Does Strong Jobs Report Give Bulls the Edge?

Well, it's finally here - Jobs day. To be sure, this is the Big Kahuna of economic reports these days. The Nonfarm Payroll data is closely watched as an indicator of both economic health and a "tell" for the Fed's future monetary policy moves. So, let's get to the numbers.

After last month's shockingly weak jobs report, the nonfarm payroll numbers for June came in like a breath of fresh air. The Labor Department reported that 287,000 new jobs were created last month, which was well above the consensus estimate for 180,000. The 287K was also above the highest estimate in the Bloomberg survey, so it is easy to say that this was a positive surprise.

The June jobs data (which was helped by 170,000 striking workers at Verizon returning to work) follows the May report where just 11,000 new jobs were created - which was actually revised lower from 28,000. But even if the returning Verizon workers are removed from the mix, the June job creation total was the best of 2016.

The report showed that the private sector created 225K new jobs in June and that average hourly earnings gained +0.1% (this tells us that workers are making a bit more money each month).

However, the unemployment rate actually rose by 0.2% to 4.9% as more people sought work and the labor force participation rate ticked higher to 62.7%.

While the report is being viewed positively by the markets in the early going, the argument over what the Fed will or won't do next will undoubtedly continue unabated. Some will argue that June's payroll numbers support the idea that May's report was a one-off while others note the 3-month average has fallen to 147K per month which is down significantly from the levels seen at the beginning of the year.

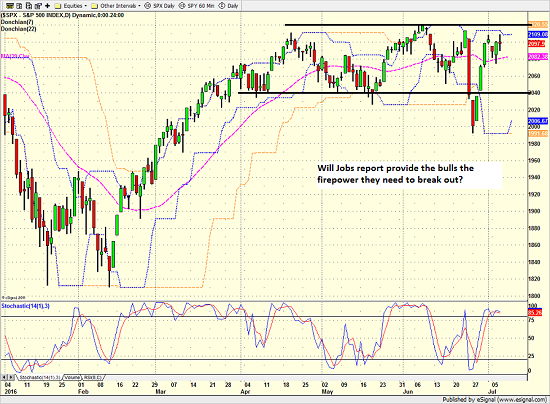

In any event, stock futures are pointing to a higher open on Wall Street before the bell. However, the question of the day is if the jobs report will provide the firepower the bulls need to break out of the current range. Personally, I'm not so sure this will do the trick. But remember, in the stock market, it's not the news, but how the market reacts to the news that truly matters. So, stay tuned as this might be interesting.

S&P 500 - Daily

View Larger Image

Current Market Drivers

We strive to identify the driving forces behind the market action on a daily basis. The thinking is that if we can both identify and understand why stocks are doing what they are doing on a short-term basis; we are not likely to be surprised/blind-sided by a big move. Listed below are what we believe to be the driving forces of the current market (Listed in order of importance).

1. The State of Global Bank Policies

2. The State of U.S. Economic Growth

3. The Impact of the "BREXIT"

4. The State of the Stock Market Valuations

Thought For The Day:

"I learned everything I needed to know from John Cougar, John Deere, John 3:16" --Keith Urban

Here's wishing you green screens and all the best for a great day,

David D. Moenning

Founder: Heritage Capital Research

Chief Investment Officer: Sowell Management Services

Looking for More on the State of the Markets?

Disclosures

The opinions and forecasts expressed herein are those of Mr. David Moenning and may not actually come to pass. Mr. Moenning's opinions and viewpoints regarding the future of the markets should not be construed as recommendations. The analysis and information in this report is for informational purposes only. No part of the material presented in this report is intended as an investment recommendation or investment advice. Neither the information nor any opinion expressed constitutes a solicitation to purchase or sell securities or any investment program.

Any investment decisions must in all cases be made by the reader or by his or her investment adviser. Do NOT ever purchase any security without doing sufficient research. There is no guarantee that the investment objectives outlined will actually come to pass. All opinions expressed herein are subject to change without notice. Neither the editor, employees, nor any of their affiliates shall have any liability for any loss sustained by anyone who has relied on the information provided.

The analysis provided is based on both technical and fundamental research and is provided "as is" without warranty of any kind, either expressed or implied. Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

David D. Moenning is an investment adviser representative of Sowell Management Services, a registered investment advisor. For a complete description of investment risks, fees and services, review the firm brochure (ADV Part 2) which is available by contacting Sowell. Sowell is not registered as a broker-dealer.

Employees and affiliates of Sowell may at times have positions in the securities referred to and may make purchases or sales of these securities while publications are in circulation. Positions may change at any time.

Investments in equities carry an inherent element of risk including the potential for significant loss of principal. Past performance is not an indication of future results.

Advisory services are offered through Sowell Management Services.