Have The Bears Found Their Raison d'Etre?

Good morning and welcome back to the land of blinking screens. The key to the markets in the early going on this fine Monday morning is the apparent easing of tensions with North Korea. For example, Central Intelligence Agency Director Mike Pompeo said over the weekend he'd seen "no intelligence" to indicate the U.S. was on the cusp of being attacked. National security adviser H. R. McMaster added, "we’re not closer to war than a week ago." As such, some of the "risk off" moves that had been put in play last week are being reviewed and stock futures point to a higher open on Wall Street.

Since it's the start of a new week, let's now focus on our objective review the key market models and indicators and see where things stand. To review, the primary goal of this weekly exercise is to remove any subjective notions one might have in an effort to stay in line with what "is" happening in the markets. So, let's get started.

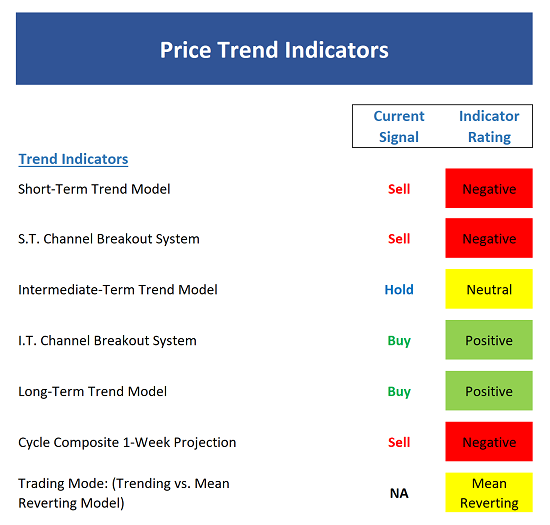

The State of the Trend

We start each week with a look at the "state of the trend." These indicators are designed to give us a feel for the overall health of the current short- and intermediate-term trend models.

View Trend Indicator Board Online

Executive Summary:

- Not surprisingly, the short-term Trend Model flipped to negative last week on the back of geopolitical tensions and a "risk off" move.

- The short-term Channel Breakout System is negative and would require a move over 2491 to turn green.

- The intermediate-term Trend Model has moved to neutral. Almost any decline from here would turn this model negative.

- The intermediate-term Channel Breakout System is designed to "hold" during sloppy/sideways periods and would require a move below 2410 in the next few days to go negative.

- The long-term Trend Model remains positive.

- The Cycle Composite points lower again this week.

- The Trading Mode models say the "trending environment" has ended and that a "mean reverting" mode is here.

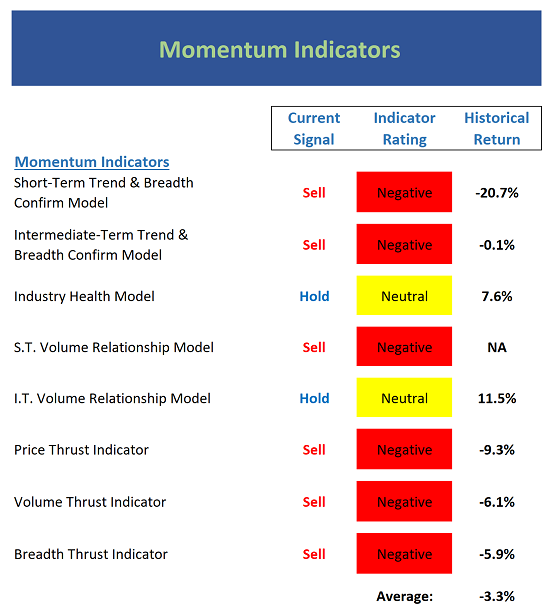

The State of Internal Momentum

Next up are the momentum indicators, which are designed to tell us whether there is any "oomph" behind the current trend...

View Momentum Indicator Board Online

Executive Summary:

- Both the short- and intermediate-term Trend and Breadth Confirm Models turned red last week. As you will recall, breadth had been weak for some time.

- The Industry Health Model is stuck in neutral

- The short-term Volume Relationship is now negative. Recall that while up volume had been above down volume, the up volume line had been declining. Last week, the up volume line crossed below the down volume line, turning the model negative.

- The intermediate-term Volume Relationship slipped to neutral as demand volume is now in a downtrend

- The Price Thrust Indicator flipped to negative last week.

- The Volume Thrust Indicator remains negative to start the week.

- The Breadth Thrust Indicator confirms the negative environment as well.

- The bottom line here is the market's internal momentum was weak before the selling started and is now negative.

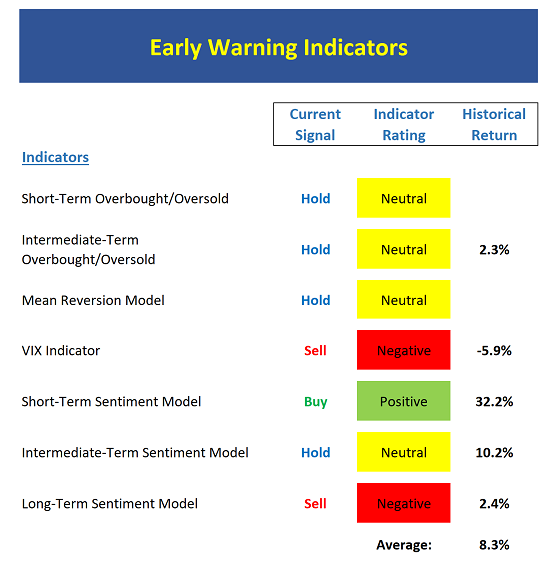

The State of the "Trade"

We also focus each week on the "early warning" board, which is designed to indicate when traders may start to "go the other way" -- for a trade.

View Early Warning Indicator Board Online

Executive Summary:

- From a near-term perspective, stocks are now approaching oversold territory.

- From an intermediate-term view, the overbought condition has been worked off and is now neutral.

- The Mean Reversion Model remains neutral.

- The VIX Indicator has spiked and has thus far, not retreated. A sustained increase would suggest that a prolonged move lower could be at hand.

- From a short-term perspective, market sentiment is now so bad that it's good.

- The intermediate-term Sentiment Model managed to move out of negative territory and is now neutral.

- Longer-term Sentiment readings remain negative.

- In sum, the "get ready to go the other way" indicators are starting to set up in the bulls' favor. They are NOT there yet, but they are moving in the right direction.

The State of the Macro Picture

Now let's move on to the market's "external factors" - the indicators designed to tell us the state of the big-picture market drivers including monetary conditions, the economy, inflation, and valuations.

View External Factors Indicator Board Online

Executive Summary:

- Absolute Monetary conditions remain moderately positive.

- The Relative Monetary Model slipped back into the neutral zone last week.

- Our Economic Model (designed to call the stock market) remains moderately positive and hasn't moved in last few weeks.

- The Inflation Model continues to fall in the neutral zone.

- Our Relative Valuation Model suggests stocks are fairly priced given the level of interest rates.

- The Absolute Valuation Model remains SOLIDLY negative.

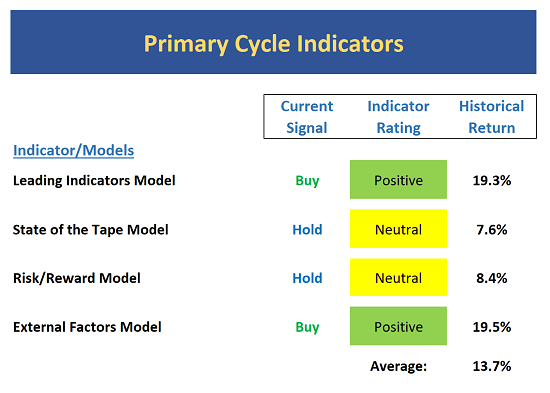

The State of the Big-Picture Market Models

Finally, let's review our favorite big-picture market models, which are designed to tell us which team is in control of the prevailing major trend.

View My Favorite Market Models Online

Executive Summary:

- The Leading Indicators model, which was our best performing timing model during the last cycle, is in good shape.

- The Tape continues to muddle along.

- There is a lot of movement within the components of the Risk/Reward model, but the model itself remains neutral.

- The External Factors model remains in the positive zone, but only by the slimmest of margins.

The Takeaway...

This week saw the market internals weaken considerably in response to the increasing tensions with North Korea. In my opinion, the key takeaway is that market momentum was poor before the price action turned south. This tells me that the table was "set" for the bears if they could find a raison d'etre . The key question at this point is if this decline will reverse quickly - as all declines have recently - or will this become the meaningful pullback that the bears and the historical cycles have been calling for.

Publishing Note: The good news is my office is put together, I have internet, phones, and cable, and I there are only a couple boxes left to explore. The bad news is that completing the moving process may take longer than I anticipated and thus, morning reports may be sporadic this week.

Thought For The Day:

When you get to the end of your rope, tie a knot and hang on. -Franklin D. Roosevelt

Current Market Drivers

We strive to identify the driving forces behind the market action on a daily basis. The thinking is that if we can both identify and understand why stocks are doing what they are doing on a short-term basis; we are not likely to be surprised/blind-sided by a big move. Listed below are what we believe to be the driving forces of the current market (Listed in order of importance).

1. The State of the North Korea situation

2. The State of the Economic/Earnings Growth (Fast enough to justify valuations?)

3. The State of Tax Reform

4. The State of Fed Policy

Wishing you green screens and all the best for a great day,

David D. Moenning

Chief Investment Officer

Sowell Management Services

Disclosure: At the time of publication, Mr. Moenning and/or Sowell Management Services held long positions in the following securities mentioned: none. Note that positions may change at any time.

Disclosures

The opinions and forecasts expressed herein are those of Mr. David Moenning and may not actually come to pass. Mr. Moenning's opinions and viewpoints regarding the future of the markets should not be construed as recommendations. The analysis and information in this report is for informational purposes only. No part of the material presented in this report is intended as an investment recommendation or investment advice. Neither the information nor any opinion expressed constitutes a solicitation to purchase or sell securities or any investment program.

Any investment decisions must in all cases be made by the reader or by his or her investment adviser. Do NOT ever purchase any security without doing sufficient research. There is no guarantee that the investment objectives outlined will actually come to pass. All opinions expressed herein are subject to change without notice. Neither the editor, employees, nor any of their affiliates shall have any liability for any loss sustained by anyone who has relied on the information provided.

The analysis provided is based on both technical and fundamental research and is provided "as is" without warranty of any kind, either expressed or implied. Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

David D. Moenning is an investment adviser representative of Sowell Management Services, a registered investment advisor. For a complete description of investment risks, fees and services, review the firm brochure (ADV Part 2) which is available by contacting Sowell. Sowell is not registered as a broker-dealer.

Employees and affiliates of Sowell may at times have positions in the securities referred to and may make purchases or sales of these securities while publications are in circulation. Positions may change at any time.

Investments in equities carry an inherent element of risk including the potential for significant loss of principal. Past performance is not an indication of future results.

Advisory services are offered through Sowell Management Services.