Do Nothing, Absolutely Nothing, Until...

The State of the Market: Executive Summary

Stocks are down again in the early going Monday as a new record high in daily coronavirus cases (as well as a new high for the 7-day average of new cases) here at home and in many places in Europe has caused traders to fear another phase of lockdowns. Yes, a vaccine appears to be coming - and faster than anyone could have imagined in March, when the pandemic started to roll through the country. The concern is that the exponential increase in cases will trigger new lockdowns, which would, of course, could put a serious dent in the economic recovery.

However, I think it is important to recognize that the stock market has been dealing with this for some time now as the S&P 500 has effectively been moving sideways since late August. And since hitting a fresh high in early September, the venerable blue-chip index looks like it has been experiencing a period of consolidation ever since. As such, the daily movement within the current trading range isn't necessarily meaningful - or a reason to take action.

Now mix in some election uncertainty - mainly over which team will control the senate - and you wind up with what I like to call a "sloppy period." And in my experience, the best way to play this type of market is to, "do nothing, absolutely nothing, until there is something to do." In other words, it probably isn't a good idea to react to every wiggle and giggle in the market at times like these (or ever, for that matter), and instead to stay focused on the big picture. Which is what our Monday morning review of my favorite primary cycle models is all about.

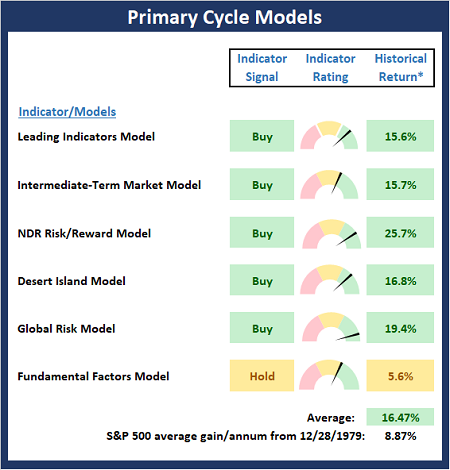

And with my Primary Cycle indicator board sporting an awful lot of green this week, my thinking is it is probably best to continue to give the bulls the benefit of any/all doubt when near-term problems arise.

The Big-Picture Market Models

There are no changes to report on the Primary Cycle board this week. As I've opined plenty of late, I believe the board is in good shape and supports the idea that stocks are currently in the midst of a cyclical bull market. To me, this suggests that investors with a longer-term time horizon should continue to side with the bull camp.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR. Past performances do not guarantee future results or profitability - NOT INDIVIDUAL INVESTMENT ADVICE.

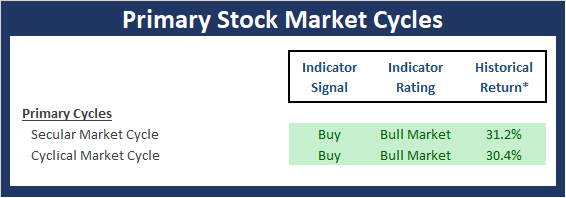

Checking On The "Primary" Cycles

While I don't often make portfolio adjustments based on the long-term trends in the stock market (aka the "primary cycles"), I have found over the years that checking in on state of the cycles and the weekly/monthly charts helps to keep the big-picture in perspective.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR. Past performances do not guarantee future results or profitability - NOT INDIVIDUAL INVESTMENT ADVICE.

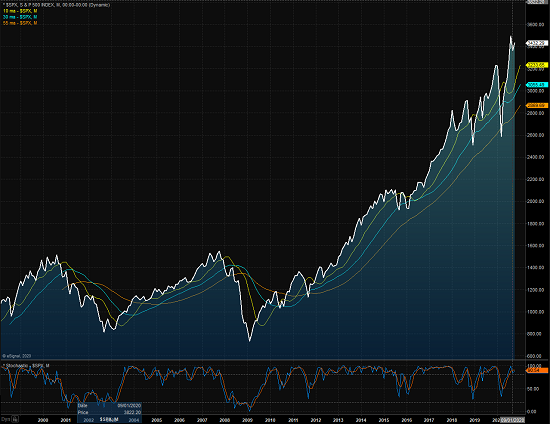

The Secular Market Cycle

Definition: A secular bull market is a period in which stock prices rise at an above-average rate for an extended period (think 5 years or longer) and suffer only relatively short intervening declines. A secular bear market is an extended period of flat or declining stock prices. Secular bull or bear markets typically consist of multiple cyclical bull and bear markets. Below is a monthly chart of the S&P 500 Index illustrating the current cycle, which we estimate began on March 9, 2009.

S&P 500 - Monthly

View Larger Chart Online

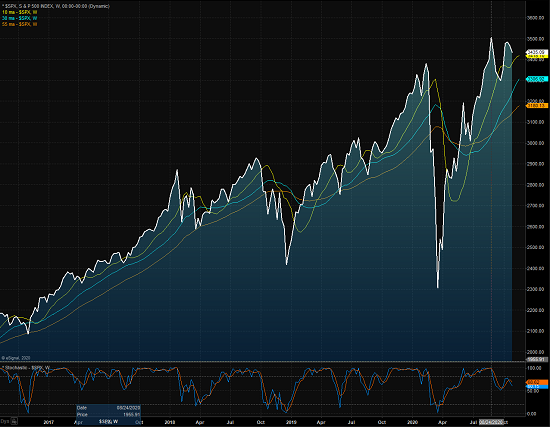

The Cyclical Market Cycle

Definition: A cyclical bull market requires a 30% rise in the DJIA after 50 calendar days or a 13% rise after 155 calendar days. Reversals of 30% in the Value Line Geometric Index since 1965 also qualify. A cyclical bear market requires a 30% drop in the DJIA after 50 calendar days or a 13% decline after 145 calendar days. Reversals of 30% in the Value Line Geometric Index also qualify. Below is a weekly chart of the S&P 500 illustrating the current cycle, which we estimate began on March 24, 2020.

S&P 500 - Weekly

View Larger Chart Online

Thought For The Day:

I've got a theory that if you give 100% all of the time, somehow things will work out in the end. -Larry Bird

Wishing you green screens and all the best for a great day,

David D. Moenning

Founder, Chief Investment Officer

Heritage Capital Research, an SEC Registered Investment Advisor

Disclosures

At the time of publication, Mr. Moenning held long positions in the following securities mentioned: None - Note that positions may change at any time.

Primary Market Models Explained

Leading Indicators Model: A group of indicators that have historically shown tendencies to lead the market at major turning points.

Intermediate-Term Market Model: A composite model-of-models focused on trend and momentum indicators which has been designed to provide identify intermediate-term trading opportunities. The model includes 38 independent indicators covering price trends, volume, breadth, momentum, historical cycles, sentiment, and mean reversion.

Risk/Reward Model: A model-of-models designed to provide an overall view of the state of the risk/reward environment. The model includes tape, monetary, and sentiment indicators as well as 7 big-picture market model readings.

Desert Island Model: If I was stranded on a desert island with access to only one market model to manage money with, this would be the model. The model is a comprehensive model-of-models comprised of trend, momentum, mean reversion, economic, monetary, sentiment, and factor-based indicators/models.

Global Risk Model: A series of indicators designed to gauge the relative risk tolerance of the global investment environment.

Fundamental Factors Model: A model-of-models designed to provide a reading on the "macro state" of the environment. The model is comprised of indicators/models in the areas of monetary conditions, the economy, corporate earnings, inflation, and stock market valuation.

NOT INVESTMENT ADVICE. The opinions and forecasts expressed herein are those of Mr. David Moenning and Heritage Capital Research and may not actually come to pass. The opinions and viewpoints regarding the future of the markets should not be construed as recommendations. The analysis and information in this report is for informational purposes only. No part of the material presented in this report is intended as an investment recommendation or investment advice. Neither the information nor any opinion expressed constitutes a solicitation to purchase or sell securities or any investment program.

Any investment decisions must in all cases be made by the reader or by his or her investment adviser. Do NOT ever purchase any security without doing sufficient research. There is no guarantee that the investment objectives outlined will actually come to pass. All opinions expressed herein are subject to change without notice. Neither the editor, employees, nor any of their affiliates shall have any liability for any loss sustained by anyone who has relied on the information provided.

Mr. Moenning is an investment adviser representative of Heritage Capital Advisors, LLC dba Heritage Capital Research (HCR), an SEC registered investment advisor.

Mr. Moenning and HCR may at times have positions in the securities referred to and may make purchases or sales of these securities while publications are in circulation. Positions may change at any time.

The analysis provided is based on both technical and fundamental research and is provided "as is" without warranty of any kind, either expressed or implied. Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

The author neither endorses nor warrants the content of this site, any embedded advertisement, or any linked resource. The author or his managed funds may hold either long or short positions in the referenced securities. Republication rights must be expressly granted by author in writing.

Investments in equities carry an inherent element of risk including the potential for significant loss of principal. Past performance is not an indication of future results.