The Bears Have a Shot...

Modern times demand modern thinking in portfolio design. Learn more...

Good morning. Since I'm technically supposed to be on vacation, let's jump right in...

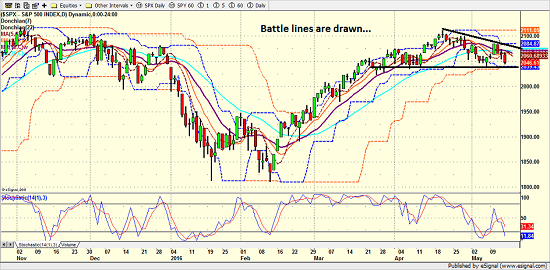

As usual, the first stop is a review of the price/trend of the market. Here's my take...

- The short-term trend continues to be down, but not dramatically so

- Near-term support in the 2020-2040 is being tested

- If support is broken, expect the bears to become emboldened

- A test of 2000 and then possibly 1950 is certainly possible

- The driver of the downside action appears to be the "Macy's trade"

- The rest of the major indices are also testing important support here

- Bulls need a stop. Bears hoping for some momentum. So, bottom line: It's "Game on"

Last week I wondered aloud if the bears would be able to find a reason for the "Sell in May" trade to take hold. This week is a bit of a different story as the "retail wreck" appears to have gained some traction among the Negative Nancy's out there. Fatigue also looks to be an issue since the list of uncertainties grows longer by the day. Therefore, some additional "downside testing" would seem to be the order of the day.

S&P 500 - Daily

View Larger Image

From a longer-term perspective (e.g. the weekly chart of the S&P 500)...

- Despite the near-term sloppiness, there is really nothing new to report

- The bottom line is that the range bound market that has been in place for more than a year continues

- Some folks are talking about a "broadening top" formation starting to take shape

- Should the bears take possession of the ball, another trip through the trading range would be logical

- However, unless the lower line in the sand is broken in a meaningful fashion, nothing really changes

S&P 500 - Weekly

View Larger Image

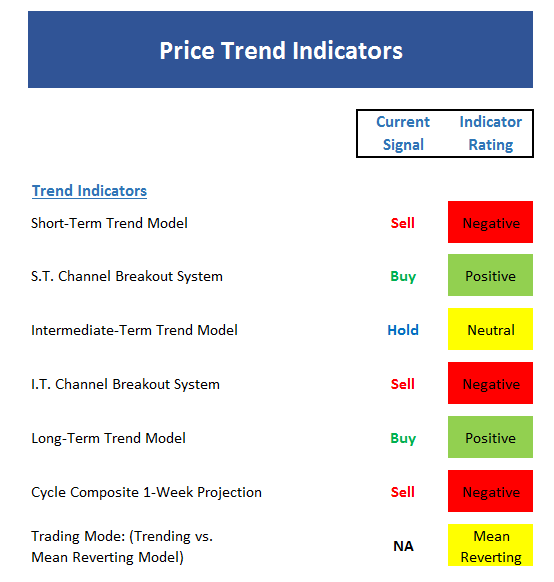

Now it's time to move on to the "weight of the evidence" via a review of our panel of indicators...

- The short-term trend remains moderately negative

- The cycle composite continues to favor the bears for the next week

- Cycles then turn higher for a summer rally

- Trading environment continues to be categorized as "mean reversion"

- Bears would appear to have the edge here

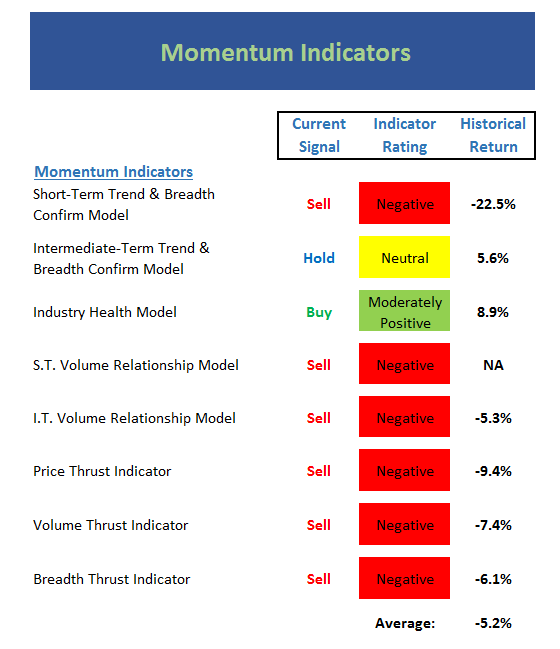

Next up is the momentum indicator board...

- Yikes, there's a lot of red on the board!

- But, prices have not "broken down" (yet?)

- It is positive that the industry health model (my "Desert Island" model) hasn't been hurt too badly to this point

- This board tells me that the bears have control of the ball

- The question is if they can do anything with their latest opportunity

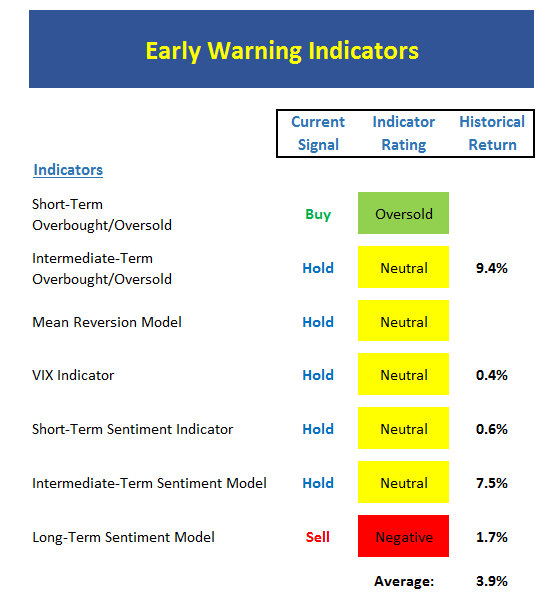

Next up is the "early warning" board, which is designed to indicate when traders may start to "go the other way" for a trade.

- The early warning indicators are starting to improve

- But... The bottom line is that stocks are not yet "set up" for a meaningful turn

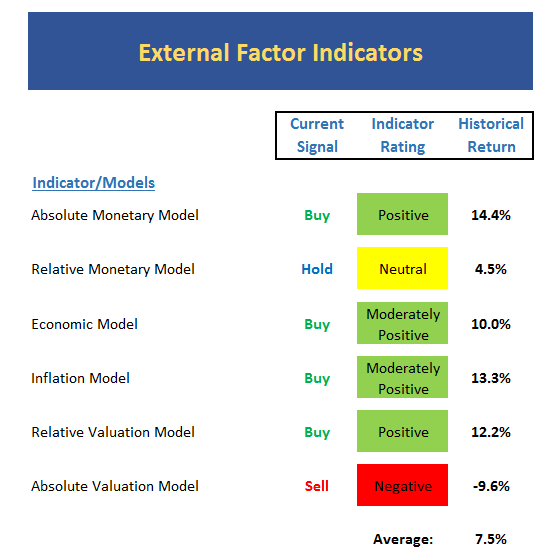

Now let's move on to the market's "external factors" - the indicators designed to tell us the state of the big-picture market drivers including monetary conditions, the economy, inflation, and valuations.

As a reminder, this board doesn't change very often.

- Nothing new to report this week

- The economic model continues to warrant some attention

- There is no denying that absolute valuations remain elevated

- Note that the average return for this board is just below the historical norm - this probably says it all

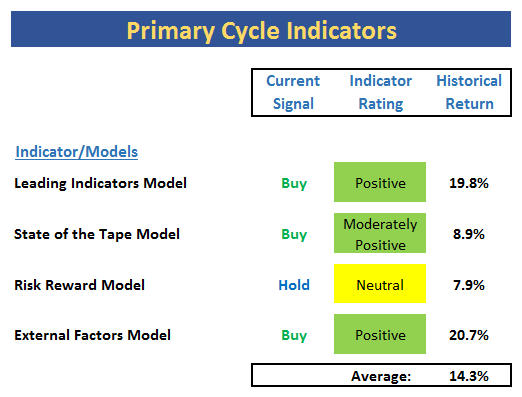

Finally, let's turn to our favorite big-picture market models, which are designed to tell us which team is in control of the prevailing major trend.

- There is no change to my favorite market models this week

- The good news is the leading indicators remain positive

The Takeaway...

To sum up, I believe the "weight of the evidence" has weakened, giving the bears a shot at getting something going to the downside in the near-term. Given the state of the indicators, we would not be at all surprised to see our friends in fur attempt to push stocks below the near-term line in the sand. And should they succeed early in the week, we will undoubtedly hear a lot of talk about another trip through the trading range and a test of important support below the 1900 level.

But then again, let's keep in mind that the bears have been unable to do much with their opportunities of late and we're not sure that this time will be any different. As such, buying the dips appears to remain the strategy to employ.

Current Market Drivers

We strive to identify the driving forces behind the market action on a daily basis. The thinking is that if we can both identify and understand why stocks are doing what they are doing on a short-term basis; we are not likely to be surprised/blind-sided by a big move. Listed below are what we believe to be the driving forces of the current market (Listed in order of importance).

1. The State of Global Growth

2. The State of Global Central Bank Policy

3. The State of the Stock Market Valuations

4. The State of the Oil Crisis

Today's Pre-Game Indicators

Here are the Pre-Market indicators we review each morning before the opening bell...

Major Foreign Markets:

Japan: +0.33%

Hong Kong: +0.84%

Shanghai: +0.84%

London: -0.30%

Germany: +0.92%

France: -0.57%

Italy: +0.16%

Spain: -0.73%

Crude Oil Futures: +$1.08 to $47.29

Gold: +11.50 at $1284.20

Dollar: lower against the yen and euro, higher vs. pound

US 10-Year Bond Yield: Currently trading at 1.723%

German 10-Year Bund Yield: Currently trading at 0.141%

Stock Indices in U.S. (relative to fair value):

S&P 500: +1.75

Dow Jones Industrial Average: +9

NASDAQ Composite: +9.25

Thought For The Day:

"It always seems impossible until it’s done." - Nelson Mandela

Here's wishing you green screens and all the best for a great day,

David D. Moenning

Founder: Heritage Capital Research

Chief Investment Officer: Sowell Management Services

Looking for More on the State of the Markets?

Disclosures

The opinions and forecasts expressed herein are those of Mr. David Moenning and may not actually come to pass. Mr. Moenning's opinions and viewpoints regarding the future of the markets should not be construed as recommendations. The analysis and information in this report is for informational purposes only. No part of the material presented in this report is intended as an investment recommendation or investment advice. Neither the information nor any opinion expressed constitutes a solicitation to purchase or sell securities or any investment program.

Any investment decisions must in all cases be made by the reader or by his or her investment adviser. Do NOT ever purchase any security without doing sufficient research. There is no guarantee that the investment objectives outlined will actually come to pass. All opinions expressed herein are subject to change without notice. Neither the editor, employees, nor any of their affiliates shall have any liability for any loss sustained by anyone who has relied on the information provided.

The analysis provided is based on both technical and fundamental research and is provided "as is" without warranty of any kind, either expressed or implied. Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

David D. Moenning is an investment adviser representative of Sowell Management Services, a registered investment advisor. For a complete description of investment risks, fees and services, review the firm brochure (ADV Part 2) which is available by contacting Sowell. Sowell is not registered as a broker-dealer.

Employees and affiliates of Sowell may at times have positions in the securities referred to and may make purchases or sales of these securities while publications are in circulation. Positions may change at any time.

Investments in equities carry an inherent element of risk including the potential for significant loss of principal. Past performance is not an indication of future results.

Advisory services are offered through Sowell Management Services.