Market Model Update: 11.15.21

With winter starting to find its way to Colorado, my wife and I decided to head to the desert to enjoy another couple weeks of summer weather. As such, I'm going to let the indicators do the talking this week and next.

So, let's get the week started with a review of the "state of the market" from a model perspective...

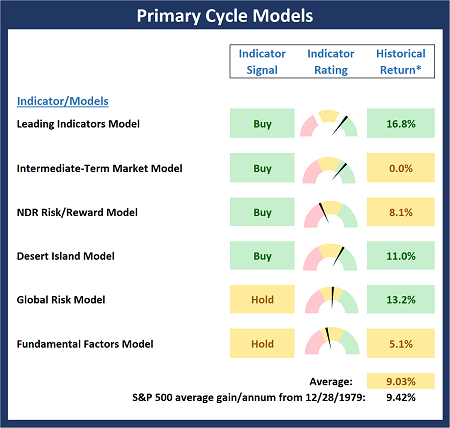

The Big-Picture Market Models

We start with six of our favorite long-term market models. These models are designed to help determine the "state" of the overall market.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

Current Take: Big Picture Models

There is one change to Primary Cycle Board this week as the Fundamental Factors Model moved up into the neutral zone. The overall message from the big-picture market models remains suggest the bulls should continue to receive the benefit of any/all doubt.

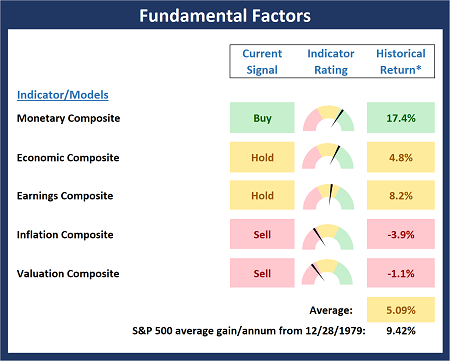

The Fundamental Backdrop

Next, we review the market's fundamental factors including interest rates, the economy, earnings, inflation, and valuations.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

Current Take: Fundamental Models

There was one changes to the Fundamental Board to report this week as the Monetary Composite upticked to positive. However, as I've been saying, the board suggests this is NOT a low-risk environment.

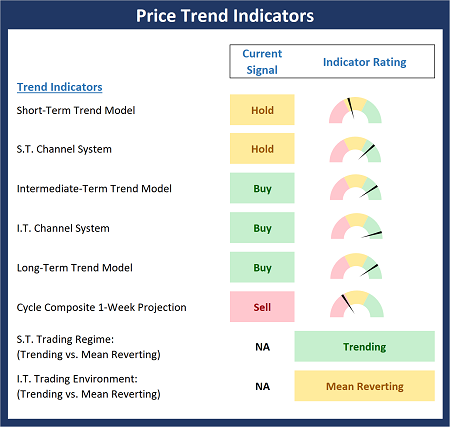

The State of the Trend

After reviewing the big-picture models and the fundamental backdrop, I like to look at the state of the current trend. This board of indicators is designed to tell us about the overall technical health of the market's trend.

Current Take: Trend Models

The Trend Board weakened a bit last week, which was to be expected after an impressive run. But my take is the board suggests the bulls remain in control.

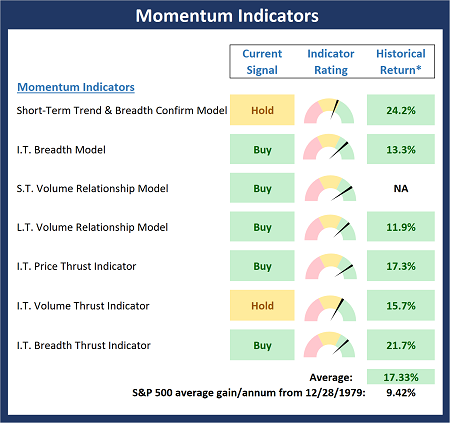

The State of Internal Momentum

Next, we analyze the momentum indicators/models to determine if there is any "oomph" behind the current move.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

Current Take: Momentum Models

Although there was some slippage on Momentum Board this past week, the preponderance of green continues to favor the bulls.

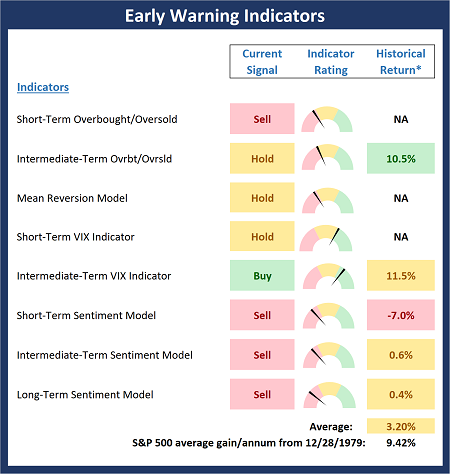

Early Warning Indicators

Finally, we look at our early warning indicators to gauge the potential for countertrend moves. This batch of indicators is designed to suggest when the table is set for the trend to "go the other way."

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

Current Take: Early Warning Models

The Early Warning Board had provided a clear warning to "get ready for a countertrend move." Thus, last week's sloppy action was not a surprise. This week, the board remains in "warning" mode and suggests that some additional downside action is possible.

Thought for the Day:

"Experience can tell you what not to do, but not what to do." --Dr. Vladimir Rockov

Wishing you green screens and all the best for a great day,

David D. Moenning

Founder, Chief Investment Officer

Heritage Capital Research, a Registered Investment Advisor

Disclosures

At the time of publication, Mr. Moenning held long positions in the following securities mentioned: None - Note that positions may change at any time.

NOT INDIVIDUAL INVESTMENT ADVICE. IMPORTANT FURTHER DISCLOSURES