Inflation Is Starting To Look Real

For years now, Fed officials have bemoaned the fact that inflation has been below their "target" of 2%. As such, the one of the primary goals of the Federal Reserve board has been to get inflation back up to levels deemed appropriate.

As someone who came into the business in mid-1980, I have always found this concept strange. Back when Paul Volcker was running the show, the goal was to keep inflation low - as low as possible. Inflation under 2% would have been viewed as a huge victory for Volcker & Co., not a problem.

But, of course, one of the constants in life is change. And make no mistake about it; the stock market game changes - all the time!

The inflation situation is a perfect example. Since the Financial Crisis, there has been a steady stream of Fed-heads who spent enormous energy, to say nothing of taxpayer dollars, attempting to pump some inflation into the economy. Again, to those of us with a lot of gray hair, this seems counterintuitive. But, as I mentioned, times have definitely changed.

First, there was Ben Bernanke, who was desperate to keep the U.S. out of a Japan-style deflationary spiral. Being an expert on the Great Depression, Mr. Bernanke knew all too well that once deflation takes hold it can be very difficult to stop. So, with asset prices reeling, it made sense to try and create some inflation.

Bernanke's gang came up with all kinds of creative ways to try and get inflation to perk up. And for a while, the plan seemed to be working. By 2010, CPI was back over 2% and in 2011 was heading back toward 4%. Mission accomplished, right?

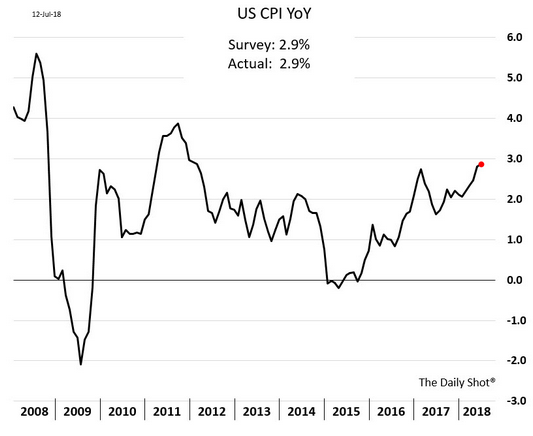

Actually, not so much. As the chart below shows, from mid-2011, CPI fell steadily and spent much of 2015 flatlined.

Janet Yellen went so far as to call the inflation trend a mystery as it seemed that inflation might be dead. Despite dramatic improvements in the labor markets, inflation remained exceptionally low. This despite the trillions spent on QE.

But if there is one thing I've learned in my career, it is that the Fed usually gets what it wants - eventually. Hence the phrase, "Don't fight the Fed."

The key point to this morning's meandering market missive is that it appears Jay Powell may soon be in a position to declare victory on the inflation front. Below are some charts I offer as exhibits in the argument that inflation is accelerating.

First there is the chart above, which shows year-over-year CPI currently approaching 3%. The question, of course, is if this trend can sustain itself.

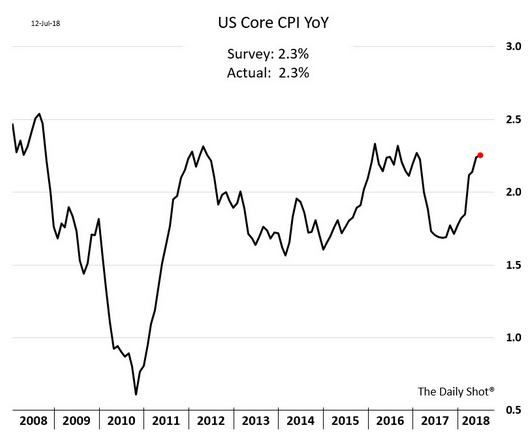

Next up is the so-called "core" CPI, which removes such pesky items as food and energy.

This chart makes it clear that Core CPI is once again over 2%. I'll argue that Core CPI is now in a trading range between 1.6-ish and 2.5%.

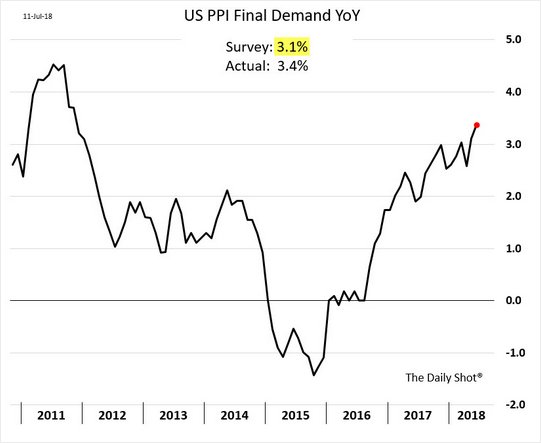

Now let's look at PPI, which is inflation at the producer level.

The trend here is pretty obvious. PPI has been moving up since the end of 2015, is currently above 3%, and has recently accelerated.

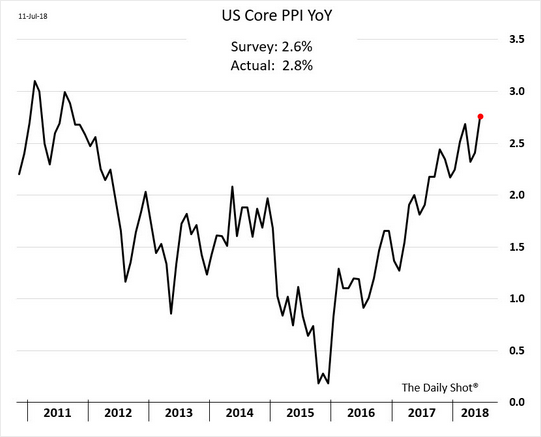

The story appears to be the same when looking at Core PPI...

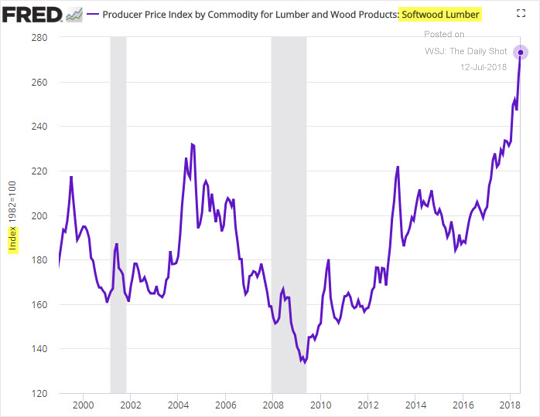

And if you want to turn the inflation "problem" on its head, take a peek at the PPI of lumber and wood products. Yowza!

Now toss in increasing costs for steel and aluminum and it isn't much of a stretch to start thinking that the next move the Fed will have to make is to slow things down.

To be sure, I've hand-picked some charts to make a point this morning. However, long-time readers should know that I tend to focus more on models than cherry-picked evidence.

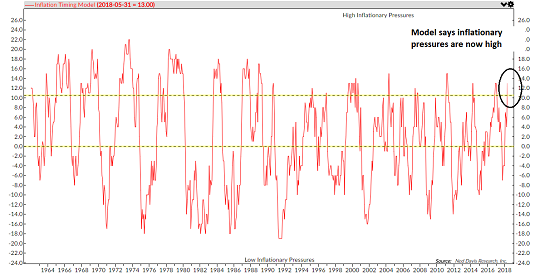

It also shouldn't come as a surprise to learn that I follow an inflation model developed by Ned Davis Research (a model that I update weekly on Mondays). This model did a great job telling me the trend of inflation - in advance. So, I thought it fitting to include the model in this morning's report.

The bottom line here is pretty easy to see. Inflationary pressures are high.

So... My question is when does the inflation "problem" flip? As the saying goes, the solution to your current problem often becomes the source of your next problem. Therefore, I think it is time to start asking if the solution to the "not enough" inflation problem becomes the "next" inflation problem. As in too much.

Yes, I know that analysts have been yammering on about this topic for some time. However, it is important to remember that "timing is everything" in this business. My point is that macro factors such as inflation, the economy, or valuation don't tend to impact day-to-day trading in the stock market. Until they do, of course. This is why I like to say that macro factors don't matter, until they do, and then they matter a lot.

The point is that while stuff like valuations and inflation aren't a problem in this market, there may come a time when they are the focal point. To be clear, I'm talking about the big-picture view here, which has nothing to do with what happens in the market this week or this month. I'm simply saying that inflation may be something to keep on your radar because it appears that the problem of not enough inflation has been solved.

Publishing Note: My next report will be published Thursday morning.

ANNOUNCEMENT:

HCR Awarded Top Honors in 2018 NAAIM Shark Tank Portfolio Strategy Competition

Each year, NAAIM (National Association of Active Investment Managers) hosts a competition to identify the best actively managed investment strategies. In April, HCR's Dave Moenning took home first place for his flagship risk management strategy.

Want to Learn More? Contact Dave

A Word About Managing Risk in the Stock Market

Thought For The Day:

The art of being wise is knowing what to overlook. -William James

Wishing you green screens and all the best for a great day,

David D. Moenning

Founder, Chief Investment Officer

Heritage Capital Research

HCR Focuses on a Risk-Managed Approach to Investing

Must Read: What Risk Management Can and Cannot Do

HCR's Financial Advisor Services

HCR's Individual Investor Services

Questions, comments, or ideas? Contact Us

At the time of publication, Mr. Moenning held long positions in the following securities mentioned: None - Note that positions may change at any time.

Disclosures

The opinions and forecasts expressed herein are those of Mr. David Moenning and may not actually come to pass. Mr. Moenning's opinions and viewpoints regarding the future of the markets should not be construed as recommendations. The analysis and information in this report is for informational purposes only. No part of the material presented in this report is intended as an investment recommendation or investment advice. Neither the information nor any opinion expressed constitutes a solicitation to purchase or sell securities or any investment program.

Any investment decisions must in all cases be made by the reader or by his or her investment adviser. Do NOT ever purchase any security without doing sufficient research. There is no guarantee that the investment objectives outlined will actually come to pass. All opinions expressed herein are subject to change without notice. Neither the editor, employees, nor any of their affiliates shall have any liability for any loss sustained by anyone who has relied on the information provided.

Mr. Moenning may at times have positions in the securities referred to and may make purchases or sales of these securities while publications are in circulation. Positions may change at any time.

The analysis provided is based on both technical and fundamental research and is provided "as is" without warranty of any kind, either expressed or implied. Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

Investments in equities carry an inherent element of risk including the potential for significant loss of principal. Past performance is not an indication of future results.