Recalibrating On The Fly

Well, that was harsh. As of last Tuesday, the market had a pretty good feel to it and a test of the 200-day moving average appeared to be in the works. The following morning, that test occurred right on schedule as the market opened strong.

But then it happened. Jay Powell started talking about declaring war on inflation and even mentioned Paul Volcker's name in the process. To say that the reference to Mr. Volcker's historic rate hikes in the early 1980's spooked the market is an understatement. In short, the S&P 500 turned on a dime and proceeded to move straight down from that moment into Friday's closing bell.

The move was swift and severe as stocks went on a one-directional tear to end of the week. Straight down. No bounces to speak of. A dive of more than 5% from Thursday's early-morning high. Ugh.

Specifically, Powell said that the economy is very strong, that the labor market is extremely tight, and the Central bank is committed to raising rates expeditiously to lower inflation. In an IMF panel discussion, Powell stressed this last part saying, "It is absolutely essential to restore price stability."

The Fed Chair went on to say that a 50-basis point hike will be on the table for the May meeting. Powell essentially blessed a bigger/faster rate hike campaign by saying, "It is appropriate in my view to be moving a little more quickly," and then following it up with, "I also think there is something to be said for front-end loading."

To be fair, Powell's language wasn't anything new or earth shaking as many Fed officials have been talking about 50bp (or higher) hikes at the May and June (and other) meetings. However, I for one, was completely taken aback by Powell's reference to former Fed Chair Paul Volcker.

Any student of history knows that Volcker declared war on inflation in the late 1970's/early 1980's, taking Fed Funds into the stratosphere. And to no one's surprise, he wound up killing the economy in the process. So, when Powell said, "Volcker knew that in order to tame inflation and heal the economy, he had to stay the course," traders sat up and took notice.

From my seat, this is what turned the market mood on a dime. One moment the thinking was that the market had come to grips with the Fed's plans and that the economy would be fine. And the next, we've got visions of Volcker's war on inflation in our heads.

The key point is that the only way to really slow wage inflation and many of the price problems is to, wait for it... slow down demand - I.E. the economy. And up until Thursday morning, the base case for the economy was that returning Fed Funds rate to neutral over the next year or so wasn't likely to hurt the economy too terribly much.

But, as I mentioned a couple weeks back, if the Fed pivots into a war on inflation, well, now we're talking about something completely different. Now we're talking about big rate hikes - and soon. We're talking about rates going well beyond "neutral." We're talking about the Fed not stopping until inflation recedes. And, of course, we're talking about economic slowdown.

Suddenly the odds of a soft landing sank as traders in both the stock and bond market were forced to recalibrate their views and expectations. Suddenly there is more uncertainty, not less. And what do traders do when uncerainty rises? Oh, that's right, they sell.

So, did the Fed chair overstate the case on Thursday morning? Will he walk back some of the statements if stocks keep tanking? Or is Powell & Co. looking to take a "shock and awe" approach to their own war on inflation in the coming months?

While this is just one man's opinion, I'm of the mind that this is the key to the next move in the stock market. A market that suddenly has a very bearish feel to it. A market that is seeing big outflows and very weak technical action.

As we head into the new week, my plan is to watch the price action very carefully as it appears we have a classic "test" of the lows on our hands. As such, how the market acts from here could be very telling.

Now let's review the "state of the market" through the lens of our market models...

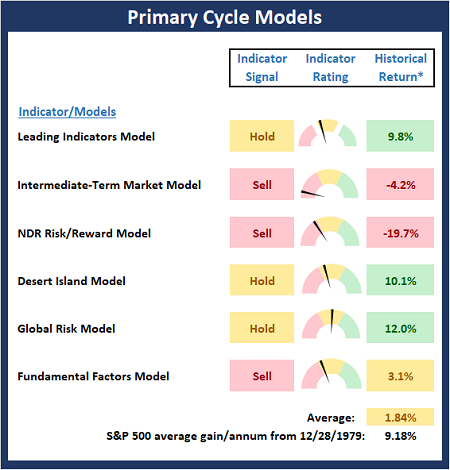

The Big-Picture Market Models

We start with six of our favorite long-term market models. These models are designed to help determine the "state" of the overall market.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

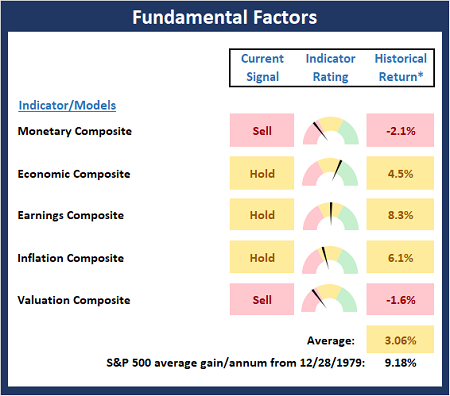

The Fundamental Backdrop

Next, we review the market's fundamental factors including interest rates, the economy, earnings, inflation, and valuations.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

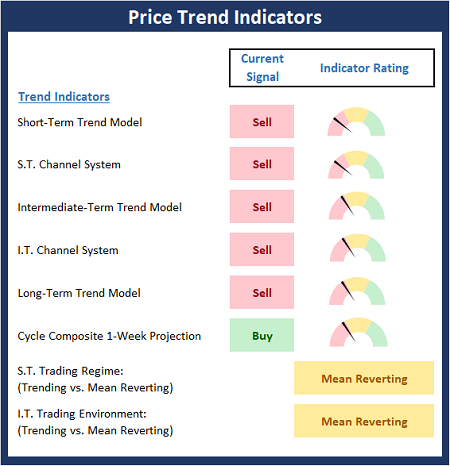

The State of the Trend

After reviewing the big-picture models and the fundamental backdrop, I like to look at the state of the current trend. This board of indicators is designed to tell us about the overall technical health of the market's trend.

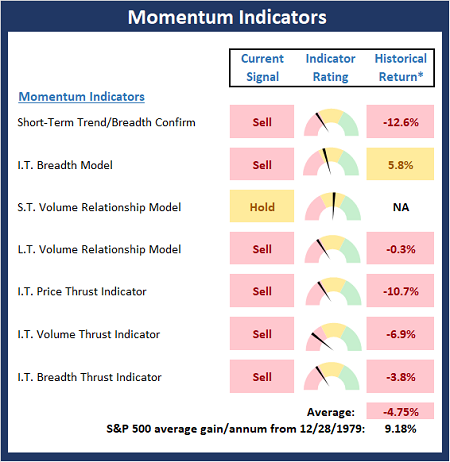

The State of Internal Momentum

Next, we analyze the momentum indicators/models to determine if there is any "oomph" behind the current move.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

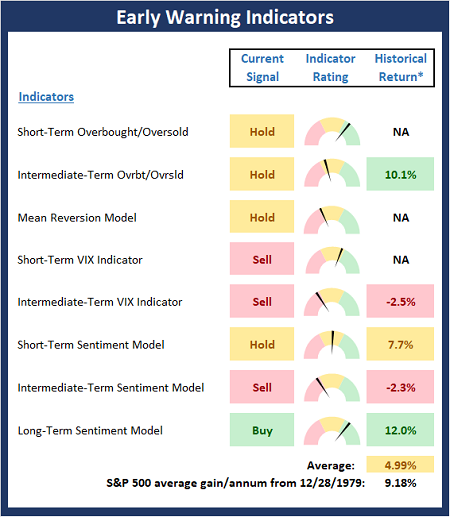

Early Warning Indicators

Finally, we look at our early warning indicators to gauge the potential for countertrend moves. This batch of indicators is designed to suggest when the table is set for the trend to "go the other way."

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

Thought for the Day:

The pessimist complains about the wind; the optimist expects it to change; the realist adjusts the sails. -William Arthur Ward

Wishing you green screens and all the best for a great day,

David D. Moenning

Founder, Chief Investment Officer

Heritage Capital Research, a Registered Investment Advisor

Disclosures

At the time of publication, Mr. Moenning held long positions in the following securities mentioned: None - Note that positions may change at any time.

NOT INDIVIDUAL INVESTMENT ADVICE. IMPORTANT FURTHER DISCLOSURES