The Early Take: Time to Work on Your Short Game

Here's our "early take" on the current state of the markets...

With the dramatic decline in the British Pound having slowed and the all-important jobs report on tap tomorrow morning, calm seems to be the word of the day so far in the markets. So, with vacation season in full swing on Wall Street, logic would suggest that today would be a good day to ignore the action in the markets and go play golf.

However, the action in the global bond markets continues to capture my attention as yields in the U.S. remain near record lows. My questions about the bond market here are (a) is this simply "the trade" that the fast money is playing right now or (b) should the action be "telling" us something important about the state of the global economy? Personally, I think it is the latter and that this is a classic case of "too many dollars chasing too few goods" as traders around the globe try to "shake hands with the central bankers" by buying bonds with both hands. And because of this, I remain concerned that this "trade" is becoming VERY, VERY crowded. So, for me, this remains something to watch closely.

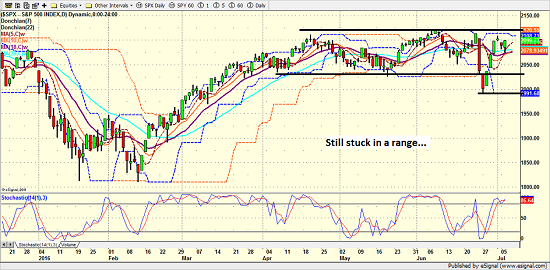

S&P 500 - Daily

View Larger Image

Current Market Drivers

We strive to identify the driving forces behind the market action on a daily basis. The thinking is that if we can both identify and understand why stocks are doing what they are doing on a short-term basis; we are not likely to be surprised/blind-sided by a big move. Listed below are what we believe to be the driving forces of the current market (Listed in order of importance).

1. The State of Global Bank Policies

2. The State of U.S. Economic Growth

3. The Impact of the "BREXIT"

4. The State of the Stock Market Valuations

Thought For The Day:

"If you can eliminate all the other choices, the remaining choice, no matter how improbable, is the answer." - Sherlock Holmes

Here's wishing you green screens and all the best for a great day,

David D. Moenning

Founder: Heritage Capital Research

Chief Investment Officer: Sowell Management Services

Looking for More on the State of the Markets?

Disclosures

The opinions and forecasts expressed herein are those of Mr. David Moenning and may not actually come to pass. Mr. Moenning's opinions and viewpoints regarding the future of the markets should not be construed as recommendations. The analysis and information in this report is for informational purposes only. No part of the material presented in this report is intended as an investment recommendation or investment advice. Neither the information nor any opinion expressed constitutes a solicitation to purchase or sell securities or any investment program.

Any investment decisions must in all cases be made by the reader or by his or her investment adviser. Do NOT ever purchase any security without doing sufficient research. There is no guarantee that the investment objectives outlined will actually come to pass. All opinions expressed herein are subject to change without notice. Neither the editor, employees, nor any of their affiliates shall have any liability for any loss sustained by anyone who has relied on the information provided.

The analysis provided is based on both technical and fundamental research and is provided "as is" without warranty of any kind, either expressed or implied. Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

David D. Moenning is an investment adviser representative of Sowell Management Services, a registered investment advisor. For a complete description of investment risks, fees and services, review the firm brochure (ADV Part 2) which is available by contacting Sowell. Sowell is not registered as a broker-dealer.

Employees and affiliates of Sowell may at times have positions in the securities referred to and may make purchases or sales of these securities while publications are in circulation. Positions may change at any time.

Investments in equities carry an inherent element of risk including the potential for significant loss of principal. Past performance is not an indication of future results.

Advisory services are offered through Sowell Management Services.