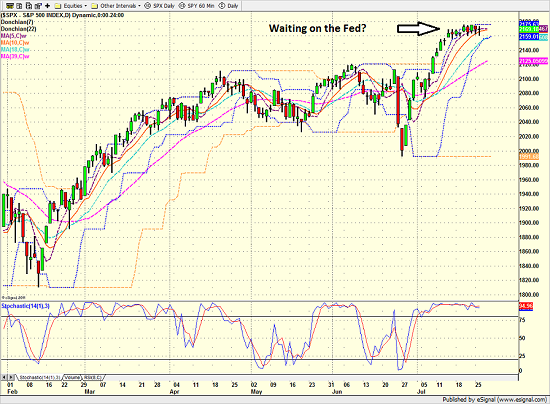

Waiting on the Fed

The recent price action in the stock market reminds us that the dog days of summer are upon us. A time when most traders are dealing with family vacations and/or focusing on keeping that little white ball in the short grass. And given that recent joyride to the upside has created a pretty strong overbought condition as well as the fact that meetings of both the FOMC and BOJ are on tap this week, I guess we shouldn't be surprised that stocks have been moving sideways for the nearly two weeks now.

To be clear, nobody expects Janet Yellen's merry band of central bankers to make any changes to interest rates today - or any other aspects of the FOMC's monetary policy. No, what investors will be looking for are hints about what the Fed is planning to do next.

A month ago, the consensus thinking was that Yellen & Co. would likely take the summer off and then announce a rate hike in September. However, in light of the fact that the Fed doesn't like to make changes to monetary policy in front of a Presidential election, the thinking now is that December may be the best bet for when the FOMC will make the next move.

S&P 500 - Daily

View Larger Image

At the same time though, there are those that argue the recent economic data has been solid and the Fed needs to get on with it. The thinking here is that (a) the June jobs report showed that May's debacle was a one off and the labor market is in good shape, (b) personal incomes are continuing to rise, (c) the risk from the BREXIT vote doesn't appear to be severe, and (d) core inflation readings are now at or above the Fed's target.

Taking No Chances

However, if we've learned anything about Janet Yellen it is that she, like her predecessor Ben Bernanke, is taking no chances with the economy and/or inflation. Recall that job one for Bernanke during the Credit Crisis was to keep the economy out of Japanese-style deflationary spiral. As such, Mr. Bernanke pulled out all the stops in an effort to create a little inflation here in the good 'ol USofA.

It appears that Ms. Yellen is also focused on inflation and isn't concerned about letting inflation "overshoot" to the upside. Thus, today's "inflation problem" isn't the fear of what too much inflation will do to the economy, but just the opposite. Therefore, the Fed's thinking is that they can be VERY patient in their effort to return the Fed Funds target back to more normal levels.

Thus, the bottom line is traders appear to be waiting for confirmation from the Fed that this remains the game plan. We'll find out this afternoon. And until then, we wait.

Current Market Drivers

We strive to identify the driving forces behind the market action on a daily basis. The thinking is that if we can both identify and understand why stocks are doing what they are doing on a short-term basis; we are not likely to be surprised/blind-sided by a big move. Listed below are what we believe to be the driving forces of the current market (Listed in order of importance).

1. The State of Global Central Bank Policies

2. The State of the Earnings Season

3. The State of U.S. Economic Growth

4. The State of Oil Prices

Thought For The Day:

"Why fit it when you were born to stand out?" --Dr. Seuss

Here's wishing you green screens and all the best for a great day,

David D. Moenning

Founder: Heritage Capital Research

Chief Investment Officer: Sowell Management Services

Looking for More on the State of the Markets?

Disclosures

The opinions and forecasts expressed herein are those of Mr. David Moenning and may not actually come to pass. Mr. Moenning's opinions and viewpoints regarding the future of the markets should not be construed as recommendations. The analysis and information in this report is for informational purposes only. No part of the material presented in this report is intended as an investment recommendation or investment advice. Neither the information nor any opinion expressed constitutes a solicitation to purchase or sell securities or any investment program.

Any investment decisions must in all cases be made by the reader or by his or her investment adviser. Do NOT ever purchase any security without doing sufficient research. There is no guarantee that the investment objectives outlined will actually come to pass. All opinions expressed herein are subject to change without notice. Neither the editor, employees, nor any of their affiliates shall have any liability for any loss sustained by anyone who has relied on the information provided.

The analysis provided is based on both technical and fundamental research and is provided "as is" without warranty of any kind, either expressed or implied. Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

David D. Moenning is an investment adviser representative of Sowell Management Services, a registered investment advisor. For a complete description of investment risks, fees and services, review the firm brochure (ADV Part 2) which is available by contacting Sowell. Sowell is not registered as a broker-dealer.

Employees and affiliates of Sowell may at times have positions in the securities referred to and may make purchases or sales of these securities while publications are in circulation. Positions may change at any time.

Investments in equities carry an inherent element of risk including the potential for significant loss of principal. Past performance is not an indication of future results.

Advisory services are offered through Sowell Management Services.