Threading The Needle

All eyes were on Jackson Hole last week. Well actually, all eyes were on their computer screens as Fed Chair Jerome Powell gave his much anticipated speech virtually at the Kansas City Fed conference, which is usually held in Jackson Hole.

In short, investors of all shapes and sizes wanted to know whether or not Mr. Powell was going to start "talking taper." And if he did, would he also discuss the Fed's next move - as in, when the U.S. central bank would start raising rates?

To review, the term "taper" here refers to a reduction in the amount of bonds the Fed purchases each month under what has become known as quantitative easing ("QE"). The plan is for the FOMC to buy bonds on the open market in order to keep rates low and liquidity high. The latest QE program was implemented as part of the central bank's extraordinary monetary support in response to COVID's impact on the economy. In case you don't follow such things, the Fed has been buying $120 billion in bonds each and every month for some time now. And many analysts believe that the QE program has helped to keep rates exceptionally low this year, despite the surge in inflation that has occurred.

With the economy having recovered from the self-induced lockdown and the ensuing stop/start recession, the belief is the Fed's extra support is no longer needed. As such, most believe Powell & Co. need to figure out how to wind down the current QE program. Without causing a lot if disruption in the markets, of course.

The good news is there is an historical analog for such a thing. If you recall, it was in 2013 that then Fed Chair Ben Bernanke first started talking about tapering the Fed's QE program that had been enacted to help support the economy after the Great Financial Crisis. At that time, Bernanke's "taper talk" took the market by surprise and a "taper tantrum" ensued in the stock market.

However, I'm not sure the previous QE tapering example will be of much help to investors this time around as things are very different now. Thus, the hissy fit the market threw in response to the idea of the Fed tapering QE (I.E., reducing the bonds bought on the open market) in 2013 doesn't appear to be happening now.

The reason is the Fed has learned to communicate its plans better - as in, much better. Therefore, the idea of the Fed pulling back here isn't a surprise. No, everybody on the planet knows this move is coming. It's just a question of when.

Powell's Tall Task

The trick for Powell on Friday was to communicate to the markets that he and his FOMC colleagues (a) recognize that the time to taper the QE program has arrived, (b) that inflation might not be transitory and as a result, may require Fed action, and (c) to address when rates might need to rise - all without upsetting markets to any great degree.

Those with a bearish bent considered the Chairman's task on Friday to be a tall order. The thinking was that Powell was likely to disappoint and as a result, market participants would vote with their feet - hitting the sell button repeatedly and in rapid fashion.

But instead, the S&P 500 rallied in response to the Chairman's speech and finished with the 52nd new all-time high this year.

Yea, But...

It appears that Jay Powell threaded the needle. Yes, he did "talk taper." But... he also left the door open on the timing by referencing the uncertainty the Delta variant brings to the Fed's monetary calculus.

On the subject of inflation, Powell did admit that prices are running hotter than expected. But... he also stuck to his guns and explained in detail why he believes that the surge in inflation is likely to be temporary. And while several of his FOMC colleagues publicly disagree, the market seemed to like what Mr. Powell was saying.

And then there was the subject of interest rates. From my seat, this was probably the most important topic of the day. You see, most folks figure that once the Fed is done tapering the QE program, the next move will be to start raising rates. In market terminology, this is called a "hiking cycle." And the bottom line is everybody knows that stocks don't tend to fare well when the Fed is in the process of raising rates.

Therefore, there have been numerous reports by Wall Street firms speculating when the tapering would begin (most believe sometime between November and January) and end (likely eight months later), and then, when the first rate-hike would occur (usually something on the order of six months later).

But... that last part is where Mr. Powell surprised to the upside. Instead of talking about when the Fed has traditionally started to raise rates, the Fed Chair told us that the end of QE didn't necessarily mean the start of a hiking cycle. No, Powell told us the Fed would need to look at the data, the state of COVID and the economy, and then act accordingly. Nice.

The Bottom Line

So, there you have it. Mr. Powell laid out a logical path that appeared to be a pleasant surprise to the markets. Every potential negative was accompanied by a market appeasing "yea, but." And my take is it looks like he may have threaded the needle beautifully.

Here's hoping you have a great week. Now let's review our indicator boards...

Publishing Note: I am traveling next week and will not publish a report.

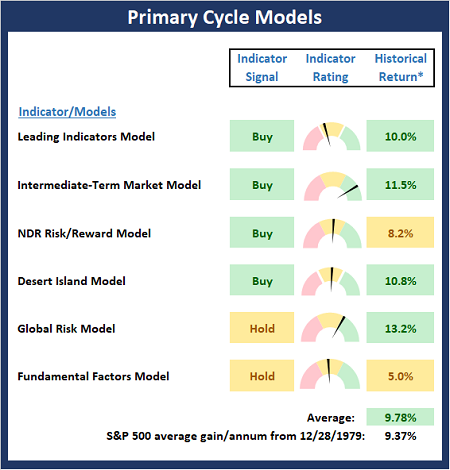

The Big-Picture Market Models

We start with six of our favorite long-term market models. These models are designed to help determine the "state" of the overall market.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

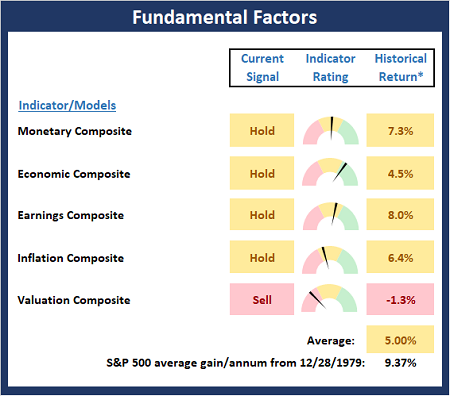

The Fundamental Backdrop

Next, we review the market's fundamental factors including interest rates, the economy, earnings, inflation, and valuations.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

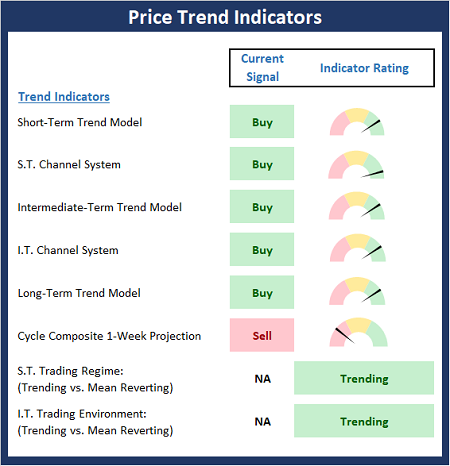

The State of the Trend

After reviewing the big-picture models and the fundamental backdrop, I like to look at the state of the current trend. This board of indicators is designed to tell us about the overall technical health of the market's trend.

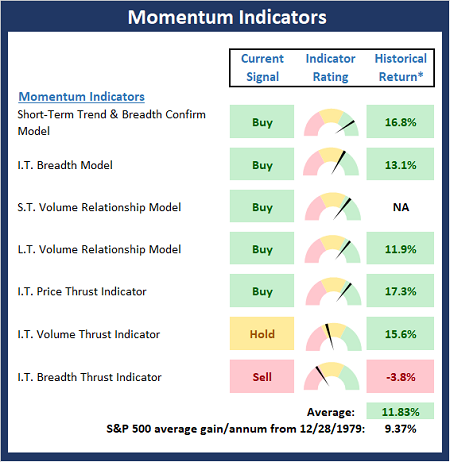

The State of Internal Momentum

Next, we analyze the momentum indicators/models to determine if there is any "oomph" behind the current move.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

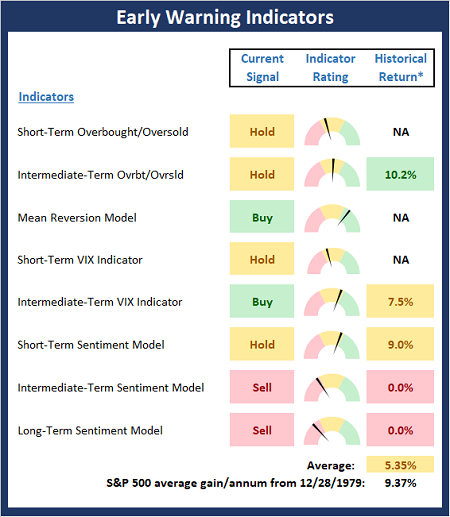

Early Warning Signals

Finally, we look at our early warning indicators to gauge the potential for counter-trend moves. This batch of indicators is designed to suggest when the table is set for the trend to "go the other way."

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

Thought for the Day:

Always be a first-rate version of yourself, instead of a second-rate version of someone else. - Judy Garland

Wishing you green screens and all the best for a great day,

David D. Moenning

Founder, Chief Investment Officer

Heritage Capital Research, a Registered Investment Advisor

Disclosures

At the time of publication, Mr. Moenning held long positions in the following securities mentioned: None - Note that positions may change at any time.

NOT INDIVIDUAL INVESTMENT ADVICE. IMPORTANT FURTHER DISCLOSURES