The Current Pattern On Wall Street Is Clear. So...

Once again, the headlines blared something along the lines of "Stock Market Closes at Another New High." However, for the second session in a row - and technically the second consecutive new all-time high for the S&P 500 - one needed a microscope to see the record close on the chart (the S&P advanced a whopping 0.09 points - or 0.00% - yesterday). So, call me cynical if you must, but I'm going to opine that the stock market remains in a consolidation phase, awaiting a catalyst (or at least some sort of a reason) to move higher from here.

Yes, I aware of the fact that the NASDAQ Composite is in a clear uptrend and the chart looks great. And frankly, this gives me hope that the rest of the market will follow the lead of the FANGs and eventually join in the new-high fun. But if one looks at the charts of the rest of the major stock market indices, the message is the same as the S&P, Dow, Midcaps, and Smallcaps are all going nowhere fast.

The bears contend that the divergence between the tech-heavy NASDAQ and the rest of the market is a harbinger of bad things to come. Our furry friends argue that the bull is growing old and starting to look a bit saggy, leadership has narrowed dramatically, there have been no "thrust" signals from the most recent advance, the France news didn't get it done, earnings season is winding down, the Fed is going to raise rates next month (triggering the old "three steps and a stumble" rule), oil is a problem again, investors are complacent (the VIX closed yesterday at the lowest level since 1993), tax reform is going to be delayed, the "hard" economic data has been weak, and valuations remain a problem. In sum, those seeing the market's glass as at least half-empty contend that stocks have nowhere to go but down.

On the other side of the court, though, the message remains a bit more upbeat. The bulls continue to argue that the economy is stronger than the data suggests, earnings are going in the right direction, the jobs market has recovered from the Great Recession, housing is back, and that Trump's policies will ensure the future remains bright from an economic/earnings standpoint.

With both teams having seemingly good arguments, the result is, yep, you guessed it; a sideways market.

Is Sideways the New Down?

While the reasons can be argued, I have contended for some time now that bouts of sideways consolidation after a rally has replaced the "two steps forward and one step back" maxim - well, at least during the current cyclical bull market, anyway.

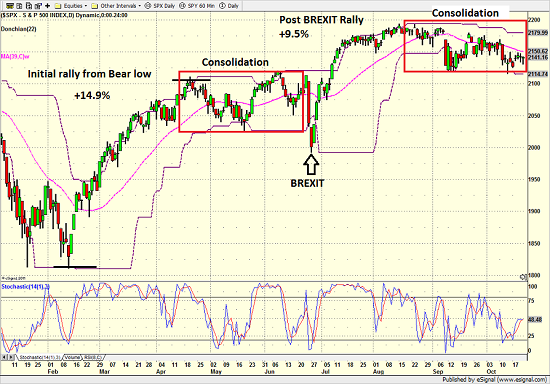

Take a look at the chart below. This is the S&P 500 daily from January through October 2016.

S&P 500 - Daily (Jan - Oct 2016)

View Larger Image

Note that the initial rally from February 11, 2016 through April 20, 2016 gained about 15% in two months. And from there, a period of sideways action - aka a consolidation phase - set in.

In my opinion, this sloppy period acted as a digestive phase after a big advance and was followed by the "freakout" over the BREXIT vote.

From the BREXIT low, the S&P proceeded to tack on 9.5% in less than a month before entering another period of sideways consolidation.

Next up, there was the pre-election jitters as Mr. Comey's headlines caused traders to fret about the outcome of the election (in both directions).

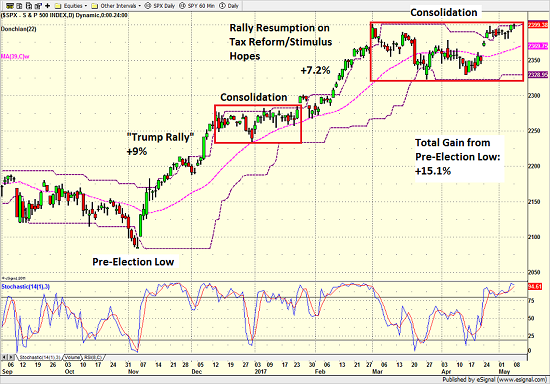

The chart below shows what has happened since that pre-election low...

S&P 500 - Daily (Sep 2016 - May 8, 2017)

View Larger Image

From the pre-election low, stocks jumped about 9% before... wait for it... another period of consolidation set in. By now, you all know the reasons why the "Trump Trade" stalled as investors worried that tax reform and stimulus might be held up by all the political wrangling over healthcare. Oh, and the "hard economic" data started to kinda stink up the joint (Q1 GDP, for example).

But after the initial failure of "repeal and replace," the White House made it clear that tax reform was its next priority. Included in the administration's initial tax plan was the opportunity to repatriate a gazillion dollars or so back to the U.S., some of which, it is assumed, will get spent on growth here at home. And of course, this creates the hope that the current economic assumptions are too low. As a result, stocks started to discount this hope with another rally of 7%.

So, what came next, you ask? What did stocks do after a 9% rally, a pause, and another 7% advance? Enter another period of sideways consolidation, that's what. Anybody besides me starting to see a pattern here?

Where To From Here?

The natural question is, what should we expect to see from here? Assuming the recent pattern holds, my guess is that something will come out of the woodwork that will allow traders to discount greener pastures ahead. This, of course, would be followed by a period of, well, you get the idea.

However, the funny thing about patterns on Wall Street is they eventually come to an end. In my experience, this occurs when there is a change in the market narrative. So, given (a) the age of the current bull, (b) the fact that my major market models are not in their happy places right now, and (c) our cycle composite is calling for a meaningful decline later this summer, I'm currently pondering what might cause the current "hope narrative" to change.

Although my crystal ball is in the shop again for repairs, I will opine that a potential combination of (1) the Fed making an additional move (and potentially becoming hostile to the market in the process) and (2) the ECB announcing an end to its QE program, might just turn hope into worry.

But before you run out and load up on put options and inverse ETFs, please understand that I don't see a "mini bear" putting the current secular bull in the ground. As such, I will contend that any meaningful dips (such as the type of cyclical bear that occurred from August 2015 - February 2016) would represent a long-term buying opportunity.

Thought For The Day:

Great things don't emanate from the comfort zone...

Current Market Drivers

We strive to identify the driving forces behind the market action on a daily basis. The thinking is that if we can both identify and understand why stocks are doing what they are doing on a short-term basis; we are not likely to be surprised/blind-sided by a big move. Listed below are what we believe to be the driving forces of the current market (Listed in order of importance).

1. The State of Trump Administration Policies

2. The State of the U.S. Economy

3. The State of Earning Season

4. The State of World Politics

Wishing you green screens and all the best for a great day,

David D. Moenning

Chief Investment Officer

Sowell Management Services

Disclosure: At the time of publication, Mr. Moenning and/or Sowell Management Services held long positions in the following securities mentioned: none. Note that positions may change at any time.

Looking for a "Modern" approach to Asset Allocation and Portfolio Design?

Looking for More on the State of the Markets?

Disclosures

The opinions and forecasts expressed herein are those of Mr. David Moenning and may not actually come to pass. Mr. Moenning's opinions and viewpoints regarding the future of the markets should not be construed as recommendations. The analysis and information in this report is for informational purposes only. No part of the material presented in this report is intended as an investment recommendation or investment advice. Neither the information nor any opinion expressed constitutes a solicitation to purchase or sell securities or any investment program.

Any investment decisions must in all cases be made by the reader or by his or her investment adviser. Do NOT ever purchase any security without doing sufficient research. There is no guarantee that the investment objectives outlined will actually come to pass. All opinions expressed herein are subject to change without notice. Neither the editor, employees, nor any of their affiliates shall have any liability for any loss sustained by anyone who has relied on the information provided.

The analysis provided is based on both technical and fundamental research and is provided "as is" without warranty of any kind, either expressed or implied. Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

David D. Moenning is an investment adviser representative of Sowell Management Services, a registered investment advisor. For a complete description of investment risks, fees and services, review the firm brochure (ADV Part 2) which is available by contacting Sowell. Sowell is not registered as a broker-dealer.

Employees and affiliates of Sowell may at times have positions in the securities referred to and may make purchases or sales of these securities while publications are in circulation. Positions may change at any time.

Investments in equities carry an inherent element of risk including the potential for significant loss of principal. Past performance is not an indication of future results.

Advisory services are offered through Sowell Management Services.