Sticking To The Script?

Good morning and Happy Friday. After enjoying a strong run higher from mid-March through the end of July, the bulls then took a much deserved and highly anticipated break. And in following the seasonal script, the major indices proceeded to pull back in August. Although it wasn't fun, the decline was definitely to be expected.

It is important to remember that in Ms. Market's game, the indices rarely move in a straight line. No, even the most ardent bulls know that a two-steps-forward and then one-step-back pattern is just fine, thank you. To be sure, the "one step back" phases are never fun and generally find a way to scare the living bejeebers out of you.

But anyone who has been around the game as long as I have knows that this is just the way it goes. During an inevitable pullback, it is VERY likely that your perhaps overexuberant/overconfident thesis will be tested. It's NOT fun as you watch your BIG winners pull back, oftentimes violently. Your stomach starts to cramp as you check the charts. That nice round number your account value recently breached now seems like mile away. You begin to wonder if you've missed something. And just like that, the game is hard again.

The good news is that unless the bears are firmly in control at the corner of Broad and Wall, these annoying pullback phases eventually run their course. Oftentimes like clockwork.

Like Clockwork

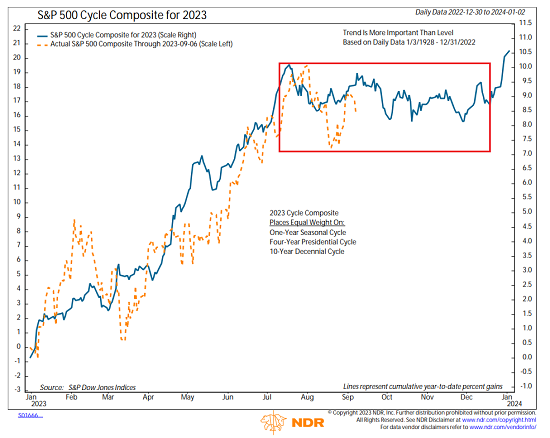

Below is the NDR Cycle Composite (CC) for 2023, which has been a pretty darn good guide for what to expect next in the stock market this year. I've shown this a time or twenty over the years, but I continue to be impressed at how often a mashup of historical cycles is able to predict (yes, in advance) what the "trend" of the market could look like going forward.

In case you need a refresher, the CC combines all the 1-year seasonal cycles, all the 4-year Presidential Cycles, and all the 10-year decennial cycles going back to early 1900. The computer crunches the numbers and produces a composite of the cycles for the year. Again, in advance.

As I've mentioned almost every time we've reviewed this work, when the stock market is in sync with its historical cycles, the CC is often a good (as in, scary good) guide as to what is going to happen next. Sure, at times, the market is driven by unique influences (think COVID) and does something completely different than history suggested. But this year, the CC has been a VERY good guide to the intermediate-term trends in the market.

As the chart below illustrates, the S&P rallied nicely into July, just as predicted. Then it pulled back in August, right on cue, of course. And although the market fell a bit more than the CC had called for, it then rallied off the August 18th low - again, eerily close to where/when the historical script said it would. Nice.

View Larger Chart

Copyright Ned Davis Research Group, All Rights Reserved

After the called for sigh-of-relief rally, which was aided by some stunning earnings results in the AI space (see the NVDA report as the poster child here), the stock market turned defensive this week - again, just as the CC had projected.

This time, the bears are fretting about (a) a backup in rates, (b) the recent strength in the US dollar, (c) the fear of more rate hikes, (d) a spike in oil prices, and most recently, (e) China's ban on iPhones for government employees.

Yes, it is indeed unnerving to watch our beloved AAPL fall 7% in two days as the bears contend that it's all downhill from here for the world's biggest company. But as I've mentioned, pullbacks aren't fun. And it appears we've got another predicted pullback on our hands. C'est la vie.

So, instead of getting emotional and freaking out, my plan is to stick with the big picture here. While the game can indeed change at a moment's notice, for me, the keys to focus on here are as follows:

- It's a bull market

- We're in the midst of a consolidation phase within that bull market

- The market is currently in sync with its historical cycles

- The cycles suggest now is the time to have some patience

Don't look now fans, but those very same cycles call for more sideways, back and forth, up and down movement until somewhere around Thanksgiving. I can live with that.

The Macro Backdrop Hasn't Changed

Then there is the macro backdrop. I've learned that it's easier to sit through a pullback when your thesis remains constructive. So, it's at times like these when it is important to keep the macro view in mind.

From my perch, the macro backdrop currently includes some pretty positive stuff such as: falling inflation, an end to the Fed's rate hiking campaign, a strong labor market, consumer resiliency, and a solid earnings picture (more on that next week). What's not to like, right?

So, unless/until something changes from a big picture perspective, my plan is to stay seated on the bull train and treat these unpleasant pullbacks as opportunities to put money to work.

Thought for the Day:

The most important thing in communication is to hear what isn't being said. -Peter Drucker

Wishing you green screens and all the best for a great day,

David D. Moenning

Founder, Chief Investment Officer

Heritage Capital Research, a Registered Investment Advisor

Disclosures

At the time of publication, Mr. Moenning held long positions in the following securities mentioned: NVDA, AAPL - Note that positions may change at any time.

NOT INDIVIDUAL INVESTMENT ADVICE. IMPORTANT FURTHER DISCLOSURES