Are You Happy With 8% in Eight Months?

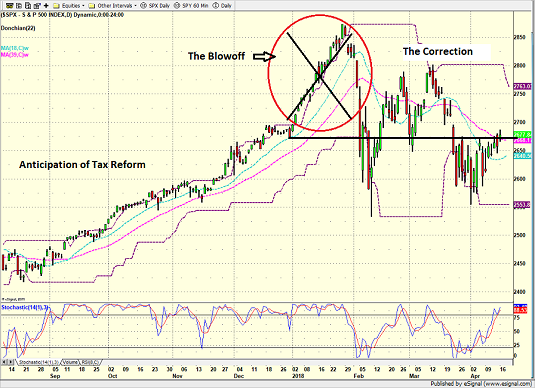

Good morning and Happy Tax Day, 2017. It is said that a picture is worth a thousand words. As such, I'd like to try and explain my view of the current market environment with a chart or two this morning.

At this time yesterday, I opined that the stock market was in the process of consolidating the gains enjoyed since the idea of tax reform became real. But an alternative explanation of what is transpiring here is that the market has "corrected" the overexuberance that occurred in January.

You remember January, don't you? A month where the S&P 500 gained nearly 6%, which happened to be the best start to a year in a very long time. A month where it became clear to everyone in the game that there was no stopping the economy and/or the stock market. A month where it is now clear that a blow-off occurred.

My view here is pretty simple. If one X's out the January spasm to the upside, the recent action is actually quite reasonable. After gaining 8.17% from September through December last year, the stock market exploded to the upside in January to add another 5.7%, bringing the 5-month gain to 16.2%. And the bottom line is this was simply too much, too fast - no matter how great things looked in the future.

So, when the bad news started to flow, and downside volatility returned, traders reacquainted themselves with the sell button. Yes, that February dive can be considered a bit ridiculous as it was driven by an unprecedented surge in "vol," which caused a great many short-vol strategies and products to implode. This created forced selling and a type of panic that hadn't been seen in a while.

However, once you get past the initial dump to the downside, which contained a "flash crash" or two along the way, the rest has been what can be considered a "garden variety" pullback. From my seat, investors are in the process of trying to figure out where prices should be relative to what lies ahead for the economy and earnings.

Below is a chart displaying my take on what has transpired over the last eight months.

S&P 500 - Daily

View Larger Image Online

The key here is to "X-out" the blow-off in January. Next, take a look at where we are now. The point is that the S&P 500 closed yesterday a smidge above where it stood as 2017 drew to a close. In other words, as of Monday's closing bell, stocks have gone nowhere for three and one-half months. And this, my friends, is what a consolidation/corrective phase is all about.

Consider this. If I had told you on August 31, 2017 that stocks would be 8.2% higher over the next eight months, how would you have felt? Frankly, a gain of 8% over eight months would have sounded pretty good to me. Bring it, please.

My point is this is exactly what investors have received from the S&P 500. Sure, the ride was a quite a bit bumpier than anyone would have liked. But the reality is you can't really complain too much about the overall outcome.

When Will It End

And yes, it is also true that the consolidation/correction may not be over. In fact, history suggests that the sloppy action is likely to stick around for a while longer.

The Bloomberg chart below shows the length of the corrections the S&P has experienced since the end of the financial crisis in 2009.

Source: Bloomberg

View Larger Image Online

While the sample size isn't large, the point is clear. Once stocks enter a consolidation/correction, it takes a while for the skies to clear and for the rally to resume.

I know, I know. The bears will argue that there is no guarantee the rally will resume. And yes, I get it, all good things must come to an end, eventually.

This is why I strive to employ a flexible approach to investing. I'm not a perma-bull nor a perma-bear. I simply try to stay aligned with what IS happening in the market. And I use a bunch of market indicators/models to help me figure this part out.

So, for now, anyway, my models/indicators tell me to favor the bulls. To be clear, there is no all-clear signal here and this is most definitely NOT the time to be overly aggressive (i.e. no time for leverage, margin, high beta, etc.). But unless/until things change - and let's keep in mind that they could at any moment - this remains a bull market correction which is likely to be resolved to the upside. Eventually.

Thought For The Day:

Give me six hours to chop down a tree and I will spend the first four sharpening the axe. - Abraham Lincoln

Wishing you green screens and all the best for a great day,

David D. Moenning

Founder, Chief Investment Officer

Heritage Capital Research

HCR Focuses on a Risk-Managed Approach to Investing

Must Read: What Risk Management Can and Cannot Do

HCR's Financial Advisor Services

HCR's Individual Investor Services

Questions, comments, or ideas? Contact Us

At the time of publication, Mr. Moenning held long positions in the following securities mentioned: none - Note that positions may change at any time.

Disclosures

The opinions and forecasts expressed herein are those of Mr. David Moenning and may not actually come to pass. Mr. Moenning's opinions and viewpoints regarding the future of the markets should not be construed as recommendations. The analysis and information in this report is for informational purposes only. No part of the material presented in this report is intended as an investment recommendation or investment advice. Neither the information nor any opinion expressed constitutes a solicitation to purchase or sell securities or any investment program.

Any investment decisions must in all cases be made by the reader or by his or her investment adviser. Do NOT ever purchase any security without doing sufficient research. There is no guarantee that the investment objectives outlined will actually come to pass. All opinions expressed herein are subject to change without notice. Neither the editor, employees, nor any of their affiliates shall have any liability for any loss sustained by anyone who has relied on the information provided.

Mr. Moenning may at times have positions in the securities referred to and may make purchases or sales of these securities while publications are in circulation. Positions may change at any time.

The analysis provided is based on both technical and fundamental research and is provided "as is" without warranty of any kind, either expressed or implied. Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

Investments in equities carry an inherent element of risk including the potential for significant loss of principal. Past performance is not an indication of future results.