Jobs Report Surprises to the Upside

All eyes are on the labor department this morning as the "big kahuna" of economic data - aka the Jobs Report - showed that the economy created 255,000 new jobs in the month of July. In market vernacular, this was an upside surprise as the consensus had been for total job creation to come in somewhere closer to 180,000.

Let's dig into the details. The unemployment rate was unchanged at 4.9%. The private sector created an impressive 217,000 new jobs. In addition, both the May and June reports were revised higher, which means the economy added an additional 18,000 jobs over the last two months. On average, the economy has created 190,000 jobs over the last three months and 206,000 new jobs have been created over the past twelve months. Next, the labor-force participation rate edged up to 62.8% (more than 400,000 people joined the labor force), average hourly wages rose 0.3% to $25.69, and hourly pay increased 2.6% in the last year.

All in, the report has been viewed as a positive by the markets with stock futures, the U.S. dollar, and bond yields all rising on the report.

The big question now is if this report changes anything as far as Janet Yellen's plans are concerned. Prior to the report, the futures markets had been pricing in an 11% chance of a rate hike in September and a 26% chance in December. While, today's jobs report will likely increase those odds a bit, the bottom line is that the Fed remains friendly at this time.

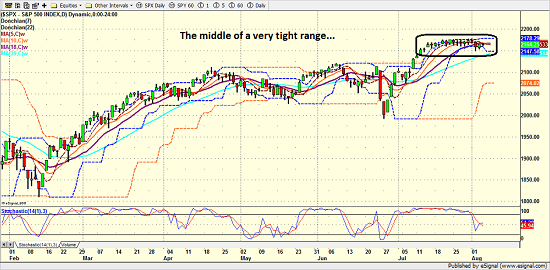

From a technical standpoint, absolutely nothing has changed - stocks remain in a very tight, sideways trading range. And although today's report appears to be a positive from an economic standpoint, the futures indicate that traders are not excited enough to push prices outside of the range at this time. This is likely due to the idea that the better jobs report might lead to higher rates. However, stay tuned as the outlook can and often does change after the opening bell rings.

S&P 500 - Daily

View Larger Image

Current Market Drivers

We strive to identify the driving forces behind the market action on a daily basis. The thinking is that if we can both identify and understand why stocks are doing what they are doing on a short-term basis; we are not likely to be surprised/blind-sided by a big move. Listed below are what we believe to be the driving forces of the current market (Listed in order of importance).

1. The State of Global Central Bank Policies

2. The State of the Earnings Season

3. The State of Oil Prices

4. The State of U.S. Economic Growth

Thought For The Day:

A government that is big enough to give you all you want is also big enough to take it all away. - Thomas Jefferson

Here's wishing you green screens and all the best for a great day,

David D. Moenning

Founder: Heritage Capital Research

Chief Investment Officer: Sowell Management Services

Looking for More on the State of the Markets?

Disclosures

The opinions and forecasts expressed herein are those of Mr. David Moenning and may not actually come to pass. Mr. Moenning's opinions and viewpoints regarding the future of the markets should not be construed as recommendations. The analysis and information in this report is for informational purposes only. No part of the material presented in this report is intended as an investment recommendation or investment advice. Neither the information nor any opinion expressed constitutes a solicitation to purchase or sell securities or any investment program.

Any investment decisions must in all cases be made by the reader or by his or her investment adviser. Do NOT ever purchase any security without doing sufficient research. There is no guarantee that the investment objectives outlined will actually come to pass. All opinions expressed herein are subject to change without notice. Neither the editor, employees, nor any of their affiliates shall have any liability for any loss sustained by anyone who has relied on the information provided.

The analysis provided is based on both technical and fundamental research and is provided "as is" without warranty of any kind, either expressed or implied. Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

David D. Moenning is an investment adviser representative of Sowell Management Services, a registered investment advisor. For a complete description of investment risks, fees and services, review the firm brochure (ADV Part 2) which is available by contacting Sowell. Sowell is not registered as a broker-dealer.

Employees and affiliates of Sowell may at times have positions in the securities referred to and may make purchases or sales of these securities while publications are in circulation. Positions may change at any time.

Investments in equities carry an inherent element of risk including the potential for significant loss of principal. Past performance is not an indication of future results.

Advisory services are offered through Sowell Management Services.