Thoughts On The Macro Themes

With the Fed meeting on tap next week (the rate announcement is slated for 2:00 pm Wednesday with the Powell presser to follow) and the crowd split on whether or not the country's merry band of central bankers will hike rates again or take a pass to get more data, it is fairly easy to argue that investors aren't likely to make major commitments beforehand.

So, instead of joining the crowd of prognosticators opining about what the Fed may or may not do, I thought it would be a good idea to spend some time this week looking at the big picture. So, without further ado, let's quickly run through the major macro drivers in order to get a feel for the fundamental backdrop for this market.

Recent Crises "Solved"

Looking at the most recent drivers to the near-term action, the good news is that both the debt ceiling and the so-called banking crisis can be placed in the "solved" category. Yay!

Sure, Janet Yellen needs to refill the Treasury's coffers to the tune of about a trillion dollars over the next few months, which could certainly become a bit of a liquidity drag on the financial markets. And yes, there is a boatload of commercial real estate loans that are "lurking" on regional bank balance sheets, which could become problematic. But the key is these potentially market-killing issues are no longer front-and-center threats to the markets/banking system/economy.

So, it hasn't been terribly surprising to see stocks breathe a sigh of relief lately. As in the S&P 500 getting close to "bull market territory" (i.e. +20% off the bottom) and breaking out above the recent trading range in the process. As in the NASDAQ and NDX continuing their leadership charge on the back of the AI theme. And heck, even the beaten down areas have shown some signs of life recently.

With the debt and banking crises out of the way, investors of all shapes and sizes can return their attention to the fundamentals. You know, stuff like the economy, the Fed, inflation, and earnings.

"It's The Economy, Stupid"

As far as the economy is concerned, you are likely aware that just about everybody on the planet expects the Good 'Ol USofA to slip into recession - and soon. The arguments for said downturn certainly make sense except for the simple fact that it just hasn't happened. Nope, despite all the teeth gnashing and table pounding over the past year and a quarter, the overall economy continues to hang in there.

Make no mistake about it; the data show the pace of economic growth IS slowing. Just about every new economic report sports a slowdown theme. However, my take is that the slowdown is occurring from a strong pace. Remember, slowing growth is NOT the same thing as a recession.

And yes, it is easy to argue that the manufacturing sector is indeed in contraction mode. However, the consumer and the services sectors appear to be doing just fine, thank you. The reason is simple. Everybody has a job. And if you lose one, there are still 1.6 jobs available for those looking for one.

So, yes Virginia, the labor market remains strong. And if I've learned anything since entering this game in 1980, it is that as long as John Q Public and family have money in their pockets, they aren't likely to skip the trip to the mall (or Amazon).

And lest we forget, the consumer is responsible for more than 70% of the country's economy. So... If the labor market is solid and consumers have money in their jeans, it is hard to see how the economy is in deep doo-doo here. At least for now anyway.

Oh, and for the numbers geeks out there, the Atlanta Fed's GDPNow forecast, which is effectively a real-time update to GDP, currently projects that as of June 1, the economy is growing at a 2% annual clip in the second quarter. Hardly the debacle so many are predicting, right?

Inflation IS Declining

Turning to the topic of inflation, the members of the FOMC tell us on a regular basis that inflation remains much too high and there is more work to be done to get it down. While it is true that the inflation data the Fed uses are indeed still too high, the key here is to recognize what the Fed is looking at.

Cutting to the chase, the Fed keeps themselves busy reviewing data that, in my humble opinion, is rearview mirror oriented. When one looks at more CURRENT pricing data, the picture changes dramatically.

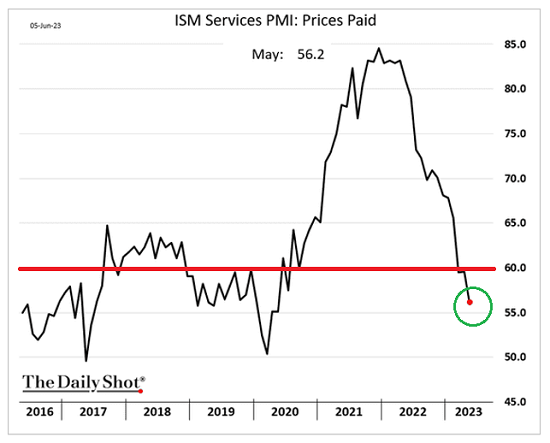

I could provide several pages of examples here. But below is one that sums things up nicely. It's the Prices Paid component of the ISM Services PMI. In other words, what businesses in the services sector are paying. As you can plainly see, the prices being paid by service providers are now BELOW where they were when COVID reared its ugly head.

View Full Size Chart

Source: The Daily Shot

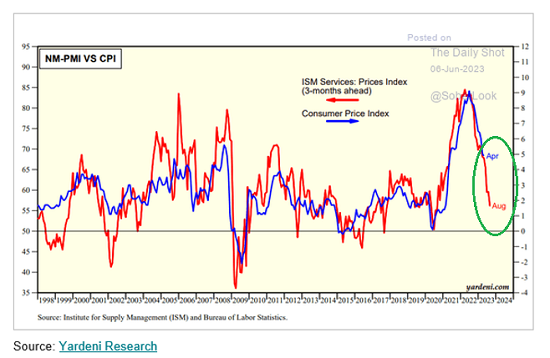

And according to the good folks at Yardeni Research, the ISM Services Prices index is a pretty darn good precursor for what the CPI is going to do in the future. See the chart below illustrating the relationship.

View Full Size Chart

Source: The Daily Shot/Yardeni Research

The key is there are lots of examples suggesting that inflation is clearly declining - in earnest. Which is something that has historically been very good for stock prices. 'Nuf said.

The Fed is Just About Done

While this is merely my $0.02, I'm of the mind that with high frequency inflation data in decline and the Fed's aggressive hiking campaign starting to "break" stuff, Powell & Co. are likely to take their foot off the gas soon. Maybe not next week. Or maybe not in July. But I think it is a pretty safe bet that the Fed is very close to being done hiking rates.

Why should I care, you ask? Because history shows that the stock market has advanced when the Fed stops hiking rates. Please understand, I'm not talking about what will happen next week, next month, or even next quarter. Trying to predict what will happen next in Ms. Market's game is a fool's errand. No. I'm talking about the big picture here.

So... With the economy growing, inflation falling, earnings rising, the Fed ready to pivot from their antagonistic stance, and the AI theme bolstering enthusiasm, I find it really difficult to be pessimistic here.

Sure, stocks could pause or pull back as things are starting to become a bit heated. But from a big picture standpoint, I remain seated on the bull train, and you can color me an optimistic dip-buyer, for the time being.

Thought for the Day:

The naked truth is always better than the best-dressed lie. -Ann Landers

Wishing you green screens and all the best for a great day,

David D. Moenning

Founder, Chief Investment Officer

Heritage Capital Research, a Registered Investment Advisor

Disclosures

At the time of publication, Mr. Moenning held long positions in the following securities mentioned: None - Note that positions may change at any time.

NOT INDIVIDUAL INVESTMENT ADVICE. IMPORTANT FURTHER DISCLOSURES