A More Cautious Stance Makes Sense

Good Monday morning and welcome back. Well, it's a new month and a new quarter - wow, where does the time go? As usual, let's start the week (and the month and the quarter) with a review my key market models and indicators. To review, the primary goal of this exercise (something I actually do on a daily basis) is to remove any preconceived, subjective notions about the markets and ensure that I stay in line what "is" really happening in the market.

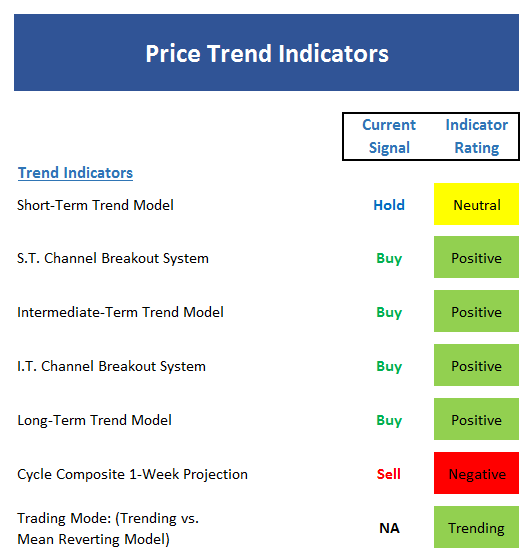

The State of the Trend

We start each week with a look at the "state of the trend." These indicators are designed to give us a feel for the overall health of the current short- and intermediate-term trend models.

Executive Summary:

- The short-term trend is clearly sideways at this point as prices are at the same level they were in mid-February

- The short-term channel system is a bit tricky here. However a break below 2322 would turn this indicator red

- Looking at the intermediate-term trend, this is the definition of "giving the bulls the benefit of doubt." The S&P 500 is sitting directly on our optimized smoothing and almost any decline would create a sell signal

- The breakdown point for the intermediate-term channel system is the same as the short-term. Below 2322 is a problem.

- The long-term trend model remains positive - something to keep in mind whenever things get sloppy from short-term perspective

- The Cycle composite suggests sloppy, sideways-to-down action for the next two weeks

- At this stage, the indicators contend that the market is still in a trending mode. However, we are on watch for a shift to either a "trending lower" or "mean reverting" mode.

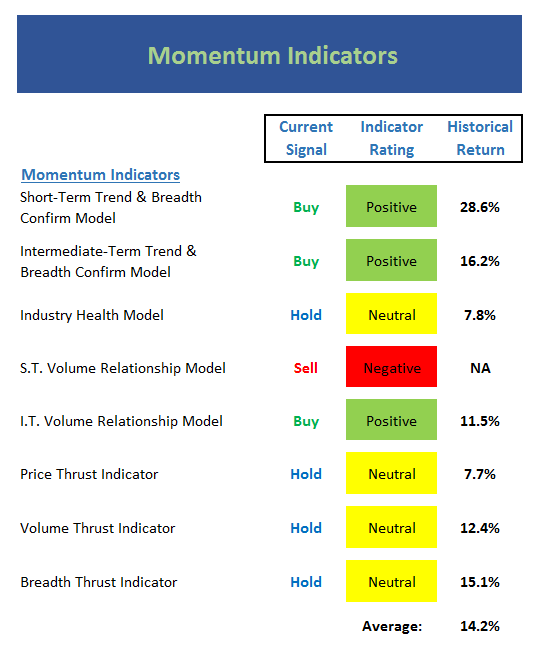

The State of Internal Momentum

Next up are the momentum indicators, which are designed to tell us whether there is any "oomph" behind the current trend...

Executive Summary:

- The s.t. Trend & Breadth Confirm model tends to be a little skittish in this type of environment. However, as of Friday's close, the reading is positive.

- The i.t. T&B Confirm model is also positive here - but only by a whisker

- As correlations among stocks relative to the S&P have risen, our Industry Health model has become less effective. This may explain the indicator's inability to reach an outright positive reading during the current bull run.

- The s.t. Volume Relationship model continues to weaken. However, a strong rally would likely rectify the situation

- The i.t. Volume Relationship model is solidly positive but is seeing some fraying around the edges

- The negative reading from the Price Thrust indicator has been worked off - but the indicator is not positive either

- The Volume Thrust indicators remains neutral as there is little "oomph" seen in either direction at this time

- Note that although the Breadth Thrust indicator is neutral, stocks can advance when the indicators is in this mode

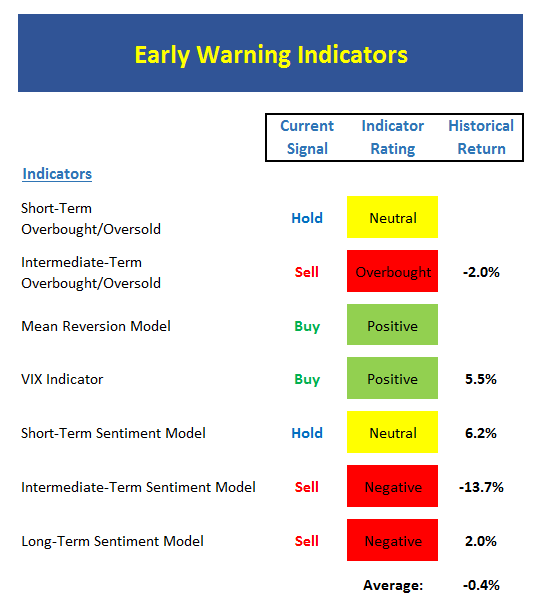

The State of the "Trade"

We also focus each week on the "early warning" board, which is designed to indicate when traders may start to "go the other way" -- for a trade.

Executive Summary:

- The recent oversold condition has been quickly "worked off' and the market is presently in a neutral state

- On an intermediate-term basis, stocks are now slightly overbought.

- The Mean Reversion model gave a buy signal on 3-28

- Both the short- and intermediate-term VIX indicators are on buy signals - but neither are strong

- Sentiment had reached extreme pessimism last week on a short-term basis, but has now reversed to neutral

- On an intermediate-term basis, sentiment is now negative

- And from a long-term perspective, sentiment remains extremely optimistic - which is a negative

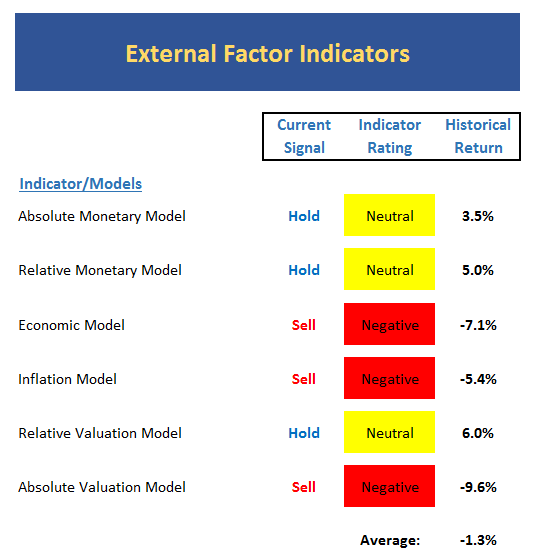

The State of the Macro Picture

Now let's move on to the market's "external factors" - the indicators designed to tell us the state of the big-picture market drivers including monetary conditions, the economy, inflation, and valuations.

Executive Summary:

- In response to the recent pullback in rates, he Relative Monetary model has upticked to neutral

- The Economic model remains out of sync during this cycle and is still negative.

- The Inflation model remains negative, but is now moving back toward the neutral zone

- No change in the valuation picture as stocks remain overbought

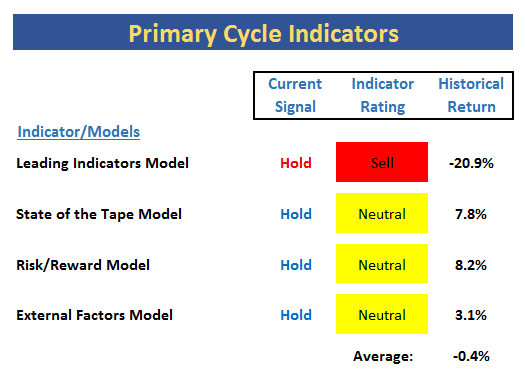

The State of the Big-Picture Market Models

Finally, let's review our favorite big-picture market models, which are designed to tell us which team is in control of the prevailing major trend.

Executive Summary:

- The Leading Indicators model, which did a fine job during the last bear phase has issued a sell signal. This is disconcerting.

- The Tape is basically neutral at this time

- The Risk/Reward model is also stuck in neutral

- The External Factors model remains on the low end of neutral but has improved slightly over past few weeks

The Takeaway...

If one looks at the Primary Cycle and External Factor boards, it is hard not to become concerned at this point in time. The Leading Indicators Model, which did such a fine job of calling both the beginning and the end of the most recent mini bear phase, turned red last week. And with the historical return for both the Primary Cycle and External boards now negative, it is probably a good idea to play the game cautiously at this time. Yet, it is important to keep in mind that these types of indicators are often very early. As such, if the S&P moves to fresh new highs, a "blow off" phase could easily begin. But for now, I have moved to a more cautious stance.

Thought For The Day:

Forgive those who least deserve it. -Bill Curry

Current Market Drivers

We strive to identify the driving forces behind the market action on a daily basis. The thinking is that if we can both identify and understand why stocks are doing what they are doing on a short-term basis; we are not likely to be surprised/blind-sided by a big move. Listed below are what we believe to be the driving forces of the current market (Listed in order of importance).

1. The State of the U.S. Economy

2. The State of Trump Administration Policies

3. The State of Global Central Bank Policies

Wishing you green screens and all the best for a great day,

David D. Moenning

Chief Investment Officer

Sowell Management Services

Looking for a "Modern" approach to Asset Allocation and Portfolio Design?

Looking for More on the State of the Markets?

Investment Pros: Looking to modernize your asset allocations, add risk management to client portfolios, or outsource portfolio Management? Contact Eric@SowellManagement.com

Disclosures

The opinions and forecasts expressed herein are those of Mr. David Moenning and may not actually come to pass. Mr. Moenning's opinions and viewpoints regarding the future of the markets should not be construed as recommendations. The analysis and information in this report is for informational purposes only. No part of the material presented in this report is intended as an investment recommendation or investment advice. Neither the information nor any opinion expressed constitutes a solicitation to purchase or sell securities or any investment program.

Any investment decisions must in all cases be made by the reader or by his or her investment adviser. Do NOT ever purchase any security without doing sufficient research. There is no guarantee that the investment objectives outlined will actually come to pass. All opinions expressed herein are subject to change without notice. Neither the editor, employees, nor any of their affiliates shall have any liability for any loss sustained by anyone who has relied on the information provided.

The analysis provided is based on both technical and fundamental research and is provided "as is" without warranty of any kind, either expressed or implied. Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

David D. Moenning is an investment adviser representative of Sowell Management Services, a registered investment advisor. For a complete description of investment risks, fees and services, review the firm brochure (ADV Part 2) which is available by contacting Sowell. Sowell is not registered as a broker-dealer.

Employees and affiliates of Sowell may at times have positions in the securities referred to and may make purchases or sales of these securities while publications are in circulation. Positions may change at any time.

Investments in equities carry an inherent element of risk including the potential for significant loss of principal. Past performance is not an indication of future results.

Advisory services are offered through Sowell Management Services.