Additional Signs of Improvement

Good Monday morning and welcome back. Although the ECB and FOMC Meetings are over and rates have been increased in the U.S., the Fed remains a focal in the markets due to the fact that we have a full calendar of Fed-speak on tap for this week. For example, at 8:00 a.m this morning, Federal Reserve Bank of New York President, William Dudley will speak, with Chicago Fed President Charles Evans scheduled to speak at 7:00 p.m. Then tomorrow, Vice Chairman Stanley Fischer, Boston Fed chief Eric Rosengren, and Dallas Fed President Robert Kaplan will all speak. And Governor Jerome Powell and St. Louis Fed President James Bullard are on the calendar later in the week. The questions that investors want more information on include (a) what the "unwind" plans for the Fed's balance sheet will look like and (b) if any FOMC members favor additional rate hikes in 2017.

Since it's the start of a new week, let's get right to our objective review the key market models and indicators. To review, the primary goal of this weekly exercise is to remove any subjective notions and ensure that we stay in line with what "is" happening in the markets. So, let's get started...

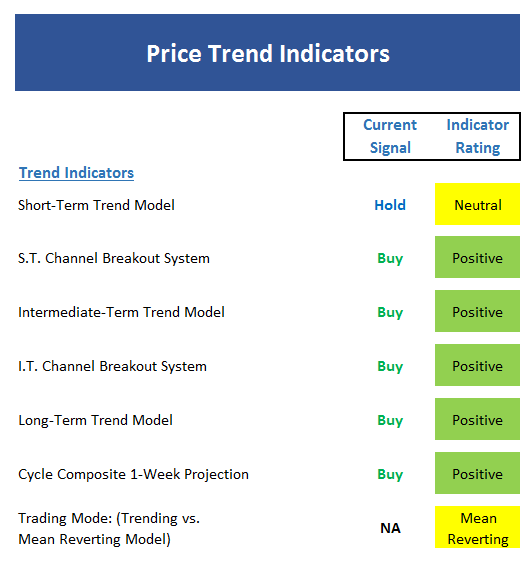

The State of the Trend

We start each week with a look at the "state of the trend." These indicators are designed to give us a feel for the overall health of the current short- and intermediate-term trend models.

View Trend Indicator Board Online

Executive Summary:

- The short-term Trend Model is now neutral as price is hovering right at the current short-term smoothing, which itself is moving sideways.

- The short-term Channel Breakout System remains positive but a break below 2415 would cause the indicators to issue a sell signal

- The intermediate-term Trend Model remains solidly positive

- The intermediate-term Channel Breakout System is also positive and gives the bulls the edge above 2352.

- The long-term Trend Model is still bullish

- The Cycle Composite is higher this week, lower next, and then points to a summer rally into the middle of July. But from there the cycle composite suggests trouble.

- The Trading Mode models are still mixed but two out of three still call this a mean-reverting environment.

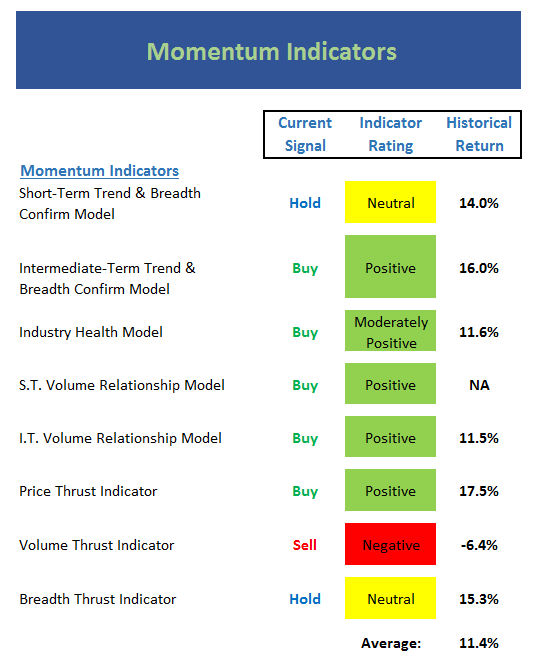

The State of Internal Momentum

Next up are the momentum indicators, which are designed to tell us whether there is any "oomph" behind the current trend...

View Momentum Indicator Board Online

Executive Summary:

- The short-term Trend and Breadth Confirm Model has slipped to neutral, which by itself is not a cause for alarm.

- Our intermediate-term Trend and Breadth Confirm Model remains positive with the all-equity A/D line at new highs. This is a big-picture positive.

- The Industry Health Model continues to improve - albeit ever-so slightly - within the moderately positive zone.

- The short-term Volume Relationship continues on a buy signal and is positive at this time - but only by a small margin.

- The intermediate-term Volume Relationship favors the bulls.

- The Price Thrust Indicator is in pretty good shape.

- The Volume Thrust Indicator has slipped to negative.

- The Breadth Thrust Indicator remains stuck in neutral.

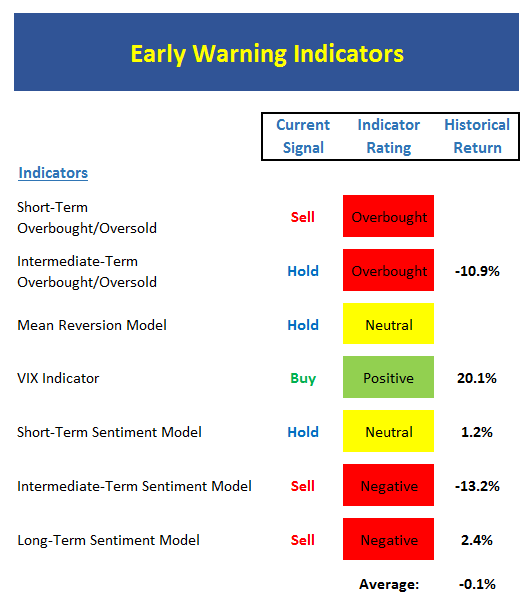

The State of the "Trade"

We also focus each week on the "early warning" board, which is designed to indicate when traders may start to "go the other way" -- for a trade.

View Early Warning Indicator Board Online

Executive Summary:

- From a near-term perspective, stocks are coming off an overbought condition, which gives the bears an opening.

- From an intermediate-term view, stocks are also overbought and beginning to reverse. This also suggests the bears have an opportunity in the near-term.

- The Mean Reversion Model remains in neutral.

- The most recent signal from the VIX Indicator was a buy.

- From a short-term perspective, market sentiment is dead neutral.

- The intermediate-term Sentiment Model continues to favor the bears.

- Longer-term Sentiment readings also favor the bear camp at this time.

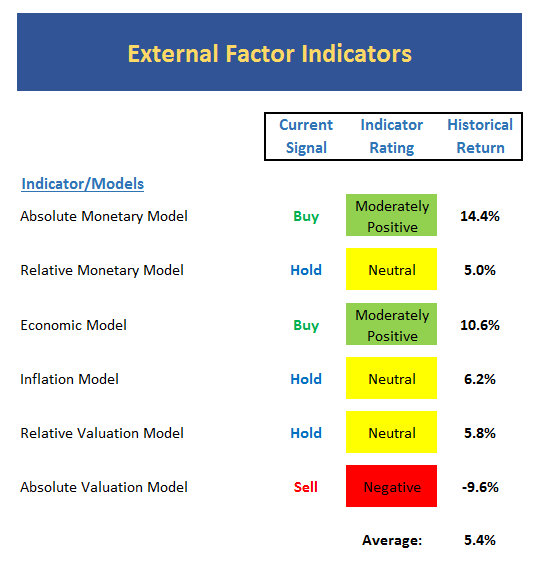

The State of the Macro Picture

Now let's move on to the market's "external factors" - the indicators designed to tell us the state of the big-picture market drivers including monetary conditions, the economy, inflation, and valuations.

View External Factors Indicator Board Online

Executive Summary:

- Monetary conditions continue to improve and our Absolute Monetary model has moved back up into positive zone.

- On a relative basis, our Monetary Model remains neutral - but is moving in the right direction.

- Our Economic Model (designed to call the stock market) continues to gain ground and appears to be getting back in sync with the market action.

- The Inflation Model continues to sport a neutral reading, which is a positive from a bigger picture standpoint.

- Our Relative Valuation Model has seen some improvement recently, but remains neutral overall.

- The Absolute Valuation Model has also improved slightly - a step in the right direction.

The State of the Big-Picture Market Models

Finally, let's review our favorite big-picture market models, which are designed to tell us which team is in control of the prevailing major trend.

View My Favorite Market Models Online

Executive Summary:

- The Leading Indicators model, was our best performing timing model during the last cycle, moved back to positive last week.

- The Tape continues to muddle along in a moderately positive fashion.

- The Risk/Reward model reading remains neutral but the most recent signal was a sell.

- The External Factors model continues to improve and suggests stock returns will be slightly above their long-term averages.

The Takeaway...

The message from the indicators boards this week continues to be one of an improving environment. While there were several "issues" with the big-picture conditions recently, some of these concerns now appear to be waning - especially in the area of rates and monetary policy. This does not mean however, that the market risk factors are now low. No, my take is that risk factors have come down a smidge and while still elevated, are not quite the concern they were a month ago. However, with the cycle composite calling for a meaningful decline to begin in mid-July, I think it is wise to remain alert at this time.

Thought For The Day:

Are you feeling inspired today? If not, shouldn't you be?

Current Market Drivers

We strive to identify the driving forces behind the market action on a daily basis. The thinking is that if we can both identify and understand why stocks are doing what they are doing on a short-term basis; we are not likely to be surprised/blind-sided by a big move. Listed below are what we believe to be the driving forces of the current market (Listed in order of importance).

1. The State of Trump Administration Policies

2. The State of the U.S. Economy

3. The State of Earning Growth

Wishing you green screens and all the best for a great day,

David D. Moenning

Chief Investment Officer

Sowell Management Services

Disclosure: At the time of publication, Mr. Moenning and/or Sowell Management Services held long positions in the following securities mentioned: none. Note that positions may change at any time.

Looking for a "Modern" approach to Asset Allocation and Portfolio Design?

Looking for More on the State of the Markets?

Disclosures

The opinions and forecasts expressed herein are those of Mr. David Moenning and may not actually come to pass. Mr. Moenning's opinions and viewpoints regarding the future of the markets should not be construed as recommendations. The analysis and information in this report is for informational purposes only. No part of the material presented in this report is intended as an investment recommendation or investment advice. Neither the information nor any opinion expressed constitutes a solicitation to purchase or sell securities or any investment program.

Any investment decisions must in all cases be made by the reader or by his or her investment adviser. Do NOT ever purchase any security without doing sufficient research. There is no guarantee that the investment objectives outlined will actually come to pass. All opinions expressed herein are subject to change without notice. Neither the editor, employees, nor any of their affiliates shall have any liability for any loss sustained by anyone who has relied on the information provided.

The analysis provided is based on both technical and fundamental research and is provided "as is" without warranty of any kind, either expressed or implied. Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

David D. Moenning is an investment adviser representative of Sowell Management Services, a registered investment advisor. For a complete description of investment risks, fees and services, review the firm brochure (ADV Part 2) which is available by contacting Sowell. Sowell is not registered as a broker-dealer.

Employees and affiliates of Sowell may at times have positions in the securities referred to and may make purchases or sales of these securities while publications are in circulation. Positions may change at any time.

Investments in equities carry an inherent element of risk including the potential for significant loss of principal. Past performance is not an indication of future results.

Advisory services are offered through Sowell Management Services.