Stick With the Bulls

Long-time readers know that I tend to hang with the glass-is-at-least-half-full crowd when it comes to the longer-term market outlook. The reasons are simple. First and foremost, stocks move higher over time. Yes, I recognize that this trend, which has largely persisted since trading began, could end at some point. And if the U.S. democracy or our capitalistic economic system were to change, I might need to adjust my thinking. But for now, more than 40 years of experience in Ms. Market's game reminds me that it usually pays to give the bulls the benefit of the doubt - the vast majority of the time.

Sure, bear markets happen. Crises occur, which cause the economy, and in turn, earnings to falter. In addition, Wall Street has a long history of overdoing just about everything, which leads to the occasional painful reset.

Such periods are not fun by any means. However, these periods of discomfort also tend to be relatively short-lived - especially if you look at things from a longer-term point of view.

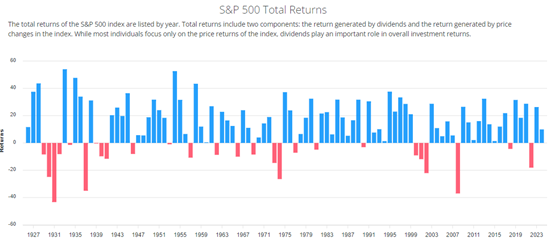

My point can be made fairly clearly below. The chart shows the calendar year returns for the S&P 500 going back to the inception of the index. The blue bars represent gains. And as you'd expect, the red bars are calendar year declines.

Source: Slickcharts.com

View Full Size Chart

When looking at this chart, my first takeaway is the vast majority of the bars are blue. This means that the S&P ends most years with a positive return. The next important thing to note is there are very few consecutive red bar streaks. And the longest stretch of red years was in the Great Depression. In modern times, the longest losing streak was three years - seen after the tech bubble burst.

Other than that, you have a red year here and there. But again, from a big-picture perspective, I think it is important to keep in mind that most years tend to end with gains in the stock market.

Now let's turn to the current market market environment and an important reason to stay seated on the bull train from a shorter-term perspective.

History Favors the Bulls Right Now

To be sure, there are lots of things for the bears to fret about here. Inflation staying sticky. The wars. Politics. High valuations. Overzealous sentiment. The Fed, etc.

Another thing the bears have been crowing about lately is how far the market has run since last fall's correction ended. The impressive rally that ensued has produced four straight monthly gains and created overbought conditions. And with sentiment getting at least a little frothy here, our furry friends suggest that a pullback is overdue.

To be fair, I don't disagree on the last point. Pullbacks, corrections, and/or what I like to call "sloppy periods" can/do occur on a fairly regular basis. And in today's markets, they can happen for all kinds of reasons (or no reason at all at times).

But, with the caveat that stocks can pull back 3-5% for almost any reason, at any time, the history of rallies like the one we're enjoying now suggest we push aside the near-term worries and lean bullish.

The Data is Convincing

Here's the deal. The computers at Ned Davis Research tell us that in the history of S&P 500, the index has rallied from November through February 16 times. Three months later, the S&P has been higher than where it closed at the end of February 87.5% of the time, by an average of 4.9% (which is double the 2% average seen for all periods). In modern times - since 1960 - stocks have been lower three months after a Nov-Feb rally only once, in 2004.

Six months later, the S&P has been higher 93.8% of the time, sporting a mean return of 6.4%. Ten months later - as in the rest of a calendar year - the market has been higher, wait for it... every single time. Ditto for the twelve months following a Nov-Feb rally... higher every single time.

The average gain for the rest of a calendar year following the Nov-Feb rally has been 15.5%, which is more than double the 6.8% return for all March through December periods. Same idea for twelve months out, as the average gain has been 18.1% compared to the 8.2% seen for all March - February periods. Not bad. Not bad at all.

So... If you can find a way to look past the next few months, which are likely to contain at least some sort of scary pullback, correction, or sloppy period, one can rest easy in the knowledge that stocks have strong odds of being higher in the coming 3-, 6-, and 12-month time frames.

Works for me.

Thought for the Day:

Let him that would move the world first move himself. -Socrates

Wishing you green screens and all the best for a great day,

David D. Moenning

Founder, Chief Investment Officer

Heritage Capital Research, a Registered Investment Advisor

At the time of publication, Mr. Moenning held long positions in the following securities mentioned: None - Note that positions may change at any time.

NOT INDIVIDUAL INVESTMENT ADVICE. IMPORTANT FURTHER DISCLOSURES