Two More Indicators Turn Green

I got a late start this morning so I'll get right to it. On this fine Thursday morning, it looks like global markets are (a) digesting the Fed statement, which appears to have been not quite as hawkish as had been feared, (b) waiting on the BOJ decision, and (c) dealing with another onslaught of earnings reports.

On the economic front, jobless claims rose but remain at historically low levels, which tells economists the jobs market remains strong.

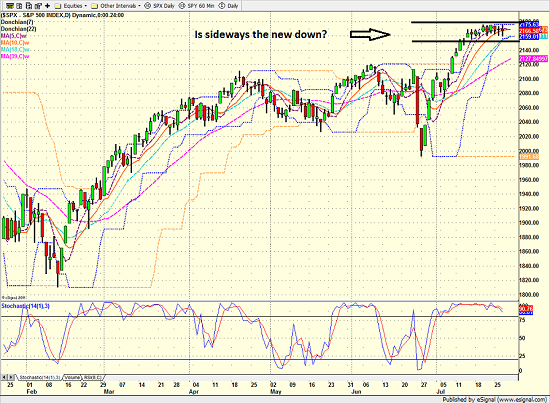

Looking at the U.S. stock market, it looks like the sideways drift continues unabated today as stocks work off the short-term overbought condition and consolidate the rapid post-BREXIT advance. In my humble opinion, at this stage of the game, every day the bears don't get something going to the downside is positive as it suggests we are seeing a "good overbought" condition. And while it does "feel" like our furry friends could get their party started at any moment, sideways appears to be the new down - well, for now, anyway.

S&P 500 - Daily

View Larger Image

Looking at my indicators, "finally" is the word of the day as two important indicators have at last turned green.

Desert Island Indicator Update

First, it is positive that one of my favorite long-term, big-picture indicators - which I refer to as my "desert island indicator" - finally muscled its way into the purely positive zone this week (it had been sitting in the "moderately positive" mode for some time). This model looks at the "technical health" (simple trend and momentum stuff) of the 104 GICS industry groups in the market. The thinking is remarkably simple. When the majority of industry groups are technically healthy, stocks tend to rise. And vice versa.

Although this type of indicator typically has very little bearing on the short-term outlook for the market, it is important to recognize that stocks have historically fared much better than average when the "state of the tape" has been in the positive zone.

What is important here is that this is the first time my favorite trend model has been in the purely positive mode since November 2014. So, I guess I can finally quit complaining about this indicator lagging behind.

The computers at Ned Davis Research tell me that since 1979 when this model has been in the positive mode, the S&P 500 has risen at an annualized rate of +34.5%. And since 2000, the SPX has gained ground at an annualized rate of +26.4% when the model is positive. Not bad.

It is also worth noting that the global version of this model went positive this week as well. History shows that since 1987, the ACWI has gained ground at an annualized rate of +22.2% when this model has been positive. And since the best moves in the stock market tend to be global in nature, well, you get the idea.

In addition, my personal "market environment" model flipped from neutral to positive this morning. To clarify, this model is not designed to be "timing" oriented, but rather is what I like to call a "confirmation" model. The idea is for this model-of-models to confirm what is happening to price of the major indices. This is especially useful in today's market as stocks where the intraday movements are controlled by algorithms.

This model has also lagged of late, which, when combined with my "desert island" model refusing to confirm, has caused me to wonder if the current breakout would quickly become just another fake out.

Finally, stocks remain overbought. So, as traders continue to digest the earnings season, we should probably expect to see some downside "testing" in the near-term, which is what appears to be happening at the open this morning.

But make no mistake about it; with a new cyclical bull market underway and our models sporting a healthy shade of green, this remains a market in which any/all dips should be bought.

Current Market Drivers

We strive to identify the driving forces behind the market action on a daily basis. The thinking is that if we can both identify and understand why stocks are doing what they are doing on a short-term basis; we are not likely to be surprised/blind-sided by a big move. Listed below are what we believe to be the driving forces of the current market (Listed in order of importance).

1. The State of Global Central Bank Policies

2. The State of the Earnings Season

3. The State of U.S. Economic Growth

4. The State of Oil Prices

Thought For The Day:

"Experience can tell you what not to do, but not what to do." --Dr. Vladimir Rockov

Here's wishing you green screens and all the best for a great day,

David D. Moenning

Founder: Heritage Capital Research

Chief Investment Officer: Sowell Management Services

Looking for More on the State of the Markets?

Disclosures

The opinions and forecasts expressed herein are those of Mr. David Moenning and may not actually come to pass. Mr. Moenning's opinions and viewpoints regarding the future of the markets should not be construed as recommendations. The analysis and information in this report is for informational purposes only. No part of the material presented in this report is intended as an investment recommendation or investment advice. Neither the information nor any opinion expressed constitutes a solicitation to purchase or sell securities or any investment program.

Any investment decisions must in all cases be made by the reader or by his or her investment adviser. Do NOT ever purchase any security without doing sufficient research. There is no guarantee that the investment objectives outlined will actually come to pass. All opinions expressed herein are subject to change without notice. Neither the editor, employees, nor any of their affiliates shall have any liability for any loss sustained by anyone who has relied on the information provided.

The analysis provided is based on both technical and fundamental research and is provided "as is" without warranty of any kind, either expressed or implied. Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

David D. Moenning is an investment adviser representative of Sowell Management Services, a registered investment advisor. For a complete description of investment risks, fees and services, review the firm brochure (ADV Part 2) which is available by contacting Sowell. Sowell is not registered as a broker-dealer.

Employees and affiliates of Sowell may at times have positions in the securities referred to and may make purchases or sales of these securities while publications are in circulation. Positions may change at any time.

Investments in equities carry an inherent element of risk including the potential for significant loss of principal. Past performance is not an indication of future results.

Advisory services are offered through Sowell Management Services.