The Three Keys To This Market

The State of the Market: Executive Summary

From my perch, there are three factors driving stock prices to-and-fro these days. First, there is the state of the on-again-off-again stimulus talks, which appear to be a modest positive again this morning. Next, there is the state of the coronavirus pandemic, which is clearly not going in the right direction here. And finally, there is the rise in interest rates, which is starting to gain the attention of traders.

On the virus front, the good news is that vaccines appear to be coming - and soon. We should learn the stage 3 trial results of at least two potential vaccines in the coming weeks. At this point in the game, traders, and in turn, the markets, are betting on a positive outcome. And as I've opined previously, this allows investors to look ahead to better days - to a time when some semblance of pre-COVID "normal" can resume.

The bad news is the number of cases is surging again - almost everywhere. My take is that the combination of schools opening and cooler weather forcing people to gather indoors again is causing a resurgence in the spread of the virus. But it is encouraging to note that there are better treatments eight months into this thing and according to the data I review each day from Johns Hopkins, the death rate is clearly slowing.

On the interest rate front, don't look now fans, but the yield on the 10-year has been rising - reaching the highest level since June on this fine Friday morning. I consulted my personal "bond kings" at Northern Capital on the subject yesterday afternoon. The firm's Chief Investment Officer, Mr. Stephen Rye, said there were two primary drivers of the move up in rates: New supply and the Biden tax plan.

As we've discussed, Wall Street appears to be discounting a Biden win. The good news for the market is this is expected to bring a larger stimulus package. This is a good thing for economic growth. However, it is a bad thing for the supply of government bonds. You see, despite being the largest, most liquid market in the world, there is still a limit as to how much debt a country can issue in a short period of time. Thus, it looks like bond buyers have been starting to demand a bit more yield from their purchases.

Then there is the tax aspect of the situation. Mr. Rye opined that while increasing taxes isn't great for equities in the long run (an opinion seconded by Paul Tudor Jones yesterday), it is a very strong development for municipal bonds. In short, with taxes going up for the rich, the demand for tax-free havens is likely to increase.

This is to say nothing of the potential for inflation. Yes, I see that there are inflation pressures building as a result of the coronavirus. But from a big-picture standpoint, I just don't see a meaningful increase in inflation - largely due to the current levels of unemployment, which remain massive from an historical perspective. My thinking is it will take quite some time for the economy to work through the unemployment problem. And until the country can return to full employment, we probably don't need to fret about runaway inflation.

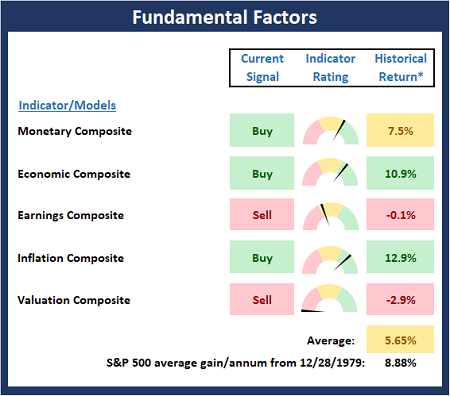

Now let's check in on our Fundamental Factors indicator board...

Publishing Note: In light of the fact that fundamentals of the stock market do not change frequently, we will publish this report on a monthly basis going forward.

The State of the Fundamental Models

Ditto from last week, as there are no changes to the Fundamental Factors board again this week. My take is Monetary conditions remain positive and supportive of both the economy and the stock market, the economic composite continues to show improvement, earnings are starting to show signs of life (both GAAP and Operating EPS estimates look to have bottomed and are now starting to move higher), inflation is not much of a problem, and valuations remain at extremely high levels. However, as I've mentioned a time or two lately, we know that valuations tend to spike when the economy emerges from a recession. So, all in, my view is the board continues to favor the bulls from a big-picture standpoint.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR. Past performances do not guarantee future results or profitability - NOT INDIVIDUAL INVESTMENT ADVICE.

Thought For The Day:

I knew if I didn't leave my bitterness and hatred behind, I'd still be in prison. -Nelson Mandela

Wishing you green screens and all the best for a great day,

David D. Moenning

Founder, Chief Investment Officer

Heritage Capital Research, an SEC Registered Investment Advisor

Disclosures

At the time of publication, Mr. Moenning held long positions in the following securities mentioned: None - Note that positions may change at any time.

Fundamental Models Explained

Monetary Composite: The popular cliche, "Don't fight the Fed" is really a testament to the profound impact that interest rates and Fed policy have on the market. It is a proven fact that monetary conditions are one of the most powerful influences on the direction of stock prices. The Monetary Composite is a combination of two proprietary monetary models developed by Ned Davis Research. The first is comprised of 14 indicators and is plotted as a composite and the second is made up of eight monetary-related indicators including money supply, and the bond and commodities markets.

Economic Composite: During the middle of bull and bear markets, understanding the overall health of the economy and how it impacts the stock market is one of the few truly logical aspects of the stock market. The economic composite is a series of three models designed to indicate the current state of the economy.

Earnings Composite: A series of four models designed to indicate the overall health of corporate earnings. The first model is based on the slope of the smoothed S&P 500 earnings per share. The second model looks at the drivers of earnings and includes indicators such as U.S. industrial production, the CRB Spot Raw Industrial Material Price Index, the Treasury yield curve, Institute for Supply Management (ISM) indices, corporate bond credit spreads, unemployment claims, and the trend in analyst earnings estimate revisions for the S&P 500. The third model is designed to indicate the likely trend in the earnings per share reported for the S&P 500 Index. This model uses a variety of macro variables to indicate whether current conditions are favorable for strong, moderate, or weak growth in S&P 500 earnings. The fourth model the median 12-month percent change in the one-year analyst forecast out of the 500 components of the index.

Inflation Model: From an historical perspective, one of the best "big picture" indicators of what the market is expected to do next is inflation. The Inflation model is designed to identify cyclical changes in the rate of inflation. The model consists of 22 individual indicators primarily measuring various rates of change of such indicators as commodity prices, the Consumer Price Index (CPI), producer prices, and industrial production.

Valuation Composite: If you want to get analysts really riled up, you need only to begin a discussion of market valuation. While the question of whether stocks are overvalued or undervalued appears to be a simple one, the subject is actually extremely complex. The Valuation composite consists of five valuation indicators/models developed by Ned Davis Research. The first valuation indicator reviews the S&P 500 Price-to-Earnings GAAP Ratio relative to normal, expensive, and bargain valuation zones. The second model measures the S&P 500’s Median P/E ratio, representing the median P/E of the 500 stocks in the index. The third model measures the Median P/E ratio of a multi-cap stock index. The fourth indicator is the P/E ratio of the Value Line Index. The fifth model is a composite of 7 indicators designed to reflect stock market valuations based on how various valuation indicators compare to their latest 10-year historical ranges.

NOT INVESTMENT ADVICE. The opinions and forecasts expressed herein are those of Mr. David Moenning and Heritage Capital Research and may not actually come to pass. The opinions and viewpoints regarding the future of the markets should not be construed as recommendations. The analysis and information in this report is for informational purposes only. No part of the material presented in this report is intended as an investment recommendation or investment advice. Neither the information nor any opinion expressed constitutes a solicitation to purchase or sell securities or any investment program.

Any investment decisions must in all cases be made by the reader or by his or her investment adviser. Do NOT ever purchase any security without doing sufficient research. There is no guarantee that the investment objectives outlined will actually come to pass. All opinions expressed herein are subject to change without notice. Neither the editor, employees, nor any of their affiliates shall have any liability for any loss sustained by anyone who has relied on the information provided.

Mr. Moenning is an investment adviser representative of Heritage Capital Advisors, LLC dba Heritage Capital Research (HCR), an SEC registered investment advisor.

Mr. Moenning and HCR may at times have positions in the securities referred to and may make purchases or sales of these securities while publications are in circulation. Positions may change at any time.

The analysis provided is based on both technical and fundamental research and is provided "as is" without warranty of any kind, either expressed or implied. Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

The author neither endorses nor warrants the content of this site, any embedded advertisement, or any linked resource. The author or his managed funds may hold either long or short positions in the referenced securities. Republication rights must be expressly granted by author in writing.

Investments in equities carry an inherent element of risk including the potential for significant loss of principal. Past performance is not an indication of future results.