Of Missiles and The Big Miss

Missiles and a big miss on the data front are in focus on this Friday morning - but so far at least stock futures are none the worse for wear.

By now, I am sure you've heard that President Trump ordered a Tomahawk missile strike against an airfield in Syria last night. The strategic strike was in response to the Syria government's use of chemical weapons on Tuesday of this week. The news was condemned as an act of aggression by Russia, which has supported the Syrian government militarily. And while both Syria and Russia contend that there were no chemical weapons involved in the attack, the WSJ is reporting that autopsy results show that sarin gas was the cause of death of three victims.

Stock futures initially sold off on the news of the missile strike but had rebounded early this morning back to around breakeven. However, then the closely watched Nonfarm Payrolls report was released.

The Bureau of Labor Statistics reported this morning that the U.S. economy created just 98,000 new jobs during the month of March, which was about half the number that had been expected (consensus expectation had been for 180,000 new jobs). In addition, the new job totals for both January and February were reduced by a total of 38,000. If the March number holds, the economy will have created 533,000 new jobs in the first quarter of the new administration.

It is worth noting that the Nonfarm Payrolls report pales in comparison to this week's ADP report, which showed that the private sector created 263,000 jobs in March. Some suggest that the weather is to be blamed as the mid-month snowstorm may have impacted the government's count on retail and construction jobs.

The good news is that the official Unemployment Rate fell by 0.2% to 4.5%. This was the lowest level seen since 2007, before financial crisis.

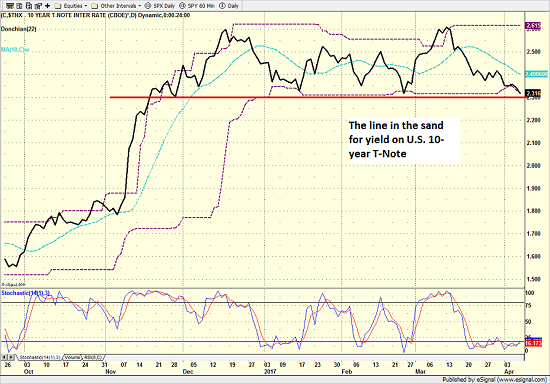

Market reaction has been interesting. Bond yields initially declined in a flight-to-safety move, with the yield on the 10-year trading as low as 2.27% in the pre-market session, which was below the low end of the trading range that has been in effect since late November.

Yield of U.S. 10-Year Treasury - Daily

View Larger Image

However, since the release of the NFP report, yields have rallied a bit and are currently trading at 2.32%. In my humble opinion, this remains an important line in the sand to watch.

On the stock market front, futures declined on word that missiles were flying and initially moved lower after the jobs report. However, just before the opening bell, stocks look like they will open only modestly lower.

In this situation, it is important to remember the old Wall Street saw, which states, it's not the news, but how the market reacts to the news that matters.

Thought For The Day:

There is a difference between involvement and commitment. A chicken is involved in breakfast, the pig is committed.

Current Market Drivers

We strive to identify the driving forces behind the market action on a daily basis. The thinking is that if we can both identify and understand why stocks are doing what they are doing on a short-term basis; we are not likely to be surprised/blind-sided by a big move. Listed below are what we believe to be the driving forces of the current market (Listed in order of importance).

1. The State of the U.S. Economy

2. The State of Trump Administration Policies

3. The State of Global Central Bank Policies

Wishing you green screens and all the best for a great day,

David D. Moenning

Chief Investment Officer

Sowell Management Services

Disclosure: At the time of publication, Mr. Moenning and/or Sowell Management Services held long positions in the following securities mentioned: none. Note that positions may change at any time.

Looking for a "Modern" approach to Asset Allocation and Portfolio Design?

Looking for More on the State of the Markets?

Investment Pros: Looking to modernize your asset allocations, add risk management to client portfolios, or outsource portfolio design? Contact Eric@SowellManagement.com

Disclosures

The opinions and forecasts expressed herein are those of Mr. David Moenning and may not actually come to pass. Mr. Moenning's opinions and viewpoints regarding the future of the markets should not be construed as recommendations. The analysis and information in this report is for informational purposes only. No part of the material presented in this report is intended as an investment recommendation or investment advice. Neither the information nor any opinion expressed constitutes a solicitation to purchase or sell securities or any investment program.

Any investment decisions must in all cases be made by the reader or by his or her investment adviser. Do NOT ever purchase any security without doing sufficient research. There is no guarantee that the investment objectives outlined will actually come to pass. All opinions expressed herein are subject to change without notice. Neither the editor, employees, nor any of their affiliates shall have any liability for any loss sustained by anyone who has relied on the information provided.

The analysis provided is based on both technical and fundamental research and is provided "as is" without warranty of any kind, either expressed or implied. Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

David D. Moenning is an investment adviser representative of Sowell Management Services, a registered investment advisor. For a complete description of investment risks, fees and services, review the firm brochure (ADV Part 2) which is available by contacting Sowell. Sowell is not registered as a broker-dealer.

Employees and affiliates of Sowell may at times have positions in the securities referred to and may make purchases or sales of these securities while publications are in circulation. Positions may change at any time.

Investments in equities carry an inherent element of risk including the potential for significant loss of principal. Past performance is not an indication of future results.

Advisory services are offered through Sowell Management Services.