Positioning For The Parade?

Although the major stock market averages failed to rise or fall by 1% or more on Wednesday (which has been the trend recently), the volatile, news-driven environment remained.

In the early going, it appeared that traders might be able to shake off the news that geopolitical tensions with Russia/Syria could mean that missiles would soon fly. While stocks did indeed open lower, by lunchtime, there were green numbers to be found amongst the market indices.

My colleagues and I concluded that traders might be starting to put the news flow behind them and position themselves for what is expected to be a strong earnings parade. And what investors may have forgotten after the last month or so is that along with earnings reports come buyback announcements.

Buybacks to the Rescue?

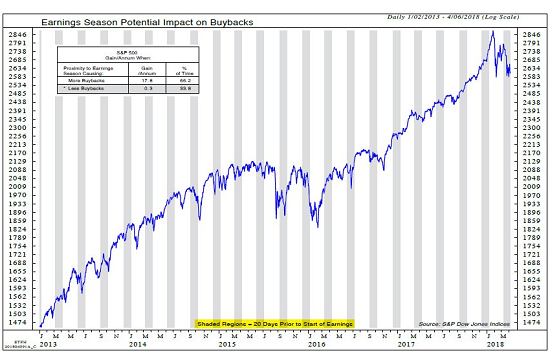

Lest we forget, companies tend to suspend stock buybacks five weeks before they release their earnings. As such, one can argue that a very large source of stock buying has been absent during the last month's sloppy action. In fact, Ned Davis Research reports that since 2013, the market has struggled in the period leading up to earnings season. According to NDR's computers, the S&P 500 has gained at a rate of just 0.3% per annum during the 20 trading days leading up to earnings season and 17.8% per year the rest of the time.

Source: Ned Davis Research View Larger Image Online

NDR also estimates that S&P 500 companies will spend between $600 and $800 billion on share buybacks this year. And with stocks currently in a corrective phase and well off their recent highs, one can argue that a significant source of demand will soon be returning to the stock market. And yes, the algos are likely aware of this fact.

So, I wasn't terribly surprised to see stocks attempt to shake off Trump's latest sabre rattling with Russia via his Twitter account.

The News Just Kept Coming

However, from noon eastern onward, stocks trended lower and finished near the lows of the day.

It appeared to me that the seemingly never-ending stream of headlines that can be construed as negative for stocks was simply too much for the bulls to overcome yesterday. Sure, earnings are forecast to grow by 15% - 18% this quarter. And yes, improving EPS does tend to be good for the market. But with a couple more headlines to deal with, the bears prevailed into the close.

In case you missed it; there were three new headlines to add to mix yesterday. First there was word that House Speaker Paul Ryan had decided to head back to Wisconsin to spend more time with his kids and would not be seeking reelection. Analysts quickly extrapolated this into a negative for the GOP, the administration's efforts, the economy, yada, yada, yada.

Then came the minutes from the latest FOMC meeting. While there were no jaw-dropping headlines associated with the minutes, the bottom line is that the tone of the meeting was construed to be a bit more hawkish that had been anticipated. And with yields rallying intraday, traders were reminded of the rising rate environment theme.

And finally, there were the "breaking news" banners yesterday afternoon announcing that explosions had occurred over Saudi Arabia. The bottom line here was the Saudis had intercepted a ballistic missile in Riyadh while shooting down two drones in another part of the country. As a result, it was easy to argue that geopolitical tensions were definitely on the rise.

A New Day

But... As I've been typing almost daily recently, today is a new day and if there is anything we've learned during market cycles in which the algos control the game, the computers tend to have little memory from one day to the next. This means that, yep, you guessed it; stocks are looking to go the other way at the open.

This morning, we've got some earnings to review (BlackRock - NYSE: BLK) and another market-moving Trump Tweet.

BlackRock reported a pretty decent quarter and the stock is higher by about $11 or 2.1% in early trade. In addition, the CEO of the world's largest money manager told investors they should forget trying to "time" this market's wild ride and stay invested in stocks.

Although Larry Fink said he isn't exactly sure what "inning we're in" in terms of the current bull run, the BlackRock CEO did say that the Trump Administration's tax cut has extended the cycle.

On the geopolitical front, the latest Trump tweet is also creating some modestly positive vibes. On the subject of Syria, Trump tweeted this morning, "Never said when an attack on Syria would take place. Could be very soon or not so soon at all!"

Thus, those concerned about an imminent attack on Syria and the resulting geopolitical mess have a bit less to fret about on this fine Thursday morning.

So, there you have it; stocks are looking to open a bit higher this morning. But the question, as always these days, is where we finish. Remember, the earnings parade kicks off in earnest with some big bank reports tomorrow. Thus, it will be interesting to see how the fast-money traders try to position themselves into tomorrow morning. Should be interesting.

Thought For The Day:

Wide diversification is only required when investors do not understand what they are doing. -- Warren Buffett

Wishing you green screens and all the best for a great day,

David D. Moenning

Founder, Chief Investment Officer

Heritage Capital Research

HCR Focuses on a Risk-Managed Approach to Investing

Must Read: What Risk Management Can and Cannot Do

HCR's Financial Advisor Services

HCR's Individual Investor Services

Questions, comments, or ideas? Contact Us

At the time of publication, Mr. Moenning held long positions in the following securities mentioned: none - Note that positions may change at any time.

Disclosures

The opinions and forecasts expressed herein are those of Mr. David Moenning and may not actually come to pass. Mr. Moenning's opinions and viewpoints regarding the future of the markets should not be construed as recommendations. The analysis and information in this report is for informational purposes only. No part of the material presented in this report is intended as an investment recommendation or investment advice. Neither the information nor any opinion expressed constitutes a solicitation to purchase or sell securities or any investment program.

Any investment decisions must in all cases be made by the reader or by his or her investment adviser. Do NOT ever purchase any security without doing sufficient research. There is no guarantee that the investment objectives outlined will actually come to pass. All opinions expressed herein are subject to change without notice. Neither the editor, employees, nor any of their affiliates shall have any liability for any loss sustained by anyone who has relied on the information provided.

Mr. Moenning may at times have positions in the securities referred to and may make purchases or sales of these securities while publications are in circulation. Positions may change at any time.

The analysis provided is based on both technical and fundamental research and is provided "as is" without warranty of any kind, either expressed or implied. Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

Investments in equities carry an inherent element of risk including the potential for significant loss of principal. Past performance is not an indication of future results.