The Good/Bad News of New Highs

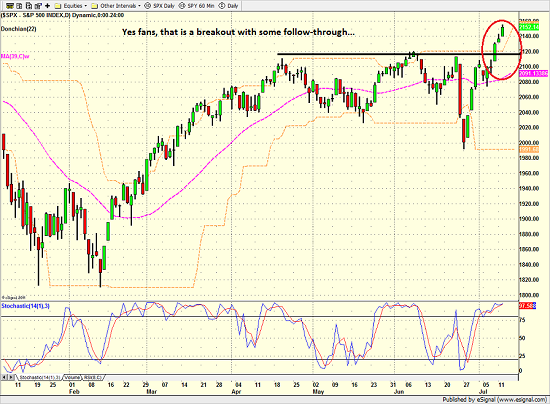

First the good news. The DJIA, S&P 500, and Mid-cap indices all closed at new all-time highs yesterday. In addition, most of our trend and internal momentum indicators are green, which is to be expected at this point in the game. On that note, our 10-day advance/decline indicator - which is designed to measure "oomph" in market breadth - hit the highest level yesterday since early 1987. Next, the earnings recession, which now spans five consecutive quarters is expected to improve during the current reporting season. And finally, history shows that breakouts that have occurred after a bear market have tended to be quite positive for the next year.

Now for the bad news. Stocks are overbought from both a short- and intermediate-term perspective. Our short-term sentiment model moved into the danger zone yesterday - meaning that some froth is developing. The cycle composite suggests the action should be sideways to down over the next week and a half. Our VIX and Mean Reversion models have both moved into their respective negative zone. And the new bond king, Jeffrey Gundlach of DoubleLine Capital, is calling the current bond market and yield search a "mass psychosis" (oh, and by the way, Germany sold 10-year bunds this morning at negative interest rates for the first time in history and Switzerland sold bonds maturing in 2058 at an average yield of 0.023%).

So, while prices are moving up at the present time in anticipation of additional central bank stimulus and an improvement in the U.S. economic picture, I'm waiting to see how this market acts during the next pullback. This will be my "tell" as to whether or not this breakout is for real or just the latest in a long string of fake-outs.

S&P 500 - Daily

View Larger Image

Current Market Drivers

We strive to identify the driving forces behind the market action on a daily basis. The thinking is that if we can both identify and understand why stocks are doing what they are doing on a short-term basis; we are not likely to be surprised/blind-sided by a big move. Listed below are what we believe to be the driving forces of the current market (Listed in order of importance).

1. The State of Global Central Bank Policies

2. The State of U.S. Economic Growth

3. The State of the Earnings Season

4. The State of the Stock Market Valuations

Thought For The Day:

"You are neither right nor wrong because people agree with you." --Warren Buffett

Here's wishing you green screens and all the best for a great day,

David D. Moenning

Founder: Heritage Capital Research

Chief Investment Officer: Sowell Management Services

Looking for More on the State of the Markets?

Disclosures

The opinions and forecasts expressed herein are those of Mr. David Moenning and may not actually come to pass. Mr. Moenning's opinions and viewpoints regarding the future of the markets should not be construed as recommendations. The analysis and information in this report is for informational purposes only. No part of the material presented in this report is intended as an investment recommendation or investment advice. Neither the information nor any opinion expressed constitutes a solicitation to purchase or sell securities or any investment program.

Any investment decisions must in all cases be made by the reader or by his or her investment adviser. Do NOT ever purchase any security without doing sufficient research. There is no guarantee that the investment objectives outlined will actually come to pass. All opinions expressed herein are subject to change without notice. Neither the editor, employees, nor any of their affiliates shall have any liability for any loss sustained by anyone who has relied on the information provided.

The analysis provided is based on both technical and fundamental research and is provided "as is" without warranty of any kind, either expressed or implied. Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

David D. Moenning is an investment adviser representative of Sowell Management Services, a registered investment advisor. For a complete description of investment risks, fees and services, review the firm brochure (ADV Part 2) which is available by contacting Sowell. Sowell is not registered as a broker-dealer.

Employees and affiliates of Sowell may at times have positions in the securities referred to and may make purchases or sales of these securities while publications are in circulation. Positions may change at any time.

Investments in equities carry an inherent element of risk including the potential for significant loss of principal. Past performance is not an indication of future results.

Advisory services are offered through Sowell Management Services.