The Bond Market Is Doing What?

To hear former PIMCO Bond King Bill Gross tell it, bonds have reversed a 35-year bullish trend and have now entered a bear market. This massive bear will purportedly last many years and wipe out tens of trillions of investor capital in the process.

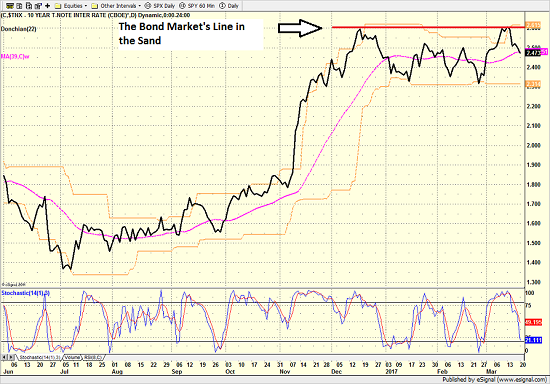

The trigger to Mr. Gross's assertions is the 2.6% level on the yield of the U.S. 10-Year T-Note. This is the line in the sand that separates bull from bear and good times from bad for bondholders.

So, with the 10-Year first moving to and then above the 2.6% level in front of last week's meeting of Janet Yellen and her merry band of central bankers, one might have expected the bond market to be downright u-g-l-y by now. After all, Yellen did raise interest rates a couple months ahead of expectations, talked about how well the economy was doing, and noted that inflation will soon be at or above the FOMC's target.

To the investing public, this probably sounds like a recipe for disaster in the bond market. A stronger economy, rising inflation, and the Fed hiking rates would appear to be a triple threat for bond prices to fall. And with yields having nearly doubled since last summer's all-time low (yes, the 1.367% closing yield seen on July 5, 2016 was an ALL-TIME low), Mr. Gross's call for a downhill slide in bond prices would seem to make sense.

A Funny Thing Happened on the Way to the Debacle

But a funny thing happened on the way to the bond debacle last week. Instead of yields shooting higher after breaking through the 2.6% line in the sand (the yield on the 10-year closed at 2.615% on March 13) in front of the Fed meeting, yields have actually pulled back from the moment Ms. Yellen stepped to the microphone. In fact, the 10-Year closed yesterday at 2.493%, which is below the "psychologically important" 2.5% level.

10-Year T-Note Yield - Daily

View Larger Image

How can this be, you ask? How can bond prices be rising when the perfect storm is obviously on the horizon? Didn't Yellen say that the rate hikes were going to continue for the next 2+ years? Isn't this what the bond bears have been calling for? What is going on here?

This, dear readers, is why trying to invest based on a "macro call" can be so difficult. In short, if you were expecting the Fed to trigger the massive bond bear that so many have been calling for, you are probably frustrated right about now. In short, bond prices are moving in the exact opposite direction from what might have been expected. Oops.

The key here is to understand that the bond market is not nearly as complex or as "emotional" as the stock market. There are no earning to deal with. No new products or rumors about sales, profit margins or the like. No, the government bond market is a VERY different animal where the only real issue is the purchasing power of the future stream of cash flows produced by the bonds.

And the bottom line is that bond investors believe that Yellen & Co. is going to be able to keep inflation in check. Believe it or not, by raising rates in March instead of waiting until May, the Fed scored some "inflation fighting" points from bond players last week. As such, yields have actually declined when most expected them to rise.

Another key here is that we may have already seen the "adjustment" needed in yields based on the expectations of better days ahead in the economy. In other words, the bond market has already "discounted" or "priced in" higher economic growth rates and inflation around 2% - this is what the double in yields since last July has been about.

And this is why new "Bond King" Jeffrey Gundlach has been calling for a near-term rally in bond prices - because the expectations for the future have already been baked into the market.

There is also the fact that Trump's big economic plans are going to take a fair amount of time to get implemented. For example, the GOP has decided to wipe out Obamacare BEFORE dealing with tax reform or stimulus spending. And based on the political calendar, it could be 2018 before tax cuts materialize and even longer before the infrastructure spending plans can get off the ground - if they get off the ground at all.

Therefore, folks like Gundlach can argue that the recent move in 10-Year yields from 1.367% to 2.615% looks to be "enough" for now.

So, unless/until bond investors get a whiff of inflation moving above and beyond the 2% target for a sustained period of time and/or economic growth surpassing expectations, that big bad bond bear may have to wait. Well, for now at least, anyway.

Thought For The Day:

"To be yourself in a world that is constantly trying to make you something else is the greatest accomplishment." -Ralph Waldo Emerson

Current Market Drivers

We strive to identify the driving forces behind the market action on a daily basis. The thinking is that if we can both identify and understand why stocks are doing what they are doing on a short-term basis; we are not likely to be surprised/blind-sided by a big move. Listed below are what we believe to be the driving forces of the current market (Listed in order of importance).

1. The State of the U.S. Economy

2. The State of Trump Administration Policies

3. The State of the Fed's Next Move

4. The State of Global Central Bank Policies (Think ECB pulling back on QE)

Wishing you green screens and all the best for a great day,

David D. Moenning

Chief Investment Officer

Sowell Management Services

Disclosure: At the time of publication, Mr. Moenning and/or Sowell Management Services held long positions in the following securities mentioned: none. Note that positions may change at any time.

Looking for a "Modern" approach to Asset Allocation and Portfolio Design?

Looking for More on the State of the Markets?

Investment Pros: Looking to modernize your asset allocations, add risk management to client portfolios, or outsource portfolio design? Contact Eric@SowellManagement.com

Disclosures

The opinions and forecasts expressed herein are those of Mr. David Moenning and may not actually come to pass. Mr. Moenning's opinions and viewpoints regarding the future of the markets should not be construed as recommendations. The analysis and information in this report is for informational purposes only. No part of the material presented in this report is intended as an investment recommendation or investment advice. Neither the information nor any opinion expressed constitutes a solicitation to purchase or sell securities or any investment program.

Any investment decisions must in all cases be made by the reader or by his or her investment adviser. Do NOT ever purchase any security without doing sufficient research. There is no guarantee that the investment objectives outlined will actually come to pass. All opinions expressed herein are subject to change without notice. Neither the editor, employees, nor any of their affiliates shall have any liability for any loss sustained by anyone who has relied on the information provided.

The analysis provided is based on both technical and fundamental research and is provided "as is" without warranty of any kind, either expressed or implied. Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

David D. Moenning is an investment adviser representative of Sowell Management Services, a registered investment advisor. For a complete description of investment risks, fees and services, review the firm brochure (ADV Part 2) which is available by contacting Sowell. Sowell is not registered as a broker-dealer.

Employees and affiliates of Sowell may at times have positions in the securities referred to and may make purchases or sales of these securities while publications are in circulation. Positions may change at any time.

Investments in equities carry an inherent element of risk including the potential for significant loss of principal. Past performance is not an indication of future results.

Advisory services are offered through Sowell Management Services.