22.1% per year since 1981. In a neutral mode, the NASDAQ has gained at a rate of +14.5% per year. And when in a negative mode, the NASDAQ has lost at a rate of -6.4% per year.

Short-Term Overbought/sold Indicator: This indicator is the current reading of the 14,1,3 stochastic oscillator. When the oscillator is above 80 and the %K is above the %D, the indicator gives an overbought reading. Conversely, when the oscillator is below 20 and %K is below its %D, the indicator is oversold.

Intermediate-Term Overbought/sold Indicator: This indicator is a 40-day RSI reading. When above 57.5, the indicator is considered overbought and when below 45 it is oversold.

Mean Reversion Model: This is a diffusion model consisting of five indicators that can produce buy and sell signals based on overbought/sold conditions.

VIX Indicator: This indicator looks at the current reading of the VIX relative to standard deviation bands. When the indicator reaches an extreme reading in either direction, it is an indication that a market trend could reverse in the near-term.

Short-Term Sentiment Indicator: This is a model-of-models composed of 18 independent sentiment indicators designed to indicate when market sentiment has reached an extreme from a short-term perspective. Historical analysis indicates that the stock market's best gains come after an environment has become extremely negative from a sentiment standpoint. Conversely, when sentiment becomes extremely positive, market returns have been subpar.

Intermediate-Term Sentiment Indicator: This is a model-of-models composed of 7 independent sentiment indicators designed to indicate when market sentiment has reached an extreme from an intermediate-term perspective. Historical analysis indicates that the stock market's best gains come after an environment has become extremely negative from a sentiment standpoint. Conversely, when sentiment becomes extremely positive, market returns have been subpar.

Long-Term Sentiment Indicator: This is a model-of-models composed of 6 independent sentiment indicators designed to indicate when market sentiment has reached an extreme from a long-term perspective. Historical analysis indicates that the stock market's best gains come after an environment has become extremely negative from a sentiment standpoint. Conversely, when sentiment becomes extremely positive, market returns have been subpar.

Absolute Monetary Model Explained: The popular cliché, "Don't fight the Fed" is really a testament to the profound impact that interest rates and Fed policy have on the market. It is a proven fact that monetary conditions are one of the most powerful influences on the direction of stock prices. The Absolute Monetary Model looks at the current level of interest rates relative to historical levels and Fed policy.

Relative Monetary Model Explained: The "relative" monetary model looks at monetary indicators relative to recent levels as well as rates of change and Fed Policy.

Economic Model Explained: During the middle of bull and bear markets, understanding the overall health of the economy and how it impacts the stock market is one of the few truly logical aspects of the stock market. When our Economic model sports a "positive" reading, history (beginning in 1965) shows that stocks enjoy returns in excess of 21% per year. Yet, when the model's reading falls into the "negative" zone, the S&P has lost nearly -25% per year. However, it is vital to understand that there are times when good economic news is actually bad for stocks and vice versa. Thus, the Economic model can help investors stay in tune with where we are in the overall economic cycle.

Inflation Model Explained: They say that "the tape tells all." However, one of the best "big picture" indicators of what the market is expected to do next is inflation. Simply put, since 1962, when the model indicates that inflationary pressures are strong, stocks have lost ground. Yet, when inflationary pressures are low, the S&P 500 has gained ground at a rate in excess of 13%. The bottom line is inflation is one of the primary drivers of stock market returns.

Valuation Model Explained: If you want to get analysts really riled up, you need only to begin a discussion of market valuation. While the question of whether stocks are overvalued or undervalued appears to be a simple one, the subject is extremely complex. To simplify the subject dramatically, investors must first determine if they should focus on relative valuation (which include the current level of interest rates) or absolute valuation measures (the more traditional readings of Price/Earnings, Price/Dividend, and Price/Book Value). We believe that it is important to recognize that environments change. And as such, the market's focus and corresponding view of valuations are likely to change as well. Thus, we depend on our Valuation Models to help us keep our eye on the ball.

Disclosures

The opinions and forecasts expressed herein are those of Mr. David Moenning and may not actually come to pass. Mr. Moenning's opinions and viewpoints regarding the future of the markets should not be construed as recommendations. The analysis and information in this report is for informational purposes only. No part of the material presented in this report is intended as an investment recommendation or investment advice. Neither the information nor any opinion expressed constitutes a solicitation to purchase or sell securities or any investment program.

Any investment decisions must in all cases be made by the reader or by his or her investment adviser. Do NOT ever purchase any security without doing sufficient research. There is no guarantee that the investment objectives outlined will actually come to pass. All opinions expressed herein are subject to change without notice. Neither the editor, employees, nor any of their affiliates shall have any liability for any loss sustained by anyone who has relied on the information provided.

Mr. Moenning may at times have positions in the securities referred to and may make purchases or sales of these securities while publications are in circulation. Positions may change at any time.

The analysis provided is based on both technical and fundamental research and is provided "as is" without warranty of any kind, either expressed or implied. Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

Investments in equities carry an inherent element of risk including the potential for significant loss of principal. Past performance is not an indication of future results.