Time To Uncork the Champagne?

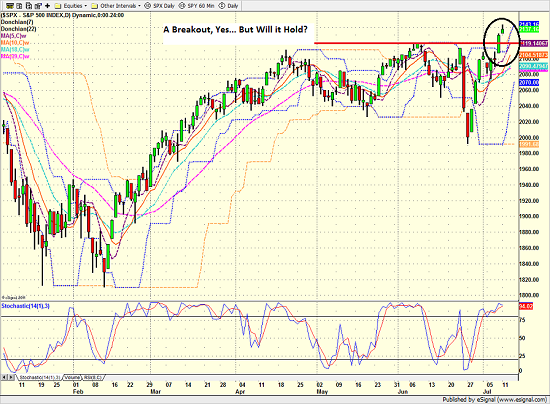

After more than a year of ups and downs, which some contend included a "mini" or cyclical bear market, the S&P 500 finally returned to The Promised Land yesterday with a new all-time closing high. To be sure, there were no fireworks on display as the venerable index closed well off the intraday high and was hit with steady selling over the last hour. But, as they say, a win is a win, right? From a big-picture standpoint, it is important to remember that all three of our models designed to "call" the type of trading environment are still unanimous in the view that this remains a mean reverting market. And given the fact that every breakout since early 2015 has ultimately become a "fake out," please forgive me if I keep the champagne on ice for a while here.

This morning, global markets are moving up a bit on the back of some political stability in Britain, as Theresa May is slated to become the next PM, and former Fed Chairman Ben Bernanke's meeting with Japanese PM Shinzo Abe in Tokyo is lending credence to the idea of more stimulus in the wings there. And with Alcoa (NYSE: AA) having started off the quarterly earnings parade on an upbeat note, the positive vibe in the markets looks like it will continue.

For me, the question of the day, of course, is when the bears are going to mount their next offensive and try to push the major indices right back into the recent range? Thus, I'll be watching closely for signs of internal momentum and plan to stay patient in terms of making any major adjustments.

S&P 500 - Daily

View Larger Image

Current Market Drivers

We strive to identify the driving forces behind the market action on a daily basis. The thinking is that if we can both identify and understand why stocks are doing what they are doing on a short-term basis; we are not likely to be surprised/blind-sided by a big move. Listed below are what we believe to be the driving forces of the current market (Listed in order of importance).

1. The State of Global Central Bank Policies

2. The State of U.S. Economic Growth

3. The State of the Earnings Season

4. The State of the Stock Market Valuations

Thought For The Day:

"You can't pay back - you can only pay forward." --Woody Hayes

Here's wishing you green screens and all the best for a great day,

David D. Moenning

Founder: Heritage Capital Research

Chief Investment Officer: Sowell Management Services

Looking for More on the State of the Markets?

Disclosures

The opinions and forecasts expressed herein are those of Mr. David Moenning and may not actually come to pass. Mr. Moenning's opinions and viewpoints regarding the future of the markets should not be construed as recommendations. The analysis and information in this report is for informational purposes only. No part of the material presented in this report is intended as an investment recommendation or investment advice. Neither the information nor any opinion expressed constitutes a solicitation to purchase or sell securities or any investment program.

Any investment decisions must in all cases be made by the reader or by his or her investment adviser. Do NOT ever purchase any security without doing sufficient research. There is no guarantee that the investment objectives outlined will actually come to pass. All opinions expressed herein are subject to change without notice. Neither the editor, employees, nor any of their affiliates shall have any liability for any loss sustained by anyone who has relied on the information provided.

The analysis provided is based on both technical and fundamental research and is provided "as is" without warranty of any kind, either expressed or implied. Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

David D. Moenning is an investment adviser representative of Sowell Management Services, a registered investment advisor. For a complete description of investment risks, fees and services, review the firm brochure (ADV Part 2) which is available by contacting Sowell. Sowell is not registered as a broker-dealer.

Employees and affiliates of Sowell may at times have positions in the securities referred to and may make purchases or sales of these securities while publications are in circulation. Positions may change at any time.

Investments in equities carry an inherent element of risk including the potential for significant loss of principal. Past performance is not an indication of future results.

Advisory services are offered through Sowell Management Services.