A New Era For Stock Market Valuations?

I've been saying for some time now that I believe the current corrective/consolidation phase will ultimately be resolved to the upside. Or put another way, I don't think we're seeing the beginning of the next big, bad bear market.

This is not to say that the latter couldn't occur as there are at least a handful of issues the stock market is tight-roping over at the present time. There is the trade war. Rising rates. The potential for inflation. The ongoing drama in Washington. The debt/banking problems in Italy, et al. The geopolitical issues with folks like North Korea and Iran. The mid-term elections. An aging economic expansion. An old bull. And the subject of today's morning market missive: stock market valuations.

Nowhere is objectivity or, in many cases, a complete lack thereof, on display more than when the subject of market valuation is broached. Personally, I see valuations as a very tricky subject. And as such, I'm hesitant to take any strong stance. No, I'd rather recognize what "is" happening and let Ms. Market tell me when/if valuations will become a problem. If they ever do become a problem, that is.

Yet, a great many analysts insist on "planting the flag" on this issue by insisting stocks are overvalued - or just the opposite. This is the perplexing part. How can one respected analyst tell us with great certainty that valuations are reasonable while another, equally respected analyst says valuations are sky high and represent significant risk?

From my seat, I can actually see both arguments here. However, the key to the divergent views on market valuation is the perspective and time-frame one chooses to utilize.

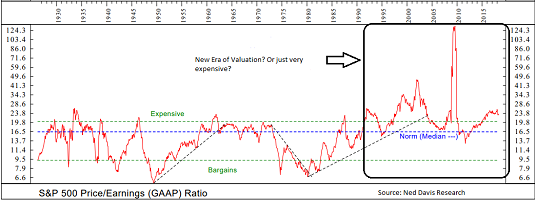

For example, the chart below shows the P/E Ratio for the S&P 500 using GAAP (Generally Accepted Accounting Principles) going back more than 90 years.

S&P 500 GAAP Price/Earnings Ratio

View Larger Image Online

If one looks at the chart as a whole and reviews the entire 92-year period, it is easy to see why many believe stocks are expensive at this stage. Sure, the P/E has improved a bit this year. But from an absolute perspective, there can be no denying that the current GAAP P/E is elevated relative to history.

However, if one looks at the last 10 years, well, stocks actually look cheap. And a similar story can be told if you look back over the last 20 years, which, can be made to sound like a long time.

My take on the subject is we are either experiencing a new "era" of valuation ranges for the S&P (the current era or range began in the mid-1990's) - or - stocks are expensive here. Take your pick.

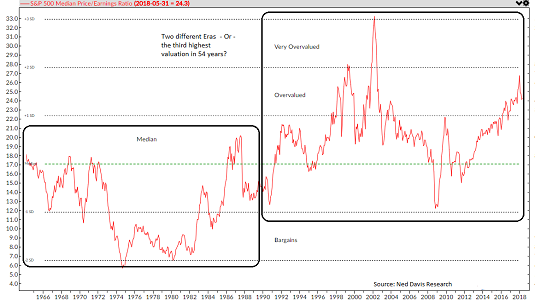

The next chart looks at the median stock's P/E in the S&P going back to 1964. The idea behind this approach is to remove the extremes in the data by using the median stock's P/E.

S&P 500 Median Price/Earnings Ratio

View Larger Image Online

This chart makes the two "eras" or valuation ranges quite clear. From the mid-1960's through the early 1990's, the range was obvious. But then as the great bull market of the 1990's took hold, the valuation range expanded. The highs were higher and the lows were lower.

Yet, it is fairly clear to me that regardless of which "era" you choose to look at, the current valuation level is lofty. In fact, the recent peak looks to be the third highest in history.

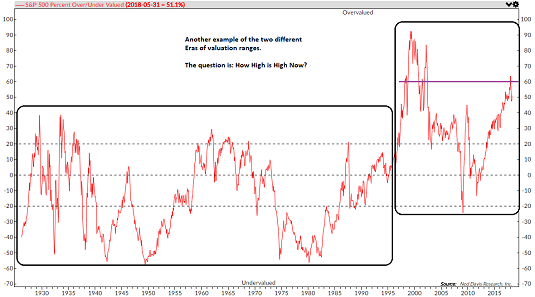

Finally, the analysts at Ned Davis Research Group have created what I'll call a normalized valuation composite, with data going back to 1926 again.

S&P 500 Normalized Composite Valuation Model

View Larger Image Online

The "normalized valuation" line is calculated by combining the median of different valuation measures based on: Dividends, Earnings, Cash Flow, Sales, Inflation-Adjust P/E, and Trend. Thus, this metric should represent a fairly complete picture of what I'll call absolute valuation measures.

Once again, I've drawn in my two "valuation eras" on the chart. So, again we are left with a dilemma. Is the current reading one of the highest of all-time or simply a bit past the mid-point of the current era?

Is It Different This Time?

Frankly, I always have a problem with "new eras" and "this time it's different" arguments. More often than not, it doesn't wind up being different this time, it just looks that way for a while.

However, I do think we need to recognize that the public's use of funds and the stock market has indeed changed since the 1980's. Yesterday's defined benefit pension plan, which was managed by professionals, has given way to defined contribution plans such as 401K's and the like. And the bottom line is the public is the one making the investment decisions today.

Next, I think it is important to recognize that the public doesn't do a lot of analysis before investing each month. No, they tend to simply plunk money automatically into their retirement plans and rarely, if ever, change the allocation to where the money is to be invested. As such, stock market valuations don't really impact this type of investing as the money just keeps flowing into the funds/ETFs in the plan.

So, is this a "new era" for valuations? Perhaps. Especially when you consider the level of interest rates. Again, where else is that money supposed to go when you have to tie up your cash for a decade in order to get anything close to 3% in the bond market?

The Bottom Line

Here's my bottom line take. Valuations are indeed high from an historical perspective. Yet, at the same time, with rates where they are, I don't see a lot of competition from a macro point of view. So, unless/until something comes along to (a) cause investors to freak out about valuations or (b) create competition for stocks, we may be stuck with this valuation dilemma for some time.

I see valuations as a risk factor that shouldn't be ignored. At the same time, I don't see valuations alone as a reason to move away from stocks. If/when the next big, bad bear begins, investors WILL care about valuations. And the high valuation levels will cause more pain during the ensuing bear than might have occurred if stocks weren't extremely overvalued. But until then, the money flows could very well keep valuations elevated.

As always, the key is to remain as objective as possible and to try and stay in line with whatever Ms. Market IS doing in the current market environment.

ANNOUNCEMENT:

HCR Awarded Top Honors in 2018 NAAIM Shark Tank Portfolio Strategy Competition

Each year, NAAIM (National Association of Active Investment Managers) hosts a competition to identify the best actively managed investment strategies. In April, HCR's Dave Moenning took home first place for his flagship risk management strategy.

Want to Learn More? Contact Dave

A Word About Managing Risk in the Stock Market

Thought For The Day:

The best thing about the future is that it comes one day at a time. - Abraham Lincoln

Wishing you green screens and all the best for a great day,

David D. Moenning

Founder, Chief Investment Officer

Heritage Capital Research

HCR Focuses on a Risk-Managed Approach to Investing

Must Read: What Risk Management Can and Cannot Do

HCR's Financial Advisor Services

HCR's Individual Investor Services

Questions, comments, or ideas? Contact Us

At the time of publication, Mr. Moenning held long positions in the following securities mentioned: none - Note that positions may change at any time.

Disclosures

The opinions and forecasts expressed herein are those of Mr. David Moenning and may not actually come to pass. Mr. Moenning's opinions and viewpoints regarding the future of the markets should not be construed as recommendations. The analysis and information in this report is for informational purposes only. No part of the material presented in this report is intended as an investment recommendation or investment advice. Neither the information nor any opinion expressed constitutes a solicitation to purchase or sell securities or any investment program.

Any investment decisions must in all cases be made by the reader or by his or her investment adviser. Do NOT ever purchase any security without doing sufficient research. There is no guarantee that the investment objectives outlined will actually come to pass. All opinions expressed herein are subject to change without notice. Neither the editor, employees, nor any of their affiliates shall have any liability for any loss sustained by anyone who has relied on the information provided.

Mr. Moenning may at times have positions in the securities referred to and may make purchases or sales of these securities while publications are in circulation. Positions may change at any time.

The analysis provided is based on both technical and fundamental research and is provided "as is" without warranty of any kind, either expressed or implied. Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

Investments in equities carry an inherent element of risk including the potential for significant loss of principal. Past performance is not an indication of future results.