The Long Road Narrative

The State of the Market

I know what you're thinking. If the stock market is looking ahead to better days, why are the stocks falling this morning?

From my seat, there appear to be three driving forces on this fine Tuesday morning. First, and perhaps most important, is the report on retail sales. But before we dive into the numbers, it is important to remember that consumers account for something like 70% of all economic activity in the United States. And with the all-important holiday shopping season coming fast, how the consumer is feeling about spending money these days is an important input to the market outlook equation.

While I won't bore you with too many data points, the Commerce Department reported this morning that retail sales rose by 0.3% in October and the numbers for September were revised lower to 1.6%. There are a couple key points here. First, the October number was below the consensus estimate of 0.5%. So, we can put that in the "miss" or disappointing column. Next, September was revised lower by 0.3% (from 1.9%), which, when combined with the October reading, means that retail sales have flat-lined recently. And the bottom line is this is not a desired result heading into the holiday shopping period.

It looks like the breathtaking, scary, exponential spike in coronavirus cases, hospitalizations, and deaths is weighing on the consumer's collective psyche. Now factor in the concern about additional lockdowns and layoffs, and well, Mr. and Mrs. John Q. Public can't be blamed for being a little cautious here.

I will argue that the next driver to today's action is profit taking from the explosive rotation trade. Make no mistake about it; I abhor the "profit taking" excuse the media tends to lazily apply whenever stocks are lower. But I think the idea of taking some profits after an impressive surge in the smallcaps/cyclicals/value trade makes some sense. Especially when you consider that algos tend to overdue just about everything on an intraday basis. So, with reports showing that value has outperformed growth by a record margin lately, it's not surprising that the fast-money types might want to cash in some chips here.

And finally, there is what I'll call "The Long Road" narrative. To be sure, the Pfizer/BioNTech and Moderna news is wonderful and should give us all hope for the future. However, getting enough of the world's population vaccinated with a vaccine that must be (a) stored at incredibly low temperatures and (b) administered twice to every person, is likely to prove challenging from a logistical standpoint. Especially when a disturbing percentage of Americans object vehemently to even wearing a darn mask!

So, I will opine that the "recovery trade" is unlikely to move in a straight line. Yes, I'd LOVE to be wrong here as nothing makes me happier than a runaway bull train. But... My guess is this theme will be second-guessed from time to time and as such, the road back to "normal" is likely to be more than a little bumpy.

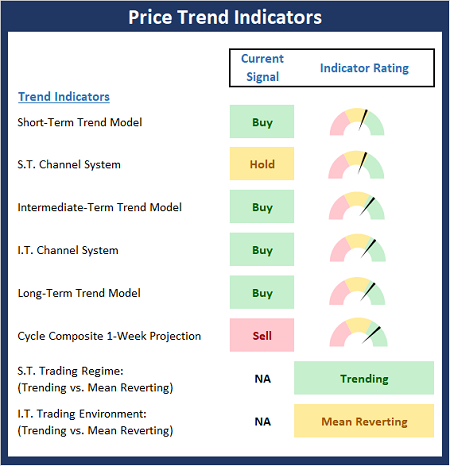

The State of the Trend Indicators

It is said that sometimes less is more. So, let me simply say that the Trend Board is in pretty good shape here. Advantage Bulls.

About The Trend Board Indicators: The models/indicators on the Trend Board are designed to determine the overall technical health of the current stock market trend in terms of the short- and intermediate-term time frames.

My Take on the State of the Charts...

Last time, I opined that the real key to the chart action would be the move either above or below the bounds of the recent trading range. And a breakout of that range is exactly what the bulls appear to be attempting at the present time. If the our Heroes in Horns can keep prices above the old highs for a few days, then technicians tell us the next move is likely higher. However, if the bulls can't hold the line, then the dreaded "breakout fake-out" is a likely outcome - and another trip through the range would be on the table.

S&P 500 - Daily

View Full Size Chart

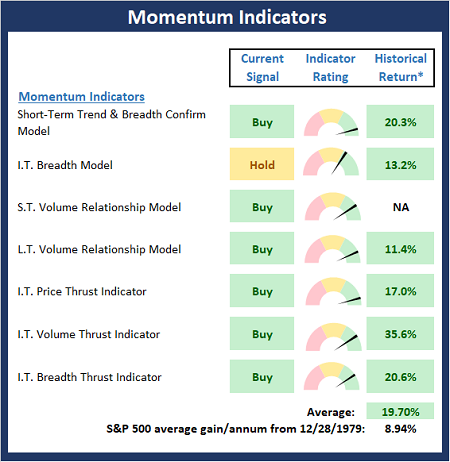

Next, let's check in on the state of the market's internal momentum indicators.

In keeping with the less-is-more theme, the Momentum board also remains in good shape. Advantage Bulls.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

Thought For The Day:

You can never cross the ocean until you have the courage to lose sight of the shore. -Christopher Columbus

Wishing you green screens and all the best for a great day,

David D. Moenning

Founder, Chief Investment Officer

Heritage Capital Research, an SEC Registered Investment Advisor

Disclosures

At the time of publication, Mr. Moenning held long positions in the following securities mentioned: none - Note that positions may change at any time.

NOT INDIVIDUAL INVESTMENT ADVICE. IMPORTANT FURTHER DISCLOSURES