Are The Bears Emerging From Hibernation?

For the past four days, this missive has offered up a baker's dozen reasons why it might be time to be cautious on the stock market. It would appear that Thursday's action proved to be an exclamation point on the theme.

The Dow plunged 317 points. The S&P 500 had its worst day in more than three and one-half months, losing 2.0 percent. The NASDAQ, which has emerged as a leader in recent weeks, gave back 2.09 percent. Midcaps dropped 2.02 percent and finished July with a loss of more than 4.3 percent. And the usually strong small caps (the Russell 2000) got smoked for 2.31 percent on Thursday and 6.41 percent during the month of July.

While bad days in the stock market aren't exactly new, they have been few and far between for the past couple of years. And what made Thursday's dance to the downside notable was the fact that there really wasn't any true catalyst to get the bear party started. Nope, this decline appeared to be the culmination of all those "issues" we've been talking about every morning this week.

Recall that we've talked about a variety of worries facing this market including: The Fed's exit, percolating inflation, the "nearest neighbor" chart pattern, the action in high yield bonds, the readings of our market environment models (which, by the way, did a nice job of telling us to take our foot off the gas in early July and to get out of high yield bonds altogether), the age of the bull run, the cycle projections, the mounting geopolitical issues, the technical divergences, and the fact that the most recent run to new highs qualified as a "no mo" event.

The bottom line is there have been plenty of warning signs. Plenty of reasons to rein it in a bit. And plenty of time to select your favorite risk management strategy.

The Question of the Day

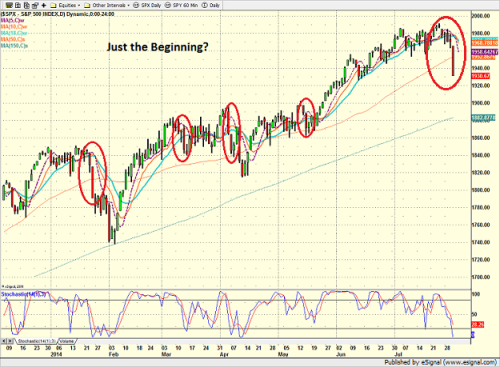

After the type of shellacking that stocks took on Thursday, the question of the day is if the long-awaited meaningful correction has arrived. Or will this turn out to be another 4-6 day wonder like so many of the pullbacks seen this year have turned out to be?

As the chart below illustrates, the two-day trash jobs this year haven't always led to further selling - especially since the end of January.

S&P 500 Daily

To be sure, Thursday's move felt exaggerated as wave after wave of sell programs washed over the tape during the vast majority of the session. The S&P would fall like a knife for 30-60 minutes at a time, bounce back 4 or 5 points, rinse and repeat.

So, given that almost all moves in the market have been exaggerated by trend-following algos lately, the question is if the reasons for Thursday's decline will be quickly forgotten if some shiny new object attracts traders' attention?

Why The Decline?

Before we can attempt to determine whether the current dive has run its course or is just getting started, we should probably make sure we understand why the market did what it did on Thursday.

For starters, there wasn't any specific catalyst to the move. The futures were down double digits an hour before the open, but only pointed to an opening loss of 15 points.

Therefore, the argument can be made that the move was a culmination of the many "issues" that are in play right now and the market simply fell due to its own weight. It was as if somebody yelled, "Everybody out of the pool!" Thursday morning.

Although the jobs report definitely has the power to turn this thing around, the laundry list of negative inputs was fairly substantial yesterday. So let's run them down...

The Laundry List

First there was the "default" in Argentina. However, this situation is more of a dispute than a country deciding not to pay its bills. But with the headlines shouting about Argentina defaulting on debt for the second time in 13 years, talk of debt contagion started making the rounds.

Next there was the ongoing banking mess in Portugal relating to Banco Espirito. Most analysts view this as an isolated incident. But, the problems at BES highlights the fact that all is not well in Europe's banking system.

Then there was the worry about Europe's economy. This time it was the inflation data - or the lack thereof - the prompted concerns about a deflationary cycle. And since the Eurozone is perhaps the third largest economy in the world, well, a bout with deflation wouldn't be pretty.

Speaking of inflation, the market has gotten a whiff of it this week. Yesterday's Employment Cost Index increased by the most in 5 years. And since Janet Yellen's argument against rising inflation has been the fact that wages haven't been rising, well...

Then on the subject of the Fed, the concern is that Yellen's bunch, which is clearly not on the same page at the moment, may be forced to raise rates before June 2015 (the current consensus expectation for when the first rate hike hits). And this week's stronger-than expected GDP report adds fuel to this fire. So, if the jobs report sports an unemployment rate under 6%, you can bet that rate fears will suddenly become front and center.

And finally there are the battles in Ukraine and Gaza, as well as the more minor skirmishes occurring in places like Libya. The simple fact of the matter is that Russia appears to be in a pickle at the moment over the downing of MH17. Therefore, there are concerns that one of the parties involved might do something stupid.

On the surface, none of the above would appear to justify a ferocious decline in the stock market. However, when you couple the list of concerns with all the other "issues" we've been talking about - especially the fact that we haven't seen a meaningful decline in eons - there is a decent chance that the bears may be starting to come out of hibernation.

Or Not...

But then again, every single one of the short and sharp declines seen recently have ALL been met with impressive buying sprees. Therefore, it is probably a good idea to watch the price action - and yesterday's lows - carefully for the next few days. Remember, at some point, the bulls will run out of steam. It's just a question of when.

Turning To This Morning

Yesterday's selling in the U.S. appears to have spilled over into the overseas markets overnight as major indices are down hard across the board. PMI data out of China showed improvement in the manufacturing sector, which may have helped stem the tide there. In Europe, traders are reacting to PMI data that continues to disappoint. Here at home, the futures also point to a weaker open. However, the all important jobs report will likely become the focal point of the session.

Pre-Game Indicators

Here are the Pre-Market indicators we review each morning before the opening bell...

Major Foreign Markets:

- Japan: -0.63%

- Hong Kong: -0.91%

- Shanghai: -0.75%

- London: -1.26%

- Germany: -1.75%

- France: -0.92%

- Italy: -0.16%

- Spain: -1.45%

Crude Oil Futures: -$0.62 to $97.55

Gold: +$2.80 at $1285.60

Dollar: lower against the yen and euro, higher vs. pound.

10-Year Bond Yield: Currently trading at 2.574%

Stock Futures Ahead of Open in U.S. (relative to fair value):

- S&P 500: -10.53

- Dow Jones Industrial Average: -79

- NASDAQ Composite: -20.10

Thought For The Day:

Those at the top of the mountain didn't just happen upon it.

Important Reminder: In order to keep pace with our growth, better serve our advisors and clients, and to provide scale for future growth, Heritage is teaming up with CONCERT Global - an SEC Registered Investment Advisor with more than $2 Billion in assets under management. CONCERT will provide more robust back-office, compliance, technology, and trading infrastructure. Client packets to make the transition will be arriving in the coming weeks.

Positions in securities mentioned: None

Wishing you green screens and all the best for a great day,

David D. Moenning

President, Chief Investment Officer

Heritage Capital Research

Check Out the NEW Website!

Investment Advisory Services Offered Through CONCERT Wealth Management, Inc. An SEC Registered Investment Advisor

The opinions and forecasts expressed herein are those of Mr. David Moenning and may not actually come to pass. Mr. Moenning’s opinions and viewpoints regarding the future of the markets should not be construed as recommendations. The analysis and information in this report is for informational purposes only. No part of the material presented in this report is intended as an investment recommendation or investment advice. Neither the information nor any opinion expressed nor any Portfolio constitutes a solicitation to purchase or sell securities or any investment program.

Any investment decisions must in all cases be made by the reader or by his or her investment adviser. Do NOT ever purchase any security without doing sufficient research. There is no guarantee that the investment objectives outlined will actually come to pass. All opinions expressed herein are subject to change without notice. Neither the editor, employees, nor any of their affiliates shall have any liability for any loss sustained by anyone who has relied on the information provided.

The analysis provided is based on both technical and fundamental research and is provided “as is” without warranty of any kind, either expressed or implied. Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

David D. Moenning, an advisor representative of CONCERT Wealth Management Inc. (CONCERT), is founder of Heritage Capital Advisors LLC, a legal business entity doing business as Heritage Capital Research (Heritage). Advisory services are offered through CONCERT Wealth Management, Inc., an SEC registered investment advisor. For a complete description of investment risks, fees and services review the CONCERT firm brochure (ADV Part 2) which is available from your Investment Representative or by contacting Heritage or CONCERT.

Mr. Moenning is also the owner of Heritage Capital Management (HCM) a state-registered investment adviser. HCM also serves as a sub-advisor to other investment advisory firms. Neither HCM, Heritage, or CONCERT is registered as a broker-dealer.

Employees and affiliates of Heritage and HCM may at times have positions in the securities referred to and may make purchases or sales of these securities while publications are in circulation. Editors will indicate whether they or Heritage/HCM has a position in stocks or other securities mentioned in any publication. The disclosures will be accurate as of the time of publication and may change thereafter without notice.

Investments in equities carry an inherent element of risk including the potential for significant loss of principal. Past performance is not an indication of future results.