All About The Growth?

Don't look now fans, but the S&P 500 is up three days in a row and has finished in the green five of the last seven sessions. This in the face of all the trade fears and hand wringing about the potential impact an extended trade war would have on the economy. As such, investors appear to have a little more spring in their step right now.

Some folks are calling the recent string of green screens a result of a little something known as "buy the rumor and sell the news." Only this time the adage has been turned on its head as traders sold on trade war fears and now appear to be buying on the idea that reality won't be as bad as expected.

Yet, as I opined on Monday, I think there is a lot more at work here than some age-old Wall Street trading strategy. As in, growth trumps trade fears. In fact, it's been my experience that growth can trump just about any problem a business or economy might have.

Got a financial problem? No worries. If your revenue is growing, the problem will likely shrink or even disappear over time.

So, despite the fact that there has been no movement on the trade front with China and the Europeans appear to be hopping mad about the current tariffs, the stock market is advancing. Why? Because in short, growth can fix everything.

We Can Afford the Trade War

Another way to look at this situation is that with the economy humming along, the U.S. can actually afford to mess around with a trade war for a while. So what if GDP loses a few tenths of a percent this year? It looks like we've got a few extra tenths to spare.

Yep, that's right; the current little rally in stocks appears to be driven by the idea that (a) the economy is growing at a strong clip, (b) inflation has yet to pose any sort of problem, and (c) the Fed doesn't appear to be bent on killing the economy. What's not to like?

It's That Time of Year Again

Then there is the upcoming earnings season. Again, can you say, "buy the rumor?"

In case you've been living in a cave, earnings are expected to be strong once again this quarter. And save a bunch of rhetoric from executives going on about trade, most analysts are looking for big numbers from corporate America over the next couple months.

So, another growth story might provide the bulls with a raison d'etre here. Party on, right?

You Buyin' The Argument?

Yes, I will admit that the tone of this morning's market missive has become a tad sarcastic. My bad. But, sometimes simplicity is what the stock market game is all about - whether it makes sense to you or not. And while the current rationale may sound a little light to some (maybe even me), it appears to be working.

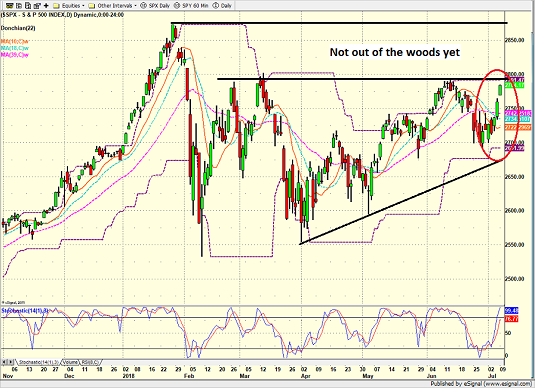

Yet, at the same time, it is important to remember that the bulls are not out of the woods yet from a chart standpoint. Sure, the recent rally has been enjoyable. But there is some pretty hefty resistance just overhead on just about every index.

S&P 500 - Daily

View Larger Image Online

Yes, the recent improvement in stocks has been fun. And the S&P 500 continues to put in higher highs and higher lows while moving from the lower left to the upper right on the chart. But the question - at least in my mind - is can it last? After all, haven't the bulls been playing the growth card for quite some time now? And as such, shouldn't the growth be baked into the cake by now?

My Take

So, for me, this looks like a good time to hail from Missouri. A good time to make Ms. Market "show me" her hand. Go ahead, blast through the resistance at 2800 and then attack the old highs. Do that with some "oomph" and I'll get on board. I'll buy into the growth game. I'll embrace the breakout. But for now, I'm going to curb my enthusiasm in deference to some pretty weak readings from some of my models.

ANNOUNCEMENT:

HCR Awarded Top Honors in 2018 NAAIM Shark Tank Portfolio Strategy Competition

Each year, NAAIM (National Association of Active Investment Managers) hosts a competition to identify the best actively managed investment strategies. In April, HCR's Dave Moenning took home first place for his flagship risk management strategy.

Want to Learn More? Contact Dave

A Word About Managing Risk in the Stock Market

Thought For The Day:

To think is easy. To act is hard. But the hardest thing in the world is to act in accordance with your thinking. - Johann von Goethe

Wishing you green screens and all the best for a great day,

David D. Moenning

Founder, Chief Investment Officer

Heritage Capital Research

HCR Focuses on a Risk-Managed Approach to Investing

Must Read: What Risk Management Can and Cannot Do

HCR's Financial Advisor Services

HCR's Individual Investor Services

Questions, comments, or ideas? Contact Us

At the time of publication, Mr. Moenning held long positions in the following securities mentioned: IJR - Note that positions may change at any time.

Disclosures

The opinions and forecasts expressed herein are those of Mr. David Moenning and may not actually come to pass. Mr. Moenning's opinions and viewpoints regarding the future of the markets should not be construed as recommendations. The analysis and information in this report is for informational purposes only. No part of the material presented in this report is intended as an investment recommendation or investment advice. Neither the information nor any opinion expressed constitutes a solicitation to purchase or sell securities or any investment program.

Any investment decisions must in all cases be made by the reader or by his or her investment adviser. Do NOT ever purchase any security without doing sufficient research. There is no guarantee that the investment objectives outlined will actually come to pass. All opinions expressed herein are subject to change without notice. Neither the editor, employees, nor any of their affiliates shall have any liability for any loss sustained by anyone who has relied on the information provided.

Mr. Moenning may at times have positions in the securities referred to and may make purchases or sales of these securities while publications are in circulation. Positions may change at any time.

The analysis provided is based on both technical and fundamental research and is provided "as is" without warranty of any kind, either expressed or implied. Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

Investments in equities carry an inherent element of risk including the potential for significant loss of principal. Past performance is not an indication of future results.