Traders Finally Don the Caps

Well it finally happened. Dow 20K, that is. And yes, there were hats - lots of hats.

After struggling with the big, round number since the middle of December, the venerable Dow Jones Industrial Average finally broke above the 20,000 level and closed Wednesday at a new all-time high of 2068.51.

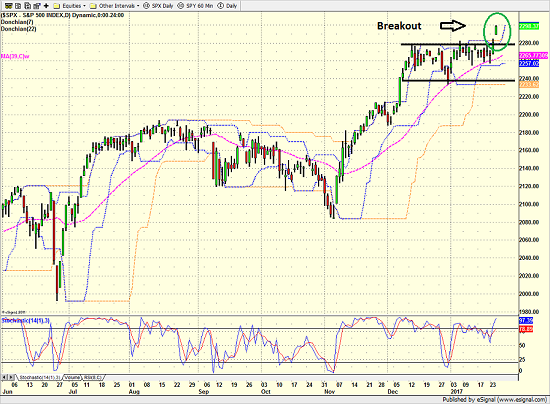

The S&P 500, NASDAQ Composite, and S&P 400 Midcap indices confirmed the move as all the major indices save the Russell 2000 smallcaps, broke above their respective trading range ceilings into new high territory. And from a technical perspective, this is a good thing.

S&P 500 - Daily

View Larger Image

The question, of course, is why? Or, perhaps more appropriately, why now?

The answer appears to be simple. Actions speak louder than words. And the executive orders that President Trump has been busy signing this week have reminded traders that the Trump administration intends on making good on the promises made during the campaign. (What a concept.)

After rallying furiously from just before the election (November 7 to be exact) on the "idea of" and "hope for" better days ahead in terms of lower taxes, reduced regulation, and a better economy, the market then stalled in mid- December. Traders worried that the goals of the Trump administration might be too lofty to achieve. After all, Trump would still have to deal with the politics of Washington.

But with executive orders being signed daily designed to actually put plans in motion, the bottom line is traders are feeling better about the prospects for greener pastures.

The latest excitement in the market centered around "the wall" to be erected between the border of the U.S. and Mexico. And as you may recall, Mexico is supposed to pay for it.

This created a rally in U.S. construction and engineering firms. Ironically, the massive Mexican cement company, Cemex (NYSE: CX), has also benefited from all the talk about building the wall as shares have rallied 21.5% in the last 8 days.

So, the materials companies joined the banks and transportation companies as beneficiaries of the "Trump Trade." This, along with the usual enthusiasm for technology helped push the Dow past the big, round number the media has been focused on. Oh, and the rally in the homebuilders didn't hurt either.

Now the question becomes, will it stick?

Recall that during the tough times seen in the market during much of 2015/16, all "breakouts" quickly morphed into "fake outs" as traders developed a habit of selling into any/all rallies. And with valuations in the stock market stretched and the President running out of big plans to announce, one has to wonder if the current joyride to the upside won't meet a similar fate.

But This Time, It Is Different

I know, I know, use of the header above is generally a fast track to losses in the stock market. However, I will opine that stocks are now discounting improving fundamentals. A stronger economy. Lower taxes. Less regulation. This is the stuff that can drive corporate profits above the current expectations. And as such, stock prices can certainly rise.

How far they can go is anybody's guess. And to be sure, if there is even a whiff of disappointment along the way, the rally could easily falter. But for now, the key is that the new administration has the ability to take action. And since actions are always better than words in this game, the market appears to be applauding.

Current Market Drivers

We strive to identify the driving forces behind the market action on a daily basis. The thinking is that if we can both identify and understand why stocks are doing what they are doing on a short-term basis; we are not likely to be surprised/blind-sided by a big move. Listed below are what we believe to be the driving forces of the current market (Listed in order of importance).

1. The State of Trump Administration Policies

2. The State of the U.S. Economy

3. The State of Global Central Bank Policies

4. The State of Bond Yields

Thought For The Day:

"Whenever you find yourself on the side of the majority, it's time to pause and reflect." - Mark Twain

Wishing you green screens and all the best for a great day,

David D. Moenning

Chief Investment Officer

Sowell Management Services

Disclosure: At the time of publication, Mr. Moenning and/or Sowell Management Services held long positions in the following securities mentioned: none. Note that positions may change at any time.

Looking for a "Modern" approach to Asset Allocation and Portfolio Design?

Looking for More on the State of the Markets?

Investment Pros: Looking to modernize your asset allocations, add risk management to client portfolios, or outsource portfolio design? Contact Eric@SowellManagement.com

Disclosures

The opinions and forecasts expressed herein are those of Mr. David Moenning and may not actually come to pass. Mr. Moenning's opinions and viewpoints regarding the future of the markets should not be construed as recommendations. The analysis and information in this report is for informational purposes only. No part of the material presented in this report is intended as an investment recommendation or investment advice. Neither the information nor any opinion expressed constitutes a solicitation to purchase or sell securities or any investment program.

Any investment decisions must in all cases be made by the reader or by his or her investment adviser. Do NOT ever purchase any security without doing sufficient research. There is no guarantee that the investment objectives outlined will actually come to pass. All opinions expressed herein are subject to change without notice. Neither the editor, employees, nor any of their affiliates shall have any liability for any loss sustained by anyone who has relied on the information provided.

The analysis provided is based on both technical and fundamental research and is provided "as is" without warranty of any kind, either expressed or implied. Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

David D. Moenning is an investment adviser representative of Sowell Management Services, a registered investment advisor. For a complete description of investment risks, fees and services, review the firm brochure (ADV Part 2) which is available by contacting Sowell. Sowell is not registered as a broker-dealer.

Employees and affiliates of Sowell may at times have positions in the securities referred to and may make purchases or sales of these securities while publications are in circulation. Positions may change at any time.

Investments in equities carry an inherent element of risk including the potential for significant loss of principal. Past performance is not an indication of future results.

Advisory services are offered through Sowell Management Services.