The Bears Tell Us...

One of the big questions at this point in the game is, can stocks really go higher from here? After all, the S&P 500 is up 10% from the pre-election low and the NASDAQ Composite has added 12.6% since November 4th. So, with stocks having run a long way in a short period of time, isn't a pullback the next order of business for Ms. Market?

Our furry friends in the bear camp certainly think so as they have a growing laundry list of reasons why the market should start heading south. Stocks are overbought, we're told. Sentiment has become overly optimistic. The Fed will be pushing rates higher. Inflation is rising. The strengthening dollar puts pressure on earnings. Trump's protectionist policies will hurt the economy. A trade war could be waiting in the wings. Valuations are high. And all the goodies the Trump administration is promising are going to take time to deliver.

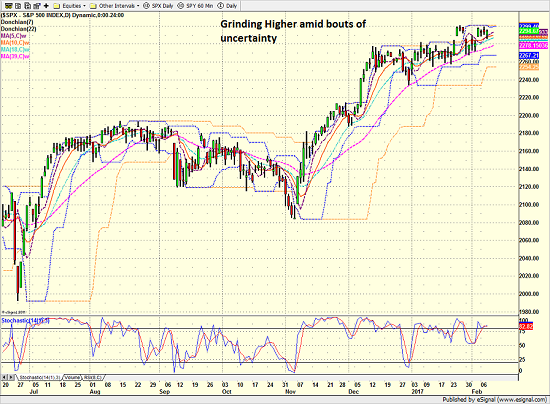

So, while we wait for tax reform to put more cash in consumers' pockets and corporate America's coffers, reduced regulation to make it easier to do business, and a stimulus plan to build all kinds of good stuff, what is the market to do? So far at least, it looks like the answer is simple - grind higher in a slow, frustrating fashion.

S&P 500 - Daily

View Larger Image

Of course, we must understand that one of the bouts of uncertainty the market experiences from time to time could easily give the bears an edge for a few days/weeks. IMO, the action seen between September and early November last year would be an example of what this might look like.

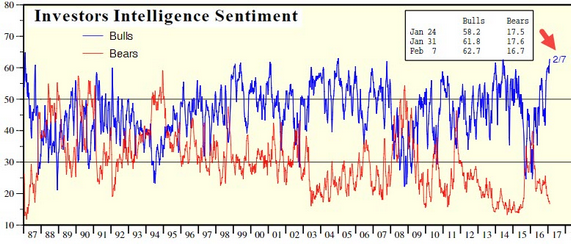

And to be sure, the bears have the table "set" for things to go their way at some point. One example of this situation can be seen in the sentiment data. According to Investors Intelligence, the number of investors claiming to be bullish is now above the highs seen in October of 2007. Uh oh.

Source WSJ.com

If one studies this chart in detail, you will note that when the percentage of Bulls exceeds 60%, stocks tend to stumble - sometimes hard. As such, this week's reading of 62.7 may give some investors reason for pause.

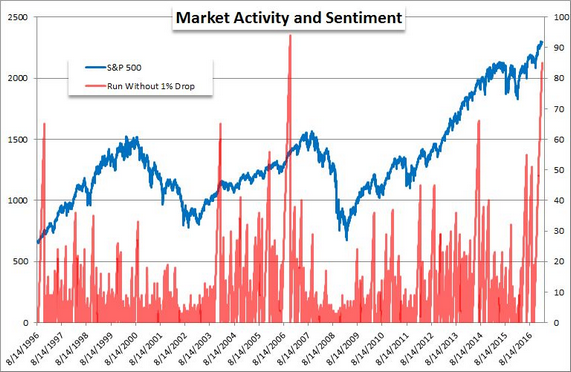

Another bear argument is that investors have become overly complacent. The WSJ reports that we've now gone 85 consecutive days without the S&P experiencing a 1% decline on a daily basis. And the last time this occurred was in 2006. Super.

Source WSJ.com

So there you have it; a myriad of reasons to worry about the stock market. And doesn't this mean that the party will soon end and that investors should be proactively cautious?

Not Exactly

My response to the question posed above is, "not exactly." You see, just because a market is "set up" to for something doesn't mean the anticipated action will actually happen - especially in the time frame expected and when everyone is looking for the same thing. Remember, once the bull train starts to roll down the tracks, it usually takes something significant to slow it down.

So, unless/until something comes out of the woodwork to spook investors in a meaningful way, the grind higher could easily continue - for a long period of time. I've seen this type of situation play out many, many times over the years. The bears tell us stocks can't go higher and yet they do. Hence the phrase, "the market can stay irrational longer than you can stay solvent."

Lest we forget, the global QE game is still going as the ECB and the BOJ are both printing money at an impressive rate. And if there is anything we've learned since the QE era began, it is that an awful lot of the capital created by central bankers tends to wind up in the U.S. stock and bond markets.

My feeling is that until the QE game ends across the pond, pullbacks and/or corrections in the U.S. stock market are likely to be short and shallow. And yes, unless a fundamental problem develops, this means that a "buy the dips" strategy remains appropriate for longer-term players.

To be clear, this does NOT mean that we won't see a stiff correction in the stock market in the near future. But from a big-picture standpoint, it is important to keep your overall strategy in mind instead of succumbing to emotions when things start to get ugly.

Thought For The Day:

We are all lying in the gutter, but some of us are looking at the stars. - Oscar Wilde

Current Market Drivers

We strive to identify the driving forces behind the market action on a daily basis. The thinking is that if we can both identify and understand why stocks are doing what they are doing on a short-term basis; we are not likely to be surprised/blind-sided by a big move. Listed below are what we believe to be the driving forces of the current market (Listed in order of importance).

1. The State of Trump Administration Policies

2. The State of the U.S. Economy

3. The State of Global Central Bank Policies

Wishing you green screens and all the best for a great day,

David D. Moenning

Chief Investment Officer

Sowell Management Services

Disclosure: At the time of publication, Mr. Moenning and/or Sowell Management Services held long positions in the following securities mentioned: none. Note that positions may change at any time.

Looking for a "Modern" approach to Asset Allocation and Portfolio Design?

Looking for More on the State of the Markets?

Investment Pros: Looking to modernize your asset allocations, add risk management to client portfolios, or outsource portfolio design? Contact Eric@SowellManagement.com

Disclosures

The opinions and forecasts expressed herein are those of Mr. David Moenning and may not actually come to pass. Mr. Moenning's opinions and viewpoints regarding the future of the markets should not be construed as recommendations. The analysis and information in this report is for informational purposes only. No part of the material presented in this report is intended as an investment recommendation or investment advice. Neither the information nor any opinion expressed constitutes a solicitation to purchase or sell securities or any investment program.

Any investment decisions must in all cases be made by the reader or by his or her investment adviser. Do NOT ever purchase any security without doing sufficient research. There is no guarantee that the investment objectives outlined will actually come to pass. All opinions expressed herein are subject to change without notice. Neither the editor, employees, nor any of their affiliates shall have any liability for any loss sustained by anyone who has relied on the information provided.

The analysis provided is based on both technical and fundamental research and is provided "as is" without warranty of any kind, either expressed or implied. Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

David D. Moenning is an investment adviser representative of Sowell Management Services, a registered investment advisor. For a complete description of investment risks, fees and services, review the firm brochure (ADV Part 2) which is available by contacting Sowell. Sowell is not registered as a broker-dealer.

Employees and affiliates of Sowell may at times have positions in the securities referred to and may make purchases or sales of these securities while publications are in circulation. Positions may change at any time.

Investments in equities carry an inherent element of risk including the potential for significant loss of principal. Past performance is not an indication of future results.

Advisory services are offered through Sowell Management Services.