Which Game Are You Playing?

When playing the stock market game, it is critical to understand the time-frame you are attempting to "win" at. For example, the big boys with their expensive co-located computers play the game measured in microseconds. Then those who sit by a computer all day trading in and out of positions focus on what I'd call the micro-term time frame - I.E. the next few hours. Next, the folks who call themselves "swing traders" focus on short-term, which I'll define as between one day and a couple weeks. I view the intermediate-term time frame as somewhere between three weeks and three months. And finally, I will define long-term as a period between three and twelve months.

The question all investors have to be able to answer is, what time frame are you focusing on? You see, fretting about a short-term problem in the stock market when you are a long-term investor is foolish. And in my experience, trying to use intermediate-term indicators to win the short-term game is a disaster.

As such, understanding what the drivers of the market are from the three major time frames (short-, intermediate-, and long-term) is mission critical.

Part of my job at Sowell Management is to attempt to do just that every two weeks. The thinking is that if we can understand what is happening in all three important time-frames, then we shouldn't find ourselves scratching our heads when the market makes a big move.

So, this morning, I'd like to spend a minute attempting to get a handle on the intermediate-term outlook for the market, which in my humble opinion, is the toughest of the bunch. But here goes...

From an intermediate-term perspective, seasonal factors, the outlook for both earnings and economic growth, and global QE remain the key drivers.

As I've mentioned a time or two lately, the seasonal/cycle winds, which have been at the bulls' backs for the past couple of months, will very soon start to become headwinds. Remember, September is typically a very volatile month (and not in a good way) and our cycle analysis suggests that the bears may own the game - to a modest degree - through early October. Thus, from a short- to intermediate-term outlook, we shouldn't be surprised if things get "sloppy" for a while. But at the same time, we should recognize that the seasonal cycle then turns mostly positive through the end of the year.

Next up is the subject of earnings and the economy. With the current earnings season largely behind us, the focus will likely turn to future expectations on the earnings front. And given that the consensus is for earnings to perk up considerably in the Q3 and Q4 reporting seasons, unless the guidance from Corporate America suddenly takes a turn for the worse, stocks would appear to have upside potential once the seasonal headwinds recede.

From an economic standpoint, it is also important to remember that we don't need to see strong economic growth in order for stocks to move higher. Since stocks tend to be a discounting mechanism for future expectations, I'm of the mind that we simply need the economic picture not to darken. Remember, the worst bear markets tend to be accompanied by a recession. And with our models suggesting that the odds of a recession in the U.S. are currently under 5%, I don't think the economic picture is a problem - at least from an intermediate-term stock market perspective.

And then there is the big driver - Global QE. The bottom line here is simple. If investors have learned anything since the credit crisis ended in 2009, it is that a fair amount of the money printed by central bankers (regardless of the color or country of origin) has tended to find its way into the U.S. stock and bond market.

So... With the Bank of England, the ECB, and the Bank of Japan continuing their QE programs, fresh cash will likely continue to wind up being put to work in the U.S. markets. Thus, it is hard to be negative about the prospects for the market when looking out over the next six months when one knows that stocks will continue to be supported by money flows.

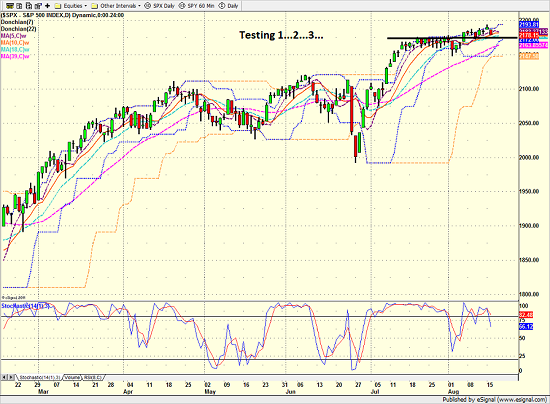

From a short-term, chart perspective, it appears that the bears may have found a way to get up off the mat and are attempting to get back in the game. Again, this shouldn't be a surprise and the real key will be if our furry friends can close first below 2175 and then 2145. Should 2175 be violated in a meaningful way the move will likely be accompanied by some sort of catalyst that will embolden the short-sellers for a while.

S&P 500 - Daily

View Larger Image

Current Market Drivers

We strive to identify the driving forces behind the market action on a daily basis. The thinking is that if we can both identify and understand why stocks are doing what they are doing on a short-term basis; we are not likely to be surprised/blind-sided by a big move. Listed below are what we believe to be the driving forces of the current market (Listed in order of importance).

1. The State of Global Central Bank Policies

2. The State of U.S. Economic Growth

3. The State of Oil Prices

Thought For The Day:

"I skate to where the puck is going to be, not where it has been” -- Wayne Gretzky

Wishing you green screens and all the best for a great day,

David D. Moenning

Chief Investment Officer

Sowell Management Services

Looking for a "Modern" approach to Asset Allocation and Portfolio Design?

Looking for More on the State of the Markets?

Investment Pros: Looking to modernize your asset allocations, add risk management to client portfolios, or outsource portfolio design? Contact Eric@SowellManagement.com

Disclosures

The opinions and forecasts expressed herein are those of Mr. David Moenning and may not actually come to pass. Mr. Moenning's opinions and viewpoints regarding the future of the markets should not be construed as recommendations. The analysis and information in this report is for informational purposes only. No part of the material presented in this report is intended as an investment recommendation or investment advice. Neither the information nor any opinion expressed constitutes a solicitation to purchase or sell securities or any investment program.

Any investment decisions must in all cases be made by the reader or by his or her investment adviser. Do NOT ever purchase any security without doing sufficient research. There is no guarantee that the investment objectives outlined will actually come to pass. All opinions expressed herein are subject to change without notice. Neither the editor, employees, nor any of their affiliates shall have any liability for any loss sustained by anyone who has relied on the information provided.

The analysis provided is based on both technical and fundamental research and is provided "as is" without warranty of any kind, either expressed or implied. Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

David D. Moenning is an investment adviser representative of Sowell Management Services, a registered investment advisor. For a complete description of investment risks, fees and services, review the firm brochure (ADV Part 2) which is available by contacting Sowell. Sowell is not registered as a broker-dealer.

Employees and affiliates of Sowell may at times have positions in the securities referred to and may make purchases or sales of these securities while publications are in circulation. Positions may change at any time.

Investments in equities carry an inherent element of risk including the potential for significant loss of principal. Past performance is not an indication of future results.

Advisory services are offered through Sowell Management Services.