The Train is Leaving the Station

While the uber-bears continue to pound the table about the risk of the next great disaster in the stock market, I'm reminded that two of the most famous cliches on Wall Street are, "The trend is your friend," and "Don't fight the tape."

In essence, these two old saws remind investors not to overthink things when the bull train starts to leave the station. And with the DJIA, the S&P 500, and the NASDAQ Composite finishing at fresh all-time highs for a second consecutive session yesterday (a feat that hasn't occurred in nearly 17 years), the bottom line here appears to be that the train is indeed in the process of leaving the station.

However, after nearly two years of sideways action and more "breakout fake-outs" than I care to count, it is easy to be skeptical of the upside trend here. And some very big names in the business have been making it hard to jump on the bull bandwagon. Folks like George Soros, Stanley Druckenmiller, Sam Zell, Marc Cuban, Marc "Dr. Doom" Faber, Carl Ichan, Bill Gross, Blackrock's Larry Fink, and even David Tepper have all issued cautionary outlooks on the stock market recently.

From my seat, it's gotten to the point where maintaining a positive outlook on stocks is actually a contrarian point of view here.

And yet, as we've pointed out several times recently, the simple fact of the matter is that, according to Ned Davis Research, a new cyclical bull market has only just begun (cue The Carpenters!). As such, the current uptrend should not be surprising to see and we remain optimistic about the potential for gains in the stock market over the next year or so.

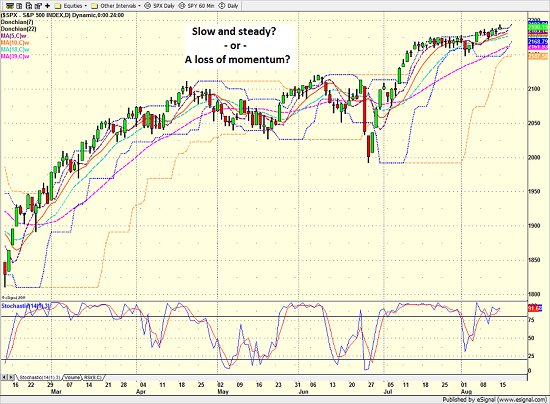

However, we must also recognize that stocks are overbought from a near-term perspective. In addition, our sentiment indicators suggest that Ms. Market's mood is getting a little too upbeat and the seasonal cycle becomes a headwind very soon (lest we forget, September is a month that is well known for downside volatility). Therefore, we should not be surprised to see the bears attempt a comeback in the near-term. A comeback that we would expect to be short-lived and an opportunity to put capital to work.

S&P 500 - Daily

View Larger Image

Current Market Drivers

We strive to identify the driving forces behind the market action on a daily basis. The thinking is that if we can both identify and understand why stocks are doing what they are doing on a short-term basis; we are not likely to be surprised/blind-sided by a big move. Listed below are what we believe to be the driving forces of the current market (Listed in order of importance).

1. The State of Global Central Bank Policies

2. The State of U.S. Economic Growth

3. The State of Oil Prices

Thought For The Day:

Employ your time in improving yourself by other men's writings, so that you shall gain easily what others have labored hard for -- Socrates

Here's wishing you green screens and all the best for a great day,

David D. Moenning

Founder: Heritage Capital Research

Chief Investment Officer: Sowell Management Services

Looking for More on the State of the Markets?

Disclosures

The opinions and forecasts expressed herein are those of Mr. David Moenning and may not actually come to pass. Mr. Moenning's opinions and viewpoints regarding the future of the markets should not be construed as recommendations. The analysis and information in this report is for informational purposes only. No part of the material presented in this report is intended as an investment recommendation or investment advice. Neither the information nor any opinion expressed constitutes a solicitation to purchase or sell securities or any investment program.

Any investment decisions must in all cases be made by the reader or by his or her investment adviser. Do NOT ever purchase any security without doing sufficient research. There is no guarantee that the investment objectives outlined will actually come to pass. All opinions expressed herein are subject to change without notice. Neither the editor, employees, nor any of their affiliates shall have any liability for any loss sustained by anyone who has relied on the information provided.

The analysis provided is based on both technical and fundamental research and is provided "as is" without warranty of any kind, either expressed or implied. Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

David D. Moenning is an investment adviser representative of Sowell Management Services, a registered investment advisor. For a complete description of investment risks, fees and services, review the firm brochure (ADV Part 2) which is available by contacting Sowell. Sowell is not registered as a broker-dealer.

Employees and affiliates of Sowell may at times have positions in the securities referred to and may make purchases or sales of these securities while publications are in circulation. Positions may change at any time.

Investments in equities carry an inherent element of risk including the potential for significant loss of principal. Past performance is not an indication of future results.

Advisory services are offered through Sowell Management Services.