Why Tactical Isn't Working - Part V (The Numbers)

With the markets waiting on both the BoJ (Bank of Japan) meeting and Janet Yellen's announcement on Wednesday, let's go ahead and spend our time this morning continuing the discussion on why tactical/technical strategies have not fared well in recent years.

So far, we've established that many tried and true stock market indicators and strategies have disappointed investors looking to "time" the stock market. Yes, these strategies did very well during the crisis in 2008. But there can be little argument that a great many tactical/technical strategies have not delivered the goods since then.

Anyone using tactical managers over the last few years probably knows the difficulty I'm referencing. However, an advisor who focuses on passive strategies recently asked me to "esplain" what I'm talking about here.

In an effort to avoid naming names of some of the biggest, highest profile firms that have struggled - or worse - let me try to make the point another way.

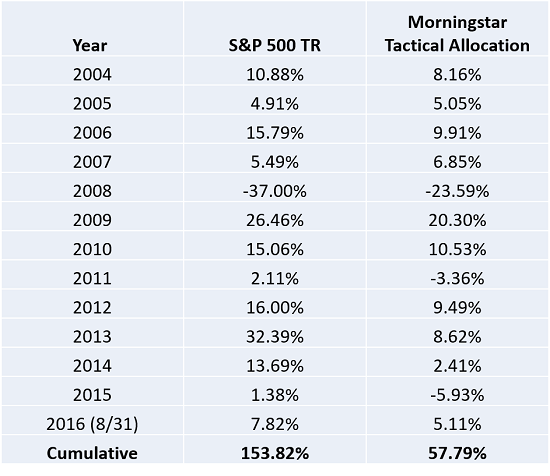

Below is a table that compares the S&P 500 to the Morningstar Tactical Allocation mutual fund category since 2004. Why have I chosen to start in 2004? In short, because many of the programs offered by my firm began in 2004 and as such, the data was handy in the wee hours this morning.

View Larger Image

Source: Morningstar

If you are like most folks, your eyes probably moved directly to the "bottom line" of this chart. Doing so makes my point fairly well as the cumulative return since 2004 for Morningstar's Tactical Allocation category is 58% versus the gain of 154% for the S&P 500 total return index (which includes the reinvestment of dividends into the index).

Obviously, this is a pretty big disparity. And according to my calculator, the tactical category has returned just 38% of the returns of the S&P. Ughh.

Yes, it is true that most tactical programs/funds tout the idea of capital preservation during big, bad, bear markets. And it is also true that the Morningstar category did just that in 2008 by losing more than a third less than the stock market index.

I also recognize that tactical managers don't claim to be able to keep up with the market during a roaring bull market environment such as years like 2009 and 2013.

However, here's the problem. The last time I think the tactical allocation fund category did anything good (i.e. performed well against the S&P) was 2008. And that's getting to be a long time ago.

For example, if you compound the returns from the beginning of 2008 through 8/31/16, the disparity is eye-popping. The tactical category's cumulative return since 1/1/08 is 18.24% versus 65.68% for the S&P total return (and 39.2% for the price-only S&P index). Ouch.

If you look closely at the numbers, it looks like the real problems began in 2011 when, in my opinion, the impact of high speed trading really started to take hold. Doing the math, I find that since the beginning of 2011, the tactical allocation category's cumulative return is 16.38% versus 94.87% for the S&P. And I'm sorry folks, but that is a downright u-g-l-y comparison.

It's Not Just the Tactical Funds

One argument that could be proffered here is that tactical strategies have notoriously underwhelmed in what is called a "40 Act Wrapper" -- I.E. an open ended mutual fund.

And in my experience, it is indeed true that tactical strategies have a long history of underperforming once they have been put into a fund wrapper and promoted broadly.

However, the performance problems of the tactical space aren't limited to the SMA manager and/or the mutual funds. Nope, the hedgies are seeing similar difficulties - and these guys are supposed to be able to do anything they want in order to perform!

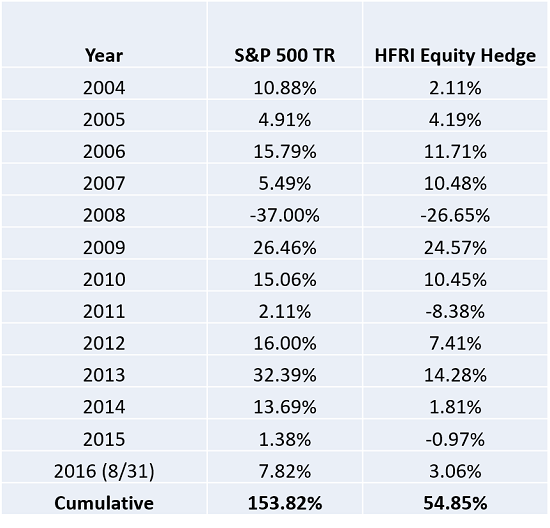

Below is a table comparing the HFRI Equity Hedge Index to the S&P. This is an index compiled by Hedge Fund Research, a hedge fund analysis shop based in the Windy City.

This particular index is comprised of hedge funds whose stated objective is to use both long and short positions in their portfolio - usually in individual equities.

View Larger Image

Source: Hedge Fund Research

Doing the same analysis we performed on the Morningstar Tactical Allocation category, I first find that the cumulative return for the HFRI Equity Hedge index over the last 12.67 years is again pretty weak compared to the S&P at 54.9% vs. 153.8%.

And while the hedgies did protect capital during 2008, it's also been a pretty rough go since then with 2011, 2013 and 2014 looking particularly difficult.

The Takeaway

So, do all the tactical mutual funds underperform? Are all the equity hedge funds lemons? Is the idea of trying to make hay while the sun shines and then taking cover when the big storms in the market hit a thing of the past? Should investors give up on the tactical approach all together?

In my humble opinion, the answer is, of course not.

The key takeaway here is that this particular investing methodology has struggled during this particular market cycle. But it is important to remember that almost all (my compliance department made me hedge there, they just hate absolute statements) investing methodologies/strategies struggle at times. Remember the late 1990's when Warren Buffett, who is viewed as one of the greatest investors of all time, decided to avoid the technology game? The bottom line here is that even the Oracle of Omaha has struggled against the benchmarks at times.

In my humble opinion, the proliferation of technical indicators, the global QE game, and the rise of the machines (which I will get to tomorrow) have combined to make the game tough for tactical managers lately.

And to be clear, this has been a strategic or buy-and-hold manager's market. This helps explain why there is a movement in the financial advisory community toward passive strategies. After an 8-year bull run, of course! (Can you say "performance chasing"?)

But this does NOT mean that investors should give up on the idea of managing risk in the markets. There are some really strong managers/funds/strategies out there. There ARE managers/strategies that have enviable long-term records over various market environments.

For example, just last week I was presented with a tactical manager who has a 24-year, live track record of tactical management with real clients and real money. This particular manager uses a risk-managed approach and has experienced only one down year over the 24-year period. And for the record, this manager lost less than 1% during his "bad year" (which, by the way, occurred in 2015).

So they ARE out there. There ARE strong managers and tactical strategies available. One just has to have the experience and the know-how to be able to properly understand what a manager is doing, how they are doing, why it works, when it doesn't, and what type of environment is likely to cause the strategy to underperform. But, oops, my apologies, now I'm talking my book.

Tomorrow, we'll get back to the question of "why" tactical is struggling right now and then finally get to what I believe are some answers to this dilemma.

Current Market Drivers

We strive to identify the driving forces behind the market action on a daily basis. The thinking is that if we can both identify and understand why stocks are doing what they are doing on a short-term basis; we are not likely to be surprised/blind-sided by a big move. Listed below are what we believe to be the driving forces of the current market (Listed in order of importance).

T1. The State of the Bond Market

T1. The State of Global Central Bank Policies

3. The State of U.S. Economic Growth

4. The State of the U.S. Dollar

Thought For The Day:

"Happiness is when what you think, what you say, and what you do are in harmony." -- Mahatma Gandhi

Wishing you green screens and all the best for a great day,

David D. Moenning

Chief Investment Officer

Sowell Management Services

Looking for a "Modern" approach to Asset Allocation and Portfolio Design?

Looking for More on the State of the Markets?

Investment Pros: Looking to modernize your asset allocations, add risk management to client portfolios, or outsource portfolio design? Contact Eric@SowellManagement.com

Disclosures

The opinions and forecasts expressed herein are those of Mr. David Moenning and may not actually come to pass. Mr. Moenning's opinions and viewpoints regarding the future of the markets should not be construed as recommendations. The analysis and information in this report is for informational purposes only. No part of the material presented in this report is intended as an investment recommendation or investment advice. Neither the information nor any opinion expressed constitutes a solicitation to purchase or sell securities or any investment program.

Any investment decisions must in all cases be made by the reader or by his or her investment adviser. Do NOT ever purchase any security without doing sufficient research. There is no guarantee that the investment objectives outlined will actually come to pass. All opinions expressed herein are subject to change without notice. Neither the editor, employees, nor any of their affiliates shall have any liability for any loss sustained by anyone who has relied on the information provided.

The analysis provided is based on both technical and fundamental research and is provided "as is" without warranty of any kind, either expressed or implied. Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

David D. Moenning is an investment adviser representative of Sowell Management Services, a registered investment advisor. For a complete description of investment risks, fees and services, review the firm brochure (ADV Part 2) which is available by contacting Sowell. Sowell is not registered as a broker-dealer.

Employees and affiliates of Sowell may at times have positions in the securities referred to and may make purchases or sales of these securities while publications are in circulation. Positions may change at any time.

Investments in equities carry an inherent element of risk including the potential for significant loss of principal. Past performance is not an indication of future results.

Advisory services are offered through Sowell Management Services.