The Question Of The Day Is...

The question of the day is simple. Are investors dealing with another banking crisis, which poses what is called "systemic" risk (I.E. Risks that threaten the entire banking system) or what my colleague Jeff Pietsch, CFA terms "idiosyncratic" risk - meaning risks that are specific to each entity involved.

To be sure, there are some systemic "issues" here. The bad news is that we feel the primary problem that triggered Silicon Valley Bancorp to go under - the fact that SVB didn't have to mark-to-market the losses on US Treasury securities - is surely widespread across smaller banks all over the country.

The good news is that this only becomes a big problem (you know, the kind of problem where the government needs to ride in on their white horses) when a bank is forced to sell those securities. In SVB's case, it was depositors taking their money out of the bank in rapid-fire fashion (the report I read said that $42 billion in deposits were withdrawn in a single day!) that caused them to sell. This, of course, created capital issues. The bank then tried to raise capital to cover. But, surprise, surprise, no one was willing to put up the money. So, bam, just like that, the bank was taken over by California regulators.

Also in the good news column is the new lending program the Fed announced the Monday after the SVB blowup. Basically, the Fed is making cash available to all banks for a period of a couple years. So... This means that banks have access to capital when/if they need it. And in turn, this means that troubled banks won't have to sell their securities at a loss and repeat the cycle SVB went through. No, they can just head over to the Fed and borrow the money.

But... You knew that was coming, right? Bank customers aren't stupid. If a bank starts to show signs of problems, depositors are still likely to pull their cash out. And too much of this behavior is a bad thing. Which is why Janet Yellen is making headlines this morning talking about protecting bank depositors. In a speech today, the Treasury Secretary and former Fed Chair says, "Our intervention was necessary to protect the broader US banking system, and similar actions could be warranted if smaller institutions suffer deposit runs that pose the risk of contagion."

So, if depositors aren't at risk of losing their money on accounts over the FDIC insured level of $250K, then there may not be a reason for folks to pull their money out en masse. And if there isn't a "run" on the bank, then it can be argued there isn't an immediate problem. At least from the bulls' perspective, anyway.

The other good news here is that the Fed, the government, and the regulators have all seen this movie before - more than once! As such, the play book is already in place to try and "make a stop" and ensure the security of the banking system.

However, on the other side of the ledger is the idea that a banking crisis - no matter how large - is likely to impact both corporate and consumer sentiment. As in, everybody takes a breath and goes easy on the spending/hiring plans for a while. Oh, and there's also the idea that this type of mess causes the chances of recession increase here.

The good news is the anticipated slowdown in economic activity is also disinflationary. Which helps the Fed big-time in their fight against the evils of inflation. Will the Fed acknowledge this at their meeting today/tomorrow? We shall see. But one thing is for sure, emergency measures to ensure the security of banks certainly complicates things for Jay Powell's merry band of central bankers.

So, as you can probably tell by now, I see this is an "on the one hand, yet on the other hand" type of situation. From my perch, the key is to be able to understand both the problems and how the markets react to the ebb and flow of the related news. So far at least, my take is that we don't have a "big" systemic problem (think S&L crisis and/or the Great Financial Crisis of 2008) on our hands.

But with the Fed on tap tomorrow, it will be VERY interesting to hear their take on all of this. Stay tuned, this will surely be interesting!

Now let's review the "state of the market" through the lens of our market models...

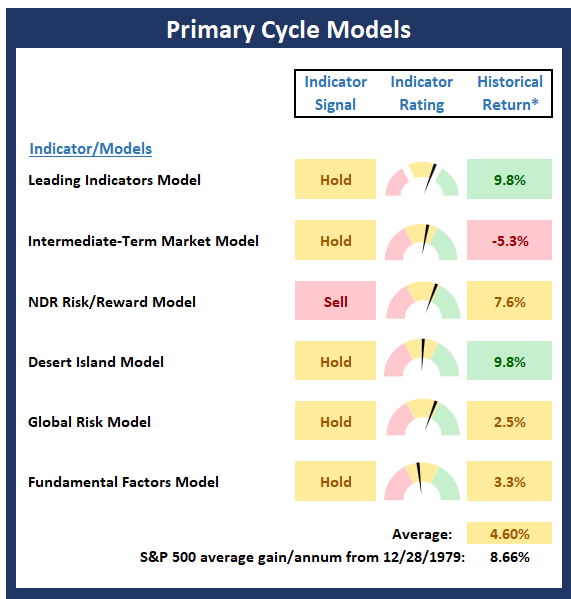

Primary Cycle Models

Below is a group of big-picture market models, each of which is designed to identify the primary trend of the overall "state of the stock market."

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

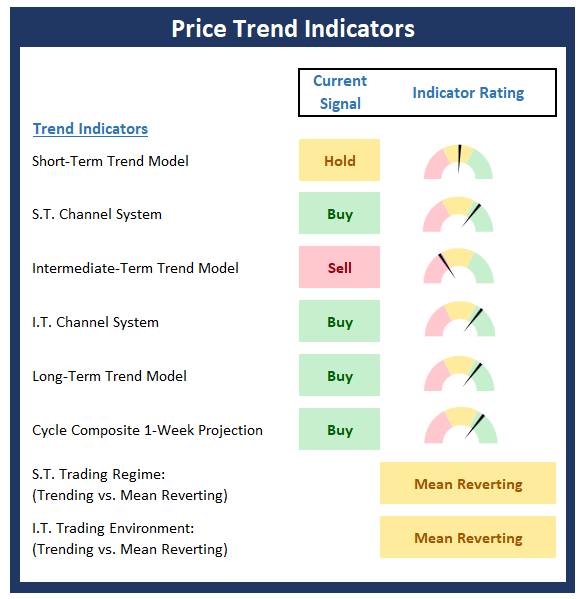

Trend Analysis:

Below are the ratings of key price trend indicators. This board of indicators is designed to tell us about the overall technical health of the market's trend.

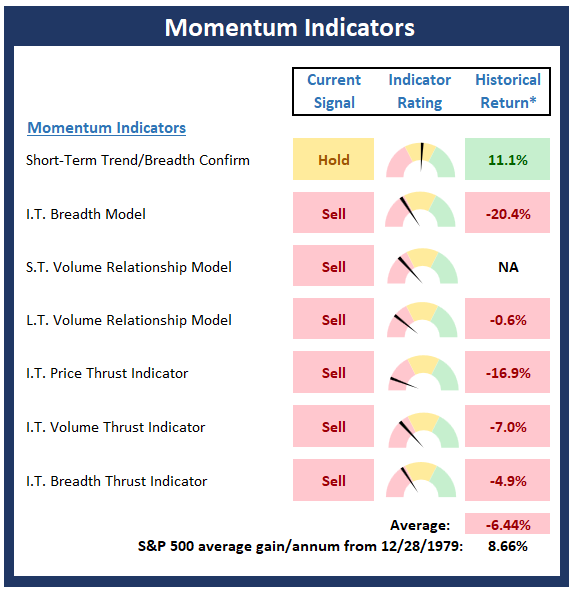

Market Momentum Indicators

Below is a summary of key internal momentum indicators, which help determine if there is any "oomph" behind a move in the market.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

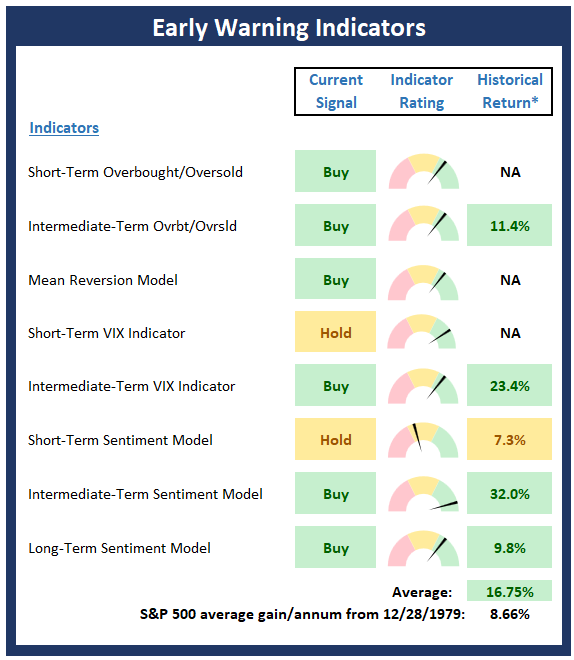

Early Warning Indicators

Below is a summary of key early warning indicators, which are designed to suggest when the market may be ripe for a reversal on a short-term basis.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

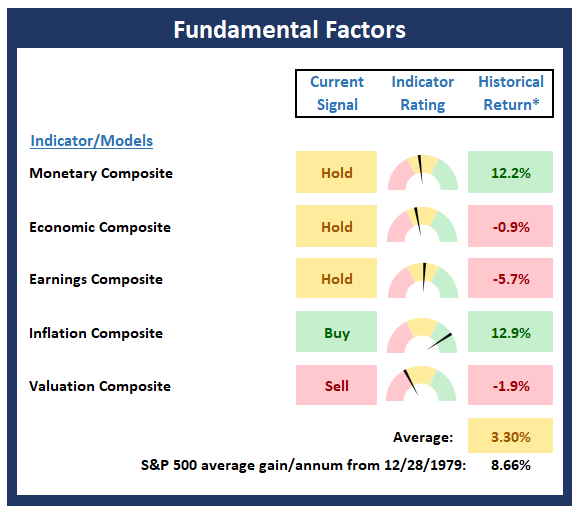

Fundamental Factor Indicators

Below is a summary of key external factors that have been known to drive stock prices on a long-term basis.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

Thought for the Day:

The simple problem of our age is how to act decisively in the absence of certainty. -Bertrand Russell

Wishing you green screens and all the best for a great day,

David D. Moenning

Founder, Chief Investment Officer

Heritage Capital Research, a Registered Investment Advisor

Disclosures

At the time of publication, Mr. Moenning held long positions in the following securities mentioned: none - Note that positions may change at any time.

NOT INDIVIDUAL INVESTMENT ADVICE. IMPORTANT FURTHER DISCLOSURES